Activities in the institutional client market

Microenterprises in

the Bank’s portfolio

1. Institutional banking clients

Applying general, financial and business relations criteria, Bank Pocztowy S.A. has divided its institutional clients into the following categories:

- Small and medium enterprises (SME),

- Microenterprises,

- Housing institutions such as condominiums, housing associations, property managers and social housing associations,

- Public Finance and Public Benefit Organizations,

- Poczta Polska and companies from its Capital Group.

In line with the Bank's strategy for 2012-2015, one of the key areas of the dynamic growth of the Bank is development of the microenterprises sector.

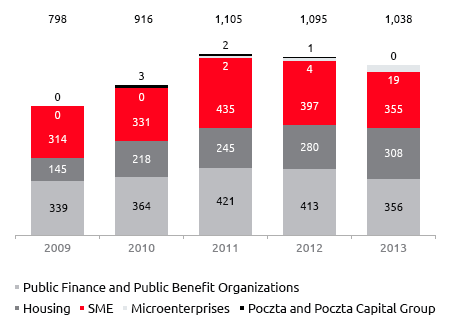

In December 2013, Bank Pocztowy S.A. had the total of 192.3 thousand clients as compared to 191.9 thousand at the end of 2012. Most of the Bank’s clients are Microenterprises. At the end of December 2013, 177.2 thousand microenterprises accounted for 92.1% of all institutional clients of the Bank. At the same time, during the financial year the number of Housing institutions in the Bank’s portfolio grew considerably from 10.7 thousand at the end of 2012 to 11.4 thousand in December 2013.

2. Development of the product offer for institutional clients

The key product in packages tailored to individual needs of institutional client segments is the current account. The Bank offers the following types of current accounts to institutional clients:

- Company Postal Accounts – for Microenterprises,

- Postal Business Package – for SMEs and property managers,

- HOUSE Postal Package and Mini House Postal Package – for condominiums, housing associations and social housing associations,

- Organization Postal Package and Small Organization Postal Package - for public benefit organizations and other non-profit organizations.

As for deposits, the Bank offers standard and individually negotiated deposits with a wide range of agreement periods, Company Saving Accounts (for microenterprises) and Business Saving Accounts (for SMEs, Housing institutions and Public Benefit Organizations).

The Bank’s credit offer for institutional clients includes in particular:

- overdraft facilities (in the current and credit accounts),

- non-revolving working capital loans (in the credit account),

- investment loans,

- loans with a thermo-modernization and renovation premium and with subsidies from the Regional Fund for Environmental Protection and Water Management in Łódź offered to Housing institutions,

- mortgage loans.

Bank Pocztowy offers comprehensive settlement services of unique quality, thanks to the access to Poczta Polska's infrastructure. The key settlement services provided in collaboration with Poczta Polska:

- managing documents of payments to the Social Security Institution and Tax Offices,

- cash payments under interbank settlements.

The Bank’s settlement offer includes:

- Giro Payment (cash payments to third parties available at the offices PocztaPolska and the Bank’s own network),

- over-the-counter deposits (cash payments to the client’s accountat the offices PocztaPolska and the Bank’s own network based on standard or individual terms),

- Postal Collect (identifying bulk payments using virtual accounts generated to a client’s bank account),

- Postal Collective Transfer (managing bulk domestic non-cash payment orders in the Polish zloty),

- sealed cash deposits (accepting sealed cash deposits from clients).

The Bank also developed relationships with companies offering international cash transfers. The Bank's key competitive advantage is the widest distribution network in Poland, composed of ca. 5,000 post offices and bank's sales points where customers can collect cash transfers. Since 2008 the Bank has cooperated with Money Gram Payment Systems Inc., providing agency services in cash transfers to Poland.

In order to improve competitiveness of its offer for institutional clients and to streamline processes, in 2013 the Bank took the following actions:

- It redesigned the offer and credit processes for microenterprises. It added new credit products for financing current needs of businesses to the offer for microenterprises, such as Light Credit Line and Express Installment Loan. Additionally, it simplified and automatized sales processes and adjusted portfolio management processes to the segment needs,

- It implemented the first stage of the new online banking system Pocztowy24 Business and successfullycompleted client migration to the new application. At the same time, the Bank continued works to expand system functionality scope in subsequent implementation stages,

- It also optimized the credit process for the SME and microenterprises segment. The credit process was tailored to the nature of companies in the SME segment and exposure size (for example a different process is applied to exposures up to PLN 1 million and to larger exposures). Automatized credit approval process for credit transactions up to PLN 200 thousand,

- It streamlined the credit process for the Housing segment, which has optimized the time of request processing and reduced the process costs,

- It continued automation of the account opening process for businesses and Housing institutions,

- It started implementation of current services for individuals not carrying out business activities, owners of multi-family buildings,

- It added bancassurance products for institutional clients to its offer (for instance property insurance, and payment protection insurance),

- It enabled clients to make on-line payments (real-time recording in the accounts) and priority incoming payments (recorded in D+1 time scheme) at the offices of Poczta Polska (depending on client configuration in Poczta Polska IT systems),

- It concluded agreements (or annexes to agreements) with Polish and foreign banks to meet the requirements of EMIR Regulation and appropriately adjusted its front-office and back office systems to the operations.

The treasury offer for institutional clients has been expanded to include:

- currency forward contracts,

- purchase and sale of debt securities (treasury and non-treasury securities, certificates of deposit),

- possibility to conclude currency forward transactions under a treasury limit.

3. Credit operations

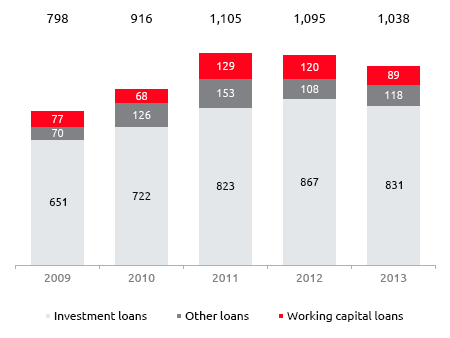

The Bank followed a credit policy for institutional clients aimed at reducing credit exposure to an individual client and significantly reduced financing extended to local government units and high-risk industries (such as building companies and developers). At the same time, the Bank strived to improve profitability of credit transactions concluded. As the credit exposure extended by the banking sector to institutional clients remained stable, the policy translated into an insignificant decrease in the Bank’s credit outstandings from institutional clients in 2013.

In December 2013 credit receivables of Bank Pocztowy S.A. from institutional clients totaled PLN 1,038.4 million and were by 5.2% lower than a year before. Bank Pocztowy, however, is a strong player in the market of services for non-profit organizations.

Investment loans are the product most often sold to institutional clientsand they accounted for 80% of the total credit exposure of the Bank from this group of clients at the end of 2013.

Loans and advances of Bank Pocztowy S.A. - institutional segment (PLN '000)

| 31.12.2013 | Structure (31.12.2013) |

31.12.2012 | Structure (31.12.2012) |

Change 2013/2012 | ||

|---|---|---|---|---|---|---|

| PLN '000 | % | |||||

| Institutional loans | 1,038,371 | 100.0% | 1,094,927 | 100.0% | (56,555) | (5.2)% |

| Investment loans | 830,600 | 80.0% | 867,220 | 79.2% | (36,620) | (4.2)% |

| Working capital loans | 89,223 | 8.6% | 119,841 | 10.9% | (30,618) | (25.5)% |

| Other loans | 118,548 | 11.4% | 107,866 | 9.9% | 10,682 | 9.9% |

Source: management information of the Bank. The data present the principal amount only.Default interest, due and undue interest, EIR fees, other prepaid expenses and revenue, other restricted revenue and interest and other receivables were not included.

In 2013 the Bank carried out an internal reclassification of key categories of exposures extended to institutions. The amounts of investment loans and other loans differ from figures presented in the Management Report on the activities of the Bank for 2012 and 2011. The change consists in reclassifying local currency mortgage loans and debt consolidation loans from investment loans to other loans. Moreover, corporate bonds were reclassified from other loans to investment loans.

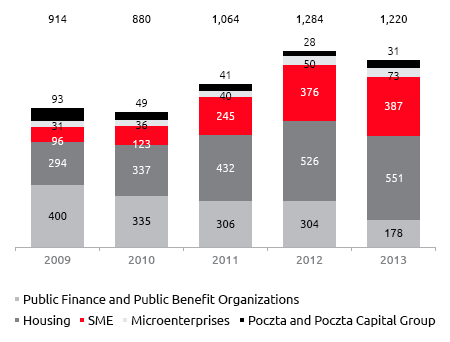

Gross loans and advances to institutional clients (in PLN million)

Gross loans and advances to institutional clients by segment (in PLN million)

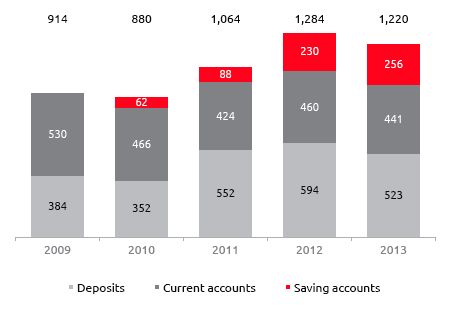

4. Deposits

As at 31 December 2013 deposits of institutional clients amounted to PLN 1,220.3 million, i.e. by 5.0% less than in 2012. At the end of 2013 Bank Pocztowy held a 0.7% share in the market of deposits of institutional clients and controlled 2.4% of the market of deposits made by non-profit organizations operating for the benefit of households1.

Most institutional clients invest free cash in term deposits. In December 2013 term deposits of institutional clients amounted to PLN 523.5 million, i.e. 42.9% of total deposits of this client group.

The amount of funds deposited in savings accounts of institutional clients also increased considerably,to reach PLN 255.8 million in December 2013, i.e. by 11.4% more than a year before. At the same time, their share in the structure of deposits of institutional clients increased from 17.9% at the end of 2012 to 21.0% in December 2013.

Deposits of Bank Pocztowy S.A. - institutional segment

| 31.12.2013 | Structure (31.12.2013) |

31.12.2012 | Structure (31.12.2012) |

Change 2013/2012 | ||

|---|---|---|---|---|---|---|

| PLN '000 | % | |||||

| Total deposits of institutions | 1,220,338 | 100.0% | 1,283,893 | 100.0% | (63,555) | (5.0)% |

| Current accounts | 440,980 | 36.1% | 460,158 | 35.8% | (19,178) | (4.2)% |

| Saving accounts | 255,827 | 21.0% | 229,657 | 17.9% | 26,170 | 11.4% |

| Deposits | 523,531 | 42.9% | 594,078 | 46.3% | (70,546) | (11.9)% |

Source: management information of the Bank. Deposits excluding those with terms negotiated individually.

2012 data restatement to ensure comparability. Reclassification of funds deposited in current accounts – classified to current liabilities of other banks in the institutional segment.

Housing institutions where those to deposit the highest amount at the Bank. In December 2013 term deposits of these entities reached PLN 550.8 million, i.e. 45.1% of total deposits of institutional clients. Deposits of SMEs were also considerable andamounted to 387.4 million, i.e. accounted for 31.7% of the total deposits of institutional clients.

Value of deposits of intitutions (in PLN million)

Value of deposits of institutions by segment (in PLN million)

In December 2013 Bank Pocztowy S.A. managed the total of 197.8 thousand of current accounts of institutional clients as compared to 198.0 thousand at the end of 2012.

Index:

1 Source: WEBIS data for Bank Pocztowy, data of the National Bank of Poland for Monetary receivables and liabilities of financial institutions, December 2013 for the banking sector

Annual Report 2013 - Bank Pocztowy

Corporate Governance

- Corporate governance: principles and scope of application

- Control system in the process of preparing financial statements

- Entity authorized to audit financial statements

- Shareholding structure and share capital

- Key information regarding Poczta Polska S.A.

- Cooperation with Poczta Polska S.A.

- Investor relations

- By-laws amending principles

- Activities of the corporate bodies of the Bank