Activities in the institutional client market

Institutional banking clients

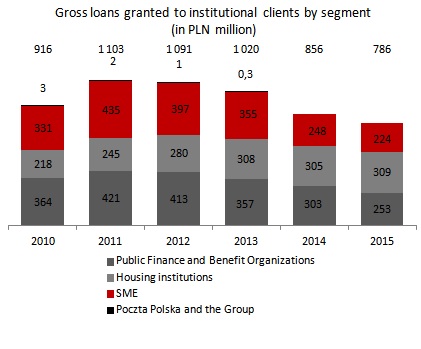

Applying general, financial and business relations criteria, the Bank has divided its institutional clients into the following categories:

- small and medium enterprises (SME),

- housing institutions such as condominiums, housing associations, property managers and social housing associations,

- Public Finance and Public Benefit Organizations to include associations, labor unions, election committees,

- Poczta Polska and companies from its Capital Group.

At the end of 2015 Bank Pocztowy had the total of 15.2 thousand institutional clients. The housing segment is the largest group of institutional clients. In December 2015 the Bank served 11.3 thousand clients in this group.

billion

institutional client segments

Development of the product offer for institutional clients

The key product in packages tailored to individual needs of institutional client segments is the current account. The Bank offers the following types of current accounts to institutional clients:

- Pocztowy Biznes Pakiet – targeted at all SMEs, real property managers and administrators, Public Finance sector, public benefit organizations, NGOs, Poczta Polska S.A. and companies from the Poczta Polska Capital Group,

- Pocztowy Pakiet MINI DOM (Mini House Postal Package) – targeted at condominiums which enter into a limited number of transactions, generate low revenue and use a narrow range of bank products. Lower package price with additional individual fees and charges for individual products,

- Pocztowy Pakiet DOM (House Postal Package) – full offer for condominiums. Free of charge transfers in return for a higher package price.

In order to simplify the Bank’s offer for institutional clients in April 2015 the Bank decided to withdraw certain products: Pocztowy Pakiet MAŁA ORGANIZACJA (Small Organization Postal Package) and Pocztowy Pakiet ORGANIZACJA (Organization Postal Package) dedicated to the Public Finance sector, Public Benefit Organizations (associations, organizations, trade unions, Parents’ Councils) and social housing associations.

The Bank also offers escrow accounts for housing purposes (both open-ended and closed-ended) for developers and used for accumulating funds paid by the buyer for purposes specified in the development agreement.

The Bank offers the following deposit products:

- standard fixed-rate deposits with the tenor of 3, 6 and 12 months and the minimal amount of PLN 1 thousand,

- individually negotiated deposits for at least PLN 50 thousand,

- automatically renewed overnight deposits of at least PLN 50 thousand with more advantageous interest rates than those proposed for overdrafts,

- Konto Oszczędnościowe Biznes (Business Saving Accounts) - for all segments. Interest rates dependent on the amount of funds on the account with two thresholds: account balance of less than PLN 10 thousand (lower interest rate) and account balance of more than PLN 10 thousand (higher interest rate),

- bank accounts in foreign currencies (USD, EUR, GBP, CHF, CAD).

The Bank offers comprehensive settlement services based on the access to Poczta Polska's infrastructure. The services include: managing cash payments made in other banks and handling payments made to the Social Insurance Institution and Tax Offices.

The Bank’s settlement offer includes:

- Giro Płatność (Giro Payment) (cash payments to third parties available at the offices Poczta Polska and the Bank’s own network),

- over-the-counter deposits (cash payments to the client’s account at the offices of Poczta Polska and the Bank’s own network based on standard or individual terms),

- Pocztowy Collect (identifying bulk payments using virtual accounts generated to a client’s bank account),

- Pocztowy Przelew Zbiorczy (Postal Collective Transfer) (managing bulk domestic non-cash payment orders in the Polish zloty),

- sealed cash deposits (accepting sealed cash deposits from clients).

Further, in 2015 the Bank continued relationships with companies offering international cash transfers. The Bank's key competitive advantage is the widest distribution network in Poland, composed of post offices and bank's sales points where customers can collect cash transfers.

The Bank’s credit offer for institutional clients includes in particular:

- overdraft facilities (in the current and credit account),

- non-revolving working capital loans (in the credit account),

- investment loans,

- loans with thermal improvement and refurbishment premium,

- loans for refurbishment and construction purposes,

- mortgage loans,

- bank guarantees.

The treasury offer for institutional clients includes:

- currency forward contracts,

- purchase and sale of debt securities (treasury and non-treasury securities, certificates of deposit),

- possibility to conclude currency forward transactions under a treasury limit.

In order to improve competitiveness of its offer for institutional clients the following steps have been taken by the Bank:

- change of the standard deposit offer: at the beginning of 2015 the number of standard deposits has been limited to three periods 3, 6 and 12 months as at 31 December 2015 (the same as those of deposits offered to consumers : MINI, MIDI and MAXI),

- reduction of the minimum amount of individually negotiated deposits to PLN 50 thousand and simplification of the process of depositing funds through an direct client communication with the Treasury Department,

- simplification of the Fee and Commission Scheme and transferring products no longer available to a separate document,

- introduction of a flexible mechanism of determining interest rates for standard overnight deposits,

- initial works on a new cash transfer services.

Credit operations

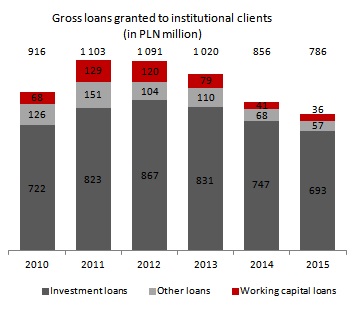

The Bank’s strategy with respect to institutional clients assumes selected growth focused on housing products. Therefore, in 2015 the Bank limited the scope of its lending campaign addressing it only to the existing key clients holding significant deposits and using settlement services. The change in the lending policy towards institutional clients translated into a decrease in credit receivables from this client group. As at 31 December 2015 the Bank’s credit receivables from institutional clients totaled PLN 785.6 million and were by PLN 70.5 million lower than in December 2014.

| Loans of Bank Pocztowy S.A. - institutional segment (in PLN ’000) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 31.12.2015 | structure(31.12.2015) | 31.12.2014 | structure (31.12.2014) |

|

|||||||

| Loans granted to institutions | 785 612 | 100,0% | 856 097 | 100,0% | (70 485) | (8,2)% | |||||

| Investment loans | 692 500 | 88,2% | 746 959 | 87,2% | (54 459) | (7,3)% | |||||

| Working capital loans | 35 637 | 4,5% | 40 956 | 4,8% | (5 319) | (13,0)% | |||||

| Other loans | 57 475 | 7,3% | 68 182 | 8,0% | (10 707) | (15,7)% | |||||

Source: management information of the Bank. The data present the principal amount only. Default interest, due and undue interest, EIR fees, other prepaid expenses and revenue, other restricted revenue and interest and other receivables were not included.

Investment loans had the highest share in the institutional clients portfolio and they accounted for 88.2% of the total credit exposure of the Bank from this group of clients at the end of 2015.

Gross loans granted to institutional clients (in PLN million)

Gross loans granted to institutional clients by segment (in PLN million)

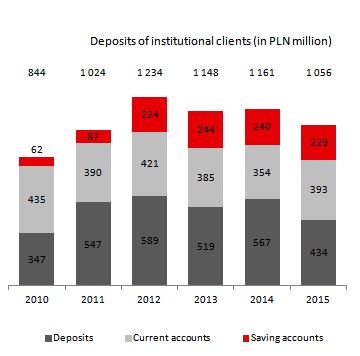

Deposits

As at 31 December 2015 deposits of institutional clients amounted to PLN 1 056.4 million, i.e. by PLN 104.3 million less than at the end of 2014. The scale of deposit activities in the institutional segment was adjusted to the limited lending activities in particular in the SME portfolio. In December 2015 Bank Pocztowy held a 0.4% share in the market of deposits of institutional clients and controlled 2.7% of the market of deposits made by non-profit organizations operating for the benefit of households9.

| Deposits of Bank Pocztowy S.A. - institutional segment (in PLN ’000) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 31.12.2015 | structure (31.12.2015) | 31.12.2014 | structure (31.12.2014) |

|

|||||||

| Total institutional deposits | 1 056 431 | 100,0% | 1 160 706 | 100,0% | (104 275) | (9,0)% | |||||

| Current accounts | 392 984 | 37,2% | 354 339 | 30,5% | 38 645 | 10,9 % | |||||

| Saving accounts | 228 996 | 21,7% | 239 472 | 20,6% | (10 476) | (4,4)% | |||||

| Deposits | 434 451 | 41,1% | 566 895 | 48,9% | (132 444) | (23,4)% | |||||

At the end of December 2015, the balance of cash on current accounts of institutional clients increased to PLN 393.0 million, i.e. it was by 10.9% higher than on 31 December 2014.

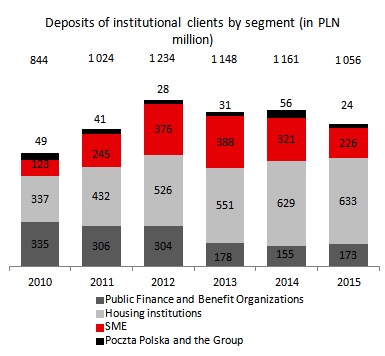

Deposits of institutional clients (in PLN million)

Deposits of institutional clients by segment (in PLN million)

At the end of 2015 Bank Pocztowy managed 20.3 thousand active current accounts of institutional clients.

Most institutional clients invest free cash in term deposits. In December 2015 term deposits of these entities reached PLN 434.5 million, i.e. 41.2% of total deposits of institutional clients. In 2015, in time of decreasing interest rates, the balance of deposits was by PLN 132.4, i.e. by 23.4% lower than at the end of 2014. At the end of 2015 the total balance deposited on saving accounts decreased by PLN 10.5 million to PLN 229.0 million.

Housing institutions where those to deposit the highest amount at the Bank. In December 2015 the value of deposits in the housing segment reached PLN 633.0 million and constituted 59.9% of the total deposits of institutional clients. Deposits of SMEs were also considerable and amounted to PLN 226.3 million, i.e. accounted for 21.4% of the total deposits of institutional clients.