Organizational and infrastructural development

Postal Finance Zones

development plan

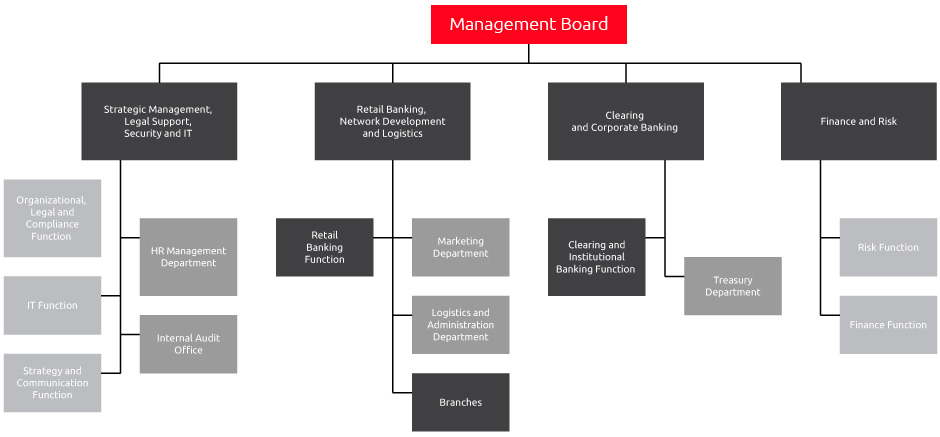

1. Organizational structure of the Bank

Bank Pocztowy S.A. includes four areas managed by individual Management Board Members:

- Strategic Management, Legal Support, Security and IT

- Retail Banking, Network Development and Logistics

- Clearing and Corporate Banking

- Finance and Risk.

Organizational structure of Bank Pocztowy S.A.

Key objectives and tasks assigned to each area:

Strategic Management, Legal Support, Security and IT:

- Organization, Legal and Compliance Function: ensure efficient operation of the Bank’s bodies, secure and efficient anti-fraud and AML operation and prevention of terrorism funding, efficient legal support to protect the interests of the Bank, ensure security, safe and efficient operation of the protected Bank's infrastructure.

- IT Function: maintain the IT infrastructure and systems on the appropriate level and develop IT systems in compliance with external clients’ expectations.

- Strategy and Communication Function: develop and verify the Bank’s strategy, ensure internal and external communication, build a positive image of the Bank and coordinate its activities regarding capital investments.

- Human Resources Management Department: develop HR, training and social policy, ensure proper quality and qualifications of staff.

- Internal Audit Office: ensure tight and efficient internal control.

Retail Banking, Network Development and Logistics:

- Retail Banking Function: develop and pursue the retail sales policy regarding bank and external products, develop the retail business.

- Logistics and Administration Department: ensure proper conditions and means of labor and organize an efficient network of retail sales for products of the Bank and of other entities.

- Marketing Department: support sales through marketing campaigns performed in compliance with the needs of sales departments, plan and implement coherent marketing communication in on- and off-line channels, build and pursue the brand strategy on the market in accordance with the overall Bank's strategy; cooperate on development of product policy and implement sales plans in terms of product and transactions offered to clients in remote channels.

Clearing and Corporate Banking:

- Clearing and Corporate Banking Function: sales of banking products and services to corporate clients; corporate business development.

- Treasury Department: perform operating activities connected with the management of liquidity, interest rate and currency risk within the accepted limits; generate profit on the trade of financial instruments on own account or on the account and behalf of clients.

Finance and Risk:

- Risk Function: develop the system of integrated risk and capital management, support implementation of the Bank’s strategy and maintain the accepted risk appetite level; develop the risk function strategy aligned with the overall strategy of the Bank; develop the Bank's policy regarding credit risk and an efficient risk monitoring, restructuring and debt collection system.

- Finance Function: implement the financial planning process in the Bank, monitor performance on financial plans, maintain accounting records; pursue internal and strategic management of assets, liabilities and structural liquidity of the Bank.

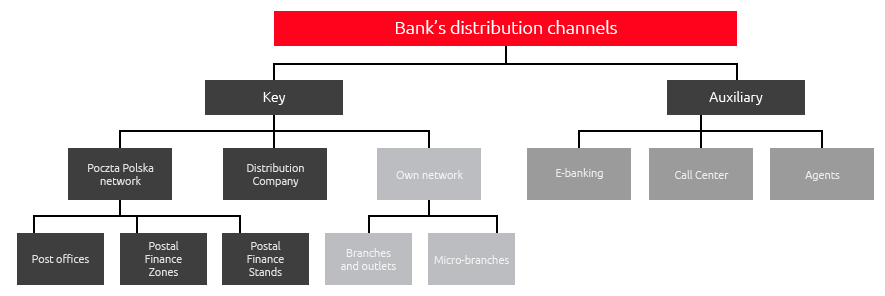

2. Banking product distribution channels

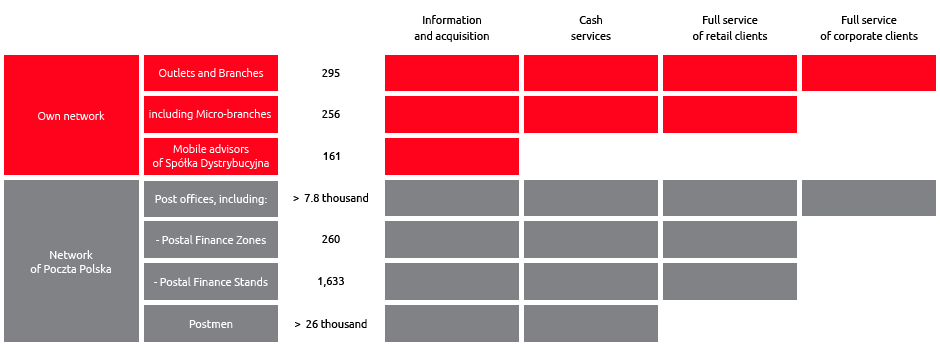

Bank Pocztowy S.A. has a developed sales network consisting of:

- key channels, i.e. the own network of the Bank, Poczta Polska sales network and the distribution network of Spółka Dystrybucyjna,

- supporting channels, i.e. e-banking, call center and agents.

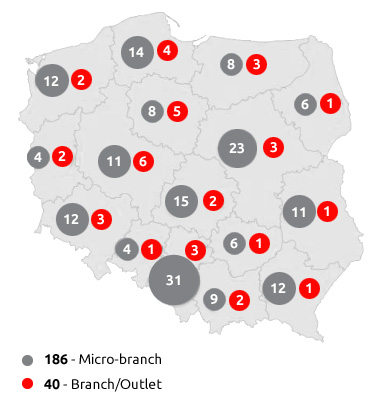

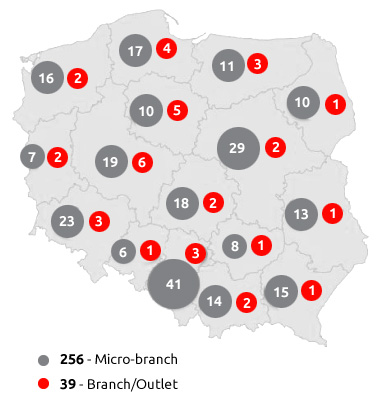

At the end of 2013, the own distribution network of the Bank included 295 entities (one Branch, 38 Outlets and 256 Micro-branches). During 2013, the network was increased by 69 Micro-branches. One Outlet was closed.

Standard Micro-branch

The development of the Micro-branch network, being the largest group of the points of sales, remained a key strategic initiative of the Bank. The Micro-branches are separate points of sales operated within post offices, with full access to banking databases, systems and applications, operated by the Bank’s employees.

The Bank develops internet distribution channels, too.Individual clients may use Pocztowy24 internet banking system, while corporate clients are offered Pocztowy24 Biznes. Call center is a phone banking system allowing clients access to their accounts and other banking services on the phone or through Internet communicators. In 2013, the Bank extended the functionality of their e-distribution channels allowing its clients opening Pocztowe Konto Standard (standard postal account) and Pocztowe Konto Nestor (postal account for seniors) through Internet.

Traditional distribution channels of Bank Pocztowy S.A. by province

| 31.12.2012 | 31.12.2013 |

|

|

Further, the products of the Bank are distributed through a network of mobile advisors to Spółka Dystrybucyjna Banku Pocztowego Sp. z o.o., which carries out acquisition of credit products among clients with limited access to the Bank’s sales network.

At the end of 2013, Spółka Dystrybucyjna Banku Pocztowego Sp. z o.o. cooperated with 161 advisors.

The Bank provides financial services using the sales network of Poczta Polska (about 7,800 outlets including 1,633 Postal Finance Stands and 260 Postal Finance Zones). The Bank’s products are also distributed through 26,000 postmen.

The extensive network provides easy access to the Bank's products countrywide.

Scope of services provided by individual channels distributing products and services of Bank Pocztowy

3. Development projects

In 2013, the total investment outlays incurred by Bank Pocztowy S.A. for development projects amounted to PLN 9.3 million. It was close to the 2012 level (PLN 9.4 million). Most investments regarded IT and included improvement and development of basic IT environment components. Outlays for development of e-distribution channels and improvement of the own network of Bank’s points of sales constituted another significant cost item.

Non-personnel expenses related to the projects amounted to PLN 2.0 million and were PLN 1.0 million lower than in 2012.

IT and Operations

Key activities regarding development of IT systems in the Bank in 2013:

- Improvement of the Bank’s IT system: It is to include the central system and its supporting systems. In 2013, the Bank developed the final version of the target business processes and the central banking system model. The preparation work included analysis of the architecture of IT solutions used by the Bank and optimization of the change management process.

- Implementing Front-End in the Bank’s Outlets: The key objective of the project is to develop a Front-End application and implement software for internet browsers to serve clients in the Bank's own network and then in Poczta Polska outlets. In 2013, the system was implemented in all Micro-branches and employees were trained on its functionalities. The implementation process in other Outlets, not included in the pilot in 2012, was also completed. Work on software upgrade was continued to provide the system with new functionalities.

- Implementing Front-End in the outlets of Poczta Polska S.A. The project is a continuation of Front-End application implementing in the Bank’s Outlets, with the key objective is to implement the new solution in the outlets of Poczta Polska to allow:extending the scope of products and services offered to clients through post offices, allowing access to the products and services in all post offices, improving and accelerating the sales of Bank's products and post-sales service offered to its clients. The work performed in 2013 included testing of on-line payments in cooperation with Poczta Polska S.A. and implementing the process in the production environment in post offices.After the positive pilot results involving opening accounts in Ferryt, the process was implemented in the production environment for Bank’s clients served in post offices.

Development of e-distribution channels

In 2013 the Bank worked on implementation of a new Internet platform for retail and corporate clients. The purpose of the investment is to provide a modern solution that will replace the existing Internet banking platform for retail and corporate clients and allow the opening of a new access channel, i.e. mobile banking, in future. The solution will be integrated with Front-End system accessible in the Bank’s outlets, which will allow simultaneous presentation of data in all distribution channels (outlets, call center, Internet banking, and mobile banking). The work performed in 2013 focused mainly on migration of corporate clients to the production environment, pilot for corporate clients, development of the retail part of the project, testing of applications for retail clients and commencing the pilot for these clients. In 2014, Nowa platforma www system will be fully operable and accessible for all clients of the Bank.

Network of banking outlets

The Bank carried out the following projects regarding traditional distribution channels:

- Micro-branches: The purpose of the project is to improve efficiency of sales in post offices through development of the Micro-branches network. In 2013, 69 Micro-branches were opened.

- Revitalization of own network:. The Bank continued revitalizing of own network involving adjustment of the Outlets to the accepted Book of Standards. Advisors are equipped with new computers. New outlets have friendly arrangement with space supporting communication with clients, modern and innovative solutions. The above changes are to support unification of service standards and improved image and technical standard of the premises. The Bank closely cooperates with this respect with Poczta Polska S.A., which is also revitalizing its network.

Projects related to the Bank’s operations

The key initiative with this respect involved the building of Customer Relationship Management system, a tool that will allow strengthening relations with clients.

The key objective of the project was to provide with comprehensive CRM solutions that would integrate all communication channels and sales supporting systems. This will allow developing of client data collection mechanisms and preparing of a special offer accessible in a preferred distribution channel. The offer will be accessible through an advisor with the use of the CRM tool, in IVR in remote channels and on the website through integration of systems under the project. The work on CRM tool development included a detailed specification underlying the test version of the operational CRM including sales supporting modules:Startup Panel, Manager Panel, Client Card, Issues and Tasks and Calendar. Another stage of the analysis was commenced to extend the application with the following modules: Campaign Generator, Reports, and Messages for Clients. The business part includes the product related and client activation strategy, cross-selling activities extended to all distribution channels to include PocztaPolska and improved business processes related to sales of new products to Bank's clients.

In the first half of 2013, Bank Pocztowy S.A. launched a pre-paid card and allowed its service in Front-End system. At present, the Bank carries out the pilot sales of the pre-paid cards in selected post office across the country.

Annual Report 2013 - Bank Pocztowy

Corporate Governance

- Corporate governance: principles and scope of application

- Control system in the process of preparing financial statements

- Entity authorized to audit financial statements

- Shareholding structure and share capital

- Key information regarding Poczta Polska S.A.

- Cooperation with Poczta Polska S.A.

- Investor relations

- By-laws amending principles

- Activities of the corporate bodies of the Bank