Credit risk

average of the banking

sector

Credit risk is the risk assumed by the Group under credit transactions and resulting in its inability to recover the amounts disbursed, loss of income or a financial loss.

It is the outcome of credit product development and launch as well as the lending process on the one hand and measures employed with a view to reducing the probability of losses, on the other. The Group’s credit risk includes both counterparty and settlement risk.

When developing its current credit risk management policy, the Group aims to maintain the risk appetite level, i.e. NPL ratio and the cost of risk, determined in the strategy. Other factors taken into account include maintaining an appropriate level of equity, compliance with the credit limits set by the Group, analyzing both strengths and weaknesses of the Group’s lending process and anticipating the opportunities and threats for its further growth. The Group’s acceptable credit risk policy also takes into account cyclicality of economic processes and changes in the credit portfolio itself.

The Group has adopted the following principles for the credit risk management process:

- analyzing credit risk of individual exposures, the entire portfolio and the capital requirement related to credit risk,

- applying internal and external limits arising from risk appetite in various areas of the credit portfolio and from the Banking Law and implemented recommendations of Polish Financial Supervision Authority, respectively,

- Functions related to direct analysis of applications, risk assessment and credit related decision making are separated from those focused on client attraction (sales of banking products),

- credit capacity and creditworthiness are the main criteria underlying all credit transactions with clients,

- credit decisions are made in the Bank in accordance with procedures and competencies determined in internal regulations on credit risk assessment and credit decision making,

- each credit transaction is monitored in terms of utilization, timely repayment, legal security, equity and organizational relationships of the obligor and, in the case of institutional clients, also in terms of their current economic and financial position,

- the financial and economic standing of each insurance company supplying credit collateral, as well as delivery of insurance policies and assignment of rights related thereto by clients are monitored on a regular basis,

- developments in the real estate market as well as the legal and economic assumptions and framework for valuation of property provided as collateral for credit exposures are monitored on a periodic basis.

Credit risk management in the Group is based on written policies and procedures defining methods of identification, measurement, monitoring, limiting and reporting of credit risk. The regulations determine the scope of competencies assigned to each unit of the Bank in the credit risk management process.

In order to determine the credit risk level, the Bank uses the following measures:

- probability of default (PD),

- recovery rate (RR),

- loss given default (LGD),

- loss identification period (LIP),

- share and structure of non-performing loans (NPL),

- coverage of non-performing loans with impairment losses (NPL coverage),

- scoring model efficiency measures (among others GINI, PSI Ratio),

- cost of risk.

The Bank carries out regular review of implementation of the adopted credit risk management policy. The review and modification includes mostly:

- internal regulations regarding client’s credit risk assessment and monitoring, as well as verification of the value of legal security, which are adjusted to changing market conditions, business specifics of each client type (group), loan purpose and determination of the minimum requirements regarding the obligatory forms of legal security,

- internal system of limiting credit activities and determining decision-making powers regarding loans,

- a system of identifying, assessing and reporting credit risk to Credit Committees, Management and Supervisory Board of the Bank,

- maximum adequacy levels of ratios used to assess credit risk and acceptable forms of own contribution for retail housing loans,

- scoring models and IT tools used in the credit risk management process.

The Bank’s reporting system includes among others:

- reporting on credit risk level, to include vintage analyses, information regarding the use of limits, quality and efficiency of credit processes,

- reports on stress tests, limit review and back-test analyses for impairment losses,

- analyses of real property market and verification of the current value of security for credit exposures,

- review of implemented credit risk policy.

The Bank prepares the following cyclical reports on its exposure to liquidity risk:

- Monthly report for the Management Board and Credit Committee of the Bank,

- quarterly report for the Supervisory and Management Board.

Portfolio quality

At the end of December 2015 the share of non-performing loans in the credit portfolio accounted for 7.0% and was 0.9 p.p. higher than a year before.

The NPL growth resulted mainly from the Group’s focus on consumer loans availed to individuals. Significantly, the NPL level recorded at the end of 2015 was lower than the risk appetite level accepted by the Group. Further, quality of the Group’s loan portfolio was considerably higher than the banking sector average, which at the end f 2015 demonstrated NPL of 7.4%).

| Portfolio quality – the share of impaired loans in the gross credit portfolio vs. market average | ||||

|---|---|---|---|---|

| 31.12.2012 | 31.12.2013 | 31.12.2014 | 31.12.2015 | |

| Group | 4,7% | 5,4% | 6,1% | 7,0% |

| Banking sector | 8,8% | 8,5% | 8,1% | 7,4% |

| Portfolio quality – the share of impaired loans in the gross credit portfolio | |||||

|---|---|---|---|---|---|

| 31.12.2012 | 31.12.2013 | 31.12.2014 | 31.12.2015 | Change 2015/2014 | |

| Capital Group total | 4,7% | 5,4% | 6,1% | 7,0% | 0,9 p.p. |

| for individuals | 4,4% | 4,7% | 5,6% | 6,4% | 0,8 p.p. |

| for institutional clients | 9,5% | 12,3% | 13,0% | 15,4% | 2,4 p.p. |

| for local authorities | 0,0% | 0,0% | 0,0% | 0,0% | (0,0) p.p. |

| Portfolio quality – impaired loans balance (PLN’000) | |||||

|---|---|---|---|---|---|

| 31.12.2012 | 31.12.2013 | 31.12.2014 | 31.12.2015 | Change 2015/2014 | |

| Capital Group total | 221 777 | 277 241 | 325 391 | 389 838 | 64 447 |

| for individuals | 157 472 | 193 465 | 247 265 | 300 766 | 53 501 |

| for institutional clients | 64 305 | 83 776 | 78 026 | 89 072 | 11 046 |

| for local authorities | 0 | 0 | 100 | 0 | (100) |

At the end of 2015 the amount of non-performing loans was by PLN 64.4 million higher than at the end of 2014, where 83% of the growth was reported in loans granted to individuals. In the institutional segment, however, the value of impaired receivables was by PLN 11.0 million higher than at the end of 2014.

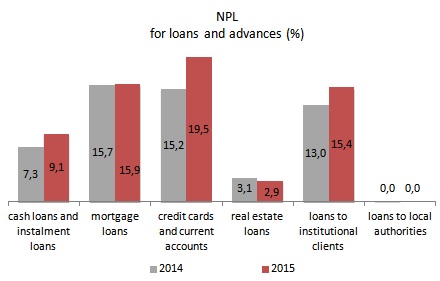

NPL for loans and advences (%)

Overdrafts, credit card debt and mortgage loans demonstrated the highest share of non-performing loans both at the end of 2015 and 2014. The ratio was high for mortgage loans, because the portfolio has been maturing gradually and at the same time the new lending has decreased. The NPL for cash and installment loans went up 1.8 p.p., which results from portfolio maturity. Significantly, the ratio is significantly lower than that of the Polish banking sector average for consumer loans granted to individuals which amounted to 12.2% at the end of 2015.

Impairment losses

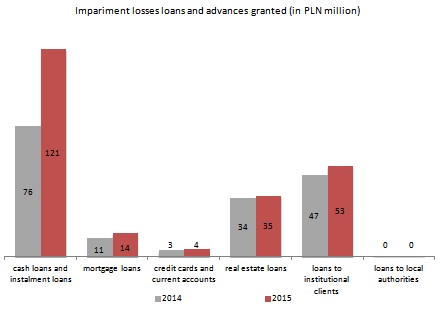

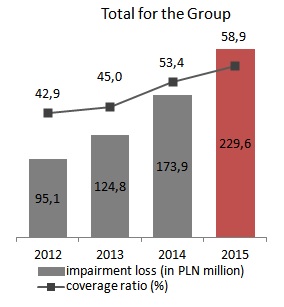

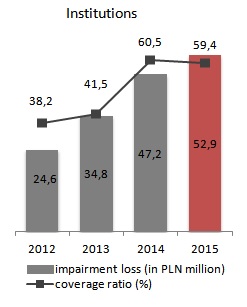

At the end of 2015 the carrying amount of impairment losses for the Group’s credit portfolio amounted to PLN 229.6 million and was 32% higher than at the end of 2014.

Impariment losses loans and advances granted (in PLN million)

Total for the Group

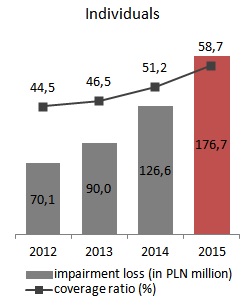

Individuals

Institutions

At the end of December 2015 the coverage ratio reached 58.9% and was 5.5 p.p. higher than at the end of December 2014. The ratio amounted to 58.7% for loans extended to individuals, including 65.5% for cash loans, and 59.4% for loans granted to institutional clients. The IBNR losses have been accounted for in the coverage ratio.