Economic and financial position

1. The change in the method of recognizing revenue due to sale of bancassurance products linked with credit facilities

With relation to the letter of the Polish Financial Supervision Authority of March 2013 addressed to the entire banking sector and concerning the method of recognizing revenue due to sale of bancassurance products, the Bank changed the method of recognizing the revenue in question in the accounting records for 2013. The change concerned bancassurance services, which were assessed as unrelated to credit facilities, and consisted in:

- deferring a revenue portion corresponding to the fee for time spent by the Bank’s staff on post-sales support for insurance services (in accordance with the stage of completion principle);

- recognizing provisions for potential reimbursement of the remuneration by the Bank due to early termination of insurance policies,

- adequate recognition of cost of selling the insurance, in line with the matching principle.

Changes resulting from the implemented methodology were recognized in the accounting records as at 30 June 2013 and covered the period from January to June 2013. As the changes made did not significantly affect the Bank’s equity, the Bank did not adjust the opening balance for 2013.

In December 2013, similarly to other banks, the Bank received a letter of the Polish Financial Supervision Authority with detailed guidelines concerning the accounting treatment of the revenue due to sale of bancassurance products. The letter recommended more stringent criteria than those applied by the Group to assessing direct relation of an insurance product and a credit facility and implemented a fair value model to distribution of the agency fee for the sale of insurance. The Group applied a new accounting treatment of revenue due to sale of bancassurance products to sales carried out in 2013 and in previous years. Retrospective changes in the accounting principles (policy) resulted in restating the financial data in the approved financial statements for prior years, i.e. the opening balance as at 1 January 2012 and, consequently, as at 1 January 2013 and the financial performance for 2012.

Following the changes in the accounting principles (policy) the Group recognizes the revenue and expense due to sale of bancassurance products related to credit facilities in the following manner:

- cash loans with insurance policy – from 6 to 11% of the revenue due to sale of bancassurance products related to cash loans is recognized on a one-off basis as commission income, while the remaining portion of the income is accounted for as interest income using the effective interest method during the credit financing period,

- mortgage loans with insurance policy – from 0% to 15% of the revenue due to sale of bancassurance products related to mortgage loans is recognized on a one-off basis as commission income, while the remaining portion of the income is accounted for as interest income using the effective interest method during the credit financing period.

The costs of sale of bancassurance products are accounted for proportionally to the method of recognizing the revenue due to sale of bancassurance products related to the facility.

As a result of changes in the accounting principles, the Capital Group made the following adjustments:

- adjustment of equity by PLN 11.7 million as at 31 December 2012, including: an adjustment of the net profit for 2012 by PLN 6.4 million.

- adjustment of the net profit for 2013 by PLN 8.1 million.

The total amount of the Group’s equity adjustment was PLN 19.7 million as at 31 December 2013.

The accounting principles applied to bancassurance products were presented in the consolidated financial statements for the year ended 31 December 2013 in notes 5b and 5f (15)(iii).

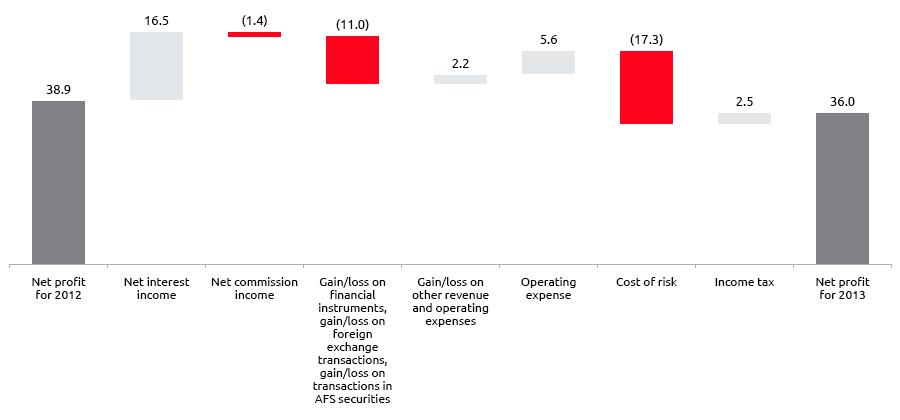

2. Key factors determining the financial profit or loss

income

In 2013 the Bank Pocztowy Capital Group generated a net profit of PLN 36.0 million, i.e. by 7.5% less than the record high profit generated in 2012.It was the second highest net profit of the Group since its establishment.

The financial profit of the Bank’s Capital Group in 2013 was determined by the following factors:

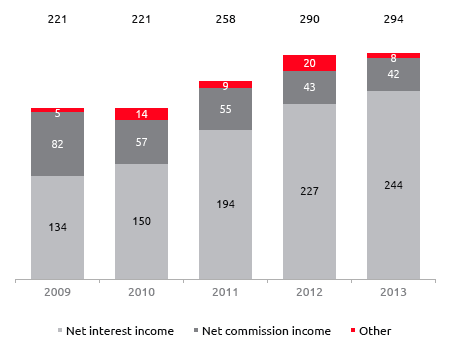

- An increase in the net interest income generated despite disadvantageous market trends, i.e. decreasing market interest rates. The net interest income amounted to PLN 243.8 million, i.e. by 7.3% more than in 2012 mainly due to an increased value of new loans extended to consumers.

- A decrease in the net commission income. The Group generated a net commission income of PLN 41.6 million, i.e. by 3.3% less than in 2012.It was affected by lower commission income due to settlement and cash transactions (by 11.4%, i.e. PLN 4.7 million).

- Lower gain/loss on transactions in securities available for sale, gain/loss on foreign exchange transactions and gain/loss on financial instruments. The Group generated the total income from such transactions of PLN 8.9 million, i.e. by 55.4% less than in 2012. The decrease resulted from the fact that the Monetary Policy Council ended the cycle of reducing interest rates in Poland and from growing aversion to risk in financial markets, which entailed higher price volatility and a pressure for a gradual increase in profitability of Polish debt instruments.

- Lower costs of operations. In 2013 the Group maintained its cost discipline, which resulted in a reduction of operating expenses by 2.6% down to PLN 212.7 million. The cost of employee benefits reached PLN 92.4 million and was by 8.7% lower than in 2012. At the same time, non-peronnel costs amounted to PLN 98.4 million and were by 2.3% higher than in 2012.

- Higher impairment losses on assets. In 2013 the cost of risk reached PLN 42.4 million and grew by 68.9% comparing to 2012. The Group recognized additional impairment losses for consumer credit portolio and credit receivables from institutional clients.

Net profit of the Bank Pocztowy Capital Group in 2013 (in PLN million)

The key income statement items:

Key income statement items of the Bank Pocztowy S.A. Capital Group (in PLN '000)

| 2013 | 2012 | Change 2013/2012 | ||

|---|---|---|---|---|

| PLN '000 | % | |||

| Operating income | 294,320 | 290,255 | 4,065 | 1.4 % |

| Net interest income | 243,807 | 227,282 | 16,525 | 7.3 % |

| Net fee and commission income | 41,628 | 43,064 | (1,436) | (3.3)% |

| Gain/loss on financial instruments measured at fair value through profit or loss and gain/loss on foreign exchange transactions | 2,905 | 6,678 | (3,773) | (56.5)% |

| Gain/loss on available-for-sale securities | 5,980 | 13,231 | (7,251) | (54.8)% |

| Gain/loss on other revenue and operating expenses | 4,076 | 1,865 | 2,211 | 118.6 % |

| General and administrative expenses | (212,738) | (218,356) | 5,618 | (2.6)% |

| Net impairment losses | (42,398) | (25,099) | (17,299) | 68.9 % |

| Gross profit | 43,260 | 48,665 | (5,405) | (11.1)% |

| Income tax | (7,233) | (9,716) | 2,483 | (25.6)% |

| Net profit | 36,027 | 38,949 | (2,922) | (7.5)% |

Bank Group income (in PLN million)

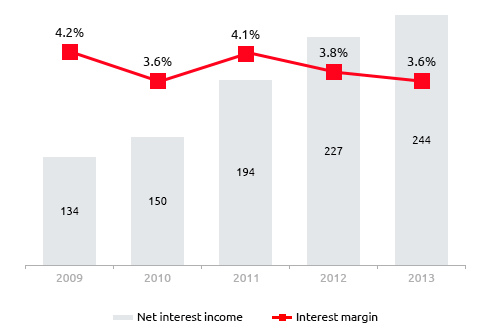

Net interest income of the Bank Group (in PLN million)

Net interest income

In 2013, like in the previous year, the net interest income constituted the key source of income for the Bank Pocztowy Capital Group.It amounted to PLN 243.8 million and was by PLN 16.5 million, i.e. by 7.3% higher than in 2012.

Apart from lower market interest rates, the net interest income of the Group in 2013 was determined by the following internal factors:

- lower interest income. In 2013 it amounted to PLN 423.4 million and was by 6.1% lower than in the previous year. The key item in the income category, interest income from term loans granted to individuals amounted to PLN 294.3 million, i.e. was by 1.5% higher than in 2012. The result was possible due to a significant increase in new lending to this customer group. The decrease in the value of the Capital Group's credit portfolio in the institutional client and local authorities segment, however, resulted in a significant drop in interest income in this client group.Interest income on financial instruments deteriorated as well.

- lower interest expense. In 2013 interest expense reached PLN 179.6 million and was by 19.6% lower than in 2012. The Group incurred much lower interest expense due to term deposits to institutional clients, which resulted primarily from lower funds deposited in current accounts and due to current accounts. Interest expense on term deposits of consumers grew, however, due to a considerable increase in their value along with expense due to treasury bonds (due to other bond issues in 2013) and a subordinated loan.

Despite the Group’s activities aimed at increasing the share of more profitable assets in the balance sheet, record low interest rates translated into a drop in interest margin.In 2013 the Bank Pocztowy Capital Group generated an interest margin of 3.6% versus 3.8% in 2012.

Interest income and expenses of the Bank Pocztowy S.A. Capital Group (in PLN '000)

| 2013 | 2012 | Change 2013/2012 | ||

|---|---|---|---|---|

| PLN '000 | % | |||

| Interest income |

423,400 | 450,790 | (27,390) | (6.1)% |

| Income on receivables from banks | 9,607 | 15,747 | (6,140) | (39.0)% |

| Income on receivables from clients, including: | 355,103 | 369,012 | (13,909) | (3.8)% |

| Overdraft facilities | 7,480 | 8,609 | (1,129) | (13.1)% |

| Credit facilities and term loans | 347,623 | 360,403 | (12,780) | (3.5)% |

| individuals | 294,269 | 289,803 | 4,466 | 1.5 % |

| institutional clients | 37,980 | 47,030 | (9,050) | (19.2)% |

| local authorities | 15,374 | 23,570 | (8,196) | (34.8)% |

| Revenue from investment financial assets classified as: | 58,541 | 65,735 | (7,194) | (10.9)% |

| available for sale | 37,891 | 43,945 | (6,054) | (13.8)% |

| held to maturity | 20,650 | 21,790 | (1,140) | (5.2)% |

| Revenue from investment financial assets held for trading | 149 | 296 | (147) | (49.7)% |

| Interest expense |

(179,593) | (223,508) | 43,915 | (19.6)% |

| Expense due to liabilites to other banks | (1,729) | (848) | (881) | 103.9 % |

| Expense due to liabilities to customers, including: | (156,552) | (207,363) | 50,811 | (24.5)% |

| Current accounts | (43,503) | (71,848) | 28,345 | (39.5)% |

| Term loans | (113,049) | (135,515) | 22,466 | (16.6)% |

| individuals | (82,795) | (75,359) | (7,436) | 9.9 % |

| institutional clients | (28,780) | (55,559) | 26,779 | (48.2)% |

| local authorities | (1,474) | (4,597) | 3,123 | (67.9)% |

| Cost of issue of debt securities and asubordinated loan | (21,312) | (15,297) | (6,015) | 39.3 % |

Net fee and commission income

Net fee and commission income was the key element of non-interest income of the Group.In 2013 it amounted to PLN 41.6 million and was by 3.3% lower than in the previous year.

Fee and commission income and expense of the Bank Pocztowy S.A. Capital Group (in PLN '000)

| 2013 | 2012 | Change 2013/2012 | ||

|---|---|---|---|---|

| PLN '000 | % | |||

| Fee and commission income | 73,006 | 68,041 | 4,965 | 7.3 % |

| originated loans and advances | 747 | 1,671 | (924) | (55.3)% |

| settlement and cash transactions | 36,742 | 41,460 | (4,718) | (11.4)% |

| payment and credit cards | 17,126 | 13,377 | 3,749 | 28.0 % |

| keeping bank accounts | 10,568 | 5,121 | 5,447 | 106.4 % |

| sale of insurance products | 3,589 | 3,091 | 498 | 16.1 % |

| other | 4,234 | 3,321 | 913 | 27.5 % |

| Fee and commission expense | (31,378) | (24,977) | (6,401) | 25.6 % |

| keeping current accounts and term deposits | (14,788) | (11,150) | (3,638) | 32.6 % |

| managing payment cards, ATM and POS cash withdrawals | (5,944) | (4,105) | (1,839) | 44.8 % |

| cash management services for the Bank | (5,574) | (5,189) | (385) | 7.4 % |

| sale of bank products | (1,211) | (5,189) | (166) | 15.9 % |

| other services | (3,861) | (3,488) | (373) | 10.7 % |

Commission income amounted to PLN 73.0 million and was by 7.3% higher than in 2012. The Capital Group reported in particular an increase in:

- revenue due to bank account maintenance (by 106.4%).The growth resulted from an increasing number of accounts managed and changes in the Fee and Commission Scheme introduced in the fourth quarter of 2013.

- payment cards and credit cards (by 28.0%) mainly due to an increase in the number of transactions performed by clients and the number of cards issued.

- sale of bancassurance products (by 16.1%), in particular accident insurance offered with the sale of cash loans.

The commission income due to the key element in this income category of the Group, i.e. settlement and cash operations, however, decreased by 11.4%. It was the effect of discontinuation of managing non-cash transfers of Social Security and related benefits in April 2012, reducing rates for Social Security transfers and a further decrease in the volume of settlements and cash operations.

In 2013 fee and commission expense increased as well. In 2013 it amounted to PLN 31.4 million, i.e. by 25.6% more than in 2012. In value terms, fee and commission expense related to current accounts for term deposits grew by 32.6% as a result of increasing cash withdrawals from current accounts provided by postmen and costs related to payment cards (by 44.8%).

Other income

In 2013 the gain/loss on financial instruments, the gain/loss on foreign exchange transactions and gain/loss on sale of available-for-sale securities amounted to PLN 8.9 million versus PLN 19.9 million in 2012. The category was discussed in detail in Section 5 dedicated to treasury operations.

In 2013 other operating income (other revenue/operating expenses) amounted to PLN 4.0 million and was by PLN 2.2 million, i.e. by 118.6% higher than in 2012.At the end of 2013 other operating revenue increased by 15.0%, i.e. by PLN 1.1 million up to PLN 8.7 million. The key item causing the increase in other operating revenue by PLN 2.2 million was revenue due to release of a provision for future liabilities (PLN 1.9 million growth).

In 2013 other operating expense was by 18.7%, i.e. PLN 1.1 million lower than in 2012. The highest decrease resulted from allowances for provisions for receivables from various debtors.

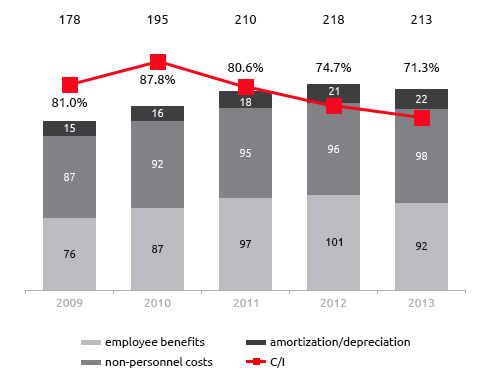

General and administrative expenses

In 2013, the Bank Capital Group focused on further cost optimization. In 2013 operating expenses of the Group reached PLN 212.7 million and decreased by 2.6% comparing to 2012, when the item value was PLN 218.4 million.

General and administrative expenses including amortization and depreciation of the Bank Pocztowy S.A. Capital Group (PLN '000)

| 2013 | Structure (2013) |

2012 | Structure (2012) |

change 2013/2012 | ||

|---|---|---|---|---|---|---|

| PLN '000 | % | |||||

| Administrative expenses including amortization and depreciation | (212,738) | 100.0% | (218,356) | 100.0% | 5,618 | (2.6)% |

| Employee benefits | (92,372) | 43.4% | (101,147) | 46.3% | 8,775 | (8.7)% |

| Non-personnel costs | (98,427) | 46.3% | (96,252) | 44.1% | (2,175) | 2.3 % |

| Amortization/depreciation | (21,939) | 10.3% | (20,957) | 9.6% | (982) | 4.7% |

The key element of operating expense of the Group were non-personnel costs. In 2013 they stood at PLN 98.4 million and grew by 2.3% comparing to 2012. Higher costs of external services, such as telecommunication and advisory services, and legal support were the key reasons for growth. At the same time, the Group’s outlays on promotion, advertising and other non-personnel costs decreased comparing to 2012.

In 2013 the Group spent PLN 92.4 million, i.e. by 8.7% less than in 2012 on employee benefits. Despite higher headcount, personnel costs were reduced thanks to the Bank’s activities aimed at optimizing and adjusting the employment structure in the Bank’s Head office to its business needs and due to changes in the remuneration system principles applied to sales staff.

Following its saving strategy in 2013 the Group renegotiated contracts with suppliers, awarded new contracts by tender and carried out investment projects to develop operations and reduced process costs.

General and administrative expenses (in PLN million) and C/I (%)

Net impairment losses

In 2013 impairment losses amounted to PLN 42.4 million (versus PLN 25.1 million in 2012).The Capital Group recognized impairment losses in particular for the following items:

- exposure due to an increase in consumer loans resulting from portfolio growth (increase in impairment losses by PLN 12.5 million);

- loans granted to institutional clients;

- loans for real property financing granted to individuals, still considering increased pre-collection activities of the Group the losses were by PLN 2.1 million lower than in 2012.

Higher impairment losses recognized in the income statement were a natural consequence of a dynamic growth of the Group’s credit portfolio in the preceding years and the process of gradual portfolio maturing. Despite higher impairment losses in 2013 the cost of risk of the Group was at the market level and amounted to 0.9%.

Net impairment losses (PLN '000)

| 2013 | 2012 | Change 2013/2012 | ||

|---|---|---|---|---|

| PLN '000 | % | |||

| Loans and advances granted to clients | (42,398) | (25,099) | (17,299) | 68.9% |

| Overdraft facilities | (3,164) | (1,393) | (1,771) | 127.1% |

| Term loans | (39,234) | (23,706) | (15,528) | 65.5% |

| individuals | (30,830) | (19,837) | (10,993) | 55.4% |

| consumer loans | (19,576) | (7,034) | (12,542) | 178.3% |

| real estate loans | (10,230) | (12,308) | 2,078 | (16.9)% |

| credit card debt | (1,024) | (495) | (529) | 106.9% |

| institutional clients | (8,795) | (3,771) | (5,024) | 133.2% |

| local authorities | 391 | (98) | 489 | - |

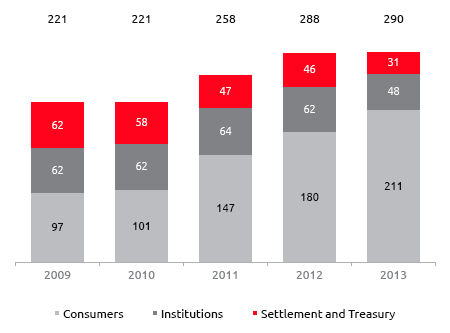

3. Business segment performance

Applying its management model (where the key criteria are the type of product, service and buyers) Bank Pocztowy S.A. divided its operations into the following business segments:

- consumers,

- institutions,

- settlement and treasury.

Income by business segment (in PLN million)

Consumer segment

From management accounting perspective the consumer segment offers products targeted at individuals. The Bank’s offer includes deposit, credit, insurance and investment products and is sold through a countrywide network of own outlets and PocztaPolska offices, online banking, mobile channels and the call center.

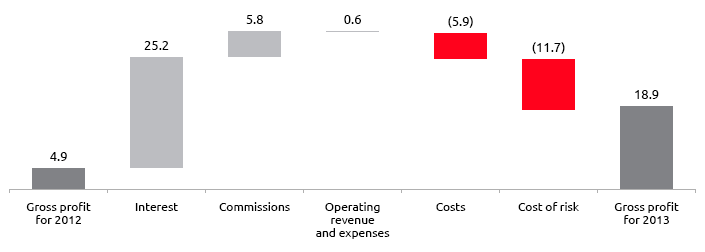

In 2013 the consumer segment generated a gross profit of PLN 18.9 million,which was by PLN 14.0 million, i.e. by 286.2% higher than in 2012.

Key gross profit growth drivers in the consumer segment:

- a considerable improvement in the net interest and commission income. Net interest income constituted the key source of segment income. It amounted to PLN 204.5 million and grew by PLN 25.2 million.A considerable improvement of the net interest income resulted from a dynamic growth of new lending to consumers.At the end of 2013 the credit portfolio value of the segment amounted to PLN 4,146.7 million and grew by 15.0% during the year.The consumer segment generated a net fee and commission income of PLN 6.3 million, i.e. by PLN 5.8 million more than in 2012.The increase was possible thanks to higher revenue from current account maintenance,

- higher administrative expenses. In 2013 the consumer segment costs reached PLN 164.2 million, i.e. by PLN 6.0 million more than in 2012. The key driver of growth were higher front-office expense related to new Bank's offices and an increase in amortization and depreciation costs of PLN 1.5 million, up to PLN 17.1 million,

- higher negative net impairment losses. In 2013 they amounted to PLN 32.1 million comparing to PLN 20.4 million in 2012, due to the process of maturing of consumer loan portfolio.

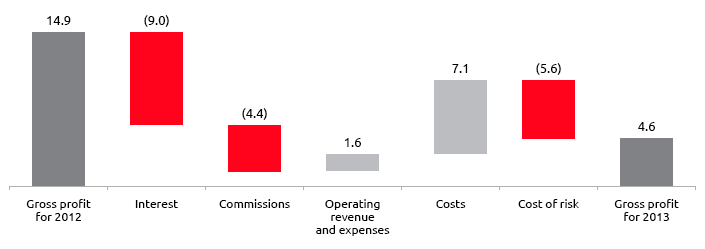

Gross profit of consumer segment in 2013 (in PLN million)

Institutional segment

Institutional segment in management accounting includes operating profit/loss from services provided to business entities with legal personality, individuals and entities with no legal personality carrying out business activities under applicable regulations and central and local administration entities. The Bank’s offer for these clients includes credit and deposit products and settlement services with products aimed at improving cash management efficiency. Products are offered through the Bank’s own network, the network of PocztaPolska and financial agents.

In 2013 the institutional segment generated a gross profit of PLN 4.6 million versus PLN 14.9 million in 2012 (a decrease of PLN 10.3 million).

The institutional segment profit was driven by the following items:

- lower net interest income.It amounted to PLN 38.5 million, i.e. by 19.0% less than in 2012. The change resulted from lower margin on deposit products,which amounted to 1.14% in 2013, as compared to 1.40% a year before.

- lower net commission income. The segment generated a net commission income of PLN 4.4 million, i.e. by 30.1% less than in 2012. The highest income drop was reported in fees for Eliksir transfers made through Infokonto, which resulted from lower fees for transfers and no commission for transferring cash surpluses;

- a decrease in administrative expenses. They amounted to PLN 34.6 million, i.e. by 7.1 less than in 2012,which was a consequence of changes in the cash management system.

- higher negative net impairment losses.In 2013 they amounted to PLN -10.3 million, as compared to -4.7 million a year before.

Gross profit of institutional segment in 2013 (in PLN million)

Settlement and treasury segment

Settlement and treasury segment in management accounting includes:

- gain/loss on operating activities covering settlement services. Key settlement services include: managing documents for payments to the Social Security Institution and Tax Offices, non-cash transfer of Social Security benefits to beneficiaries and cash payments in inter-bank settlements,

- gain/loss on financial instruments measured at fair value through profit or loss, gain/loss on foreign exchange transactions and realized gain/loss on transactions on securities available for sale

The segment also concludes transactions in the inter-bank market, invests the cash surplus in market instruments and acquires funds for the Bank.It repurchases client funds obtained by operating segments at a transfer rate and sells the funds to finance their credit operations.

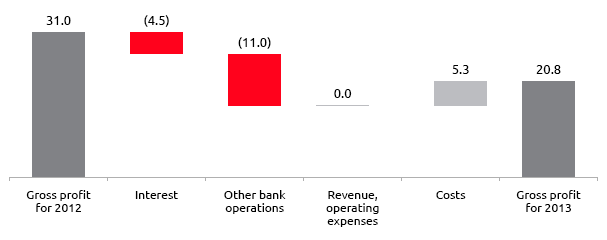

In 2013 the settlement and treasury segment generated a gross profit of PLN 20.8 million versus PLN 31.0 million in 2012 (a decrease of PLN 32.9%).

The key gross profit drivers in the settlement and treasury segment in 2013:

- a decrease in the net commission income. In 2013 it amounted to PLN 21.9 million and was by PLN 4.5 million (16.9%) lower than in the previous year. It was the effect of reducing rates for Social Security transfers in December 2013 and discontinuation of managing non-cash transfers of Social Security and related benefits in April 2012,

- lower gain/loss on treasury operations comprising a realized gain/loss on transactions on securities available for sale, a gain/loss on financial instruments measured at fair value through profit or loss and gain/loss on foreign exchange transactions. It amounted to PLN 8.9 million and was by PLN 11.0 million lower than in 2012,

- lower administrative expenses.

In 2013 the segment costs reached PLN 10.1 million, i.e. by PLN 5.3 million less than in 2012.

Gross profit of settlement and treasury segment in 2013 (in PLN million)

4. Key effectiveness ratios

Lower profit of the Bank Pocztowy Capital Group reported in 2013 and resulting mainly from the increase in the cost of risk led to deterioration of the return on assets and return on equity.In 2013 return on equity of the Group stood at 9.6% and was by 1.8 p.p. lower than in 2012. Significantly, the economic downturn translated into lower ratios in the entire sector, i.e. net return on equity of the banking sector dropped by 0.9 p.p. to 10.3%.1

Higher income of the Bank’s Capital Group along with stable operating expenses improved the Cost/Income relation. In 2013 the Cost/Income ratio amounted to 71.3%, i.e. was by 3.4 p.p. lower than in 2012.

Key effectiveness ratios of the Bank Pocztowy S.A. Capital Group

| 31.12.2013 | 31.12.2012 | Change 2013/2012 | |

|---|---|---|---|

| ROE (net) | 9.6% | 11.4% | (1.8) p.p. |

| ROA (net) | 0.5% | 0.6% | (0.1) p.p. |

| Costs including amortization/income (C/I) | 71.3% | 74.7% | (3.4) p.p. |

| Net interest margin | 3.6% | 3.8% | (0.2) p.p. |

| CAR | 12.8% | 14.0% | (1.2) p.p. |

| NPL (non-performing loans) – the share of impaired loans and advances in the entire credit portfolio | 5.4% | 4.7% | 0.7 p.p. |

Net ROE calculated as a net profit for a given year to average equity (calculated as the average of equity at the end of a given year and at the end of the previous year) taking into account the net profit for a given year.

Net ROA calculated as a net profit for a given year to average assets (calculated as the average of assets at the end of a given year and at the end of the previous year).

Costs including amortization and depreciation/Income (C/I) calculated as the general and administrative expenses including amortization and depreciation to total income (net interest income, net fee and commission income, gain/loss on financial instruments measured at fair value through profit or loss, gain/loss on foreign exchange transactions, realized gain/loss on transactions on securities available for sale, other operating revenue and expenses).

Net interest margin calculated a relation of net interest income for a given year to average assets (calculated as average daily balance of assets). The methodology of calculating the margin was changed due to standardization of internal reporting of the Bank.

NPL (Non Preforming Loans) calculated as a relation of impaired loans to the gross loans and advances to clients.

The share of impaired loans in the credit portfolio reached 5.4% versus 4.7% in 2012. Significantly, the ratio was considerably better than that of the entire Polish banking sector (7.7%)2.

5. Changes in the statement of financial position in 2013 – key items

As at 31 December 2013 the balance sheet total of the Bank Pocztowy Capital Group amounted to PLN 7 382.7 million and was by PLN 262.1 million, i.e. by 3.7% higher than at the end of 2012.

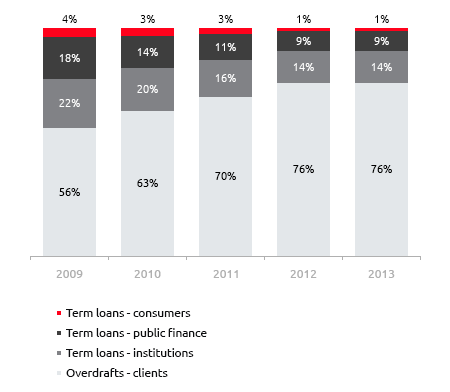

Assets

The key increase in assets was recognized in net loans and advances to customers. At the end of 2013 they amounted to PLN 5 055.7 million and grew by PLN 456.2 million during the year. The item accounted for 68.5% of the total assets of the Group (versus 64.6% a year before).The amount of investments in financial assets increased as wellto reach PLN 1 842.0 million, i.e. by PLN 388.0 million more than in 2012.Consequently, their share in assets increased from 20.4% at the end of 2012 to 25.0% in December 2013.

Cash in hand and at the National Bank of Poland, however, decreased comparing to 2012.In December 2013 it amounted to PLN 327.2 million and decreased by 607.5 million comparing to the end of 2012.Consequently, its share in assets increased from 13.1% at the end of 2012 to 4.4% in December 2013.

Structure of credit receivables from clients of Bank Group (%)

Key balance sheet items of the Bank Pocztowy S.A. Capital Group (PLN ‘000)

| 31.12.2013 | Share (31.12.2013) |

31.12.2012 | Share (31.12.2012) |

Change 2013/2012 | ||

|---|---|---|---|---|---|---|

| PLN '000 | % | |||||

| Cash in hand and deposits with the Central Bank | 327,242 | 4.4% | 934,743 | 13.1% | (607,501) | (65.0)% |

| Receivables from other banks | 36,329 | 0.5% | 29,849 | 0.4% | 6,480 | 21.7 % |

| Loans and advances granted to clients | 5,055,712 | 68.5% | 4,599,545 | 64.6% | 456,167 | 9.9 % |

| Investments in financial assets | 1,842,036 | 25.0% | 1,453,987 | 20.4% | 388,049 | 26.7 % |

| Net non-current assets | 74,881 | 1.0% | 71,552 | 1.0% | 3,329 | 4.7 % |

| Other assets | 46,545 | 0.6% | 30,977 | 0.5% | 15,568 | 50.3 % |

| Total assets | 7,382,745 | 100.0% | 7,120,653 | 100.0% | 262,092 | 3.7 % |

| Liabilities to the Central Bank | 11 | 0.0% | 6 | 0.0% | 5 | 83.3 % |

| Liabilities to other banks | 41,762 | 0.6% | 2,824 | 0.0% | 38,938 | 1 378.8 % |

| Liabilities arising from sold securities (repo) | 49,610 | 0.7% | 0 | 0.0% | 49,610 | - |

| Liabilities to clients | 6,230,578 | 84.4% | 6,317,949 | 88.7% | (87,371) | (1.4)% |

| Liabilities arising from issue of debt securities | 431,597 | 5.8% | 206,282 | 2.9% | 225,315 | 109.2 % |

| Subordinated liabilities | 142,027 | 1.9% | 142,891 | 2.0% | (864) | (0.6)% |

| Other liabilities | 95,395 | 1.3% | 89,231 | 1.3% | 6,164 | 6.9 % |

| Total liabilities | 6,990,980 | 94.7% | 6,759,183 | 94.9% | 231,797 | 3.4 % |

| Total equity | 391,765 | 5.3% | 361,470 | 5.1% | 30,295 | 8.4 % |

| Total equity and liabilities | 7,382,745 | 100.0% | 7,120,653 | 100.0% | 262,092 | 3.7 % |

Other assets include: financial assets held for trading, current income tax receivables, net deferred income tax assets, other assets.

Other liabilities include: financial liabilities held for trading, provisions, net deferred income tax provision, current income tax liabilities, other liabilities.

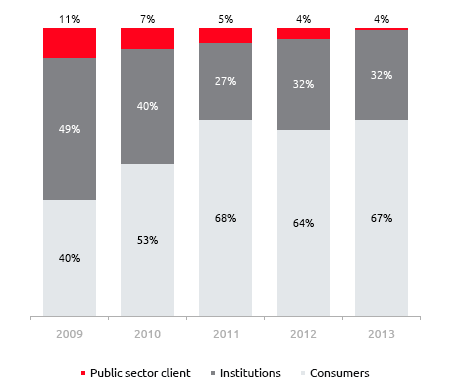

Equity and liabilities

The following changes in the equity and liabilities structure of the Bank Pocztowy Capital Group took place in 2013:

- the amount of liabilities towards customers. At the end of 2013 they amounted to PLN 6,230.6 million and decreased by PLN 87.4 million comparing to the end of 2012. They accounted for 84.4% of the balance sheet total versus 88.7% in December 2012,

- the value of liabilities due to issue of debt securities increasedto reach PLN 431.6 million in December 2013, i.e. by PLN 225.3 million more than a year before. They accounted for 5.8% of the equity and liabilities of the Bank versus 2.9% in December 2012,

- liabilities due to securities sold amounted to PLN 49.6 million, while at the end of 2012 the Capital Group did not hold any liabilities of this kind,

- equity amounted to PLN 391.8 million and accounted for 5.3% of the total equity and liabilitiesas compared to PLN 361.5 million and a 5.1% share in December 2012. The Capital Group’s equity increased following an allocation of the profit for 2012 to other reserve capital.

Structure of liabilities to the clients of Bank Group (%)

In years 2009-2011 non-bank finacial entities were classified as

financial instututions, in line with the reporting standards

applied in the Bank.

Index:

1 Financial Supervision Authority, Monthly data for the banking sector – December 2013.

2 Source: http://www.knf.gov.pl/opracowania/sektor_bankowy/dane_o_rynku/Dane_miesieczne.html

Annual Report 2013 - Bank Pocztowy

Corporate Governance

- Corporate governance: principles and scope of application

- Control system in the process of preparing financial statements

- Entity authorized to audit financial statements

- Shareholding structure and share capital

- Key information regarding Poczta Polska S.A.

- Cooperation with Poczta Polska S.A.

- Investor relations

- By-laws amending principles

- Activities of the corporate bodies of the Bank