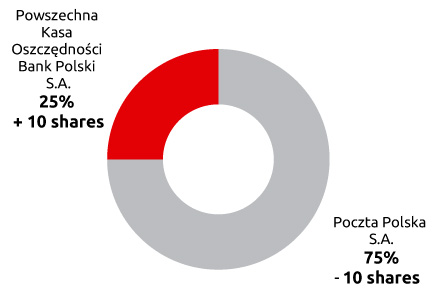

Shareholding structure and share capital

At the end of 2013 the share capital of Bank Pocztowy S.A. amounted to PLN 97,290,400 and was divided into 9,729,040 with the face value of PLN 10 each. It included:

- 291,300 registered A series shares carrying no voting preference, but carrying preferential rights to asset distribution in case of liquidation of the Bank in proportion of 5 to 1 versus ordinary shares;

- 9,437,740 (nine million four hundred thirty seven thousand seven hundred forty) ordinary registered B series shares.

Poczta Polska S.A. is a strategic shareholder and a business partner of Bank Pocztowy S.A. holding 75% minus 10 shares in its share capital. PKO Bank Polski S.A. is a minority shareholder holding 25% plus 10 shares; it purchased the shares in 2004.

All A series shares are held by Poczta Polska. If voting on the distribution of assets of Bank Pocztowy, Poczta Polska will hold 77.76% of votes, while PKO Bank Polski 22.33% of votes.

Shareholding structure

| Number of shares |

Interest in the share capital |

|

|---|---|---|

| Poczta Polska S.A. | 7,296,770 | 74.9999% |

| Powszechna Kasa Oszczędności Bank Polski S.A. | 2,432,270 | 25.0001% |

During 2013 the share capital level and shareholding structure of the Bank did not change.

According to the current strategy, an IPO with Warsaw Stock Exchange may be a form of raising additional capital for Bank Pocztowy in future. Therefore, B series shares shall become bearer shares as determined in the Act on securities trading following their dematerialization.

The Bank’s shareholders have carried out negotiations regarding its target ownership structure. As at the date of this report, the Bank did not have any information on binding decisions made with this regard.

Annual Report 2013 - Bank Pocztowy

Corporate Governance

- Corporate governance: principles and scope of application

- Control system in the process of preparing financial statements

- Entity authorized to audit financial statements

- Shareholding structure and share capital

- Key information regarding Poczta Polska S.A.

- Cooperation with Poczta Polska S.A.

- Investor relations

- By-laws amending principles

- Activities of the corporate bodies of the Bank