Activities in the consumer market

consumers

1. Consumers

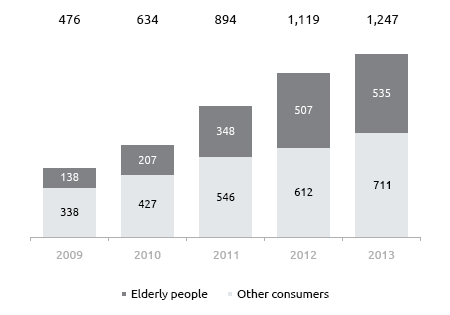

In 2013 Bank Pocztowy S.A. acquired over 286.9 thousand new consumers. A group of these individuals was acquired under a wider project of Poczta Polska, Bank Pocztowy and Zakład Ubezpieczeń Społecznych (Social Insurance Institution) encouraging elderly people to accept payments of social security benefits to a bank account.

Following the Bank’s actions aimed at stimulating customers to use banking services, such as an introduction of fees for clients who do not use the account, an insignificant number or current account holders who did not use the account left the Bank. Consequently, at the end of 2013 the number of customers of Bank Pocztowy reached 1,246.5 thousand, i.e. 127.4 more than in 2012. Nearly 43% of consumers are elderly people.

Number of the Bank's consumers ('000)

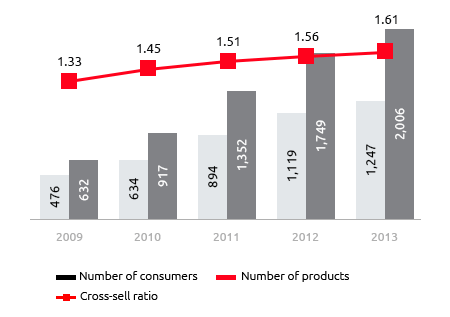

Number of consumers ('000) and cross-selling

The largest group of consumers (1,019 thousand) were current account holders.

Apart from fostering a dynamic growth of the number of new customers, the Bank also developed relationships with its existing customers. In 2013 individual clients used 1.61 of the Bank’s product, while in 2012 it was 1.56 product.

2. Development of the product offer for consumers

Bank Pocztowy S.A. prepared a simple and comprehensible offer for consumers including a wide range of credit and deposit products. The Bank also offers insurance and investment products through its distribution channels. The offer covers the following product groups:

- current accounts (Pocztowe Konto Standard and Pocztowe Konto Nestor),

- saving accounts (Nowe Konto Oszczędnościowe, Pocztowe Konto Oszczędnościowe),

- term deposits,

- consumer credit (including cash loans for staff of Reduced Credit Risk Employers1, cash loans for elderly people and cash loans for other consumers, including revolving overdrafts,

- mortgage loans (including housing loans, mortgage loans and debt consolidation loans),

- insurance and investment products.

A current account is the key product used for acquiring consumers and the focal point in customer relationships. In order to acquire new clients in September 2013 the Bank introduced changes to the fee and commission scheme for personal accounts and it introduced a fee for keeping accounts of non-active customers. At the same time, keeping accounts of clients using payment cards and payments of bills at the bank and post offices remained free of charge.

Striving to acquire stable consumer deposits, in 2013 the Bank developed its term deposit offer introducing progressive term deposits More and more, where the interest rate depend on the term of the deposit. These deposits also assume a monthly payment of interest accrued to the current account and no interest loss if the deposit is terminated before maturity. To increase the value of long-term deposits the Bank offers progressive term deposits with a two- and three-year term to maturity.

In 2013 the Bank introduced material changes to the credit offer:

- it introduced a permanent offer dedicated to elderly people,

- it expanded sales networks and started cooperation with network agents distributing cash loans,

- it revised the principles of establishing collateral for cash loans,

- it offered cash loans with accident insurance and mortgage loans with AVIVA insurance package on promotional terms,

- it increased maximum limits for credit cards.

To stimulate consumers to use banking services, Bank Pocztowy introduced two promotional programs: I like Pocztowy! and I earn with Pocztowy, offering financial bonuses to consumers for recommending the Bank’s services and for using additional products and services of the Bank.

The Bank offers bancassurance products thanks to its cooperation with insurance companies, such as: Pocztowe Towarzystwo Ubezpieczeń Wzajemnych, Aviva Towarzystwo Ubezpieczeńna Życie S.A., Grupa Ergo Hestia, Towarzystwo Ubezpieczeń Europa S.A. and Amplico Life S.A. Changes in the insurance offer proposed to the Bank's clients included:

- Expanding the insurance product range sold with cash loans to include life insurance and adding unemployment insurance to the mortgage loan offer.

- Introducing life insurance products for credit card holders - increasing the sum insured with the increase of maximum credit limits.

- Offering life insurance Support for relatives for current account holders.

- Launch of the Golden Future Investment Program. The program is offered to clients in the form of Group Investment Insurance Agreement with the saving term of at least 8 years. It enables investing funds in four Unit-Linked Insurance Plans with various investment risks. After the investment period the client may transfer the principal amount to the Premium Agreement, concluded in the form of individually continued insurance for the period of 30 years.

- Offering health insurance products in the insurance outlet (the Bank’s website enabling the Bank’s clients to compare products and make a purchase).

- Expanding the offer to include Accident Insurance for holders of a current account with an overdraft limit.

The Bank has also started works to introduce the following products to the bancassurance offer: drug policy, insurance package to the Standard and Nestor current accounts and assistance services.

3. Credit operations

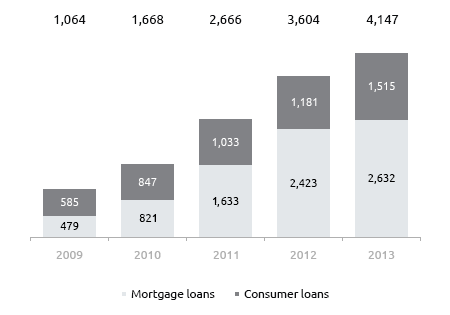

At the end of 2013 gross credit receivables of Bank Pocztowy S.A. from consumers totaled PLN 4,146.7 million versus PLN 3,604.4 million at the end of 2012 (a 15.0% increase). The Bank’s share in credit receivables from consumers of the banking sector amounted to 0.9% (by 0.1 p.p. more than at the end of 2012)2.

Gross loans and advances of Bank Pocztowy S.A. - consumers (in PLN '000)

| 31.12.2013 | Structure (31.12.2013) |

31.12.2012 | Structure (31.12.2012) |

Change 2013/2012 | ||

|---|---|---|---|---|---|---|

| PLN '000 | % | |||||

| Gross loans and advances, including | 4,146,661 | 100.0% | 3,604,381 | 100.0% | 542,280 | 15.0 % |

| Mortgage loans | 2,632,211 | 63.5% | 2,423,284 | 67.2% | 208,927 | 8.6 % |

| Consumer loans | 1,514,450 | 36.5% | 1,181,097 | 32.8% | 333,353 | 28.2 % |

Source: management information of the Bank. The data present the principal amount only.Default interest, due and undue interest, EIR fees, other prepaid expenses and revenue, other restricted revenue and interest and other receivables were not included.

Gross loans and advances to consumers (in PLN million)

A large portion of the portfolio are mortgage loans. At the end of 2013 the Bank’s receivables due to mortgage loans reached PLN 2,632.2 million and were by 8.6% higher than in December 2012.

In 2013 the Bank, offering local currency loans only, extended PLN 325.4 million of mortgage loans (98% of which were housing loans), i.e. by 61.8% less than in 2012, when the sales reached PLN 852.1 million. The decrease resulted from the strategy followed. Due to limited capital, the Bank focuses on the sale of products with the highest profitability considering their effect on the capital, which implies promoting the sale of cash loans and a stable sale of mortgage loans.

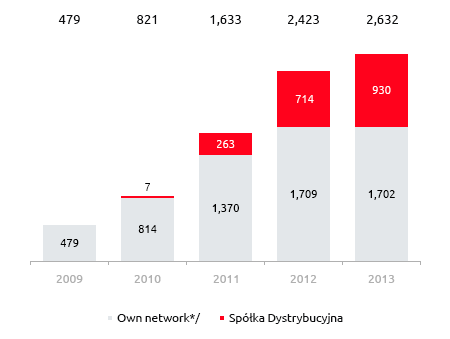

Mortgage loans value by distribution channel (in PLN million)

* including loans and advances granted in cooperation with agents.

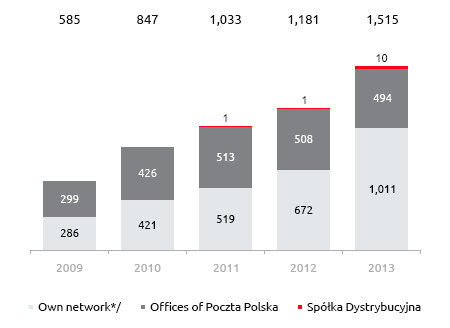

Consumer loans value by distribution channel (in PLN million)

* including loans and advances granted in cooperation with agents.

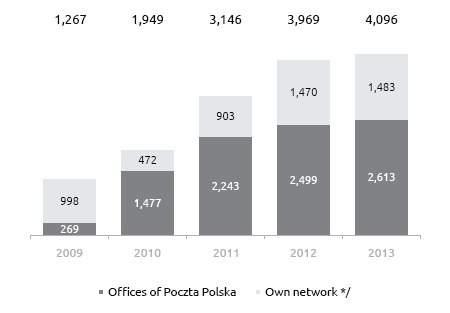

Mortgage loans in the Bank’s portfolio were granted mainly through own sales points. At the end of 2013, 64.7% of the Bank’s credit exposure was sold through own sales points (as compared to 70.5% in 2012). At present Spółka Dystrybucyjna Banku Pocztowego is the only distribution channel for mortgage loans of the Bank, hence the sale through this channel in the total Bank’s receivables due to mortgage loans has been growing gradually. At the end of 2013, the Bank’s receivables due to mortgage loans sold through this channel reached PLN 930.0 million and increased by 30.2% during the year.

In 2013 the Bank dynamically acquired new consumer credits.At the end of December 2013 receivables due to such products reached PLN 1,514.5 million, i.e. by 28.2% more than a year before. In 2013 the Bank sold consumer loans with the value of PLN 886.4 million, i.e. by 41.5% higher than in 2012.The key distribution channels are own sales network and the offices of Poczta Polska.

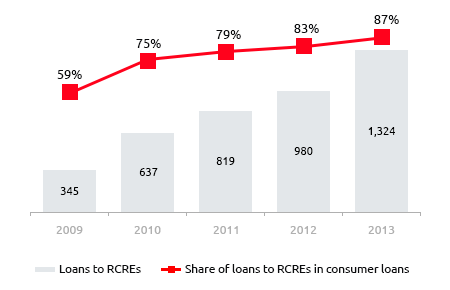

In the consumer loan portfolio the Bank focuses on more secure facilities for Reduced Credit Risk Employers (RCRE), which constituted 87.4% of the entire portfolio at the end of December 2013.

Loans granted to RCREs (in PLN million)

4. Deposits

When acquiring deposits in the market Bank Pocztowy strived to optimize costs of financing due its high liquidity in 2013.

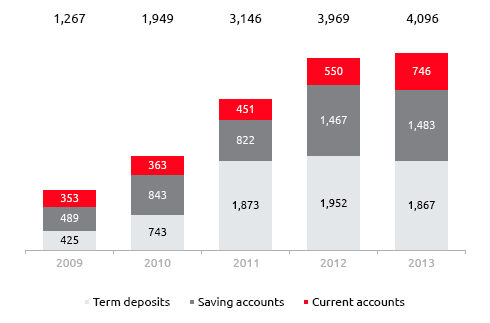

As at 31 December 2013 consumers deposited in the Bank the total of PLN 4,095.6 million versus PLN 3,969.3 million at the end of December 2012 (a 3.2% growth). Consequently, the Bank's share in consumer's deposits market reached 0.8%3.

Deposits of Bank Pocztowy S.A. - consumers (in PLN '000)

| 31.12.2013 | Structure (31.12.2013) |

31.12.2012 | Structure (31.12.2012) |

Change 2013/2012 | ||

|---|---|---|---|---|---|---|

| PLN '000 | % | |||||

| Client deposits, including: | 4,095,641 | 100.0% | 3,969,327 | 100.0% | 126,314 | 3.2% |

| Current accounts | 745,877 | 18.2% | 549,634 | 13.8% | 196,243 | 35.7% |

| Saving accounts | 1,483,109 | 36.2% | 1,467,450 | 37.0% | 15,658 | 1.1% |

| Term deposits | 1,866,655 | 45.6% | 1,952,243 | 49.2% | (85,588) | (4.4)% |

Source: management information of the Bank.The data present the principal amount only,excluding interest accrued.

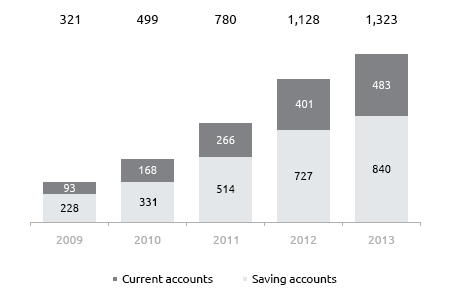

In 2013, funds deposited on current accounts of consumers increasedto reach PLN 745.9 million in December 2013, i.e. by 35.7% more than a year before. At the end of 2013 Bank Pocztowy managed 839.7 thousand active current accounts of consumers. This implies that in 2013 the Bank acquired a 112.4 thousand accounts net and was one of the banks reporting the highest increase in the number of current accounts. In September 2013 Bank Pocztowy S.A. was ranked tenth in the bank ranking for the number of current accounts with the market share of 3.0%4.

Number of current accounts and saving accounts (in '000)

More and more progressive deposits introduced to the offer in 2013 were the most popular saving product among consumers. In the second half of 2013 the Bank limited acquisition of deposits, due to its moderate liquidity needs.

In December 2013 consumers deposited PLN 1,483.1 million on saving accounts in the Bank, i.e. by 1.1% more than at the end of 2012. The result was affected by a less attractive saving product offer. Following a decrease in interest rates, the interest on saving accounts in the Bank dropped from 3.7% at the end of 2012 to 1.8% in December 2013.

In December 2013, 63.8% of consumers’ funds deposited in Bank Pocztowy, i.e. 0.8 p.p. more than at the end of 2012 were acquired through Poczta Polska.

Consumer deposits value (in PLN million)

Consumer deposits value by distribution channel (in PLN million)

* including accounts opened through agents

5. Bank cards

Bank Pocztowy S.A. offers the following types of bank cards to consumers:

- Visa Electron debit cards issued to personal accounts and saving accounts,

- Postal Visa Credit Cards,

- Zasilacz pre-paid cards (a pilot).

Major changes in the payment card offer of the Bank:

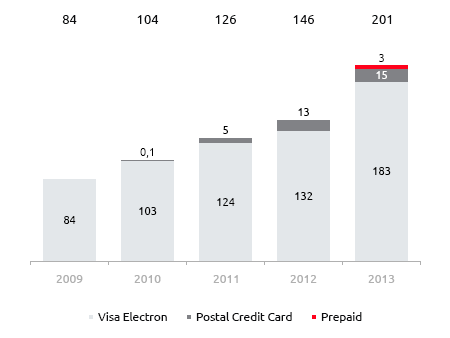

- Debit cards. Anticipating the increase in the sale of cards and in the number of transactions carried out using such cards, the Bank decided to exempt consumers from payment for account maintenance only if they hold a payment card and offered exemption from a monthly payment for the card provided that a user has concluded non-cash transactions for the total amount of PLN 200 (for Nestor account) and PLN 300 (for Standard account) in a given month. Moreover, the Bank replaced the limit of free-of-charge cash withdrawals in own offices with free-of-charge withdrawals in nearly 5,000 cashpoints of PKO Bank Polski, BZ WBK and Planet cash4you located countrywide. The offer change increased the sales from ca. 3 thousand to 11 thousand new debit cards a month. At the same time, the number of cash transactions concluded using the cards grew by 38% and the value - by 36%.

- Postal Credit Cards. The Bank launched a card promotion for new customers and did not charge any fee for issuing cards and the first year of their use. To encourage customers to activate their cards and actively use the credit limit, the Bank launched a promotion reducing the interest rate for cardholders down to 9.99%. The Bank also increased the maximum credit limit amount from PLN 5,000 to PLN 20,000 and introduced additional insurance covering repayment of credit card debt.

- Zasilacz pre-paid cards. In 2013, the Bank carried out a pilot sale of Zasilacz pre-paid cards in 153 post offices. Experience from the pilot project will be used to develop a strategy for development and sale of pre-paid cards in the Bank

By the end of December 2013 Bank Pocztowy S.A. issued 201.1 thousand payment cards for consumers (i.e. by 38.1% more than at the end of 2012), including 15.2 thousand credit cards (i.e. by 14.3% more than a year before).

The number of payment cards of consumers (in '000)

Index:

1 Reduced Credit Risk Employers include: the Police, city authorities, fire stations, public healthcare units, companies listed at the WSE and companies from the Poczta Polska Capital Group

2 Source: WEBIS data for Bank Pocztowy, data of the National Bank of Poland for Monetary receivables and liabilities of financial institutions, December 2013 for the banking sector

3 Source: WEBIS data for Bank Pocztowy, data of the National Bank of Poland for Monetary receivables and liabilities of financial institutions, December 2013 for the banking sector

4 Source: PRNews.pl Current account market – Q3 2013, 12 December 2013

Annual Report 2013 - Bank Pocztowy

Corporate Governance

- Corporate governance: principles and scope of application

- Control system in the process of preparing financial statements

- Entity authorized to audit financial statements

- Shareholding structure and share capital

- Key information regarding Poczta Polska S.A.

- Cooperation with Poczta Polska S.A.

- Investor relations

- By-laws amending principles

- Activities of the corporate bodies of the Bank