Human resources management

age for employment persons

1. Headcount and employment structure

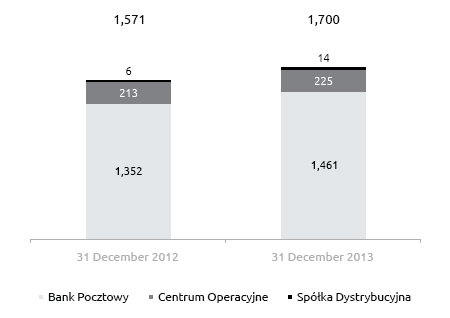

As at 31 December 2013, the headcount in the Bank Pocztowy Capital Group was 1,700 FTEs and was 129 FTEs higher than at the end of 2012.

As at 31 December 2013, the headcount in Bank Pocztowy S.A. was 1,461 FTEs and increased by 109 FTEs during the year. The increase resulted mostly from development of the retail sales network, i.e. Micro-branch type outlets.

At the end of 2013 Bank Pocztowy S.A. employed 1,475 people. The employment structure was as follows:

- females (1,058) dominated among employees;

- the average employee age was 35;

- the average number of years spent with the Bank was 4;

- all employees were high school or university graduates, out of whom 69% held university diplomas, and 7% completed post-graduate studies.

Employment in the Bank Pocztowy Capital Group

(FTEs)

2. Training and development

The development policy pursued by Bank Pocztowy in 2013 arose mostly from “Development Strategy of Bank Pocztowy S.A. for the years 2012-2015”. Training and development projects were addressed mostly to managers, retail banking employees and the staff of Poczta Polska.

Development programs and courses for managers

In 2013, the Bank delivered the following training projects for managers:

- Development program for key managerial staff: a program for the professional team of key managers established in 2012 was continued with the purpose to improve their strategic competency level. Activities performed included training on financial analysis and strategic marketing, as well as courses improving their managerial skills. The program was delivered by ICAN Institute, the publisher of Harvard Business Review Polska. Participation in the program allowed the trainees access to the tools allowing achievement of the world standard competency level.

- Ekstra KLASA Menedżerów development program. The comprehensive development program is addressed to managers in the retail sale network of Bank Pocztowy S.A. The completion of the program (commenced in October 2013) is planned for October 2014. Its objective is to improve business efficiency of participants through:

– standardizing managerial competencies in the retail network,

– identifying individual leadership styles and personal efficiency improvement methods,

– providing practical tools and solutions to allow efficient leading of people and teams in frequently changing environment.

Further, the program includes an in-depth analysis of development needs, the cycle of four training modules, as well as evaluation of the program on the business level.

- Individual managerial coaching, i.e. a project dedicated to top level managers, aimed at improvement of their effectiveness in the organization.

- Mazowiecka Akademia Przywództwa Innowacyjnego project. Managers and successors participated in a series of classes co-funded by European Social Fund under Mazowiecka Akademia Przywództwa Innowacyjnego (Mazovian Academy of Innovative Leadership) project. The workshop included three modules: directing, managing and leadership and were delivered by a well-known and appreciated psychologist. Their participants included Department and Office Heads and Deputies and individuals appointed as their successors in the cycle 2012/2013. The total number of trainees included 41 people divided in six groups.

- Mentoring i sukcesja w BankuPocztowym S.A. (Mentoring and Succession in Bank Pocztowy S.A.) development program. The program is performed in the Head Office and addressed to successors, deputies and key employees (mentors). The project objective is to ensure replacement for key employees with unique competencies and gradual preparing of their successors. The mentoring process has the form of managerial mentoring, during which individuals with professional experience and successes appoint their successors or deputies. During the program, they transfer their knowledge to the appointed individuals and inform them about key success factors. The program includes also expert mentoring, where directors appoint mentors from among employees with unique competencies so that they can transfer their knowledge to appointed trainees. The mentoring process is carried out on a regular basis, upon an annual cycle. Both mentors and trainees have participated in introduction workshops aimed at detailed analysis of the process and tools supporting the mentoring program. In 2013, 134 employees were appointed to the program and trained in seven workshop groups. They were also offered with a program including three soft skill modules:Presentation and Communication, Personal Efficiency i.e. Self-Management in a Team and Assertiveness and Motivation. The first module was delivered to 67 employees divided in seven trainee groups.

- Managerial workshops: In April 2013, workshops dedicated to the entire managerial staff of Bank Pocztowy took place. Their objective was to summarize the Q1 performance and to develop business initiatives decisive for the successful implementation of the Bank’s strategy in subsequent years.

Additionally, improvement of managerial skills included continued training on employee assessment based on CREDO value code, efficient recruitment and goal cascading.

Training improving efficiency of the retail banking operations

The following courses were delivered to retail banking employees:

- Inception training dedicated to new hires, including the product offer of the Bank, IT systems and professional sales methods on the basic and advanced level.

- Additional courses regarding new products offered by the Bank and allowing authorization to perform specific banking transactions.

- Ekstraklasa to MY retail workshops: This is an annual meeting of all retail banking employees. Its objective in 2013 was to enhance cooperation in the retail banking area. During the workshop, the employees could demonstrate their creativity, team work skills and courage in facing new challenges. Further, it included summary of retail performance in 2013 and presentation of assumptions for 2014.

Other training initiatives

Individual growth: The support included employees who had won the top scores in the CREDO-based assessment process. They were awarded with a package of individual development-focused measures. Additionally, individual support in the form of training, conferences, seminars and post-graduate courses included IT, finance, new trends in retail banking, HR and foreign languages.

E-learning: The training is dedicated mostly to Bank's employees. They regard mostly security, banking secret, personal data protection and ethics. Training on quality standards, anti-money laundering and update of product offer addressed to sales employees are also performed on the e-learning platform.

The e-learning courses included the total of 3,770 people.1

Obligatory training as imposed by the law, e.g. the labor law, banking law, public finance, occupational health and safety, personal data protection and risk management.

Training for new hires Witamy w Pocztowym (Welcome to Pocztowy). Its objective is to introduce new hires to the mission, vision, strategy, values, processes and principles adopted by the Bank. Further, the training includes IT systems and practical information useful in the first weeks spent with the Bank.

Training for employees of PocztaPolska S.A. and companies of the Bank’s Capital Group

In 2013, using the support of internal trainers of Bank Pocztowy S.A., product and sales courses were delivered to Poczta Polska S.A. employees under the Agency Agreement including product and sales training arrangements.

In 2013, 6,166 employees were trained in Bank Pocztowy, 307 stationary courses delivered including 130 individual classes.

Distribution Company employees were trained on cash loans.

Operating Center employees participated in professional courses related to amendments to labor and tax law and business trip settlement. Further, managers were trained on anti-mobbing policy and team operation. A cycle of courses on competency development and testing called First Step Manager and Strategic Leadership Academy by ICAN was commenced.

3. Incentive system

In order to ensure effective achievement of assumed business objectives and improve the potential of the Organization, in 2013 the Bank used the Management by Objectives system introduced in 2011. Apart from cascading and participative defining of the objectives, the system is used to determined individual goals for managers. Focusing on key objectives allows additional mobilization and preparing of the Bank for the stretch goal achievement (including finance) even in rapidly changing business conditions. Implementation of MbO assumptions contributes to improved productivity and competencies of employees providing appropriate incentives and involving them in tasks aimed at strategic objectives.

In 2013 the Bank changed the principles of delivering the goal setting workshops. Having strategic objectives defined by the Management Board, the managers worked on goals in the “cost” and "revenue" groups. Effects of their work, in the form of detailed goals, were then presented to the Management Board and discussed. The concept allowed developing a detailed map of objectives, i.e. the structure of managerial goals, and precise analysis of operating objectives along with ratios and individuals in charge of each goal, as well as aligning the Bank’s structure of objectives.

On the turn of June and July, a mid-year review of the MbO performance was carried out. It was similar to the goal setting process, i.e. in the cascade form. During the concluding conversations, the expected efficiency improvement was the key point, and update, including new initiatives and settlement, was added to Individual Goal Lists. MbO charts of managers were standardized. The maximum weight assumed for development goals was 30%, and at least half of them would have to have financial measures attached (cost or revenue-related with the performance settlement at the end of 2013), with financial (cost and revenue) objectives being assigned the weight of at least 70%. Further, it was decided that the settlement of goals above 100% would take place only in the case of over-performance of quantity-related goals, and in exceptional cases, for over-performance of quality-related goals.

As a result, the goals determined were focused on improved work efficiency and Bank’s performance, subject to application of the goals with financial measures compliant with MbO standardization output being determined by the management level.

In mid-2013, bonus granting principles were introduced for Collection Unit employees in High Risk Loan Monitoring and Management Department. The principles will remain valid for one calendar year and are to motivate the employees to provide the Bank with the best financial result possible through maximized revenue on interest, commissions and derecognition of impairment losses (principal recovery).

4. Extra benefits

The Bank Pocztowy Capital Group provides its employees with extra benefits, to include:

- Employee pension schemes (EPS) being an important element securing the financial perspectives of employees related to the need to raise additional capital for the post-employment period. Such schemes are carried out by Bank Pocztowy S.A. and Centrum Operacyjne Sp. z o.o.

- Comprehensive health care programs in Bank Pocztowy S.A. and Centrum Operacyjne Sp. z o.o.: They provide a broad access to private health care for all employees. Under the contract, the health care may include family members on preferential terms.

- Sports and leisure programs: The Bank and Centrum Operacyjne Sp. z o.o. offer their employees to join a sports and leisure program provided by Benefit Systems Sp. z o.o. MultiSport card allows unlimited access to a network of sports and leisure facilities across the country. Under the contract, each employee may buy additional cards for kids and a partner.

- The MultiBenefit rebate program carried out in cooperation with Benefit Systems Sp. z o.o. Accessing an Internet platform, employees may purchase goods on preferential terms and use a number of leisure related offers, such as movies, theaters and weekend outings.

5. IT systems in HR processes

In 2013, Bank Pocztowy S.A. continued the project of rationalizing and sorting out the key HR processes commenced in 2012. Among others, it extended the application supporting HR management, called KARO. The system is to systematize and simplify management processes related to HR, training, improve the employee evaluation process, goal setting and assessment under MbO and allow efficient recruitment. In 2013, the following HR processes have been transferred to the IT system: HR application, employee statement of joining the private health care system, MultiSport, change of personal data and registering a family member with Social Insurance Institution (ZUS).

Apart from improving the data access and flow among employees, managers and HR Management Department in relation to personal and HR data management, the purpose of introducing IT systems to HR management is to replace hard copies of certain documents (e.g. holiday requests, personal evaluation forms or training requests) with their electronic versions.

Index:

1 Training participant: a Bank’s employee participating in a class;one employee can participate in a few classes

Annual Report 2013 - Bank Pocztowy

Corporate Governance

- Corporate governance: principles and scope of application

- Control system in the process of preparing financial statements

- Entity authorized to audit financial statements

- Shareholding structure and share capital

- Key information regarding Poczta Polska S.A.

- Cooperation with Poczta Polska S.A.

- Investor relations

- By-laws amending principles

- Activities of the corporate bodies of the Bank