Credit risk

Credit risk is the risk assumed by the Group under credit transactions and resulting in its inability to recover the amounts disbursed, loss of income or a financial loss. It is the outcome of credit product development and launch as well as the lending process on the one hand and measures employed with a view to reducing the probability of losses, on the other. The Group’s credit risk includes both counterparty and settlement risk.

While developing its current credit risk management policy, the Group aims to maintain the share of exposures with recognized impairment in the credit portfolio (NPL ratio) as determined in the risk strategy, an appropriate level of equity, analyze strengths and weaknesses of the Group’s lending process and anticipate the opportunities and threats for its further growth. The Group’s acceptable credit risk policy also takes into account cyclicality of economic processes and changes in the credit portfolio itself.

The Group has reviewed methodologies and all parameters in order to adapt them to changing market conditions.

The following principles have been adopted for the credit risk management process:

- analyzing credit risk of individual exposures, the entire portfolio and the capital requirement related to credit risk;

- using internal and external limits determined by the risk appetite in various areas of the credit portfolio, the Banking Law and recommendations of the Polish Financial Supervision Authority, respectively. The types and levels of the limits used by the Group with regard to lending are determined by internal regulations on credit limits related, among other things, to large exposure concentration, industry concentration, exposure concentration based on type of collateral and product;

- functions related to direct analysis of applications, risk assessment and credit related decision making are separated from those focused on client attraction (sales of banking products);

- creditworthiness is the main criterion underlying all credit transactions with clients;

- credit decisions are made in the Group in accordance with procedures and competencies determined in internal regulations on credit risk assessment and credit decision making;

- each credit transaction is monitored from its conclusion to full settlement in terms of utilization, timely repayment, legal security, equity and organizational relationships of the obligor and, in the case of institutional clients, also in terms of their current economic and financial position;

- developments in the real estate market as well as the legal and economic assumptions and framework for valuation of property provided as collateral for credit exposures are monitored on a periodic basis.

Credit risk management in the Group is based on written policies and procedures defining methods of identification, measurement, monitoring, limiting and reporting of credit risk. At least once a year, the Group reviews and verifies these instructions, procedures and credit risk limits. The regulations determine the scope of competencies assigned to each unit of the Bank in the credit risk management process.

In order to determine the credit risk level, the Group uses the following measures:

- probability of default;

- recovery rates;

- share and structure of impaired loans;

- coverage of impaired loans with impairment losses;

- scoring model efficiency measures;

- cost of risk.

The Group prepares the following cyclical reports on its credit risk exposure:

- monthly report for the Management Board and Credit Committee of the Bank,

- quarterly report for the Supervisory and Management Board.

Portfolio quality

At the end of December 2013, the share of exposures with recognized impairment in the total loan portfolio amounted to 5.4%, i.e. increased by 0.7 p.p. year on year. The portfolio quality deterioration resulted mainly from its gradual reaching of maturity, which was not balanced with a growth in the value of new loans. Despite this, quality of the Group’s loan portfolio was considerably higher than the banking sector average, which at the end of December 2013 demonstrated NPL of 7.7%.1

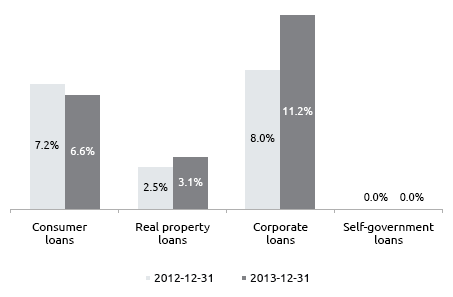

Portfolio quality – the share of loans with recognized impairement in the loan portfolio

| 31.12.2013 | 31.12.2012 | Change 2013/2012 |

|

|---|---|---|---|

| Group's total, including: | 5.4% | 4.7% | 0.7 p.p. |

| for private individuals | 4.6% | 4.3% | 0.3 p.p. |

| for corporate clients | 11.2% | 8.0% | 3.2 p.p. |

The share of impaired loans increased mostly in the corporate credit portfolio. In December 2013, it reached 11.2% and was 3.2 p.p. higher than a year before. NPL for loan receivables from individuals increased from 4.3% at the end of 2012 to 4.6% in December 2013.

NLP for term loans

Loans granted to self-government institutions as well as real property loans bore the lowest risk at the end of 2013 (NPL of 0.0% and 3.1%, respectively).

In December 2013, the value of exposures with recognized impairment was PLN 277.2 million and was PLN 55.5 million higher than at the end of 2012.Term loans to private individuals accounted of majority of the amount. The value of these exposures was PLN 189.4 million including PLN 114.2 million of consumer loans.During 2013, the value of impaired term loans granted to private individuals increased by PLN 34.5 million.Further, the Group’s corporate loan portfolio included impaired loans of PLN 71.5 million. The amount was PLN 19.5 million higher than at the end of 2012.

Portfolio quality - loans with recognized impairment (PLN '000)

| 31.12.2013 | 31.12.2012 | Change 2013/2012 |

|

|---|---|---|---|

| Groups's total, including: | 277,241 | 221,777 | 55,464 |

| for private individuals | 189,362 | 154,886 | 34,476 |

| for corporate clients | 71,470 | 51,992 | 19,478 |

| for self-government clients | 0 | 0 | 0 |

Impairment loss

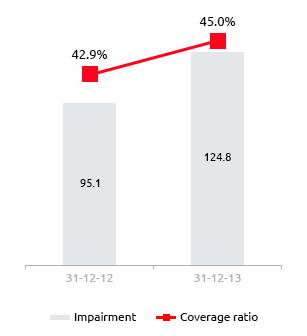

At the end of 2013, the impairment loss on the loan portfolio of the Capital Group was PLN 124.8 million, which was 31.2% more than at the end of December 2012.

The total impairment loss included the loss on impaired exposures of PLN 109.9 million and incurred but unreported losses (IBNR) of PLN 14.9 million.

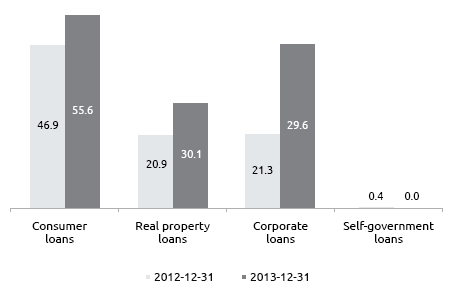

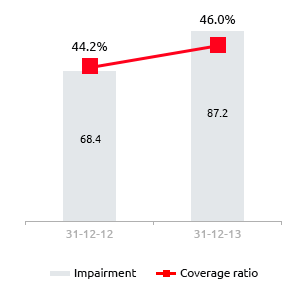

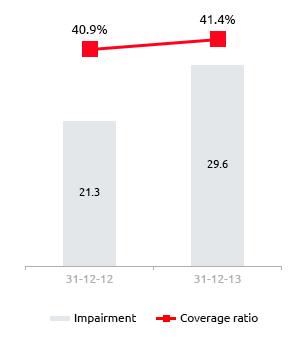

At the end of the analyzed period, the value of impairment losses for overdraft facilities was PLN 8.0 million and PLN 117.8 million for term loans and credit facilities. The total impairment loss for term loans and credit facilities granted to individuals was PLN 87.2 million and increased by PLN 18.7 million during the year.It included mostly loss on consumer loans (PLN 55.6 million) and for real property loans (PLN 30.1 million).Impairment loss on corporate loans amounted to PLN 29.6 million and was PLN 8.3 million higher than at the end of December 2012.For credit exposure to self-government institutions the Bank recognized an IBNR allowance of PLN 24 thousand compared to PLN 412 thousand a year before.

Impairment loss for term loans (in PLN million)

During 2013, the coverage ratio of impaired loans increased in the Group.In December 2013, it amounted to 45.0% and was 2.1 p.p. higher compared to the end of 2012. The ratio level was as follows:

- 48.8% for overdraft facilities,

- 44.8% for term loans including 46.0% for individuals

- and 41.4% for corporate clients.

Total Bank

Private individuals

Corporate clients

Index:

1 https://www.knf.gov.pl/opracowania/sektor_bankowy/dane_o_rynku/Dane_miesieczne.html

Annual Report 2013 - Bank Pocztowy

Corporate Governance

- Corporate governance: principles and scope of application

- Control system in the process of preparing financial statements

- Entity authorized to audit financial statements

- Shareholding structure and share capital

- Key information regarding Poczta Polska S.A.

- Cooperation with Poczta Polska S.A.

- Investor relations

- By-laws amending principles

- Activities of the corporate bodies of the Bank