Situation in the banking sector

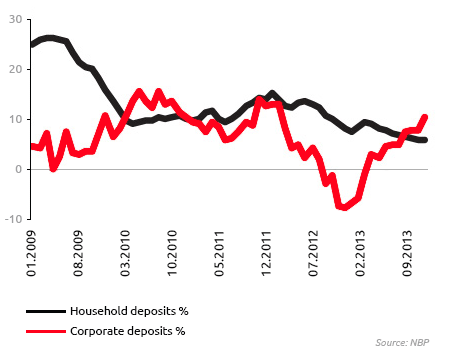

Deposits of households and enterprises

At the end of 2013 the total deposits in the banking system amounted to PLN 846 billion, i.e. by 6% more than at the end of 2012. Deposits held for households stood at PLN 543.6 billion. In 2013 the dynamics of deposits held of households dropped to 5.6% in December year-on-year (versus 7.7% in December 2012). The deposit growth was lower than in previous years due to a difficult situation in the labor market and lower interest rates of the National Bank of Poland, which deteriorated the attractiveness of investing in the banking sector. In December 2013, deposits of enterprises increased by 10% year-on-year, up to PLN 206.5 billion. The increase resulted from gradually improving condition of the business sector and moderate investment activities of firms.

Dynamics of deposits (YoY)

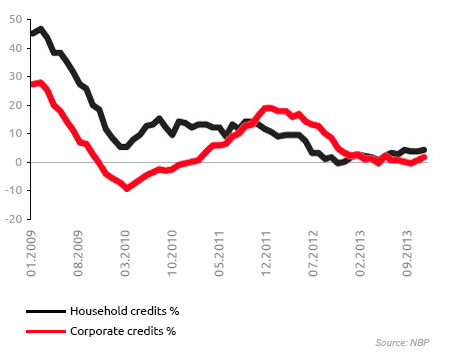

Loans and advances to households and enterprises

At the end of 2013 the credit receivables in the banking system reached PLN 937.3 billion, i.e. by 4% more than at the end of 2012. Loans and advanced to households went up by 4.5% up to PLN 562.4 billion in 2013. Housing loans in the local currency grew from PLN 148.8 billion in December 2012 to PLN 170.3 billion at the end of 2013. Record low interest rates and a considerable housing offer of developers positively affected new lending. Additionally, a number of people intending to finance acquisition of a flat with a credit facility decided to buy an apartment in 2013 due to amendments to Recommendation S, which will prohibit financing 100% of a real property with a bank loan. On the other hand, consumers had to struggle with a difficult situation in the labor market and waited for the launch of the Flat for the Young program, which impeded the increase in the mortgage loans in the Polish zloty. The portfolio value of foreign currency loans dropped to PLN 165.4 billion, i.e. was by PLN 9.5 billion lower than at the end of 2012. The decrease in the portfolio value resulted in particular from fluctuations in the exchange rate of the zloty and early repayments, as the access to foreign currency financing was extremely difficult. Receivables of the banking sector due to consumer loans from individuals increased. In December 2013 they totaled PLN 138.4 billion (versus PLN 132.1 billion in December 2012). Consumer loan volume resulted from more relaxed criteria applied by certain banks in loan request analysis related to the improved macroeconomic trends in the second half of 2013 and optimistic outlooks for 2014. In December 2013 the value of loans granted to enterprises was PLN 274.6 billion versus PLN 270.4 in December 2012 (1.5% growth). Despite the rebound in the economy in the second half of 2013 enterprises used free production capacities and were not ready to invest in their increasing.

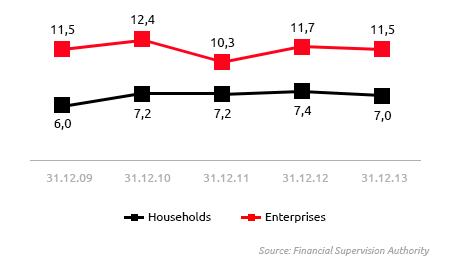

Interest rate on deposits and loans

In 2013 the Monetary Policy Council continued easing the monetary policy. The reference rate was reduced to the lowest level in history (i.e. down to 2.50%), which considerably affected interest on deposits and loans.According to the data of the National Bank of Poland in 2013 the average interest rate on new deposits of households in PLN amounted to 2.9% versus 4.7% in 2012. Average interest on new deposits of enterprises amounted to 2.7% as compared to 4.4% in the previous year. Average interest on new loans granted to households in the Polish zloty in 2013 stood at 10.0%, having dropped by 1.1 p.p. versus 2012. As for loans for households, the interest on housing loans amounted to 5.5% (versus 7.0% in the prior year), and interest on consumer loans reached 14.9% (16.1% in 2012). In the business sector, the interest on new loans in the local currency amounted to 4.9% in 2013, while in 2012 it was 6.7%.

Financial performance of the banking sector

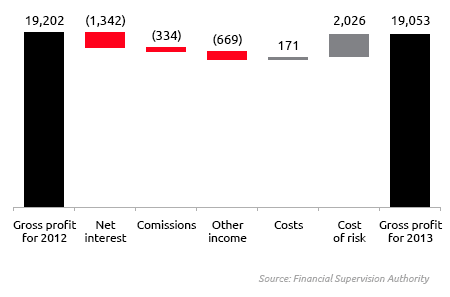

In 2013 banks reported a net profit of PLN 15.4 billion,i.e. at a level similar to that of 20121. Banking sector performance was affected by:

- Intense competition for deposits, due to which costs of financing dropped more slowly than asset profitability in the market of decreasing interest rates. Consequently, the net interest income of the banking sector deteriorated considerably.

- Decrease in the net fee and commission income.

Gross profit of banking sector in 2013 (in PLN million)

While some banks increased fees for account maintenance, many followed the recommendations of the Financial Supervision Authority, reduced the sale of investment insurance products (polisolokaty), and implemented recommended changes in disclosure of revenue due to sale of bancassurance products.

- Decrease in other income, mainly due to dividend and foreign exchange transactions.

- An insignificant decrease in operating expenses. The change results from a reduced number of people employed in the banking sector (by ca. 0.8 thousand FTEs) and a lower number of branches (by nearly 0.2 thousand).

- A considerable decrease in impairment losses on non-performing loans due to improved quality of credit receivables.

The share of impaired receivables in the total receivables from the non-financial sector dropped from 8.8% in December 2012 to 8.5% at the end of 20132. The year 2013 also saw an improvement in the quality of credit exposures of banks to enterprises and households.

Banks allocated a portion of profits for 2013 to increase capital and did not acquire a high volume of new loans, therefore the solvency ratio of the domestic banking sector grew from 14.7% in December 2012 to 15.8% in December 2013. In December 2013 Tier 1 ratio amounted to 14.2% (versus 13.1% at the end of 2012).

Non-performing loans in the banking sector (%)

Index:

1 Source: Financial Supervision Authority, Monthly data for the banking sector file – December 2013

2 Source: NBP. Financial data of the banking sector.File - receivables

Annual Report 2013 - Bank Pocztowy

Corporate Governance

- Corporate governance: principles and scope of application

- Control system in the process of preparing financial statements

- Entity authorized to audit financial statements

- Shareholding structure and share capital

- Key information regarding Poczta Polska S.A.

- Cooperation with Poczta Polska S.A.

- Investor relations

- By-laws amending principles

- Activities of the corporate bodies of the Bank