Investor relations

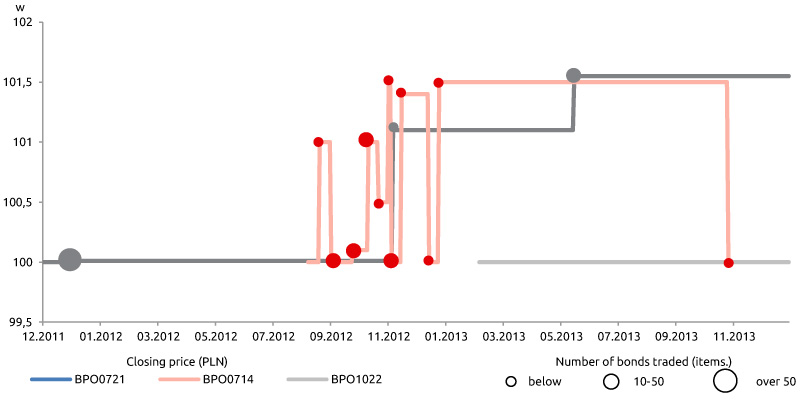

Since December 2011 bonds of Bank Pocztowy S.A. have been traded in an alternative trading system, on Catalyst market.

The key objective of investor relations is to provide stakeholders with ongoing reliable information regarding Bank Pocztowy in a simple and comprehensible manner, in compliance with the law.

Since Bank’s shares are not traded on a regulated market, in 2013 its activities regarding investor relations focused on:

- developing relations with holders of Bank’s bonds or parties interested in purchasing them;

- fulfilling information obligations related to the fact that the Bank’s bonds are quoted with the alternative trading system on Catalyst market maintained by Warsaw Stock Exchange (ASO GPW).

At the end of 2013, the following bonds of Bank Pocztowy S.A. were quoted with ASO GPW (Catalyst):

| Series | Type | ASO GPW symbol |

NDS symbol | Issue date |

First quoting date |

Redemption date |

Face value (in PLN) |

Number of bonds |

Issue value (in PLN) |

Interest |

|---|---|---|---|---|---|---|---|---|---|---|

| A | subordinated | BPO0721 | PLBPCZT00015 | 08.07.11 | 02.12.11 | 08.07.21 | 10,000 | 4,734 | 47,340,000 | WIBOR6M+375 pb* |

| B | ordinary | BPO0714 | PLBPCZT00023 | 10.07.12 | 27.08.12 | 10.07.14 | 10,000 | 20,000 | 200,000,000 | WIBOR6M+170 pb |

| C | subordinated | BPO1022 | PLBPCZT00031 | 05.10.12 | 20.02.13 | 05.10.22 | 10,000 | 5,000 | 50,000,000 | WIBOR6M+350 pb |

* until 8.07.16; from 9.07.16 to 8.07.21 WIBOR6M+3.75+1.5 p.p.

Quotings and performance on the bonds of Bank Pocztowy

Bank Pocztowy S.A. has published annual and semi-annual reports in order to fulfil the information duties related to Catalyst and to provide good transparency of its operations.

Further, although not obliged by the law, the Bank publishes selected financial data. The publication provides an opportunity to organize press conferences at which representatives of the Management Board discuss performance for a given period.

In 2013, Bank Pocztowy S.A. had four successful bond issues:

- one of three-year ordinary bonds of B2 series totaling PLN 147.85 million, with the redemption date 13 December 2016;

- three series of short-term bonds (D1, D2 and D3) of PLN 60 million, PLN 30 million and PLN 50 million, respectively.D1 and D2 series bonds were redeemed on 2 December 2013 and 8 January 2014, respectively..

Following the issue of B2 series bonds, Bank’s representatives participated in a series of meetings with corporate investors organized as a roadshow. The B2 series bonds were offered at ASO GPW on 13 March 2014.

| Series | Type | ASO GPW symbol |

NDS symbol | Issue date |

First quoting date |

Redemption date |

Face value (in PLN) |

Number of bonds |

Issue value (in PLN) |

Interest |

|---|---|---|---|---|---|---|---|---|---|---|

| B2 | ordinary | BPO1216 | PLBPCZT00049 | 13.12.13 | 13.03.14 | 13.12.16 | 10,000 | 14,785 | 147,850,000 | WIBOR6M+140 pb |

The following individual is in charge of ongoing investor relations:.

Magdalena Ossowska-Krasoń

press spokesperson

e-mail: M.Ossowska-Krason@pocztowy.pl

Phone: (22)328 76 06

Mobile: 601 057 496

All current and periodic reports submitted to Catalyst through EBI and other information regarding bonds issued by the Bank are published at the Bank Pocztowy website (www.pocztowy.pl), in the section Obligacje Banku Pocztowego.

Annual Report 2013 - Bank Pocztowy

Corporate Governance

- Corporate governance: principles and scope of application

- Control system in the process of preparing financial statements

- Entity authorized to audit financial statements

- Shareholding structure and share capital

- Key information regarding Poczta Polska S.A.

- Cooperation with Poczta Polska S.A.

- Investor relations

- By-laws amending principles

- Activities of the corporate bodies of the Bank