General information about the Capital Group

Reactivation of postal banking in Poland was the idea underlying establishment of Bank Pocztowy S.A. in Poland. Initially, the Bank was a typical settlement institution with performance highly related to the volume of settlements with Poczta Polska.

At present, Bank Pocztowy S.A., the parent in the Capital Group, focuses on consumer banking and provides a supplementary offer for institutional clients. The Bank’ target group are residents of smaller towns and micro- and small enterprises operating locally. The Bank pays special attention to the needs of the elderly. Having those in mind, the Bank has launched an extensive financial education program and an attractive offer for people not using financial services.

Pursuing its mission of Simple and accessible banking, the Bank offers reasonably-priced, simple and comprehensible financial services in a friendly environment. It also constantly responds to changing client needs and actions of competitors to develop closer relationships with its customers.

Poczta Polska S.A. is a strategic shareholder and a business partner of Bank Pocztowy S.A. holding 75%, i.e. 10 shares in its share capital. Powszechna Kasa Oszczędności Bank Polski S.A. also holds shares in the bank (25% + 10 shares).

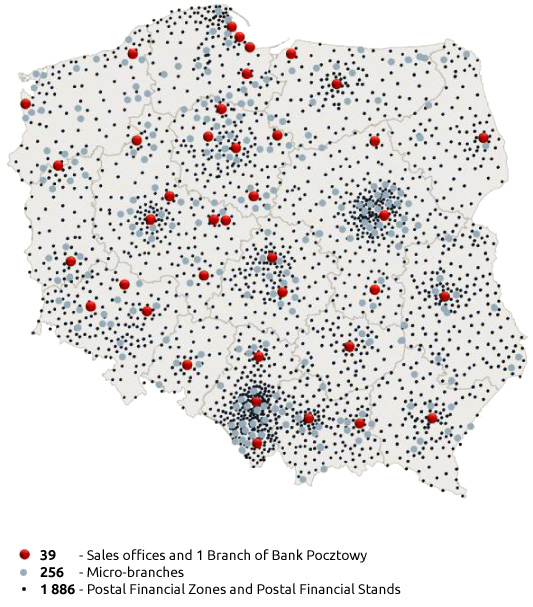

Thanks to the strategic alliance with Poczta Polska, the Bank’s services and products are available in ca. 7.8 thousand sales points countrywide. Apart from Poczta Polska, Bank Pocztowy offers its services and products through 295 own outlets, electronic distribution channels (online and telephone banking) and a network of mobile agents of a subsidiary – Spółka Dystrybucyjna Banku Pocztowego Sp. z o.o. Additionally, the Bank’s products are distributed by 26 thousand postmen and other agents. The wide distribution network constitutes a unique competitive advantage of the Bank.

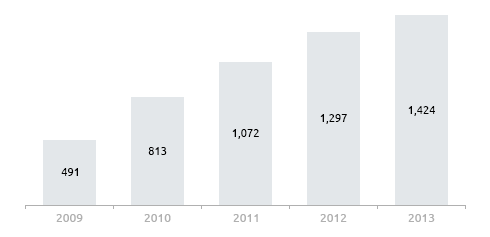

Number of consumers and microenterprises ('000)

At the end of 2013 the Bank provided services to 1,423.7 thousand consumers and micro-enterprises. In 2013 it acquired 286.9 thousand new consumers, contributing to the process of preventing financial exclusion, which is a negative phenomenon observed in Poland. The Bank provided products and services to over 15.1 thousand institutions, i.e. by 5.9% more than in December 2012.

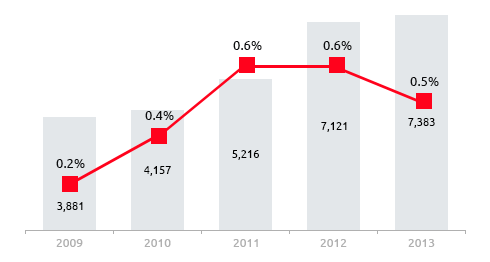

On 31 December 2013 the balance sheet total of the Bank Pocztowy Capital Group amounted to PLN 7,382.7 million and represented 0.5% of total assets of the Polish banking sector1. Gross loans and advances to customers reached PLN 5,180.5 million.

Balance sheet total (in PLN million) ROA (net) (%)

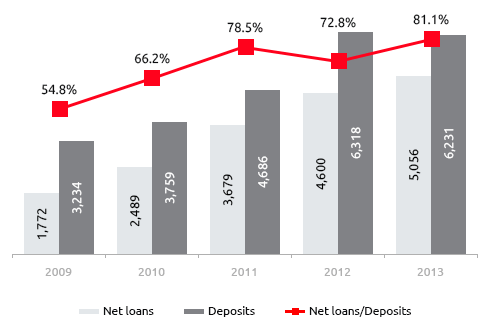

Liabilities to Group clients stood at PLN 6,230.6 million and included mainly cash from consumers of PLN 4,157.2 million.

Following its dynamic growth reported in recent years, Bank Pocztowy S.A., the parent in the Capital Group, managed to gain an important position in selected segments of the Polish banking sector. The Bank secures a good position in the current account market with a share of 3.0% . In 2013 the Bank managed accounts of over 6% of elderly Poles, which is a good result considering low demand for banking services in this group. Bank Pocztowy is also an important financial partner of public benefit institutions, such as schools, foundations, and non-profit institutions. At the end of December 2013 its share in credit outstandings of the banking sector from non-profit institutions reached 5.3% and the share in deposits and other liabilities of the sector to this customer group amounted to 2.4% 4.

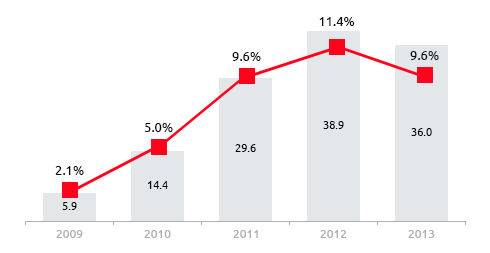

Net profit (in PLN million) and ROE (net) (%)

Loans and Deposits (in PLN million) Loans / Deposits (%)

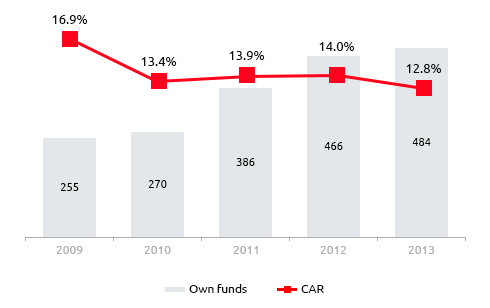

Own funds of the Bank Group (in PLN million) and CAR (%)

Financial liquidity of the Bank Pocztowy S.A. Capital Group was good in 2013. At the end of the year the relation of loans and advances to deposits stood at 81.1%. The Group also holds sufficient equity considering the scale of its operations. In December 2013 the solvency ratio for the Group amounted to 12.8%, and Tier 1 reached 9.5%.

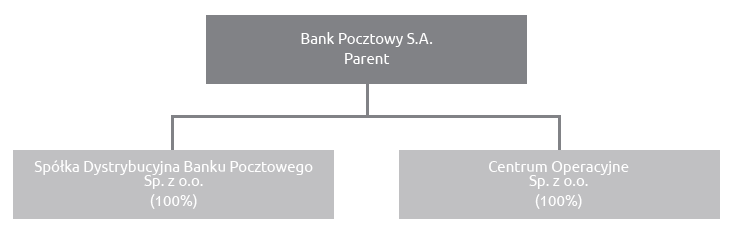

Subsidiaries of the Bank also play an important role in implementing the strategy of the Capital Group:

- Spółka Dystrybucyjna Banku Pocztowego Sp. z o.o., whose key objective is to support distribution channels of Bank Pocztowy and access prospect clients from remote locations.

- Centrum Operacyjne Sp. z o.o., providing professional services in process administration for products and services for entities in the financial sector.

At the end of 2013 the headcount in the Bank Pocztowy Capital Group was 1,700 FTE.

Since November 2011 bonds of Bank Pocztowy S.A. have been traded in the Over-The-Country Catalyst market. After meeting reporting requirements, the bonds have been listed in the Calatyst market, which was a clear signal for investors and contractors of Bank Pocztowy S.A. that the entity has become a listed, hence a transparent company, reliable for its market and business stakeholders.

Historical background

Bank Pocztowy started operations in 1990. Reactivation of postal banking in Poland was the idea underlying its establishment. To this aim and in order to develop Bank Pocztowy S.A. the GIRO non-cash settlement system was launched to enable fast and easy processing of bulk payments, reduce costs of issuing and circulating cash in the economy and to provide bank services to clients, in particular consumers, through a wide distribution network of Poczta Polska. Therefore, initially the Bank was a typical settlement institution with performance highly related to the volume of settlements with Poczta Polska.

In 1998, transformation into a consumer bank was initiated. The Bank started to reach an increasingly large group of clients through a sales network of Poczta Polska and own branches and sales points. At the same time, it started to launch new products. In 1999 all post offices provided comprehensive services related to GIRO personal accounts and, additionally, Visa Electron cards to the accounts were offered. In 2003, the Bank launched an online information system. Two years later, in 2005, GIRO personal accounts were renamed to Pocztowe Konto Nestor for elderly people and Pocztowe Konto Standard.

Agreement concluded by Bank Pocztowy and Poczta Polska in 2006 regulating the terms of cooperation between the institutions in consumer banking services was a breakthrough event for the Bank's consumer business. Under the agreement over 2 thousand Postal Financial Points were opened in post offices by the end of 2009 to streamline service provision to the Bank’s customers by post office staff. Following the gradual changes and development of the sales network, in February 2010 the number of clients exceeded 500 thousand, in October 2011 it was 1 million, and now it its approaching 1.5 million.

In 2010 the Bank’s subsidiaries: Spółka Dystrybucyjna Banku Pocztowego Sp. z o.o. and Centrum Operacyjne Sp. z o.o. were established and started business activities. As a result ,the Bank Pocztowy Capital Group was set up.

Key financial data of the Bank Pocztowy S.A. Capital Group for the years 2009-2013

| 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|

| Balance sheet total (PLN '000) | 3,881,000 | 4,156,609 | 5,215,801 | 7,120,653 | 7,382,745 |

| Loans and advances to customers 1/(in PLN '000) | 1,772,350 | 2,488,835 | 3,679,382 | 4,599,545 | 5,055,712 |

| Liabilities to customers (in PLN '000) | 3,233,529 | 3,759,124 | 4,685,735 | 6,317,949 | 6,230,578 |

| Equity (PLN '000) | 281,812 | 294,968 | 321,395 | 361,470 | 391,765 |

| Income of the Group 2/ (in PLN '000) | 221,495 | 221,165 | 258,473 | 290,255 | 294,320 |

| Administrative expenses (PLN '000) | (178,352) | (195,204) | (209,837) | (218,356) | (212,738) |

| Net impairment losses (in PLN '000) | (33,804) | (9,673) | (12,877) | (25,099) | (42,398) |

| Gross profit (PLN '000) | 8,096 | 17,529 | 37,531 | 48,665 | 43,260 |

| Net profit (PLN '000) | 5,907 | 14,412 | 29,555 | 38,949 | 36,027 |

| Net ROA (%) | 0.2 | 0.4 | 0.6 | 0.6 | 0.5 |

| Net ROE (%) | 2.1 | 5.0 | 9.6 | 11.4 | 9.6 |

| Costs including amortization and depreciacion / income (C/I) 3/ (%) | 81.0 | 87.8 | 80.6 | 74.7 | 71.3 |

| Solvency ratio (w%) | 16.9 | 13.4 | 13.9 | 14.0 | 12.8 |

| Tier 1 (%) | 16.6 | 13.2 | 10.6 | 9.9 | 9.5 |

| NPL 4 / (%) | 7.2 | 7.2 | 5.0 | 4.7 | 5.4 |

| Net interest margin to total assets 5/ (%) | 4.2 | 3.6 | 4.1 | 3.8 | 3.6 |

| Headcount (FTEs) | 1,154 | 1,323 | 1,496 | 1,571 | 1,700 |

| Number of offices | 57 | 74 | 161 | 227 | 295 |

| Number of consumers and microenterprises ('000) | 491 | 813 | 1,072 | 1,297 | 1,424 |

1. Net loans and advances

2. Net interest income, net fee and commission income, gain/loss on financial instruments measured at fair value through profit or loss and realized gain/loss on transactions on securities available for sale.

3. Income increased by gain/loss on other revenue and operating expenses.

4. NPL (non-performing loans) – the share of impaired loans and advances in the entire credit portfolio. The ratio for the years 2009-2011 was recalculated to ensure data comparability.

5. Interest margin – change in the methodology of calculating interest margin for data presented in the Management Report on the Activities of the Bank for the years 2011 and 2012.The currently applied methodology takes into account average assets (calculated as average daily assets), while in the former one the assets covered two periods: assets at the end of a given year and the previous one.

Index:

1 Source: Financial Supervision Authority, Monthly data for the banking sector file – December 2013

2 Source: PRNews.pl Current account market – Q32013, 12 December 2013

3 Source: Central Statistical Office – Number of old-age pensioners and pensioners at the end of 2013

4 WEBIS data for Bank Pocztowy, data of the National Bank of Poland forMonetary receivables and liabilities of financial institutions, December 2013 for the banking sector

Annual Report 2013 - Bank Pocztowy

Corporate Governance

- Corporate governance: principles and scope of application

- Control system in the process of preparing financial statements

- Entity authorized to audit financial statements

- Shareholding structure and share capital

- Key information regarding Poczta Polska S.A.

- Cooperation with Poczta Polska S.A.

- Investor relations

- By-laws amending principles

- Activities of the corporate bodies of the Bank