Activities in the consumer market

thousand new retail customers

Consumers

In 2016 the Bank acquired 158 thousand new consumers and microenterprises, mainly thanks to the ZawszeDarmowe account with the fee maintenance guarantee.

At the end of 2016, services offered by Bank Pocztowy were used by 1,309.9 thousand consumers (individuals and microenterprises), i.e. 174.3 thousand less than a year before. The number of customers decreased as a result of a review of the Bank’s accounts, when the Bank closed dormant saving and current accounts. Under Article 60 of the Banking Law the Bank closed inactive accounts with no transactions reported other than interest accrual and with the cash balance of less than PLN 200. Consequently, the customer portfolio has become more accurate and realistic.

Development of the product offer for consumers

The Bank has created a simple and comprehensible offer for consumers, including deposit, credit, investment, and insurance products.

At the end of 2016 the offer covered the following product groups:

- current account (Pocztowe Konto ZawszeDarmowe),

- saving accounts (Pocztowe Konto Oszczędnościowe and Pocztowe Konto 500+),

- fixed-rate term deposits: short-term MINI, mid-term MIDI, and long-term MAXI, i.e. as at 31 December 2016 it was respectively: 4, 6 and 36 months,

- floating-rate term deposits based on WIBID 3M – Market + 30M,

- 3-month unit-linked deposit,

- cash loans, revolving overdrafts and credit cards,

- mortgage loans (including housing loans, mortgage loans and debt consolidation loans),

- insurance,

- investment funds,

A current account for consumers is the key product used for acquiring consumers.

Translation: Unlimited benefits

within account

Encouraging its clients to pro-actively use Pocztowe Konto ZawszeDarmowe, in April 2016 the Bank launched an “Unlimited Benefits” Program, which enables making any account operations with no additional charges apart from the monthly maintenance fee. Key transactions included in the program are domestic transfers ordered through any channel, including immediate transfers and Sorbnet transfers; cash withdrawals from any ATM in Poland and abroad and cash delivery to any address through a postman. Moreover, to welcome new clients and encourage them to pro-actively use the account from the very first days, the Bank launched the onboarding process for new ZawszeDarmowe account holders. The program objective is to present account functionalities to consumers and special schemes and offers.

To expand the functionalities of current accounts, the Bank offers immediate transfer services through Pocztowy24 online banking and Contact Centre. The new offer was highly appreciated by consumers, who made 45 thousand immediate transfers during the first six months of the offer launch.

In 2016 the deposit offer for consumers remained stable, i.e. the Bank continuously offered products well known to its customers, such as MINI, MIDI, MAXI, Lokata Rynek+ 30M and Pocztowe Konto Oszczędnościowe.

The investment funds’ offer constitutes and interesting alternative to the deposit offer for clients with a higher risk appetite. Since January 2015 the Bank, in cooperation with Ipopema TFI, has offered the possibility to purchase units in selected investment funds with a various investment strategy and risk profile. Investment products are available in the Bank’s sales network only.

In 2016, a number of changes were made in the product offer of investment funds. In July 2016 the Bank launched white label funds under the name “Pocztowy SFIO”, which comprised the following sub-funds: Pocztowy Ostrożny (Postal Bank Prudent Fund) and Pocztowy Zrównoważony (Postal Bank Balanced Fund).

In the following months of 2016 the following changes were made to the Pocztowy SFIO offer:

- the name of the “Pocztowy Ostrożny” subfund (Postal Bank Prudent Fund) was changed to “Pocztowy Stabilny” (Postal Bank Stable Fund),

- “Pocztowy Gotówkowy” subfund (Postal Bank Cash Fund) was launched,

- “Pocztowy Zrównoważony” (Postal Bank Balanced Fund) was replaced with the “Pocztowy Obligacji” (Postal Bank Bond Fund).

In the “IPOPEMA SFIO” portfolio two products from the Bank’s offer are no longer available: “Ipopema Gotówkowy” (Ipopema Cash Fund) and “Ipopema Obligacji” (Ipopema Bond Fund).

“IPOPEMA SFIO” was replaced with “Pocztowy SFIO” in “Lokata z Funduszem” (Unit-linked Deposit). Consequently, the product offers one subfund only (“Pocztowy Stabilny”).

Steps were taken to improve security of clients acquiring participation units in investment funds: the processes of customer segmentation and presales (welcome call) have been enhanced. Moreover, the training program, including introductory training, has been extended to maximally improve competencies of Relationship Managers.

The Bank also offers bancassurance products in cooperation with insurance companies, such as: Pocztowe Towarzystwo Ubezpieczeń Wzajemnych, Aviva Towarzystwo Ubezpieczeń na Życie S.A., Aviva Towarzystwo Ubezpieczeń Ogólnych S.A. and Pocztowe Towarzystwo Ubezpieczeń na Życie. The insurance coverage for borrowers using cash loans did not change in 2016 and includes unemployment insurance, accident insurance and life insurance. The offer for mortgage loan borrowers and current account holders has remained unchanged. The Bank offers real estate insurance and life and unemployment insurance packages.

In 2016 the Bank worked on changes in the bancassurance offer related to cash loans, i.e. it prepared a table of charges depending on the age, sum insured and the risk of individual clients and changes in the insurance documentation. It also worked with insurance companies to adjust the insurance documentation to changes in the Act on out-of-court settlement of disputes.

Moreover, the Bank pro-actively participates in the government program “Rodzina 500 plus” and in April 2016 it offered the possibility for consumers to request for care allowance under the “Rodzina 500 plus” program in the online channel Pocztowy24. In view of the needs of the beneficiaries, it launched a Pocztowe Konto 500+ (Postal Bank Account 500+) which allow for saving funds for larger future expenditure at an attractive interest rate of 4% p.a.

In March 2016 the Bank modified its process of applying for cash loans to enable tailoring the credit offer to individual client needs. Counteroffer, i.e. a tool presenting the best offer for a client suggests credit parameters (interest, fee, tenor and loan amount) tailored to the needs of a given borrower, taking into account his credit history and financial standing.

In the first half of 2016 the Bank introduced changes to the risk classes and price matrices in the cash loan approval process. Now the price is determined individually based on product characteristics and customer details which are also considered by the Bank. The change enabled the Bank to more adequately adjust price parameters to requesting borrowers.

In late July and early August the Bank modified the terms of Pożyczka na Poczcie (Post Office Loan). The product terms were modified, i.e. a maximum loan amount has been increased to PLN 3,500, the maximum tenor has been increased from 12 to 48 months and the maximum amount granted based on a statement of means only has been increased from PLN 1,000 to PLN 3,500. At the same time the product pricing has been changed. Zero interest rate and a fixed fee have been replaced by a new price and terms of charging fees applicable to cash loans.

The new Post Office Loan was promoted vigorously.

In 2016 the Bank carried out a project implementing the New Cash Loan Approval Process. In line with the Bank’s assumptions, the process is simple, easy and intuitive - user-friendly and motivating for Relationship Managers, but at the same time safe for the Bank. Apart from the technological process, other elements, such as the product and credit risk were modified to provide an optimal comprehensive solution. The implementation of the new process was planned for the end of the first quarter of 2017.

Credit operations

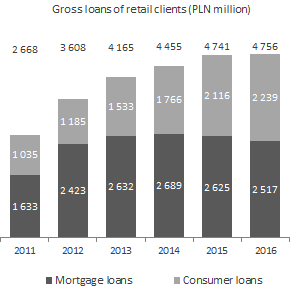

At the end of 2016 gross credit receivables of Bank Pocztowy from consumers totaled PLN 4,756.5 million versus PLN 4,741.3 million in December 2015 (a 0.3% increase). The Bank’s share in credit receivables from consumers in the banking sector amounted to 0,8%.

| Gross loans granted to clients of Bank Pocztowy S.A. in the retail segment (PLN’000) | ||||||

|---|---|---|---|---|---|---|

| Change 2016/2015 | ||||||

| 31.12.2016 | Structure (31.12.2016) |

31.12.2015 | Structure (31.12.2015) |

PLN ‘000 | % | |

| Gross loans and advances, including: | 4 756 471 | 100,0% | 4 741 255 | 100,0% | 15 216 | 0,3 % |

| Mortgage loans | 2 517 278 | 52,9% | 2 625 126 | 55,4% | (107 848) | (4,1)% |

| Consumer loans | 2 239 193 | 47,1% | 2 116 129 | 44,6% | 123 064 | 5,8 % |

Management information of the Bank. The data present the principal amount only. Default interest, due and undue interest, commissions, other prepaid expenses and revenue, other restricted revenue and interest and other receivables were not included.

Consumer loans include cash loans and installment loans, overdrafts and credit card debt and the principal amount balance of loans granted to microenterprises, which amounted to PLN 31,890 thousand as at 31 December 2016, as compared to PLN 39,308 thousand as at 31 December 2015. The item does not include mortgaged consumer loans, which were presented in “Mortgaged loans” in the amount of PLN 207.3 million as at 31 December 2016 and PLN 224.2 million as at 31 December 2015.

Gross loans of retail clients (PLN million)

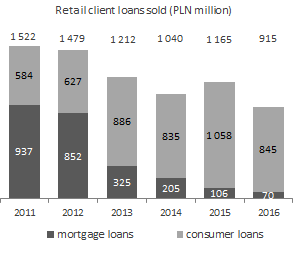

Retail client loans sold (PLN million)

In 2016 the Bank followed its strategy of focusing on consumer loans and reducing the sale of mortgage loans. The lending activity concentrated on the sale of most profitable products from the point of view of the effect on equity. In 2016 the balance of consumer loans increased by 5.8% and reached 2,239.2 million at the end of December. In 2016 the Bank sold consumer loans with the value of PLN 844.9 million.

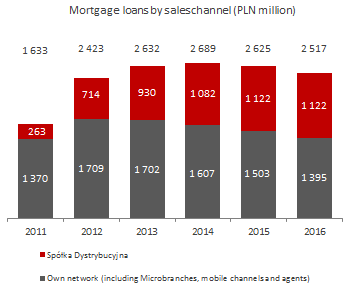

Mortgage loans remain a large portion of the portfolio. As at 31 December 2016, the Bank’s receivables due to mortgage loans reached PLN 2,517.3 million and were by 4.1% lower than in December 2015. In 2016 the Bank, offering local currency loans only, extended PLN 69.7 million of mortgage loans, i.e. by 34% less than in 2015, when the sales revenue reached PLN 106.2 million. The decrease resulted from the strategy followed. The Bank focuses on the sale of products with the highest profitability considering their effect on the capital, which implies promoting the sale of consumer loans.

All mortgage loans are extended by the Bank in the local currency.

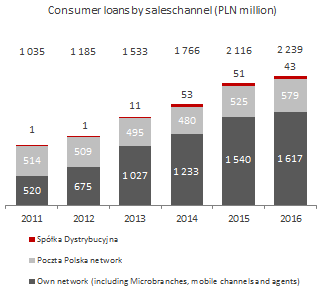

Spółka Dystrybucyjna is the only distribution channel for mortgage loans. The key distribution channels for consumer loans are own sales network and the offices of Poczta Polska. The cash loan campaign was supported by BTL marketing activities at the offices of the Bank and Poczta Polska countrywide.

Consumer loans by sales channel (PLN million)

Mortgage loans by sales channel (PLN million)

In 2016 the Bank still sold consumer loans to its existing clients under the CRM campaign based on individual limits. Consequently, the share of Bank’s clients using loans grew by 2 p.p. (from 10% to 12%) and therefore the yield earned on relationship with these names increased. In 2016 the share of consumer loans sold to existing customers reached 46% as compared to 24% in 2015. The result was generated through:

- more intensive telephone campaigns (by 48%) and texting campaign (by 129%),

- increasing the number of clients who received information about the offer on the phone (by 21%) and by text (by 184%),

- cyclical retention actions addressed to clients with maturing loans,

- using advanced analytics to apply predicting modeling to optimize targeting clients in the campaign,

- optimizing multi-channel process, where the Call Center calls clients from the database and reports sales leads for further processing by the sales network.

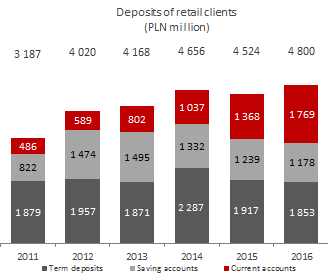

Deposits

In 2016 the Bank adjusted the speed of developing its deposit base to credit needs, including optimization of the funding costs. At the end of December 2016 individuals deposited in the Bank the total of PLN 4,800.2 million versus PLN 4,523.5 million at the end of December 2015. The balance of deposits in the retail segment grew by PLN 276.7 million.

The growth in deposits of individuals resulted only from the increase in the balance of current accounts. It has grown by PLN 401.0 million, i.e. by 29.3% YoY.

| Deposits of Bank Pocztowy S.A. - retail segment (PLN’000) | ||||||

|---|---|---|---|---|---|---|

| Change 2016/2015 | ||||||

| 31.12.2016 | Structure (31.12.2016) |

31.12.2015 | Structure (31.12.2015) |

PLN ‘000 | % | |

| Client deposits, including: | 4 800 231 | 100,0% | 4 523 510 | 100,0% | 276 721 | 6,1 % |

| Current accounts | 1 768 796 | 36,8% | 1 367 747 | 30,2% | 401 049 | 29,3 % |

| Saving accounts | 1 178 656 | 24,6% | 1 238 990 | 27,4% | (60 334) | (4,9)% |

| Term deposits | 1 852 779 | 38,6% | 1 916 773 | 42,4% | (63 994) | (3,3)% |

Source: management information of the Bank. The data present the principal amount only. Interest accrued and EIR-based fees were not included.

Deposits of retail customers

(PLN million)

Due to low interest rates the lowest demand was reported for saving accounts and term deposits. In December 2016 retail clients deposited PLN 1,178.7 million on saving accounts at the Bank, i.e. by 60.3 million less than at the end of December 2015. At the end of December 2016 the balance of term deposits amounted to PLN 1,852.8 million and was PLN 64.0 million lower than at the end of 2015. The decrease in the balance of saving accounts and term deposits resulted mainly from the pricing policy adopted by the Bank, which was aimed at reducing the costs of financing and adjusting their level to decreasing interest income, which resulted from low market interest rates.

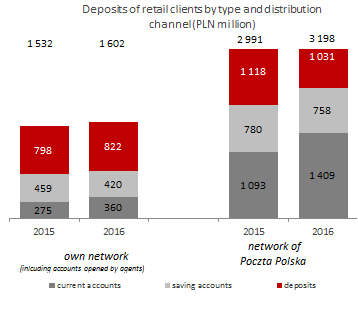

Deposits of retail customers by type and

distribution channel (PLN million)

In 2016 the structure of individual deposits by sales channel did not change considerably comparing to 2015. For many years the offices of Poczta Polska have been the key sales channel for deposit products. At the end of 2016, retail products acquired through the Poczta Polska network accounted for 66.6% of the total balance of deposits, including:

- current accounts – 79.7% (versus 79.9% in December 2015),

- saving accounts – 64.3% (versus 63.0% in December 2015),

- deposits – 55.6% (versus 58.3% in December 2015).

The remaining 33.4% of deposits was acquired through own network of the Bank.

In 2016 the Bank opened 165 thousand new ZawszeDarmowe accounts, including 75% accounts through the network of Poczta Polska. At the end of December 2016 ZawszeDarmowe accounts comprised 53% of all accounts of individuals and Pocztowe Konto Nestor accounts - popular in previous years - only 25% of the current account portfolio.

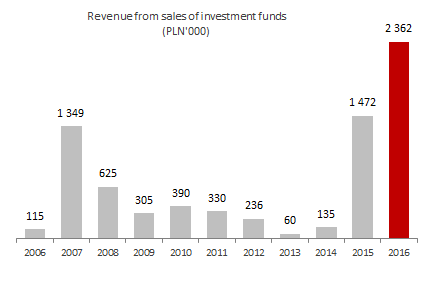

Investment funds

The investment funds’ offer constitutes and interesting alternative to the deposit offer for clients with a higher risk appetite.

Since January 2015 the Bank, in cooperation with Ipopema TFI, has offered the possibility to purchase units in selected investment funds (Subfunds: Gotówkowy, Obligacji, Dłużny, Makro Alokacji, Akcji, Globalnych Megatrendów, m-INDEKS, Małych i Średnich Spółek, Short Equity) with a various investment strategy and risk profile. Investment products are available in the Bank’s sales network only.

Since 2006 the Bank has offered units of PKO TFI investment funds.

In 2016 the Bank sold investment fund units with the value of PLN 196 million and reported record high revenue from the sale of these units of PLN 2 million.

The best-selling subfund was Ipopema Gotówkowy (Ipopema Cash Fund) with low risk based on secure highly liquid assets (debt instruments and cash) with a minimum 6-month investment period.

Revenue from sales of investment funds

(PLN'000)

In 2016 the Bank’s clients developed their investment competencies, which translated into a growth in the share of higher risk subfunds, such as Ipopema Dłużny (Ipopema Debt Fund), Pocztowy Stabilny (Postal Bank Stable Fund) and Ipopema Obligacji (Ipopema Bond Fund). The decrease in the balance of some high-risk funds, such as Ipopema Akcji (Ipopema Equity Fund), Ipopema Makro Alokacji (Ipopema Makro Equity Fund) and Ipopema MiŚS (Ipopema SME Fund) resulted from disadvantageous situation in the market and replacing these funds in the “Lokata z Funduszem” product with Bank “Pocztowy SFIO” subfunds, in particular “Stabilny” (Stable) subfund.

Bank cards

In 2016 Bank Pocztowy offered the following types of bank cards to consumers:

- MasterCard and Visa Electron debit cards issued to personal accounts,

- Visa Business Elektron cards issued to Pocztowe Konto Firmowe accounts,

- MasterCard and Visa Classic credit cards.

| Debit and credit cards held by retail clients (‘000) | ||||||||

|---|---|---|---|---|---|---|---|---|

| Change 2016/2015 | ||||||||

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | ‘000 | % | |

| Cards, including: | 130 | 150 | 204 | 241 | 257 | 276 | 19 | 7,4 % |

| MasterCard and Visa Electron | 121 | 132 | 183 | 221 | 239 | 259 | 20 | 8,3 % |

| Visa Business Electron | 4 | 4 | 5 | 6 | 7 | 7 | 0 | 0,4 % |

| MasterCard and Visa Classic credit cards | 5 | 13 | 15 | 13 | 10 | 9 | (1) | (9,6)% |

| Prepaid | 1 | 1 | 0 | 0 | 0 | - | ||

At the end of 2016 the payment card portfolio for consumers amounted to PLN 276 thousand, out of which 97% were debit cards.

Major changes in the payment card offer of the Bank:

- new prices for issuing cards and processing card transactions were introduced in February 2016,

- the strategy aimed at increasing the number of transactions made by consumers using their first debit cards was launched on 1 June 2016,

- the sales support program Bank Pocztowy Card Ambassadors for own sales network, aimed at increasing commitment of Relationship Managers selling cards, developing their knowledge and exchanging best practices in card selling was implemented on 1 July 2016,

- the possibility to accept transfers by individuals using payment cards and MasterCard Money Send or Visa Personal Payments services was introduced on 1 July 2016,

-

the possibility to accept transfers by individuals using payment cards and MasterCard Money Send or Visa Personal Payments services was introduced on 1 July 2016,

Translation: 10% bonus on payment

card at the post office - At the same time, the Bank launched promotion of Cash Back services (cash withdrawal at payment) at post offices and outlets earmarked ‘Visa CashBack’ or ‘MasterCard: Pay card and withdraw cash’. The maximum amount of a single payment using MasterCard has been increased to PLN 500.

On 1 December 2016 the Bank, in cooperation with Euronet, introduced proximity transaction services for cash withdrawals.