External factors

Key trends in the economy

Gross Domestic Product and its components

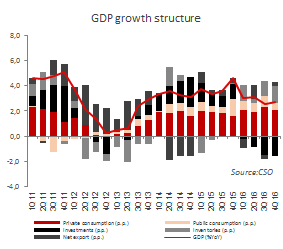

In 2016 the Polish economy grew slower than a year before. In line with the data of the Polish Central Statistical Office, the GDP growth amounted to 2.8%, while in 2015 it had reached 3.9%. The slower growth rate resulted mainly from lower investments in the economy. They dropped by 5.5% although in 2015 they had grown by 6.1%. The main reason was the delay in the use of EU funds under the 2014-2020 Perspective, mainly by local administration and high uncertainty related to the external and internal environment, which made companies postpone their investment initiatives. On the other hand, household consumption expenditure growth of 3.6%, which was the highest level since 2008, fostered the economic growth in 2016. Higher household consumption expenditure resulted from improved situation in the labor market, higher purchasing power of wages related to deflation observed in the entire 2016 and the transfer of PLN 17.3 billion to families with children under the Family 500+ Program. In line with the calculations of the Central Statistical Office, in 2016 the share of the net exports in GDP amounted to 0.1 p.p. only, as compared with 0.6 p.p. in 2015 due to faster growth in imports of goods of services than in exports.

GDP growth structure

Labor market

Labor market trends have not changes considerably since 2014. At year-end, the unemployment rate dropped from 9.7% at the end of 2015 to 8.3%, which was the lowest ratio in the last 25 years. In 2016 unemployment decreased in Poland despite lower investments in the economy. The decisive factors were the talent shortage in certain industries and lower labor supply observed in the last few years resulting from demographic processes and economic emigration.

The year 2016 was another year of employment growth in the business sector. In December 2016, 5,799 thousand people worked in the business sector, as compared to 5,626 thousand in December 2015. Employment in the business sector grew during the entire 2016 and in December the growth rate reached 3.1% (versus 1.4% a year before). Higher employment in the business sector positively affected consumption of households on the one hand and increased savings of households on the other. In particular, it was difficult to find competent talents in industries which generally report labor shortages. Moreover, a number of companies which postponed new investment projects decided to hire new staff.

In 2016, the growth in employment (unemployment reduction) was accompanied with an increase in salaries and wages in the business sector. Nominal annual growth of wages reached 4.1%, as compared to 3.5% in 2015. As deflation has been observed in the last few years, the increase in real wages was higher than the nominal growth and amounted to 4.7% versus 4.5% in 2015.

Prices of goods and services

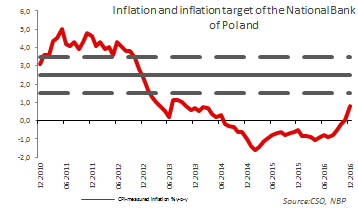

In 2016 the consumer price index amounted to – 0.6% (versus – 0.9% a year before), which implies a considerable deviation from the inflation target of the National Bank of Poland. Annual deflation was reported until October, when it reached 0.2% YoY and then, in December inflation of 0.8% YoY was observed. The key reasons for lower prices in Poland reported nearly during the entire 2016 were considerably low prices of world energy resources, including crude oil (although insignificant growth has been observed), lower costs of using flats (following a decrease in prices of gas and electricity) and still relatively low prices of food. In February 2016 world oil prices were the lowest since 2004 (BRENT crude oil price was USD 38.18 and NYMEX - USD 26.21). Subsequently, they started to grow, due to the reduction in production volumes heralded by key suppliers. At the same time, the American dollar strengthened versus other currencies, including the Polish zloty, which translated into a considerable increase in retail prices of fuel at the end of the year. Despite the Russian embargo on European agricultural and food produce imposed in July 2014 the prices of food increased, because food manufacturers managed to adjust to the new circumstances and acquire new buyers. Despite the increased consumption demand in 2016, core inflation rates remained low. Moreover, at the beginning of the year, core inflation rate (excluding prices of food and energy) was negative for the first time since 2006. In 2016 average core inflation rate amounted to -0.2% versus +0.3% in 2015.

Inflation and inflation target of National Bank of Poland

Public finance and the treasury debt securities market

In 2016 the public finance and in particular the tax income was affected by long-term deflation. The average annual deflation amounted to 0.6%, while the Ministry of Finance projected average annual inflation of 1.3% in the Budget Act of March 2016. The economic growth rate of 2.8% also proved much lower than assumed in the Budget Act (3.8%). Still, the key reason for the economic slowdown was not a decrease in consumer demand but lower investments, so finally the budget revenue was not affected. To support the budget in 2016 the Minister of Finance took steps to improve the efficiency of the VAT collection system. According to the data of the Ministry of Finance in December 2016 the budgetary deficit amounted to PLN 46.3 billion (vs. PLN 54.74 billion projected), i.e. 84.6% of the amount planned for the entire year. The budget revenue reached 314.6 billion, i.e. 100.3% of the annual plan, while the expenditure stood at PLN 360.9 billion, i.e. 97.9% of the amount planned for 2016.

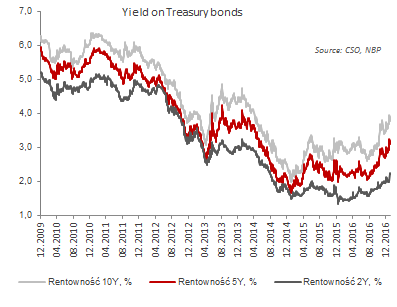

Like in the previous years, in the first half of 2016 the Ministry of Finance focused on selling a major part of Treasury bonds planned for sale in a given year. The Ministry of Finance started pre-financing borrowing needs of the State Budget for 2016 in 2015, therefore in December 2015 it found financing for 20% of the annual needs, at the end of June it was 70% and the process was completed in November. At the same time, the Ministry commenced pre-financing borrowing needs of the State Budget for 2017 and at the end of 2016 ca. 27% was pre-financed. Further quantitative easing works of the European Central Bank carried out in March 2016 and deferring increases in interest rates in the U.S. by Fed (finally increased in December) and eliminating assets in the form of Treasury bonds from the taxable amount of banks also positively affected the prices of Polish Treasury securities. On the other hand, the deterioration of the S&P credit rating of Poland and the negative outlook assigned in January, the deterioration of the Moody’s rating to negative in May 2016 and the Brexit referendum in June exerted a short-term negative impact on Treasury securities. Negative external factors, which affected the Polish debt market accumulated in the last quarter of 2016: presidential elections in the U.S., constitutional referendum in Italy and strong expectations concerning interest rate increase in the U.S. At the end of December the yield on 2-year bonds was 2.04% versus 1.58% at the end of December 2015, the yield on 5-year bonds was 2.89% versus 2.23% at the end of 2015 and yield on 10-year bonds increased from 2.95% at the end of 2015 to 3.63%.

Yield in Treasury bonds

At the end of Q3 2016, public debt amounted to PLN 939.6 billion (51.1% of GDP) vs. PLN 877.3 billion (48.8% of GDP) at the end of 2015.

Exchange rates

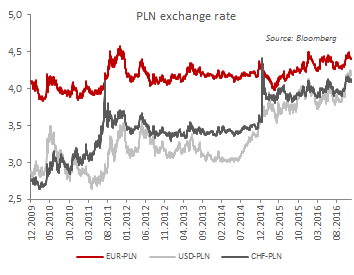

In 2016 exchange rates were fluctuating considerably, mainly due to policies followed by key global central banks, i.e. the European Central Bank, the Federal Reserve, Bank of Japan and the Swiss National Bank. Exchange rates were also strongly affected by Brexit referendum and presidential elections in the United States. Britain’s decision to exit the European Union and the results of the presidential elections in the United States were highly surprising and caused dramatic changes in currency markets. In the view of deepening deflation in the Eurozone, at the beginning of 2016 the European Central Bank further reduced the deposit rate (after the reduction by 10 p.p. in December 2015) from -0.30% to -0.40%. Other interest rates, including the reference rate, remained unchanged during the entire 2016. In 2016, ECB carried out extensive quantitative easing. Fed, however, have continuously postponed the interest rate increase finally increased the rates in December. Fed raised the rates by 25 b.p. from 0.25-0.50% to 0.50-0.75%. At the same time, Fed intends to continue tightening the monetary policy in 2017 and 2018. Strategies followed by central banks, the results of the Brexit referendum and presidential elections in the United States caused fluctuations in the EUR/USD rates of exchange. Finally, at the end of the year, the American dollar was significantly stronger than then the euro and other currencies, including PLN, comparing to 2015. At the end of 2016 the USD/PLN rate was 4.18, the EUR/PLN rate was 4.40 and the CHF/PLN rate was 4.10. Apart from foreign factors, in 2016 the rate of exchange of the Polish zloty was considerably affected by local circumstances, such as the deterioration of the S&P’s rating of Poland and the change of the Moody’s outlook to negative in May 2016. Another important factor affecting the PLN rate was the Bill on loans in Swiss francs presented by the Chancellery of the President of the Republic of Poland and the announcement of the plans to amend the bill and the presentation and submission of the Spread Act to the Polish Parliament.

PLN exchange rate

Monetary policy

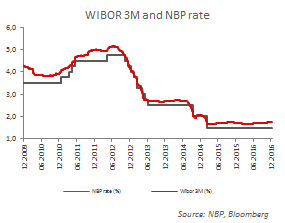

In 2016 the Monetary Policy Council did not change interest rates. Based on CPI and GDP projections prepared by the National Bank of Poland, the Monetary Policy Council expected that deflation would end in 2016 and at the same time it considered the economic slowdown in Poland as a temporary situation related to the delays in utilizing funds from the new EU perspective. At the end of 2016 the reference rate was 1.50%, bill of exchange rediscount rate: 1.75%, Lombard rate: 2.50%, and deposit rate: 0.50%. Unchanged interest rates of the National Bank of Poland translated into stabilization of market rates in 2016. At the end of 2016, WIBOR 3M amounted to 1.73% versus 1.72% at the end of 2015.

WIBOR 3M and NBP rate

| Economic ratios | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

|---|---|---|---|---|---|---|---|

| GDP (YoY) | 3,9% | 4,5% | 1,9% | 1,7% | 3,3% | 3,9% | 2,8% |

| Inflation (average for the period) | 2,6% | 4,3% | 3,7% | 0,9% | 0,0% | (0,9)% | (0,6)% |

| Registered unemployment rate (at period end) | 12,4% | 12,5% | 13,4% | 13,4% | 11,5% | 9,8% | 8,3% |

| Deposits and other liabilities (PLN billion, at period end) | 682,0 | 761,9 | 797,9 | 845,9 | 914,5 | 996,0 | 1 081,8 |

| Households (PLN billion, at period end) | 421,2 | 478,0 | 514,9 | 543,6 | 591,6 | 646,0 | 704,9 |

| Enterprises (PLN billion, at period end) | 181,3 | 203,3 | 187,8 | 206,5 | 225,9 | 249,3 | 269,0 |

| Receivables (PLN billion, at period end) | 770,0 | 880,8 | 901,1 | 937,4 | 1 005,7 | 1 076,4 | 1 124,7 |

| Average EUR/PLN rate | 3,99 | 4,12 | 4,19 | 4,19 | 4,18 | 4,18 | 4,36 |

| Average USD/PLN rate | 3,01 | 2,96 | 3,26 | 3,16 | 3,15 | 3,77 | 3,94 |

| Average CHF/PLN rate | 2,89 | 3,35 | 3,47 | 3,41 | 3,44 | 3,91 | 4,00 |

| Reference rate (at period end) | 3,50% | 4,50% | 4,25% | 2,50% | 2,00% | 1,50% | 1,50% |

| WIBOR 3M (at period end) | 3,95% | 4,99% | 4,11% | 2,71% | 2,06% | 1,72% | 1,73% |

Situation in the banking sector

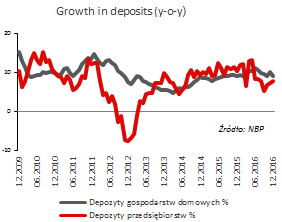

Deposits of households and enterprises

At the end of 2016 the total deposits in the banking system amounted to PLN 1,081.8 billion, i.e. by 8.6% more than at the end of 2015. Household deposits stood at PLN 704.9 billion. In 2016, the growth rate of household deposits increased to a double digit number in June (11.2% YoY), which was related to the launch of the Family 500+ program in April. Eventually, in December 2016 the household deposits growth rate stood at 9.1% YoY (versus 9.2% in December 2015). The increase resulted from the launch of the program financially supporting families with children (meeting specific criteria) and the improvement in the labor market. Another deposit driver was deflation reported during the entire year. On the other hand, record low interest rates of the National Bank of Poland still discouraged consumers from depositing funds with banks. In December 2016, deposits of enterprises amounted to PLN 269.0 billion, i.e. increased by 7.9% during the year vs. a 10.4% increase in December 2015. In the first half of the year corporate deposits grew (by 13.1% YoY in May 2016) following the improvement in the financial position of companies and suspended investment processes. Despite the suspension of investment initiatives, in the second half of the year a number of businesses adopted other saving methods than bank deposits.

Growth in deposits (y-o-y)

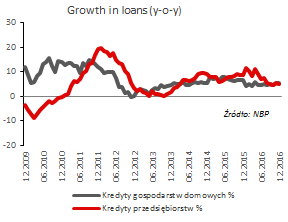

Loans and advances to households and enterprises

In December 2016, loan receivables in the banking sector totaled PLN 1,124.7 billion, being 4.5% higher than in December 2015. Loans and advanced to households went up by 5.2% to PLN 665.1 billion. Housing loans in the local currency grew from PLN 212.0 billion in December 2015 to PLN 234.4 billion at the end of 2016 (by 10.6%). Record low interest rates and an improvement on the labor market positively affected the scale of the new lending campaign. In the first half of 2016 the Flat for the Young (Mieszkania dla Młodych) considerably increased the demand for mortgage loans among households. Not only was the entire amount for 2016 used, but also a portion of funds for 2017 was disbursed. On the other hand, the down payment was increased from 10% to 15% on 1 January 2016, in accordance with the Recommendation S issued in 2014, which adversely affected the credit appetite. In December 2016 the value of the loan portfolio denominated in foreign currencies dropped to PLN 162.4 billion and was by PLN 3.8 billion lower than at the end of 2015. The decrease in the portfolio value resulted from strategies followed by banks and their clients as a part of the process of restructuring loans in CHF approved by mutual agreement of the parties. Another adverse factor was the implementation of restrictions under Recommendation S, which dramatically impeded taking loans in foreign currencies. In 2016 receivables of the banking sector arising from consumer loans from individuals increased. In December 2016 they totaled PLN 135.4 billion (versus PLN 126.5 billion in December 2015). The consumer loan volume increased due to low interest rates and less stringent credit approval policies followed by banks, which resulted from improvement in the situation on the labor market and higher credit demand of households, the credit standing of which has improved following the launch of the Family 500+ Program. In December 2016 the value of loans granted to enterprises was PLN 344.8 billion as compared to PLN 326.0 billion in December 2015 (5.8% growth). The credit demand of businesses was lower than in previous years, because investment projects were not carried out and the cost of credit for companies increased.

Growth in loans (y-o-y)

Interest rate on deposits and loans

In 2016 the Monetary Policy Council did not change interest rates. The reference rate remained at a record-low 1.50% and the Lombard rate stood at 2.50%, which materially affected the interest rates on loans and deposits. According to the data of the National Bank of Poland, in December 2016 the average interest rate on new local currency deposits of households amounted to 1.5% versus 1.8% in December 2015. Average interest on new deposits of enterprises was equal to 1.2% as compared to 1.5% in the previous year. Average interest on new loans granted to households in the Polish zloty in December 2016 stood at 6.2%, with no change since the end of 2015. As for loans for households, in December 2016 the interest on housing loans amounted to 4.4% (no change since the end of 2015), and interest on consumer loans reached 7.6% (versus 8.0% at the end of 2015). In the corporate sector, the interest on new loans in the local currency amounted to 3.6%, i.e. the same as in December 2015.

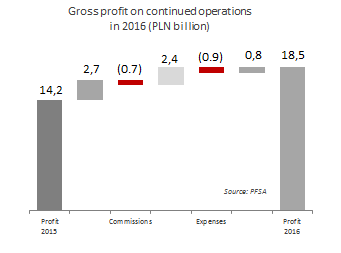

Financial performance of the banking sector

In 12 months of 2016 Polish banks generated the net profit of PLN 13.9 billion, i.e. 24.3% higher than in December 2015. Significantly, since February 2016, performance of a group of banks was adversely affected by endorsement of the Act on tax on certain financial institutions. On the other hand, in the second quarter of 2016, the sale of shares in VISA Europe Limited was finally settled, which improved performance of some banks and, due to the income size, drove performance of the entire banking sector.

In 2016 the banking sector performance was affected by:

- The increase in the net banking income (by PLN 3.4 billion, i.e. 6.1% versus December 2015), mainly as a result of a marked increase in profit from other banking activities (by PLN 1.5 billion, i.e. 25.2% comparing to December 2015). One of the reasons was the settlement of the sale of shares in VISA Europe Limited discussed above, where following the transactions banks reported an additional income totaling to PLN 2.5 billion. Significantly, the transaction was a non-recurring event and the performance of the banking sector would have been lower if it had not been made. In 2016 the net interest income grew by PLN 2.7 billion, i.e. by 7.6% vs. 2015 as a result of changes in the deposit and credit policies of banks, i.e. reducing interest rates on deposits and at the same time increasing the interest rates on a portion of loans, which eventually increased banks’ margins. At the same time, the net fee and commission income decreased in 2016 (by PLN 0.7 billion, i.e. by 5.4% versus 2015), which resulted from the deterioration of revenue from bancassurance services in certain banks, the revenue from loans granted, revenue from maintaining bank accounts and bank cards and the revenue from securities operations, managing investment and pension funds and asset management.

- The increase in operating expense by PLN 0.9 billion, i.e. 2.5% in the period from December 2015 to December 2016 was a consequence of the endorsement of the Act on certain financial institutions, which imposed an additional tax on banks totaling to PLN 3.2 billion.

- A decrease in the negative balance of allowances and provisions of PLN 0.8 billion, i.e. by 10.4% in 2016. Factors which positively affected the balance of impairment losses and provision were: improved situation in the labor market, transfer of cash to households under the Family 500+ program, low interest rates which drove stabilization or improvement of the financial situation of a number of borrowers and the sale of credit receivables to debt collection agencies by selected banks.

Gross profit on continued operations

in 2016 (PLN billion)

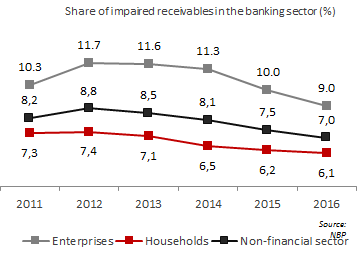

Share of impaired receivables in the banking sector

(%)

The share of impaired receivables in the total receivables from the non-financial sector dropped from 7.5% in December 2015 to a record low level of 7.0% in December 2016 . The year 2016 also saw an improvement in the quality of credit exposures of banks to enterprises and households and certain banks sold their credit exposures to external companies.

Banks retained a large portion of profits generated in 2015 and refrained from or suspended dividend payment, hence the capital base strengthened (the increase in equity from PLN 159.1 billion at the end of 2015 to PLN 162.0 billion at the end of December 2016) and the total capital ratio increased from 16.3% in December 2015 to 17.4% in December 2016. In December 2016 Tier 1 ratio amounted to 15.9% versus 15.0% at the end of 2015.

In 2016 banks focused on improving efficiency by way of optimizing human resources and the sales network. The process was driven by earlier mergers and acquisitions and development of online banking services. Consequently, the number of persons employed in the banking sector dropped at the end of December 2016 by 2.1 thousand people and the sales network was reduced by 29 outlets.

Capital market

Stock market (WSE main market and ASO New Connect market)

The year 2016 saw an increase in key indices of the Warsaw Stock Exchange (WIG and WIG20). WIG20 grew by 4.77% up to 1,947 points and WIG by 11.38% up to 51,754.03 points. At the end of December 2016 the value of Polish firms listed at the Warsaw Stock Exchange reached PLN 557.1 billion and was by 7.8% higher than in December 2015. The number of IPOs dropped from 30 in 2015 to 19 in 2016 and was the lowest number of IPOs in the last three years.

Investors were less active as well. In 2016 shares worth PLN 189.2 billion changed hands as a result of session transactions, i.e. by 7.5% less than in the previous year.

Investment funds’ net assets

In 2016 the growth rate of Polish investment fund assets amounted to 2.7% as compared to 21% in 2015. Cash inflows were observed in the first half of 2016 (net inflows of PLN 9.7 billion and an increase in the total assets up to PLN 261.9 billion), while in the second half of the year outflows prevailed .