Activities in the institutional client market

thousand institutional clients

Institutional banking clients

Applying general, financial and business relations criteria, the Bank has divided its institutional clients into the following categories:

- small and medium enterprises (SME),

- housing institutions such as condominiums, housing associations, property managers and social housing associations,

- Public Finance and Public Benefit Organizations to include associations, labor unions and other organizations,

- Poczta Polska and companies from its Capital Group.

At the end of 2016 Bank Pocztowy had the total of 14.9 thousand institutional clients. The housing segment (11.2 thousand clients) is the largest group of institutional clients.

The institutional segment does not include microenterprises, which are included into the retail segment in management reporting of the Bank.

Development of the product offer for institutional clients

The key product in packages tailored to individual needs of institutional client segments is the current account. The Bank offers the following types of current accounts to institutional clients:

- Pocztowy Biznes Pakiet (Business Postal Package) – targeted at all SMEs, real property managers and administrators, Public Finance sector, public benefit organizations, NGOs, Poczta Polska S.A. and companies from the Poczta Polska Capital Group,

- Pocztowy Pakiet MINI DOM (Mini House Postal Package) – targeted at condominiums which enter into a limited number of transactions, generate low revenue and use a narrow range of bank products; The package is offered at lower price, but additional fees and charges for individual services,

- Pocztowy Pakiet DOM (House Postal Package) – full offer for condominiums. A higher product price is offered in the package, but transfers are made free of charge.

As a part of the settlement products development strategy, a new service “Giro Wysyłka” (Giro Transfer) was launched. The service enables transferring cash from Bank offices to over 200 countries.

The Bank offers the following deposit products:

- standard fixed-rate deposits with the tenor of 3, 6 and 12 months and the minimal amount of PLN 1 thousand,

- individually negotiated deposits for at least PLN 50 thousand,

- automatically renewed overnight deposits of at least PLN 50 thousand with more advantageous interest rates than those proposed for overdrafts,

- Konto Oszczędnościowe Biznes (Business Saving Accounts) - for all segments; The account interest rate depends on the account balance,

- bank accounts in foreign currencies (USD, EUR, GBP, CHF, CAD).

The Bank offers comprehensive settlement services based on the access to Poczta Polska's infrastructure. The services include: managing cash payments made in other banks and handling payments made to the Social Insurance Institution and Tax Offices.

The Bank’s settlement offer includes:

- Giro Płatność (Giro Payment) (cash payments to third parties available at the offices Poczta Polska and the Bank’s own network),

- Giro Wysyłka (Giro Transfer) (making cash transfers from the Bank’s own network),

- over-the-counter deposits (cash payments to the client’s account at the offices of Poczta Polska and the Bank’s own network based on standard or individual terms),

- Pocztowy Collect (identifying bulk payments using virtual accounts generated to a client’s bank account),

- Pocztowy Przelew Zbiorczy (Postal Collective Transfer) (managing bulk domestic non-cash payment orders in the Polish zloty),

- sealed cash deposits (accepting sealed cash deposits from clients).

Further, in 2016 the Bank continued relationships with companies offering international cash transfers. The Bank's key competitive advantage is the widest distribution network in Poland, composed of post offices and bank's sales points where customers can collect cash transfers.

The Bank’s credit offer for institutional clients includes in particular:

- revolving loans,

- non-revolving working capital loans,

- investment loans,

- loans with thermal improvement and refurbishment premium,

- loans for refurbishment and construction purposes,

- mortgage loans,

- bank guarantees.

The treasury offer for institutional clients includes:

- currency forward contracts,

- purchase and sale of debt securities (treasury and non-treasury securities, certificates of deposit),

- possibility to conclude currency forward transactions under a treasury limit.

In order to improve competitiveness of its offer for institutional clients the following steps have been taken by the Bank:

- launching a new service for making cash transfers from the Bank’s own network),

- starting works on offering cash transfers in the Poczta Polska network,

- adjusting the deposit offer to market terms.

Credit operations

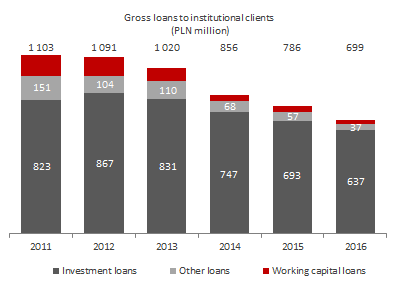

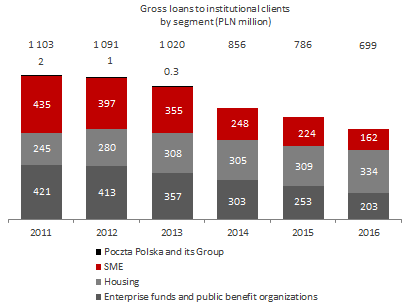

As at 31 December 2016 the Bank’s credit receivables from institutional clients totaled PLN 699.2 million and were by PLN 11,0% lower than in December 2015.

| Loans originated in the institutional segment by Bank Pocztowy S.A. (PLN’000) | ||||||

|---|---|---|---|---|---|---|

| Change 2016/2015 | ||||||

| 31.12.2016 | Structure (31.12.2016) |

31.12.2015 | Structure (31.12.2015) |

PLN ‘000 | % | |

| Loans granted to institutions | 699 182 | 100,0% | 785 612 | 100,0% | (86 430) | (11,0)% |

| Investment loans | 636 910 | 91,1% | 692 500 | 88,2% | (55 590) | (8,0)% |

| Working capital loans | 25 049 | 3,6% | 35 637 | 4,5% | (10 588) | (29,7)% |

| Other loans | 37 223 | 5,3% | 57 475 | 7,3% | (20 252) | (35,2)% |

Source: management information of the Bank. The data present the principal amount only. Default interest, due and undue interest, EIR fees, other prepaid expenses and accrued income, other restricted revenue and interest were not included.

Lower balances of loans granted to institutional clients reported in 2016 resulted from a strategic decision of the Bank to change the credit policy in this respect and reduce financing extended to these client groups. In 2016, like in 2015, the Bank limited its new loans and facilities were granted mainly to its key clients, mainly from the Housing segment (condominiums, housing associations, property managers and social housing associations), holding considerable deposits and using settlement services. The credit policy related to institutional clients was changed to increase the yield on new loans and ensure capital sufficient to grow new loans in the retail segment.

Investment loans had the highest share in the institutional clients portfolio. At the end of 2016 investment loans accounted for 91.1% of the total credit receivables of the Bank due from this customer group.

Gross loans to institutional customers (PLN million)

Gross loans to institutional customers by segment (PLN million)

Deposits

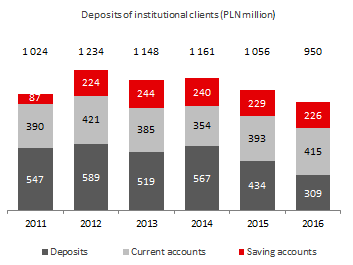

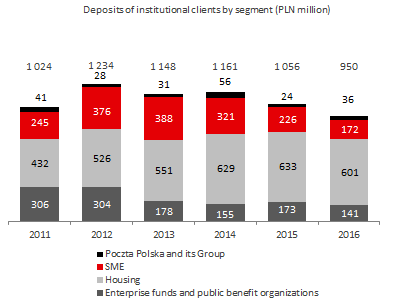

As at 31 December 2016 deposits of institutional clients amounted to PLN 949.7 million, i.e. by PLN 106.8 million less than at the end of 2015. The decrease in liabilities to this client category resulted from adjusting the level of deposits to liquidity needs of the Bank and limited lending activity, in particular to SMEs.

| Deposits of the institutional segment in Bank Pocztowy S.A. (PLN’000) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 31.12.2016 | Structure (31.12.2016) |

31.12.2015 | Structure (31.12.2015) |

|

|||||||

| Total institutional deposits | 949 653 | 100,0% | 1 056 431 | 100,0% | (106 778) | (10,1)% | |||||

| Current accounts | 414 860 | 43,7% | 392 984 | 37,2% | 21 876 | 5,6% | |||||

| Saving accounts | 226 063 | 23,8% | 228 996 | 21,7% | (2 933) | (1,3)% | |||||

| Deposits | 308 730 | 32,5% | 434 451 | 41,1% | (125 721) | (28,9)% | |||||

Source: management information of the Bank. The data present the principal amount only. Interest accrued and EIR-based fees were not included. Deposits without individually negotiated deposits of Poczta Polska.

At the end of December 2016, the balance of cash on current accounts of institutional clients increased to PLN 414.9 million, i.e. it was by 5.6% higher than on 31 December 2015. At the end of 2016 Bank Pocztowy managed 20,3 thousand active current accounts of institutional clients, i.e. the number of accounts had not changed much since December 2015.

In 2016 the Bank was less active in acquiring individually negotiated deposits with high interest rates, because the portfolio of highly stable deposits of individuals had been growing. Consequently, the balance of term deposits amounted to PLN 308.7 million and was by PLN 125.7 million lower than at the end of December 2015.

At the end of 2016 the total balance deposited on saving accounts decreased by PLN 2.9 million to PLN 226.1 million.

Deposits of institutional customers (PLN million)

Deposits of institutional customers by segment (PLN million)

Housing institutions where those to deposit the highest amount at the Bank. In December 2016 the value of deposits in the housing segment reached PLN 600.5 million and constituted 63.2% of the total deposits of institutional clients. Deposits of SMEs were also considerable and amounted to PLN 172.4 million, i.e. accounted for 18.1% of the total deposits of institutional clients.