Treasury operations

investment financial

assets

Treasury operations of Bank Pocztowy focus on:

- managing the market interest rate exposure and short-term exposure under the Banking Book and managing currency risk exposure under the Trading Book;

- trading operations on own account and transaction with the Bank’s clients;

- managing long-term liquidity risk through the issue of long-term debt securities of the Bank.

Banking book

In 2016 the Bank concluded mainly sale and purchase transactions in securities, sell-buy-back and buy-sell-back transactions and deposited or borrowed funds in the interbank market as a part of managing short-term liquidity and interest rate risk. Moreover, it entered into derivative transactions such as FRA or IRS to hedge against interest rate risk.

At the end of 2016 the total investments in financial assets of the Bank reached PLN 1,464.6 million, i.e. by PLN 216.5 million (17.3%) more than at the end of 2015. The change resulted mainly from a higher balance of Government Bonds, which amounted to PLN 1,358.6 million at the end of December 2016 and was by PLN 184.3 million (i.e. 15.7%) higher than at the end of 2015. Government Bonds accounted for 92.8% of financial assets in the entire investment portfolio.

| Change 2016/2015 | ||||

|---|---|---|---|---|

| 31.12.2016 | 31.12.2015 | PLN ‘000 | % | |

| Investments in financial assets | 1 464 557 | 1 248 037 | 216 520 | 17,3 % |

| available for sale, including: | 1 175 686 | 803 347 | 372 339 | 46,3 % |

| Treasury bonds | 1 069 691 | 779 609 | 290 082 | 37,2 % |

| Bank bonds and certificates of deposit | 8 988 | 8 924 | 64 | 0,7 % |

| Shares | 4 019 | 14 814 | (10 795) | (72,9)% |

| Debt instruments issued by the National Bank of Poland | 92 988 | - | 92 988 | - |

| held to maturity, including: | 288 871 | 444 690 | (155 819) | (35,0)% |

| Treasury bonds | 288 871 | 394 645 | (105 774) | (26,8)% |

| Bank bonds and certificates of deposit | - | 50 045 | (50 045) | (100,0)% |

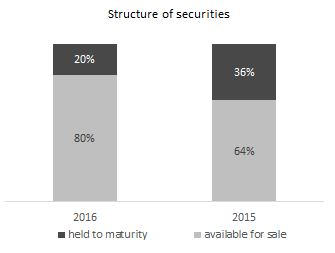

Investment financial assets available for sale with the total value of PLN 1,175.7 million accounted for 80.3% of investment financial assets, and the remaining 19.7% were bonds held to maturity, the value of which was PLN 288.9 million.

Structure of securities

In its securities portfolio the Bank also holds debt securities issued by other banks, classified to loans and receivables and presented as receivables from other banks. As at 31 December 2016 the balance of securities was PLN 40.2 million and was similar to that reported a year before.

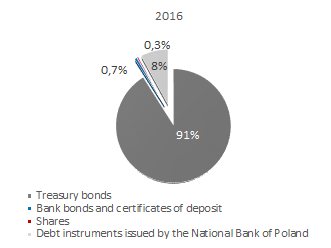

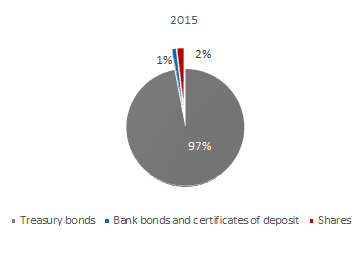

Structure of securities available for sale

Structure of securities held to maturity

In 2016 interest income on investment financial assets and receivables from other banks amounted to PLN 35.4 million and was by 11.4% lower than in 2015. The decrease resulted from low market interest rates.

To diversify the sources of funding and provide additional sources of long-term financing the Bank issued long-term debt securities.

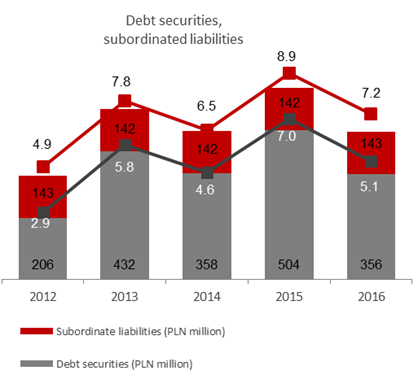

The total debt securities and subordinated liabilities amounted to PLN 498.5 million, which accounted for 7.2% of the balance sheet total of the Group.

As at 31 December 2016 liabilities due to issue of debt securities (excluding subordinated liabilities) accounted for 5.1% of the total liabilities and equity of the Bank, as compared to 7.0% at the end of December 2015. Their share dropped by 1.9 p.p. when the Bank had redeemed ordinary B2 series bearer bonds with the face value of PLN 147.9 million. The B2 series bonds were traded in the Catalyst alternative trading system of the Warsaw Stock Exchange (Catalyst).

Debt securities,

subordinated liabilities

The Bank holds subordinated liabilities, which amounted to PLN 142.8 million at the end of December 2016. Subordinated bonds worth PLN 99.7 million (as at 31 December 2016), traded in the Catalyst alternative trading system of the Warsaw Stock Exchange are the largest item in subordinated loans.

The following changes occurred in subordinated liabilities in 2016:

- The Bank redeemed 4,734 subordinated bearer bonds with the total face value of 47.3 million before their maturity.

- It had issued securities with the total face value of PLN 50 million.

As at 31 December 2016 subordinated liabilities of the Group also included a loan from Poczta Polska of PLN 43.1 million.

In 2016 the Bank followed hedge accounting principles concerning future cash flows in floating rate portfolios denominated in PLN. Hedging relationships are developed using Interest Rate Swaps. As at 31 December 2016 the face value of hedged items amounted to PLN 215 million and increased by PLN 75 million since 31 December 2015.

Trading book

At the end of December 2016 the Bank entered into transactions in 10 foreign currencies: EUR, USD, GBP, CHF, JPY, CAD, CZK, SEK, DKK and NOK.

In 2016 the Bank also traded in interest rate financial instruments, but the activities were quite limited.

In 2016 the Bank’s trade transactions in the currency and interest rate market (trading in treasury bonds) remained insignificant.