Significant events in the Capital Group in 2016

Continued growth in cash loans and installment loans

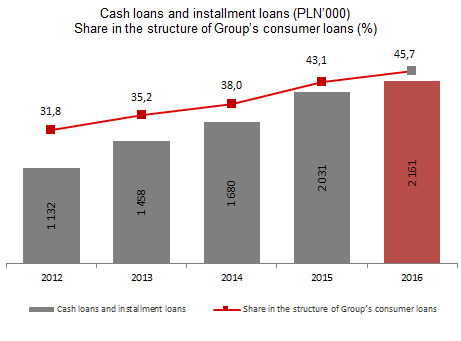

In 2016 the Group followed the balance sheet optimization strategy aimed at increasing the share of more profitable assets, i.e. cash loans and installment loans, which have become flagship products of the Group. At the end of December 2016 the total value of cash loans and installments loans reached PLN 2,161.3 million, having grown by PLN 130.1 million, i.e. 6.4% since December 2015.

In line with the strategy adopted, in 2016, like in preceding years, the Group was changing its credit exposure structure to improve the interest yield, i.e. grow the share of cash loans and installment loans and reduce the proportion of loans to institutional clients and real estate loans.

Cash loans and installment loans (PLN '000)

Share in the structure of Group's consumer loans (%)

| Loans and advances granted to clients of the Bank Pocztowy S.A. Capital Group (PLN’000) | |||||||

|---|---|---|---|---|---|---|---|

| Change 2016/2015 | |||||||

| 31.12.2016 | Structure (31.12.2016) |

31.12.2015 | Structure (31.12.2015) |

PLN '000 | % | ||

| Gross loans and advances granted to clients | 5 472 152 | 100,0% | 5 542 489 | 100,0% | (70 337) | (1,3)% | |

| individuals, including: | 4 734 032 | 86,5% | 4 711 355 | 85,0% | 22 677 | 0,5 % | |

| cash loans and installment loans | 2 161 347 | 39,5% | 2 031 277 | 36,7% | 130 070 | 6,4 % | |

| mortgage loans | 212 847 | 3,9% | 228 598 | 4,1% | (15 751) | (6,9)% | |

| real estate loans | 2 314 454 | 42,3% | 2 402 034 | 43,3% | (87 580) | (3,6)% | |

| overdraft facilities | 28 857 | 0,5% | 32 478 | 0,6% | (3 621) | (11,1)% | |

| credit card debt | 16 527 | 0,3% | 16 968 | 0,3% | (441) | (2,6)% | |

| institutional clients | 532 574 | 9,7% | 578 292 | 10,4% | (45 718) | (7,9)% | |

| local government | 205 546 | 3,8% | 252 842 | 4,6% | (47 296) | (18,7)% | |

| Impairment losses on receivables | 317 813 | 229 607 | 88 206 | 38,4 % | |||

| Net loans and advances | 5 154 339 | 5 312 882 | (158 543) | (3,0)% | |||

Lower balances of loans granted to institutional clients and local government institutions reported in 2016 resulted from a strategic decision of the Group to change the credit policy in this respect and reduce financing extended to these client groups.

Growth of deposits of consumers

At the end of December 2016 the total Group’s liabilities to clients reached PLN 5,763.0 million having grown by PLN 20.6 million (i.e. 0.4%) since December 2015. During the year, liabilities to consumers increased by 5.9%, i.e. by PLN 260.9 million and on 31 December 2016 their balance was PLN 4,705.7 million. The amount of funds deposited on current accounts (mainly on saving and settlement accounts) of consumers increased to reach PLN 2,797.8 million at the end of December 2016 (13.1% more than in December 2015).

| Liabilities to clients of the Bank Pocztowy S.A. Capital Group (PLN’000) | ||||||

|---|---|---|---|---|---|---|

| Change 2016/2015 | ||||||

| 31.12.2016 | Structure (31.12.2016) |

31.12.2015 | Structure (31.12.2015) |

PLN ‘000 | % | |

| Liabilities to clients | 5 763 014 | 100,0% | 5 742 377 | 100,0% | 20 637 | 0,4 % |

| Retail clients | 4 705 730 | 81,7% | 4 444 874 | 77,4% | 260 856 | 5,9 % |

| Institutional clients | 1 019 498 | 17,6% | 1 247 743 | 21,7% | (228 245) | (18,3)% |

| Government agencies and local government bodies | 37 786 | 0,7% | 49 760 | 0,9% | (11 974) | (24,1)% |

In 2016 the Group tried to reduce the sale of deposits of institutional clients, government and local government entities with negotiated high interest rates due to the growing portfolio of consumer deposits, which are more stable. The Group adjusted the balance of deposits to its liquidity needs and a strategic decision to reduce the acquisition of deposits in this client group. Consequently, the balance of deposits of institutional clients decreased by 18.3% and those of government and local government entities - by 24.1%.

Increase in the operating income

In 2016 the Group operated in a disadvantageous environment of low interest rates, which have not changed since March 2015. Additionally, the Group’s financial performance was adversely affected by the bank tax imposed on 1 February 2016 in line with the Act on tax on certain financial institutions of 15 January 2016, Journal of Laws of 2016, item 68). The bank tax applies to domestic banks, foreign bank branches, branches of credit institutions, credit unions, domestic insurance and reinsurance companies and branches and major branches of foreign insurance and reinsurance companies and lending institutions. The act imposed a tax rate of 0.44% p.a. on banks with the taxable amount equal to the month-end balance of assets in excess of PLN 4 billion less equity and treasury securities. In 2016 the Group incurred expenditure related to this tax amounting to PLN 4.8 million.

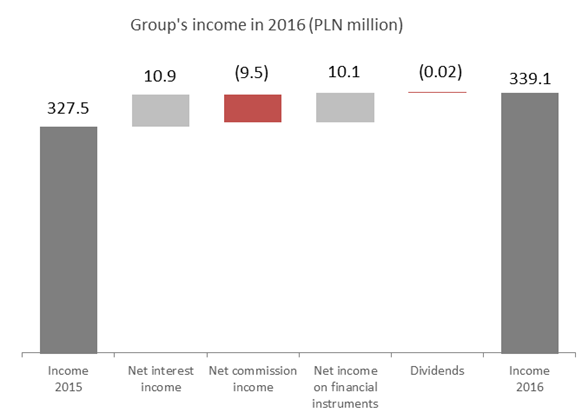

Despite disadvantageous market environment, in 2016 the Group generated income of PLN 339.1 million, i.e. 3.5% more than in 2015.

Group's income in 2016 (PLN million)

Higher income was generated mainly due to:

- An increase in the net interest income by 4.2% mainly due to efficient optimization of cost of deposits (in 2016 average cost of deposits amounted to 0.93% versus 1.26% in 2015) and the growing share of cash loans and installment loans with the highest interest yield in the loan portfolio.

- A decrease in the net fee and commission income by 16.5%, mainly due to the recognition of additional provisions for possible claims resulting from the pending proceedings instigated by the President of the Office for Competition and Consumer Protection (“UOKiK”) on 4 December 2015 to determine if the Bank employed practices violating collective consumer interests.

- Higher gain on transactions in securities available for sale, gain on foreign exchange transactions and gain on other financial instruments. The total income on such transactions amounted to PLN 23.6 million, i.e. by 10.1 million more than in 2015 mainly as a result of settling the sale of shares in VISA Europe to VISA Inc. under the acquisition of VISA Europe by VISA Inc., as a result of which the Group generated income of PLN 16,872 thousand, including:

- PLN 12,244 thousand in cash;

- PLN 3,592 thousand of income from preference C series shares convertible to ordinary A series shares in Visa Inc.;

- PLN 1,036 thousand of income from the Group’s share in the deferred cash payment.

Bond issues

The Bank has consistently followed its policy of diversifying sources of finance, by way of developing its activities in the treasury bond markets.

On 23 December 2015 the General Shareholders’ Meeting of the Bank approved a public issue of bonds scheme up to a maximum face value of issued and outstanding bonds of PLN 1,000,000,000.

- Bonds will be issued under a public offering with and without an obligation to produce a prospectus (Article 33.1 of the Act on bonds) and a private placement (Article 33.2 of the Act on bonds);

- Bonds may be issued in one or many series as: (i) ordinary bonds or (ii)subordinated bonds in accordance with Article 22 of the Act on bonds and Article 127 of the Banking Law;

- All bonds issued will be unsecured;

- Bonds will take the form of a document and they will be recorded in the register kept by the entity designated by the Management Board of the Bank or the securities deposit maintained by Krajowy Depozyt Papierów Wartościowych S.A. or from the issue date they may be recorded in the register and then reregistered to the securities deposit kept by Krajowy Depozyt Papierów Wartościowych S.A.;

- The Management Board will request for admitting the bonds for trading on the regulated market of the Warsaw Stock Exchange (Giełda Papierów Wartościowych w Warszawie S.A.) in the Catalyst system.

At the same time, the Management Board authorized the Bank to determine final terms of issue of individual bond series, terms of bond allotment to investors and any actions taken to carry out the Issue Scheme.

On 16 May 2016, the Polish Financial Supervision Authority approved the prospectus of the Bank.

On 8 June 2016 the Bank issued P1 series subordinated bonds under the Public Issue of Bonds Scheme. The total face value of P1 series bonds is PLN 50,000 thousand. Bonds bear a floating interest rate equal to the sum of WIBOR 6M base rate and a margin of 2.8% p.a., starting from the second interest period. In the first interest period the interest rate was 4.5% p.a. Bonds redemption date falls in 2026. For the first time, the bonds are intended for individual investors.

On 23 June 2016, the Bank obtained PFSA’s consent to include PLN 50,000 thousand constituting a subordinated liability under the issue of the P1 series subordinated bonds in the calculation Tier 2 capital. Consequently, the Bank strengthened the capital ratios and provided a safety buffer against the equity requirements of PFSA. The Bank will be able to dispose of funds from the bond issue at its own discretion, in particular it may allocate them to finance current operations and grow lending activity.

On 8 July 2016 the Bank prematurely redeemed 4,734 subordinated bearer bonds with the total face value of PLN 47,340 thousand, assigned a code PLBPCZT00015 by Krajowy Depozyt Papierów Wartościowych S.A. (National Deposit of Securities) and quoted in the Catalyst alternative trading system operated by Warsaw Stock Exchange under the abbreviated name BPO0721.

On 30 August 2016, the Bank decided to register 500,000 subordinated P1 series bearer bonds of the Bank with the face value PLN 100 (one hundred zloty) each in the securities deposit and assign them a code PLBPCZT00080. Bonds were registered on 1 September 2016.

The Management Board of Giełda Papierów Wartościowych w Warszawie S.A. (Warsaw Stock Exchange) decided that 8 September 2016 will be the first day of trading of 500,000 P1 series bearer bonds with the face value of 100 each assigned a code PLBPCZT00080 by the National Deposit of Securities in the Catalyst alternative trading system. The bonds will be traded in the continuous trading system under a shortened code “BPO0626”.

On 13 December 2016, pursuant to the Terms of Issue, the Bank redeemed 14,785 ordinary B2 series bearer bonds with the face value of PLN 147,850 thousand. The B2 series bonds were traded in the Catalyst alternative trading system of the Warsaw Stock Exchange (Catalyst).

Until then the Bank was present in the debt market for institutional investors, where it had issued long-term bonds with the value exceeding PLN 800 million in the last few years.

The Bank provided detailed information on the issue of bonds in its current reports, which are available at the website of the Catalyst market and of the Bank www.pocztowy.pl.

Awards and distinctions

In 2016 the Group earned a number of awards expressing appreciation for the development of the product offer and efficient implementation of the strategy. Individual awards were also granted to the Bank’s experts and managers.

The market appreciated a simple and clear offer of the Bank. The cash loan offered by the Bank took the second place in the May ranking of Comperia.pl. The ranking survey was carried out among Fast50Club users and concerned key product parameters.

The Bank’s cash loan was ranked second by TotalMoney.pl in the category of cash loans up to PLN 5 thousand for internal clients. The Bank also came second in the category of cash loans for external clients. In the TotalMoney.pl ranking banks prepared a pricing offer for a loan of PLN 10,000 with a 24-month tenor for a three person family with a net monthly income of PLN 4,423 earned under an indefinite employment contract. The offers for internal and external clients were compared. The ranking included the offer of 17 creditors.

In 2016, for the second year in a row, the cash loan, i.e. the flagship product of the Bank received a Portfel “Wprost” award in the personal loans category. This prestigious award is given to financial institutions offering most innovative and competitive products and services which most adequately respond to client needs. The project is carried out under the patronage of the Minister of Treasury.

Pocztowe Konto 500+ (Postal Bank Account) with a 4% interest rate for new cash up to PLN 5 thousand received a Camperia Stars award and it was selected as the best saving account in the Comperia.pl ranking twice (in April and May 2016).

The Bank took the fifth place in the survey analyzing the Customer Service Quality in Remote Banking, organized for the fifth time by MojeBankowanie.pl. The award is all the more valuable, as the Bank reported the largest progress among all survey participants, improving its performance by 19 p.p. in the last 12 months. This implies an advancement by 23 places.

Moreover, the Bank was ranked one of the top three mediation-friendly financial institutions. The “Mediation-Friendly Financial Institution” title was awarded to the Bank by the Polish Financial Supervision Authority in 2015. The competition had been launched two years ago. In accordance with the resolution of the Polish Financial Supervision Authority the award is granted to financial institutions which publicly declare their intention to resolve disputes amicably through mediation and at the same time in a given calendar year they agreed to mediation by the Mediation Center of the Court of Arbitration at the Polish Financial Supervision Authority or managed to settle a dispute amicably before any mediation proceedings were instigated for over 30 percent of requests for mediation put in by clients. The award may also be granted if a financial institution requested for mediation concerning at least 10 requests and at the same time agreed on mediation in the Mediation Center of the Polish Financial Supervision Authority.

The Bank came third in the twenty fourth round of the competition held by the Gazeta Bankowa monthly and the National Bank of Poland in the Small and Medium Commercial Bank category. It was appreciated for its good performance in 2015 in the following categories: dynamic growth, portfolio structure and efficiency.

The Bank came third in the bank customer satisfaction survey carried out by the Parkiet daily and got 3.6 points in the five-point scale, which is much above the average result of 2.6. This award is highly satisfying, because it was given by clients, whose opinions were used to create the ranking. Moreover, customers also appreciated competencies of our Relationship Managers, easy access to accounts and services with as little bureaucracy as possible.

The Bank got three awards in this year’s edition of the prestigious The Best Annual Report 2016 contest organized by the Institute for Accounting and Taxes and the Warsaw Stock Exchange. The Annual Report of the Bank Pocztowy Capital Group for 2015 was the winner in the category Best Annual Report of a bank or a financial institution. The Bank was also recognized for the best financial statements and the greatest progress in improving a marketing report. The first place in this prestigious competition is a great distinction and a way of acknowledging the top quality of the Bank’s financial reporting. The standards applied by the Bank, transparency and the practical value of annual reports make the Bank one of the best companies in this respect among those not listed at the WSE (apart from Catalyst).

Ms. Magdalena Nawara was selected as one of the TOP 10 female managers in the Polish capital market. Magdalena Nawara and other top managers were selected to “TOP 10 women of the financial market” by Internet users observing the Polish financial market.

The Chief Economist, Ms. Monika Kurtek, was ranked third in the competition for the best macroeconomic analysts organized by the Rzeczpospolita and Parkiet dailies in cooperation with the National Bank of Poland. The award committee also granted awards for the most accurate forecasts for the Polish economy in 2015. To become one of the top macroeconomic analysts, at each quarter-end participants submitted forecasts for the following four months for key macroeconomic indicators: change in GDP, investments, CPI, unemployment rate and the country’s current account. All forecasts were awarded a specific number of points for their accuracy. On this basis top Polish economists were selected from among 42 participants.

The Managing Director of the Legal and Administration Function, Jolanta Ciążyńska-Syka received an Honorable Award from the Polish Banks Association granted to people, whose creative work and effort shaped the Polish banking sector.