General information about the Capital Group

Bank Pocztowy (Bank) is a consumer bank providing safe and simple financial services through the network of Poczta Polska, its own offices operating countrywide and through mobile channels. Its business model is based on strategic partnership with Poczta Polska, which ensures exclusive access to its distribution network and a wide consumer portfolio in provincial Poland.

The mission of the Bank, the parent of the Bank Pocztowy Capital Group (the Bank Pocztowy Capital Group, the Capital Group, the Group) is defined as “simple, safe and well-priced banking”. For consumers it implies:

- focus on the simplest products, processes and communication;

- good price guaranteed to a wide group of consumers;

- modern financial services based on integration within the Poczta Polska Capital Group.

Bank Pocztowy focuses on consumer banking and the offer for microenterprises.

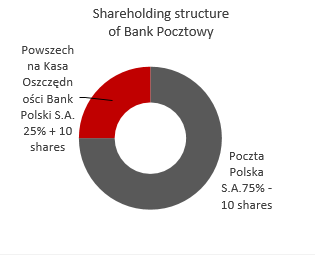

Poczta Polska S.A. is the key shareholder and business partner of Bank Pocztowy holding 75% -10 shares in its share capital. Powszechna Kasa Oszczędności Bank Polski S.A. also holds shares in the Bank (25% +10 shares).

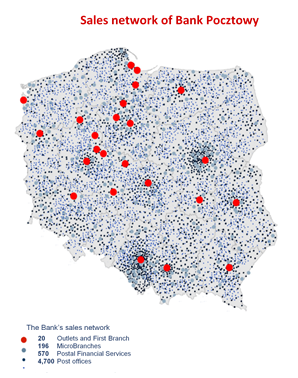

Thanks to the strategic alliance with Poczta Polska, the Bank’s services and products are available in ca. 4.7 thousand outlets and offices countrywide. Apart from Poczta Polska, Bank Pocztowy offers its services and products through 217 own offices, electronic distribution channels (online and telephone banking) and a network of mobile agents of its subsidiary – Spółka Dystrybucyjna Banku Pocztowego Sp. z o.o. Additionally, the Bank’s products are distributed by ca. 23 thousand postmen and selected agents. The wide distribution network constitutes a unique competitive advantage of the Bank.

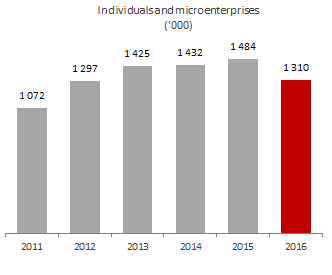

At the end of 2016 the Bank provided services to 1,309.9 thousand consumers and microenterprises. In 2016 it acquired 158 thousand new clients in this group. The Bank served over 14.9 thousand of entities in the institutional segment. Consequently, at the end of 2016 the Bank had about 1,324.8 thousand clients in consumer and institutional segments. The number of customers decreased following a review of consumer accounts aimed at updating the consumer base.

Individuals and microenterprises ('000)

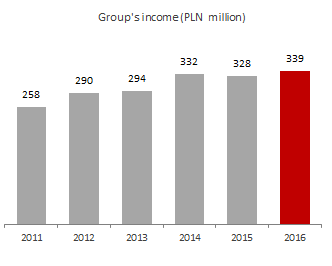

In 2016 the Capital Group generated a net profit of PLN 2.5 million.

The Group’s revenue reached PLN 339.1 million in 2016 and was 3.5% higher than in 2015.

Group's income (PLN million)

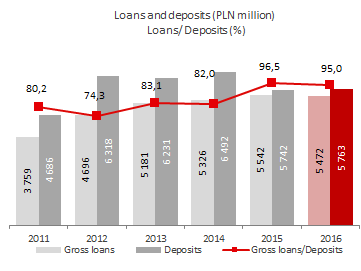

As at 31 December 2016, the balance sheet total of the Group amounted to PLN 6,936.6 million and represented 0.4% of the total assets of the Polish banking sector[1]. The total gross loans and advances granted to clients amounted to PLN 5,472.2 million with 86.5% of consumer loans. Liabilities to the Group’s customers amounted to PLN 5,763.0 million, including over 81.7% of funds obtained from the consumer sector. With its 2.7%[2] share, the Group has gained a relatively good position in the current accounts market thanks to dynamic growth reported in the last few years and the increase in the number of consumers.

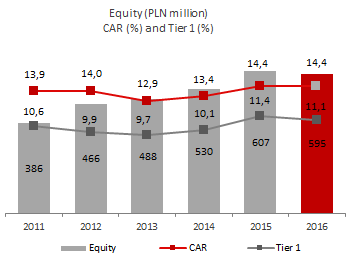

During 2016, the Group maintained its liquidity ratios at a safe level, and its capitals were adequate to the scale of operations. At the end of the year the relation of loans and advances to deposits stood at 95.0%. As at 31 December 2016 the solvency ratio amounted to 14.4% and Tier 1 reached 11.1%.

Loans and deposits (PLN million)

Loans/Deposits (%)

At the end of 2016 headcount in the Group reached 1,546 FTEs versus 1,618 in 2015.

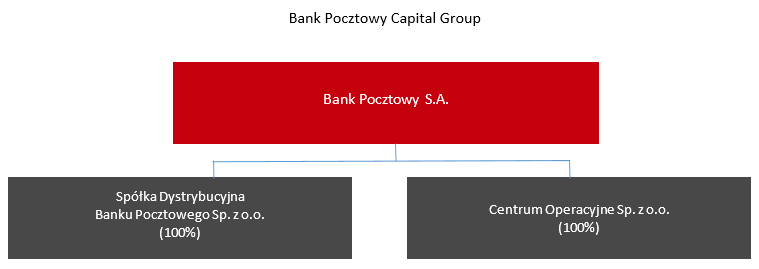

Subsidiaries of the Bank play an important role in implementing the strategy of the Capital Group. They include:

- Spółka Dystrybucyjna Banku Pocztowego Sp. z o.o. (Spółka Dystrybucyjna), whose key objective is to support distribution channels of Bank Pocztowy and access prospect clients from remote locations.

- Centrum Operacyjne Sp. z o.o. (Centrum Operacyjne) providing professional services including administration processes for products and services to the Bank, the clients of the Capital Group and Poczta Polska.

CAR (%) and Tier 1 (%)

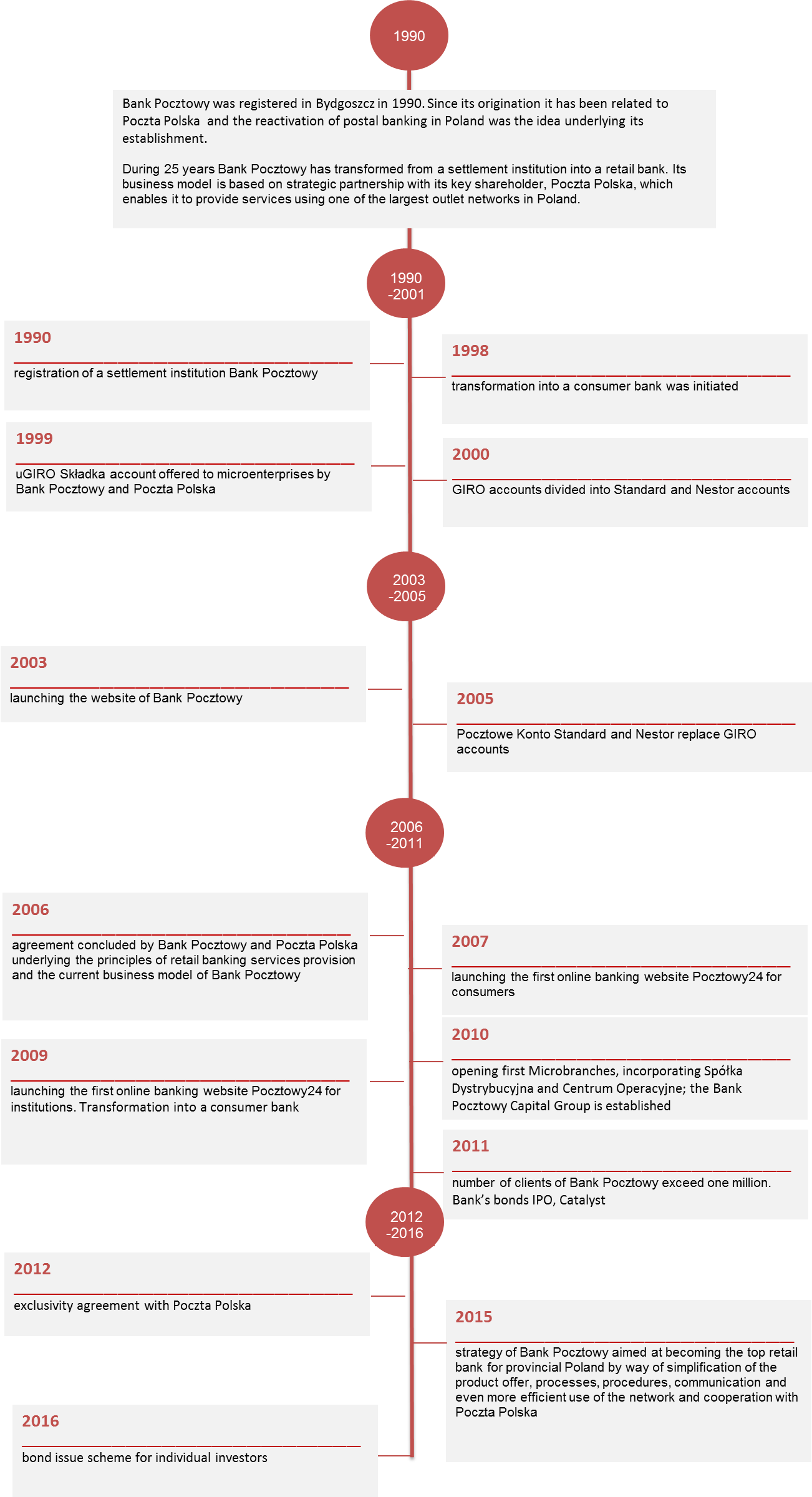

The Bank started operations in 1990 and the reactivation of postal banking in Poland was the idea underlying its establishment. To this aim and in order to develop the Bank, the GIRO non-cash settlement system was launched to enable fast and easy processing of bulk payments, reduce costs of issuing and circulating cash in the economy and to provide bank services to clients, in particular consumers, through a wide distribution network of Poczta Polska. Therefore, initially the Bank was a typical settlement bank with performance highly related to the volume of settlements with Poczta Polska.

In 1998, transformation into a consumer bank was initiated. The Bank started to reach an increasingly large group of clients through the sales network of Poczta Polska and own branches and points of sale. At the same time, it started to launch new products.

In 1999 all post offices provided comprehensive services related to GIRO personal accounts and, additionally, Visa Electron cards to the accounts were offered. In 2003, the Bank launched its website. Two years later, in 2005, GIRO personal accounts were renamed to Pocztowe Konto Nestor for elderly people and Pocztowe Konto Standard.

Agreement concluded by the Bank and Poczta Polska in 2006 regulating the terms of cooperation between the institutions in consumer banking services was a breakthrough event for the Bank's consumer business. Under the agreement over 2 thousand Postal Financial Points were opened in post offices by the end of 2009 to streamline service provision to the Bank’s customers by post office staff. Following the gradual changes and development of the sales network, in February 2010 the number of clients exceeded 500 thousand, in October 2011 it was 1 million, and at the end of 2016 it reached 1.3 million.

In 2010 the Bank’s subsidiaries: Spółka Dystrybucyjna Banku Pocztowego Sp. z o.o. and Centrum Operacyjne Sp. z o.o. were established and commenced business activities. As a result, the Bank Pocztowy Capital Group was set up.

Historical overview

| Key data of the Bank Pocztowy S.A. Capital Group for 2011-2016 | |||||||

|---|---|---|---|---|---|---|---|

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | Change 2016/2015 | |

| Key financial data: | |||||||

| Group’s income 1/ (PLN’000) | 258 473 | 290 255 | 294 320 | 332 340 | 327 528 | 339 081 | 3,5 % |

| Administrative expenses (PLN ‘000) | (209 837) | (218 356) | (212 738) | (218 622) | (217 030) | (224 898) | 3,6 % |

| Net impairment losses (PLN’000) | (12 877) | (25 099) | (42 398) | (61 013) | (65 158) | (100 496) | 54,2 % |

| Gross profit (PLN ‘000) | 37 531 | 48 665 | 43 260 | 55 145 | 42 879 | 7 312 | (82,9)% |

| Net profit (PLN ‘000) | 29 555 | 38 949 | 36 027 | 43 639 | 33 931 | 2 510 | (92,6)% |

| Balance sheet: | |||||||

| Balance sheet total (PLN ‘000) | 5 215 801 | 7 120 653 | 7 382 745 | 7 719 027 | 7 213 030 | 6 936 566 | (3,8)% |

| Loans and advances granted to clients2/(PLN’000) | 3 679 382 | 4 599 545 | 5 055 712 | 5 151 777 | 5 312 882 | 5 154 339 | (3,0)% |

| Liabilities to clients (PLN’000) | 4 685 735 | 6 317 949 | 6 230 578 | 6 492 023 | 5 742 377 | 5 763 014 | 0,4 % |

| Equity (PLN’000) | 321 395 | 361 470 | 391 765 | 439 632 | 542 485 | 523 442 | (3,5)% |

| Key ratios: | |||||||

| Net ROA (%) | 0,6 | 0,6 | 0,5 | 0,6 | 0,5 | 0,04 | (0,46) p.p. |

| Net ROE (%) | 9,6 | 11,4 | 9,6 | 10,5 | 6,9 | 0,5 | (6,4) p.p. |

| Costs including amortization / income (C/I)3/ (%) | 80,6 | 74,7 | 71,3 | 65,3 | 66,8 | 67,6 | 0,8 p.p. |

| Solvency ratio 4 /(%) | 13,9 | 14,0 | 12,9 | 13,4 | 14,4 | 14,4 | 0,0 p.p. |

| Tier 1 4/ (%) | 10,6 | 9,9 | 9,7 | 10,1 | 11,4 | 11,1 | (0,3) p.p. |

| NPL 5/ (%) | 5,0 | 4,7 | 5,4 | 6,1 | 7,0 | 8,9 | 1,9 p.p. |

| Net interest margin to total assets 6 / (%) | 4,1 | 3,8 | 3,6 | 3,8 | 3,6 | 3,7 | 0,1 p.p. |

| Business figures: | |||||||

| Headcount (FTEs) | 1 496 | 1 571 | 1 700 | 1 633 | 1 618 | 1 546 | (4,4)% |

| Number of offices | 161 | 227 | 295 | 293 | 284 | 217 | (23,6)% |

| Number of consumers and microenterprises (‘000) | 1 072 | 1 297 | 1 425 | 1 432 | 1 484 | 1 310 | (11,7)% |

1 Net interest income, net fee and commission income, gain/loss on financial instruments measured at fair value through profit or loss, gain/loss on foreign exchange transactions, realized gain/loss on other financial instruments and dividend.

2 Net loans and advances.

3 Income increased by gain/loss on other revenue and operating expenses.

4 As at 31 December 2014 and 31 December 2015 and 31 December 2016 CAR and Tier 1 values were calculated in accordance to the Regulation (EU) no. 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms. Pursuant to the above regulations, the Bank has been released from the obligation to determine its consolidated capital requirements. Separate data. In the remaining years CAR and Tier 1 values were calculated In accordance with Resolution no. 76/2010 of the Polish Financial Supervision Authority of 10 March 2010 regarding the scope and detailed principles of determining capital requirements due to various risk types (as amended). Separate data. 5 NPL – the share of impaired loans and advances in the gross loan portfolio.

6 Net interest margin calculated as a relation of net interest income for a given year to average assets (calculated as average daily balance of assets).

Business model of Bank Pocztowy

Bank Pocztowy is a Polish consumer bank with a simple offer responding to basic and actual needs of consumers. The Bank offers its clients well-priced services rendered based on integration with Poczta Polska in the form of common product initiatives and the sales network.

Translation:

Which is Bank Pocztowy?

- The simplest – The bank is specialized in the simplest products

- Cheap – The bank is quaranting reasonable price for broad range of Customers

- Integrated with Poczta Polska – The bank is offering modern financial services based on integration in the Poczta Polska Group.

Simple

The Bank provides comprehensible financial services and products adjusted to clients’ needs, friendly environment, clear procedures and understandable communications.It offers simple products in the Polish zloty to institutional clients and operates in the settlement and treasury segment as well.

Inexpensive

The Bank offers financial services at affordable prices through the largest network in the market: through Poczta Polska outlets, Bank’s outlets and remote channels.

Integrated with Poczta Polska

Its business model is based on strategic partnership with Poczta Polska (75% of shares minus 10 shares of the Bank), which ensures exclusive access to its distribution network and a wide consumer portfolio in provincial Poland. Providing comprehensive services to the Poczta Polska Capital Group, the Bank plays the role of a center of excellence and a supplier of financial services including banking services, bancassurance and investment products in the Poczta Polska Capital Group.

At the end of December 2016 the elaborate distribution network encompassed over 4.7 thousand post offices, including 570 Postal Financial Zones and 217 Bank offices, including 196 Microbranches located in post offices. The network has been expended to incorporate online banking services (Pocztowy24) and telephone banking (Contact Center and PocztowySMS) and provides the Bank’s services countrywide.

The other shareholder of the Bank is PKO BP holding 25% of interests plus 10 shares).

Competitive advantages

The competitive advantages discussed below constitute key factors, which enable the Bank to achieve its strategic objectives.

Strategic alliance between the Bank and Poczta Polska.

The Bank’s business model is based on a strategic partnership with the key shareholder, Poczta Polska, which ensures exclusive access to its distribution network (on terms stipulated in the Cooperation Agreement) and a wide consumer base in regional Poland.

Bank and insurance service are one of the main pillars of the strategy followed by the Poczta Polska Capital Group.Poczta Polska assumes that the share of bank and insurance products in its revenue structure will grow considerably by 2019.The Bank’s contribution is also important for the financial performance of the Poczta Polska Capital Group.

Poczta Polska is the top provider of postal services in Poland, rendering services for consumers and corporations countrywide.

Poczta Polska is one of the largest Polish enterprises in terms of the distribution network (the total of over 7.4 thousand offices of various kind as at 31 December 2016), including over 4.7 thousand outlets distributing bank and insurance products.Thanks to its extensive network and a wide services scope Poczta Polska can reach nearly every Pole.Moreover, having won the tender Poczta Polska will act as a universal service provider of postal services from 1 January 2016 to the end of 2025 under the decision of the Office of Electronic Communication. Therefore, it will operate a great number of distribution outlets countrywide, as required by applicable regulations.

The Bank operates and pursues its strategy based on resources and infrastructure of Poczta Polska, hence gaining access to a wide group of clients, in particular in provincial Poland, in particular in smaller towns countrywide.

Thanks to the strategic partnership with Poczta Polska and access to its clients Bank Pocztowy can acquire new clients at low costs, with no need to incur high expenditure on advertising campaigns born by competitors or on own distribution network.

Access to the distribution network of Poczta Polska

Under the Cooperation Agreement and other related agreements concluded with Poczta Polska the Bank has gained exclusive access to the distribution network of Poczta Polska.It constitutes a considerable competitive advantage of the Bank in terms of customer acquisition countrywide (including areas of low banking penetration).Therefore, over 50% of existing clients of the Bank live in rural areas and towns of less than 5 thousand inhabitants, and ca. 70% in towns with population to 50 thousand.According to the Bank, clients from smaller towns are less willing to acquire bank services, buy fewer bank products and visit traditional bank outlets more often than big city clients.Unbanked clients from rural areas and small towns are the target group of the Bank, which can be reached through the extensive distribution network.The lowest cross-sell ratio has also been observed in rural areas and smaller towns.

Under the Agency Agreement with Poczta Polska, postmen of Poczta Polska can carry out acquisition activities and offer selected services of the Bank, for instance deliver cash to the Bank’s clients.

Access to the client base of Poczta Polska

The access to the distribution network of Poczta Polska enables the Bank to offer its products to Poczta Polska's clients.It is particularly important in areas, where the competition in financial services is less intense, i.e. in rural Poland and small towns.For these market relationship banking model is of key importance to enable making transactions and purchasing bank products in bank offices.

Image of a secure and stable Polish bank

Poczta Polska, which is directly controlled by the State Treasury, is the majority and controlling shareholder of the Bank.In time of financial market uncertainty, thanks to the indirect involvement of the State Treasury the Bank is perceived as a secure and stable Polish financial institution, offering an alternative for other financial institutions and lenders operating in regional Poland.

In regional Poland the Bank competes not only with other banks but also with credit unions, which undergo restructuring, and other lenders, which are not subject to regulatory supervision.According to the Management Board of the Bank, its image of a stable and secure financial institution significantly affects clients’ decision to acquire financial products.

Bank Pocztowy compared to other commercial banks and cooperative banks[3]

The Polish banking sector may be divided into commercial banks and cooperative banks.According to the Polish Financial Supervision Authority 36 commercial banks and 558 cooperative banks operated in Poland at the end of December 2016.

Since the Group had focused on consumers in 2009, the growth in loans and advances granted by the Group to consumers in the years 2009-2016 was much higher than in the entire banking sector and in the group of cooperative banks.The average annual growth in consumer deposits acquired by the Group in the years 2009-2016 amounted to 24.5%.The average annual growth in liabilities to consumers in the entire banking sector in the same period was 6.8% and 6.2% in the group of cooperative banks.

Similarly, the growth in deposits of consumers in the years 2009-2016 was considerably higher than in the commercial banking sector and in the group of cooperative banks.The average annual growth in consumer deposits acquired by the Group in the years 2009-2016 amounted to 20.1%.The average annual growth in liabilities to consumers in the entire commercial banking sector in the same period was 9.5% and 11.7% in the group of cooperative banks.

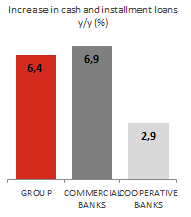

In 2016 the Group still focused on the offer targeted at consumers, in particular on cash loans and installment loans.Following the adoption of the policy in 2016, the balance of cash loans and installment loans reached PLN 2,161.3 thousand, i.e. it increased by 6.4%.The Group reported a growth at the level similar to that of the commercial bank sector (6.9%) and much higher than in the cooperative bank sector (2.9%).

In accordance with the data of the Polish Financial Supervision Authority, the increase in consumer loans in the entire banking sector resulted from low interest rates, less severe criteria of credit approval, for instance as a result of the improved situation in the labor market and higher demand of households, whose credit standing have improved following the launch of the Family 500+ program.

Increase in cash and installment loans

y/y (%)

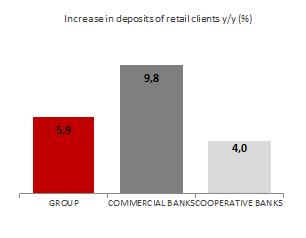

Increase in deposits of retail clients y/y (%)

In 2016 consumer deposits with commercial banks increased by 9.8% YoY. The increase in the deposit base resulted from the launch of the Family 500+ program providing financial support to large families and the improved situation in the labor market. Another factor was the deflation observed during the entire year 2016. On the other hand, record low interest rates of the National Bank of Poland still discouraged consumers from depositing funds with banks. The increase in the consumer deposit base of the Group was 4.0% higher than in the cooperative banking sector.

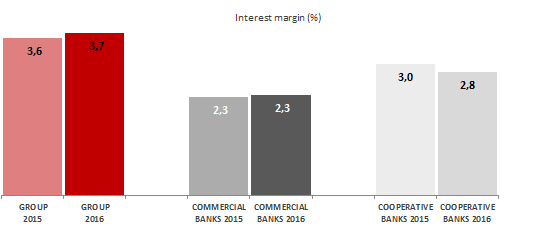

Interest margin (%)

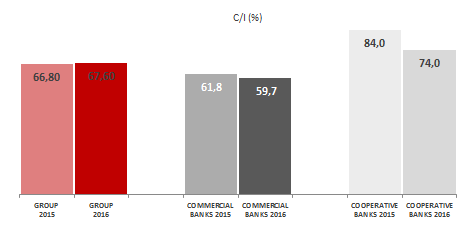

C/l (w %)

Interest margin, ROE for the banking sector – the denominator specifies the asset level with interest margin and capital level for ROE at the end of 2016 and the end of 2015.

A 4.2% increase in the net interest income of the Group (YoY) and stable market interest rates resulted in a growth in the interest margin by 0.1 p.p. up to 3.7%. Significantly, the Group’s margin was considerably higher than in the entire commercial banking and cooperative banking sectors.

C/I ratio of the Bank measuring operating efficiency in commercial banks and cooperative banks improved comparing to 2015, while in the Group, the ratio dropped by 0.8 p.p. comparing to the previous year due to significant non-recurring events. The ratio for the Group is higher than in cooperative banking sector.

[1] Source: Financial Supervision Authority, monthly data for the banking sector file – December 2016.

[2] Source: PRNews.pl Current account market – Q3 2016, 23 November 2016.

[3] Source: Financial Supervision Authority, monthly data for the banking sector file – December 2016.