Strategy 2017-2021

The new strategy of Bank Pocztowy until 2021

Bank Pocztowy, based on a close partnership with Poczta Polska, wants to become a leader in retail banking in Poland, a bank selected by families and micro-enterprises and e-commerce market participants, a major partner in government and social initiatives and a major provider of financial services in the Group of Poczta Polska.

The Bank's new strategy for 2017-2021 was adopted and published in June 2017. It was developed based on the development strategy of Poczta Polska (announced in April), assuming the close synergy of both entities. The aim of joint actions will be to build a third strong financial group in the area of financial services (apart from the PKO Bank Polski Group and the PZU Group). Through a wide distribution network and a wide range of services, the Group of Poczta Polska will reach virtually every inhabitant of Poland.

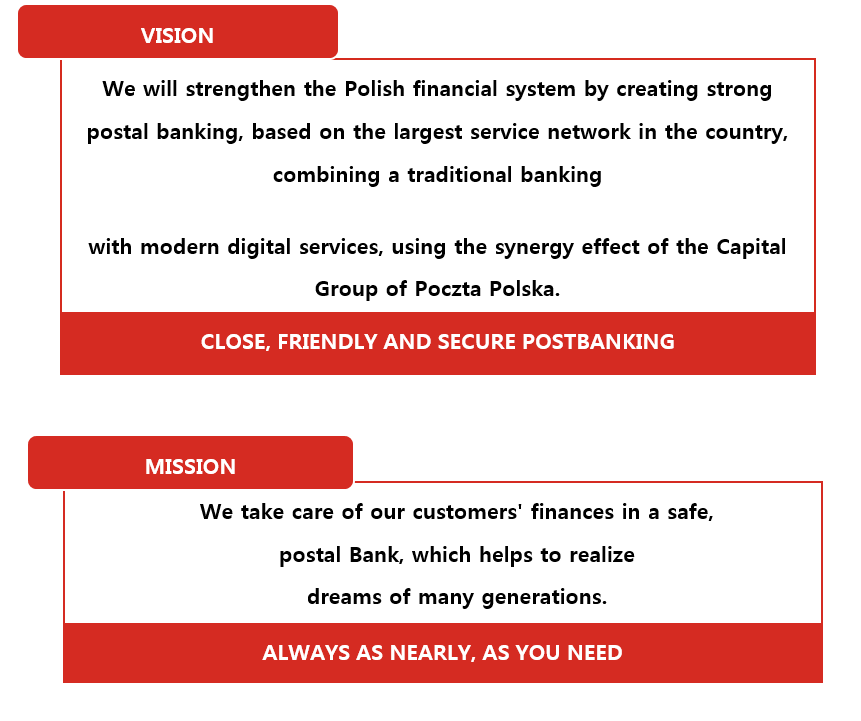

A new mission and vision

As a part of the work on the strategic activities of Bank Pocztowy for the coming years, there were adopted a new mission and vision:

Business model

A new business model has been developed within the framework of the strategy, which will be based on:

- real use of the Poczta Polska network,

- efficient business processes,

- a wider product range targeted to customers from new segments.

SPOŁECZNA ODPOWIEDZIALNOŚĆ – SOCIAL RESPONSIBILITY

PARTNER W BUDOWIE NOWOCZESNEGO PAŃSTWA – PARTNER IN MODERN STATE BUILDING

SPRAWNOŚĆ – EFFICIENCY

JAKOŚĆ – QUALITY

RENTOWNOŚĆ – PROFITABILITY

KLIENT – CUSTOMER

Wykorzystanie potencjału sieci Poczty Polskiej – Utilizing the potential of the Poczta Polska Network

Osiągnięcie rynkowego poziomu procesowo-produktowego – Achieving the market level of process and product

Akwizycja nowych grup Klientów i dywersyfikacja oferty produktowej – Acquisition of new customer groups and diversification of product offer

Strategic transformation

Strategy for 2017-2021 assumes a three-step transformation of Bank Pocztowy.

The first of the areas: "More Postal" is based on a close partnership of Bank Pocztowy with Poczta Polska. Both entities intend to increase cooperation through joint products and loyalty programs, sales processes, marketing actions, e-commerce projects, but also joint social initiatives. The new strategy also assumes coherence and improved standardization of the offices network. It is planned, among others, construction of a network of approximately 750 Financial and Digital Service Points.

An important element of the new strategy is to a responsible systemic role by Bank Pocztowy. It will be implemented within four perspectives:

- State - the active participation of Bank Pocztowy in the implementation of the Strategy of Responsible Development and the use of the highest availability of financial services in ensuring the financial stability of the State;

- Customer - Offering simple and secure products, at a price that is affordable, accessible in outlets and modern digital channels across the country;

- Society - counteracting exclusion, participation in helping people with disabilities and senior citizens;

- Poczta Polska and its employees - ensuring job at the post offices while maintaining profitability and creating opportunities for the development of new competence of the staff of Poczta Polska in the era of progressive digitization of services.

The industrial customer still remains the main segment for Bank Pocztowy. However, Bank Pocztowy decided to increase the diversification of its product offer, going towards the offer of "More Business". The new strategy includes among others, increasing of the housing market share and active development of services and products for micro-enterprises and SMEs, as well as using the potential in the area of settlement services.

"More digital" - this is the third element of the transformation of Bank Pocztowy. This area complements the traditional offer that is simple and customers-friendly with secure and modern digital banking. EnveloBank - a brand that will debut on the market in the third quarter of 2017, will combine banking products, services from the Poczta Polska Group and external partners, allowing access to digital customers from three groups defined by the Bank - young and independent (18-24 years), responsible (25-49 years) and microenterprises.

Bank Pocztowy wants to be an active partner, participating in government and social programs at the local and central level (e.g. ePUAP, Program 500+, digitization in the tax area).

Strategic objectives

In the perspective of the strategy for 2017-2021, Bank Pocztowy will strive to achieve its main strategic objectives in four areas.

Within the business area, by providing the highest availability of basic financial services in Poland for retail clients and micro-enterprises, the bank wants to become a favourite bank of the Polish families and small businesses, especially in smaller towns.

Financing of growth, profitability and a secure credit portfolio are key objectives in the financial area. They will be implemented with increased diversification of funding sources and care for business viability.

In the area of development as a primary objective was designated construction of the engaged and a competent team who will develop postal banking.

On the other hand, strategic objectives for the process area are: creating a new quality of cooperation with Poczta Polska and tight synergy with the Group companies. Bank Pocztowy will strive to create simple and automated processes integrated with the entire Poczta Polska Group.

The realization of the indicated objectives will only be possible thanks to fulfilment of certain conditions regarding the Bank's capital measures. The strategy assumes that the main source of capital reinforcement in 2017 will be the recapitalization of the Bank by the existing shareholders in the amount of PLN 90m in proportion complied with the current shareholder structure. In the next few years, the Bank is planning to recapitalize the Bank of PLN 260m by new or existing shareholders and issue equity instruments totalling up to PLN 100m, as well as the accumulation of net profit generated in the individual years of the Strategy.

As a result of the implementation of strategic assumptions, Bank Pocztowy plans to achieve ROI return at the level of 10.4%, a balance sheet total of PLN 11.9bn and a net profit of PLN108.4m in 2021.