Development strategy 2015-2018

Implementation status

As at 31 December 2016 “Development Strategy of Bank Pocztowy S.A. for 2015-2018” was the binding strategic document, approved by the Management Board on 16 April 2015.

The document updated the Bank development vision until 2018, thus responding to ongoing macroeconomic changes seen in the banking sector (reduced possibilities to pursue the former development model of a small universal bank) and assumptions arising from the strategy adopted by Poczta Polska S.A., as a result if which the importance of banking and insurance services in the Group’s strategy increased.

Pursuant to these assumptions, the key characteristics that make the Bank stand out among competitors include:

- a network of offices which enable the widest access to financial products and services in Poland;

- a simple offer (one current account, three types of deposits: mini, midi and maxi and a simple cash loan), which satisfy basic financial needs of the Bank’s clients;

- reasonable and competitive product prices;

- advanced integration with Poczta Polska, S.A. which consists in using its potential and developing the product offer in cooperation with other entities from the Poczta Polska Capital Group;

- simple and inexpensive sales and client service processes used in the Poczta Polska S.A. network;

- simple marketing communication in sales points and outlets of Poczta Polska;

- corporate culture focused on stretch goals.

The following strategic objectives to be achieved by 2018 have been defined in the Strategy:

- client base of PLN 2.4 million individuals;

- exceeding the balance of PLN 4 billion in consumer loans;

- credit portfolio diversification;

- reducing the total cost/income ratio to less than 60%.

In 2016, the Bank focused its operations on the following areas to achieve the strategic assumptions:

- EnveloBank, the new mobile and e-banking system

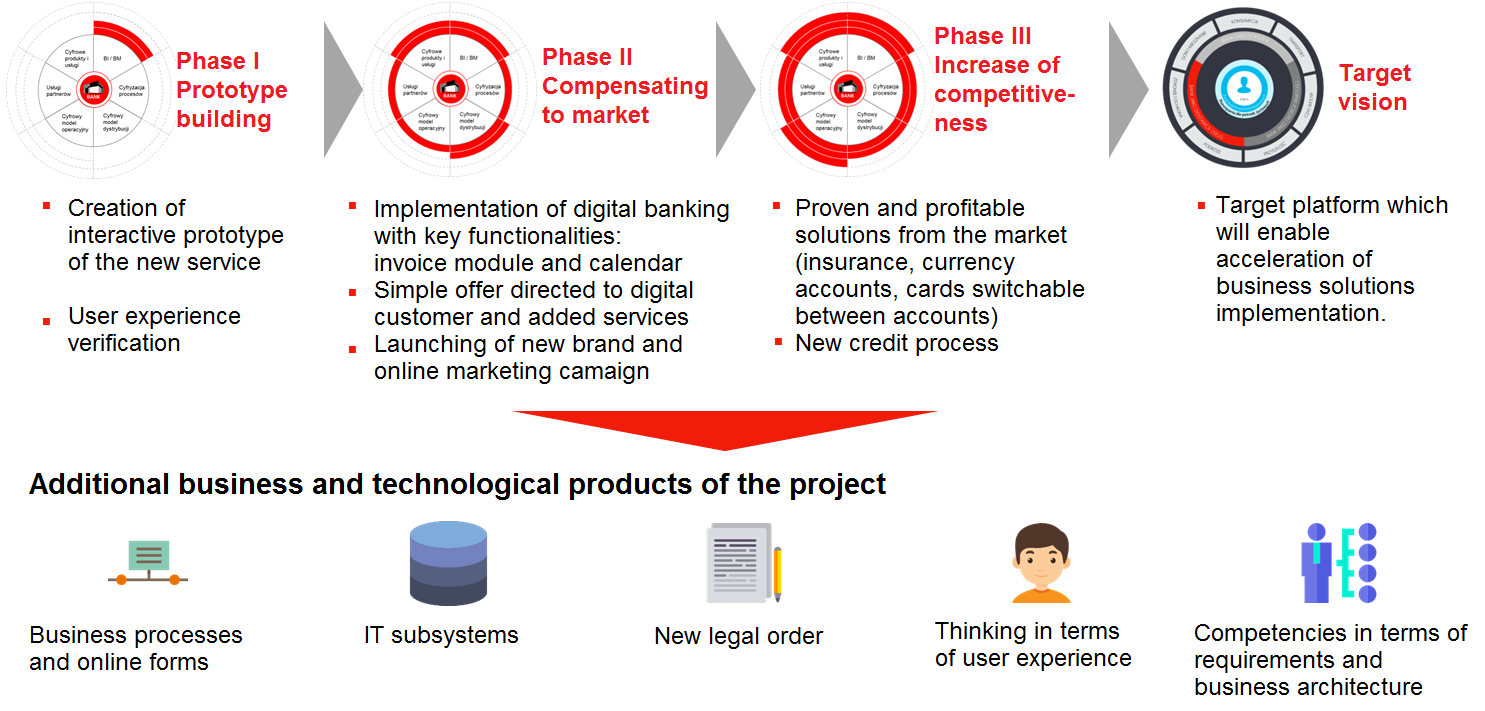

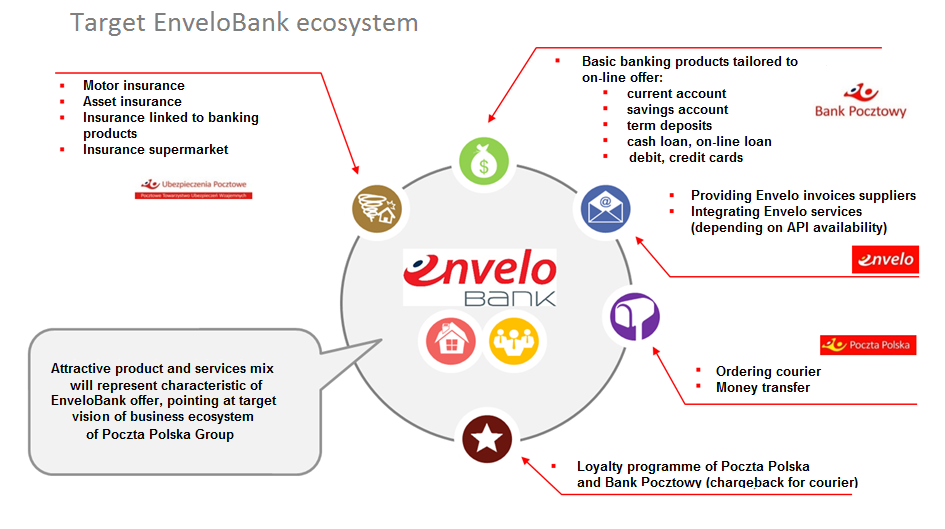

Implementation of EnveloBank is a key element of the Bank’s business model. It will provide response to the needs of the segment of young digital customers and ensure high acquisition level in mid-term perspective. At the same time, EnveloBank composes courier mail services with banking and insurance offer in the form of a modern user interface.

- Improving customer loyalty and satisfaction

Measures undertaken in this area were supported by an extended CRM system and initiatives aimed at customer activation and improved cross-selling performance, mostly in the form of implementation of a new data warehouse linked to CRM.

- Improved customer service quality

Implementation of new working standards for advisers and planned modification of incentive systems supporting employee loyalty and, thus, long-term relations with customers will improve the quality of customer service.

- Developing a low-cost operating model

This goal will be achieved mostly through optimization of processes offering the largest improvement opportunities, as well as digitalization and automation of back office processes.

In 2016, changes in business environment and development perspective have contributed to the decision on development of a new Bank’s Strategy. The key initiatives include:

- commencing works on a new Strategy of the Poczta Polska S.A. Capital Group;

- governmental projects and initiatives;

- growing competition on the financial services market;

- changes in distribution networks of banks;

- progressing digitalization of customers.

According to the work schedule agreed with the Supervisory Board, the new strategy shall be developed and approved in the first half of 2017.

Key activities carried out in 2017 which should contribute to performance of key strategic objectives include:

- digital bank launch in 2017 (EnveloBank project). The initiative is aimed at encouraging young people to use services of Bank Pocztowy. Project details have been presented item 12.3 hereof;

- sustainable growth in sales of consumer loans based on a new, modernized loan process, at the same time ensuring loan portfolio quality improvement;

- extending the scope of key transaction-related services offered to customers ensuring transparency and accessibility of offered products;

- continuing White Label sales of investment funds under Bank’s brand;

- developing a custom-made attractive offer for microenterprises and a financing program for that segment using domestic and EU funds;

- developing clearing services with special focus on money transfers dedicated to immigrants;

- continuing works on the implementation of the Customer Relationship Management system, which allows for increasing sales margin;

- continuing rebranding of traditional outlets, at the same time increasing activity in Microbranches.

Key business objectives for 2017:

- increase in the balance of consumer loans and in loan portfolio profitability;

- improved profitability of current accounts;

- a one-third increase of the balance of net current assets in the funds;

- maintaining the existing performance in the institutional segment;

- improving loan portfolio quality.

Further, the Bank will try to obtain some capital injections, mainly in order to meet regulatory requirements regarding capital adequacy measures.

The Group’s ability to achieve the objectives determined for 2017 shall depend mostly on external conditions, in particular the economic growth seen in Poland and decisions regarding interest rates made by the Monetary Policy Council. Material factors that may reduce projected profit include: growing amortization costs related to implementation of the mobile banking system, increased charges paid to Bank Guarantee Fund and the banking tax.

Key strategic projects pursued in 2016 and 2017 include the commissioning of EnveloBank platform, a new digital brand responding to the needs of digital customers the Bank has increasingly focused on. EnveloBank is an initiative included in the idea of digital development of the Poczta Polska S.A. Capital Group.

The project is nearing the Stage 2 closing, which will result in making the EnveloBank solutions accessible to customers in 2017.

At present, the solution is being tested.

Subsequent stages will include its adjustment to customer expectations based on experience gained in the course of cooperation with customers.

The new offer shall combine banking and postal services offered by the Group with those offered by external partners.

Building added value through synergy in offering both existing and new products to digital clients in the Poczta Polska S.A. Capital Group companies is of key importance for the project.

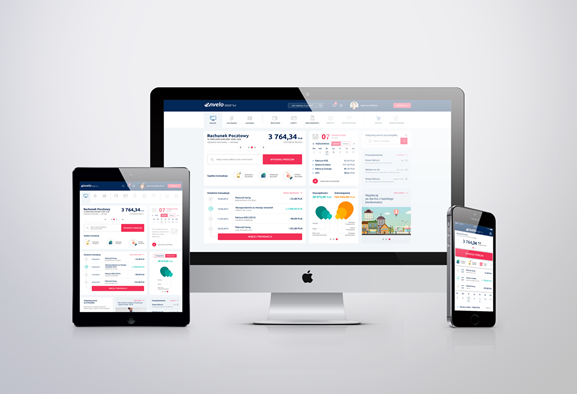

The designed solution shall be available in the form of RWD-based banking interface and a dedicated mobile application for IOS and Android.

The designed solution shall be available in the form of RWD-based banking interface and a dedicated mobile application for IOS and Android.

EnveloBank offers useful functionalities and is user-friendly as its design includes user experience (UX). The user interface and EnveloBank application have been tested in the course of comprehensive focus and expert survey, which has resulted in implementation of over 100 recommendations that will improve end-user experience.

The key objective of the EnveloBank project is to improve competitiveness of the Bank’s offer and entering the rapidly growing digital consumer market.

In the coming years, EnveloBank shall become an important tool attracting new customers and thus shall significantly impact the speed and quality of Bank’s business development.