Capital adequacy

The Group’s capital adequacy is managed on the Bank level. It is aimed to ensure that the Bank's equity level is not lower than the one required by internal and external regulations. The regulations link the required capital level with the scale of operations and risks assumed by the Bank.

Considering the above, the Bank regularly:

- Identifies risks material for its business;

- Manages material risks;

- Determines internal capital to be maintained should the risk materialize;

- Calculates and reports capital adequacy measures;

- Allocates internal capital to business areas;

- Performs stress tests;

- Compares its capital needs with the level of equity held;

- Integrates the capital adequacy assessment with development of the Bank’s Strategy, financial and sales plans.

Equity

For the purpose of equity calculation, the Bank applies methods arising from Regulation of the European Parliament and of the Council (EU) no. 575/2013 of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending the Regulation (EU) no. 648/2012. The equity of the Bank consists of Tier 1 (CET1) and Tier 2 funds.

In 2014, Tier 1 funds in the Bank included:

- Equity instruments meeting the conditions addressed in CRR;

- Agio related to the instruments referred to above;

- Retained earnings, to include current period gains or annual profit before a formal decision confirming the final financial performance for a given year following an approval of a competent body;

- Accumulated other comprehensive income;

- Reserve capital;

- General risk reserve;

- Unrealized gains and losses measured at fair value (in amounts including transition regulations referred to in Articles 467 and 468 of the CRR);

- Other Tier 1 items as determined in CRR;

and were reduced by:

- Carrying amount of intangible assets.

In 2014, Tier 2 funds in the Bank included cash obtained from a subordinate loan received in 2014 from Poczta Polska and two issues of subordinate bonds (carried out in 2011 and 2012, respectively).

Capital requirements (Pillar 1)

For the purpose of total capital requirement calculation, the Bank applies methods arising from Regulation of the European Parliament and of the Council (EU) no. 575/2013 of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending the Regulation (EU) no. 648/2012, including in particular:

- The standard method of calculating the capital requirement due to credit risk;

- A simplified collateral recognition method where the counterparty’s risk weight is replaced with the collateral (its issuer’s) risk weight;

- The standard method of calculating the capital requirement due to operational risk;

- The standard method for the risk of credit valuation adjustment;

- The standard method of calculating the capital requirement due to currency risk;

- The maturity method of calculating the capital requirement due to general interest rate risk;

- The standard method of calculating the capital requirement due to special debt instrument price risk;

- The method of calculating the capital requirement due to large exposures.

Since the trading scale was immaterial and the level of currency transactions performed was low, the capital requirement regarding market risks and currency risk for the Bank was PLN 0.00. This meant that at the end of 2014 the Bank’s capital requirement was limited to credit risk, operational risk and risk of credit valuation adjustment.

In 2014 the supervisory solvency ratio was above the required regulatory minimum.

In 2014 the Bank worked on achieving compliance both on the Bank and the Group level with Regulation of the European Parliament and of the Council (EU) no. 575/2013 of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending the Regulation (EU) no. 648/2012. The introduced changes resulted in modification of two reports: COREP (capital requirements) and Large Exposures. Additionally, the following new reports were introduced:

- Liquidity;

- NSFR (stable funding);

- Leverage Ratio;

- Losses (on mortgage loans);

- Encumbrance (quality of assets).

Internal capital (Pillar 2)

When identifying key risks that occur in the Bank’s operations, having included the scale and complexity of a given operation, additional risks are considered which, according to the management, are not fully covered by Pillar 1 risks. The identification is to optimally adjust the structure of internal capital to the actual capital needs that reflect the true risk exposure level.

For the additional risk purpose, the internal capital is calculated based on internal methods accepted by the Management Board, which include the scale and specifics of the Bank’s operations in a given risk context.

Additionally, when determining the internal capital, the Bank applies a conservative approach with regard to risk diversification among each risk type.

Please note that due to the specifics of liquidity risk and in light of market standards and practices, the Bank does not determine an additional internal capital for this risk type. For this reason, special focus is placed on the process evaluation and management.

In 2014 the internal solvency ratio was above the required regulatory minimum.

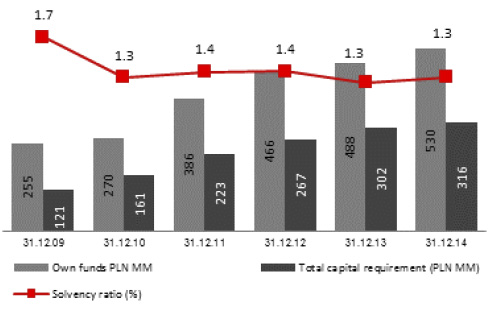

Capital adequacy of the Group

Disclosures (Pillar 3)

Pursuant to Resolution no.385/2008 of Polish Financial Supervision Authority of 17 December 2008, regarding detailed principles and a manner of publishing quality and quantity data regarding capital adequacy of banks and the scope of information subject to publication (with subsequent amendments) and to General Principles of Disclosing Information on Capital Adequacy in Bank Pocztowy S.A. accepted by the Supervisory Board of the Bank, in 2014 the Bank published information on its capital adequacy in a separate document issued within 30 days of

the date of approving the annual financial statements by its General Shareholders' Meeting.

The following tables present detailed calculation of base figures regarding regulatory capital and the solvency ratio as at 31 December 2014 and 31 December 2013.

Equity (PLN’000)

| 31.12.2014 | 31.12.2013 | |

|---|---|---|

| I. Tier 1 capital | 399,481 | 364,937 |

| Equity instruments paid for | 94,378 | 97,290 |

| Adjustments related to instruments in Tier 1 capital in the transition period | 2,330 | 0 |

| Agio | 8,600 | 8,600 |

| Retained profit attributable to parent’s owners, including: | 38,179 | 25,030 |

| - Profit | 38,179 | 36,871 |

| - Loss | 0 | (11,841) |

| Accumulated other comprehensive income | 3,571 | (1,943) |

| Adjustments related unrealized gains/losses on instruments in Tier 1 capital | (5,532) | (167) |

| Reserve capital | 183,019 | 159,989 |

| Funds for general banking risk | 108,345 | 106,345 |

| Other intangible assets | (32,307) | (30,207) |

| Tier 2 capital | 130,872 | 123,140 |

| Equity instruments and subordinated loans classified as Tier 2 capital | 93,000 | 123,140 |

| Adjustments related to instruments in Tier 2 capital in the transition period | 37,872 | 0 |

| Equity | 530,353 | 488,077 |

Capital requirements (PLN ‘000)

| 31.12.2014 | 31.12.2013 | |

|---|---|---|

| Capital requirements for credit, counterparty credit, dilution and settlement risk, including for exposures |

278,470 | 267,750 |

| With 0% risk weight | 4,955 | 5,884 |

| With 20% risk weight | 43,135 | 45,440 |

| With 35% risk weight | 1,154 | 1,091 |

| With 50% risk weight | 162,333 | 145,771 |

| With 75% risk weight | 59,528 | 69,164 |

| With 100% risk weight | 2,491 | 400 |

| With 150% risk weight | 4,835 | 0 |

| With 250% risk weight | 0 | 0 |

| Other risk weights | 39 | 0 |

| Capital requirement for operational risk | 37,495 | 33,981 |

| Capital requirement for credit valuation adjustment (CVA) | 315,965 | 301,731 |

| Total capital requirement | 315,965 | 301,731 |

| Solvency ratio | 13.4% |

12.9% |

| Tier 1 | 10.1% | 9.7% |

In 2014 the Bank’s activities ensured the maintaining of capital ratios on a save level, above the regulatory minimum.

Annual Report 2014 - Bank Pocztowy

Corporate Governance

- Corporate governance: principles and scope of application

- Control system in the process of preparing financial statements

- Entity authorized to audit financial statements

- Shareholding structure and share capital

- Key information regarding Poczta Polska S.A.

- Cooperation with Poczta Polska S.A.

- Investor relations

- By-laws amending principles

- Activities of the corporate bodies of the Bank