Key trends in the economy

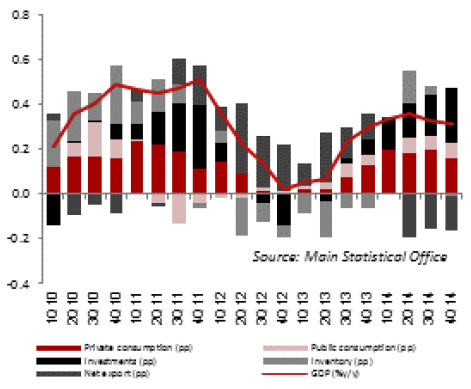

Gross Domestic Product and its components

Despite tough external conditions, among others the Russian-Ukrainian conflict and the economic slowdown in the Eurozone, Gross Domestic Product (GDP) in Poland increased by 3.3% in 2014, i.e. much faster than in 2013 and 2012. The growing domestic demand including consumption and investment was the key factor contributing to the growth. A 9.4% increase in investments was a positive surprise. A consumption growth by 3.0% was supported by an improved standing of the labor market, dropping prices of goods and services, which translated into increased purchasing power of salaries and wages. A decrease in interest rates of the National Bank of Poland making consumer loans attractive also contributed to the positive trend. The year 2014 was the first period in four years with net exports adversely affecting the economic growth in Poland. On the one hand, this resulted from only slight speed up of exports growth compared to 2013 (among others arising from the embargo on Polish products imposed by Russia); on the other hand, it was caused by growing imports (triggered by increased consumption and investments in the economy).

GDP growth structure

Labor market

In 2014 the condition of the labor market improved significantly. At year-end, the unemployment rate dropped to 11.5% from the level of 13.4% at the end of 2013 and was the lowest since December 2008. The decrease in the unemployment rate was unaffected by a slight economic slowdown in the second half of the year; also, weather (mild winter) in the last quarter of the year positively affected the unemployment statistics.

The employment figures reported by the business sector confirm the upturn in the labor market. In December 2014, 5,549 thousand people worked in the business sector, as compared to 5,491 thousand in December 2013. Employment in the business sector grew during the entire 2014 and in December reached the growth rate of 1.1%. The increase positively affected domestic demand. New jobs resulted among others from the investment activity increase in the sector.

In 2014, the growth in employment (unemployment reduction) was accompanied with an increase in salaries and wages in the business sector. While in 2013 average salary growth rate reached 2.9%, in 2014 it increased to 3.7%. Thanks to a zero inflation level, the actual salary increase in companies also reached 3.7% in 2014.

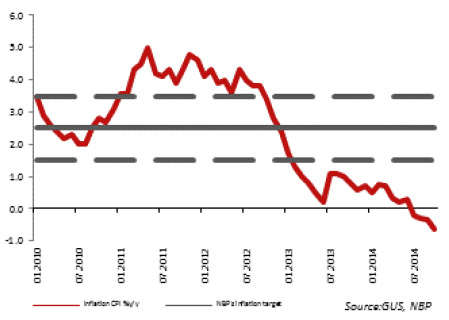

Inflation

In 2014 average annual inflation amounted to 0.0% versus 0.9% a year before. Following the Moscow – Kiev conflict and the Crimean crisis, EU member states and the U.S. imposed visa, financial and economic sanctions on Russia, to which it responded appropriately. Embargo imposed by Russia on foodstuffs has proven the most harmful, both for Poland and other EU member states. Accompanied with good yields, it has resulted in oversupply of foodstuffs and reduction in their prices. As a result, in July 2014, Polish economy saw the first ever case of annual deflation. No regulated price increases in the second half of 2014 and a rapid decrease in global crude oil prices resulting from its oversupply and no supply reduction by OPEC increased the deflationary processes and as a result, the annualized CPI ratio dropped to 1.0% in December 2014. Thus, it significantly differed from the bottom value of deviation from the inflation objective determined by the National Bank of Poland. In 2014 core inflation (excluding food and electricity prices) amounted to 0.6% versus 1.2% in 2013, while in December 2014 the ratio dropped to of 0.5% year-on-year.

Inflation and inflation target of NBP

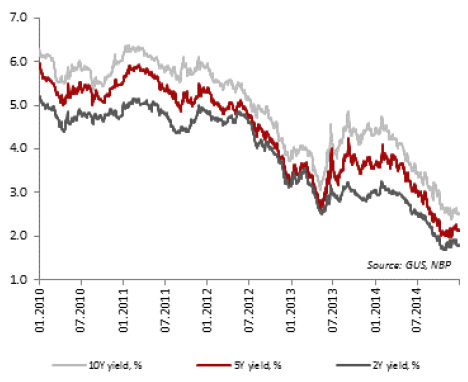

Public finance and the treasury debt securities market

The year 2014 was a good time for Polish public finance. Despite an inflation drop in the first half of the year, followed by growing deflation in the second half of the year, the budgetary deficit amounted to PLN 29.5 billion according to draft calculation by the Ministry of Finance compared to PLN 47.5 billion projected in the Budget Act for 2014. The realized income amounted to 101.9%, while expenditure to 96.1% of the planned level.

At the end of Q3 2014, public debt amounted to PLN 802.1 billion (46.8% of GDP) vs. PLN 882.3 billion (53.1% of GDP) at the end of 2013.

The improved standing of the public finance in 2014, advance funding of debt demand in 2013 (25% at the end of December) and a large scale of funding of annual debt early in 2014 (60% at the end of February) allowed the Ministry of Finance’s flexible management of the treasury bonds supply in the subsequent months, adjusting its structure to market conditions. Limited supply of debt securities accompanied with an interest rate reduction formerly announced and implemented in October by Monetary Policy Council contributed to a growing demand for Polish Treasury securities. Finally, at year-end, yield on two-year bonds was 1.77% (vs. 3.03% at the end of 2013), yield on five-year bonds was 2.15% (vs. 3.65% at the end of 2013) and yield on ten-year bonds was 2.54% (vs. 4.35% a year before).

Yield on treasury bonds

Exchange rates

In 2014, decisions and communications of European Central Bank (ECB) and American Federal Reserve (Fed) along with Russian-Ukrainian conflict and the related visa, financial and economic sanctions, Ebola epidemic, establishing of ISIS and a rapid decrease in global crude oil prices were the key factors affecting forex rates. Deterioration in relationships between the West and Russia caused by the Ukrainian crisis further slowed down economic growth in the Eurozone through a decrease in prices of goods and services.

As a result, ECB reduced interest rates by the total of 20 basis points in June and September 2014 (the reference rate to 0.05% and deposit rate to -0.20%). Further, ECB announced non-standard measures aimed at the triggering of economic growth and inflation, among others in the form of long-term TLTRO for banks, buyback of asset-backed securities and asset-backed bonds. At the same time, Fed continued the quantitative easing policy commenced in 2013, gradually limiting the QE3 program, which was finally closed in October 2014. Following a visible improvement of the labor market and the economy as a whole, Fed signaled its readiness to increase interest rates in the U.S. in 2015. These measures resulted in an increase in the exchange rate of USD to EUR and other currencies, to include PLN. At the end of 2014, USD/PLN rate was 3.52. The PLN/EUR rate remained stable for most of the year. Only in December, following an increase in global risk aversion and a drop in the value of RUB, it decreased. At the end of 2014 the PLN/EUR exchange rate stood at 4.28.

PLN exchange rate

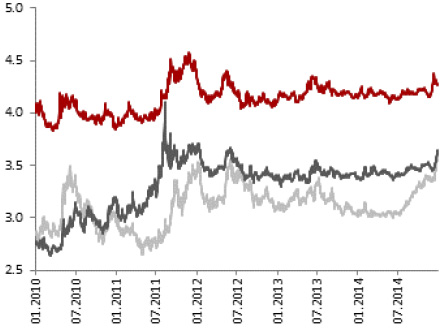

Monetary policy

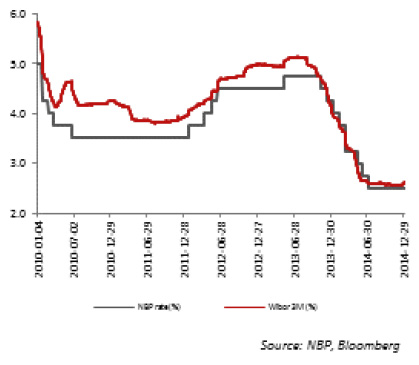

For most of 2014, Monetary Policy Council maintained interest rates flat, including the reference rate at 2.50%. Following the escalation of Russian-Ukrainian conflict and the risk of economic slowdown, in June 2014 Monetary Policy Council indicated the possibility of further interest rate reduction. Following the imposing of economic sanctions against Russia by the EU and U.S. and Russia’s strong response in August, in October Monetary Policy Council decided to reduce the reference rate by 50 basis points (to 2.00%), bill of exchange rediscount rate by 50 b.p. (to 2.25%), lombard rate by 100 b.p. (to 3.00%), leaving the deposit rate unchanged (on the level of 1.00%). At the same time, Monetary Policy Council might further adjust the monetary policy to growing deflation processes should market standing deteriorate. Interest rate reduction by the National Bank of Poland translated into lower market rates in 2014. At the end of 2014, WIBOR 3M amounted to 2.06% versus 2.71% at the end of 2013.

WIBOR 3M and NBP rate

Economic ratios

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | |

|---|---|---|---|---|---|---|

| GDP (y/y) | 1.6% | 3.9% | 4.5% | 1.9% | 1.7% | 3.3% |

| Inflation (period average) | 3.5% | 2.6% | 4.3% | 3.7% | 0.9% | 0.0% |

| Registered unemployment rate (period end) | 12.1% | 12.4% | 12.5% | 13.4% | 13.4% | 11.5% |

| Deposits and other liabilities (PLN bn, period end) | 625.0 | 682.0 | 761.9 | 797.9 | 845.9 | 914.5 |

| - Household (PLN bn, period end) | 383.6 | 421.2 | 478.0 | 514.9 | 543.6 | 591.6 |

| - Enterprises (PLN bn, period end) | 164.9 | 181.3 | 203.3 | 187.8 | 206.5 | 225.9 |

| Receivables (PLN bn, period end) | 651.7 | 770.0 | 880.8 | 901.1 | 937.4 | 1 005.7 |

| EUR/PLN (average exchange rate) | 4.32 | 3.99 | 4.12 | 4.19 | 4.19 | 4.18 |

| USD/PLN (average exchange rate) | 3.11 | 3.01 | 2.96 | 3.26 | 3.16 | 3.15 |

| CHF/PLN (average exchange rate) | 2.86 | 2.89 | 3.35 | 3.47 | 3.41 | 3.44 |

| Reference rate (period end) | 3.50% | 3.50% | 4.50% | 4.25% | 2.50% | 2.00% |

| WIBOR 3M (period end) | 4.27% | 3.95% | 4.99% | 4.11% | 2.71% | 2.06% |

Source: GUS, NBP, Bloomberg

Annual Report 2014 - Bank Pocztowy

Corporate Governance

- Corporate governance: principles and scope of application

- Control system in the process of preparing financial statements

- Entity authorized to audit financial statements

- Shareholding structure and share capital

- Key information regarding Poczta Polska S.A.

- Cooperation with Poczta Polska S.A.

- Investor relations

- By-laws amending principles

- Activities of the corporate bodies of the Bank