Economic and financial position

1. Key factors determining the Group’s financial profit or loss

record net profit in

the Group’s history

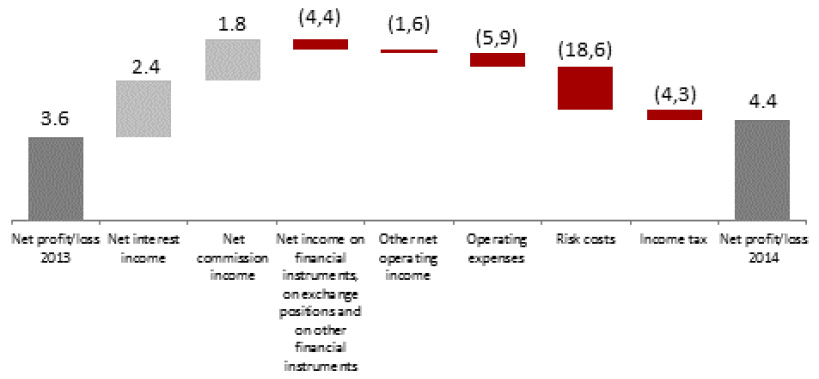

In 2014 the Group generated gross profit of PLN 55.1 million vs. PLN 43.3 million in the prior year. Net profit amounted to PLN 43.6 million and was 21.1% higher than in the prior year thus hitting the record level in the Group’s history.

The financial profit of the Group in 2014 was determined by the following factors:

- An increase in the net interest income generated despite disadvantageous market trends, i.e. decreasing market interest rates. The net interest income amounted to PLN 268.2 million, i.e. increased by 10.0% vs. 2013 mainly due to a decrease in financing expenses and an increase in the share of high-margin consumer loans in the structure of Group’s loan portfolio.

- An increase in the net interest income generated despite disadvantageous market trends, i.e. decreasing market interest rates. The net interest income amounted to PLN 268.2 million, i.e. increased by 10.0% vs. 2013 mainly due to a decrease in financing expenses and an increase in the share of high-margin consumer loans in the structure of Group’s loan portfolio.

- Lower gain/loss on transactions in securities available for sale, gain/loss on foreign exchange transactions and gain/loss on financial instruments. The Group generated the total income from such transactions of PLN 4.5 million, i.e. by 49.0 less than in 2013, mainly due to significant unpredictable fluctuations in its market environment.

- Maintaining the cost discipline. In 2014 the Group saw a clear slowdown in the growth of operating expenses as a percentage of income (the expenses increased by 2.8% and operating income by 12.9%).

- Higher impairment losses on assets. In 2014 the cost of risk reached PLN 61.0 million and grew by 43.9% comparing to 2013. The Group recognized additional impairment losses for consumer loan portfolio and credit receivables from institutional clients.

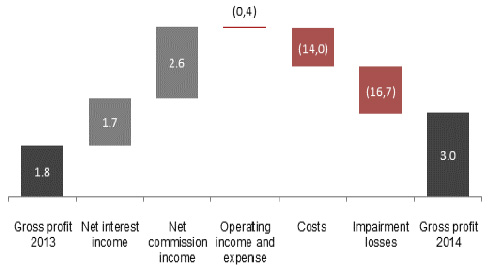

Net profit of the Group in 2014 (PLN MM)

The key income statement items:

Key income statement items of the Bank Pocztowy S.A. Capital Group (in PLN'000)

| 2014 | 2013 | Change 2014/2013 | ||

|---|---|---|---|---|

| PLN'000 | % | |||

| Operating income | 332,340 | 294,320 | 38,020 | 12.9 % |

| Net interest income | 268,150 | 243,807 | 24,343 | 10.0 % |

| Net fee and commission income | 59,657 | 41,628 | 18,029 | 43.3 % |

| Net income on financial instruments measured at fair value through profit or loss and on exchange position |

2,763 | 2,905 | (142) | (100.0)% |

| Gain/loss on other financial instruments | 1,770 | 5,980 | (4,210) | (70.4)% |

| Other net operating income | 2,440 | 4,076 | (1,636) | (40.1)% |

| General and administrative expenses | (218,622) | (212,738) | (5,884) | 2.8 % |

| Net impairment loss | (61,013) | (42,398) | (18,615) | 43.9 % |

| Gross profit | 55,145 | 43,260 | 11,885 | 27.5 % |

| Income tax | (11,506) | (7,233) | (4,273) | 59.1 % |

| Net financial income for the current period | 43,639 | 36,027 | 7,612 | 21.1 % |

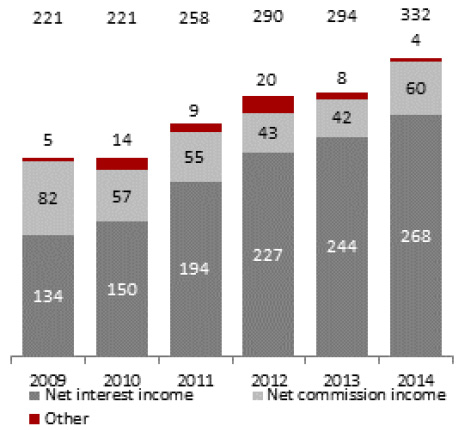

Net interest income

In 2014, like in the previous year, the net interest income constituted the key source of income for the Group.

It amounted to PLN 268.2 million and was by PLN 24.3 million, i.e. by 10.0% higher year to year.

Interest income and interest expense of the Bank Pocztowy S.A. Capital Group (PLN’000)

| 2014 | 2013 | Change 2014/2013 | ||

|---|---|---|---|---|

| PLN'000 | % | |||

| Interest income | 416,278 | 423,400 | (7,122) | (1.7)% |

| Income on receivables from other banks | 9,064 | 9,607 | (543) | (5.7)% |

| Income on receivables from clients arising from loans and advances, including: | 361,466 | 355,103 | 6,363 | 1.8 % |

| Overdraft facilities | 7,125 | 7,480 | (355) | (4.7)% |

| Credit facilities and term loans | 354,341 | 347,623 | 6,718 | 1.9 % |

| Individuals | 309,011 | 294,269 | 14,742 | 5.0 % |

| Institutional clients | 34,300 | 37,980 | (3,680) | (9.7)% |

| Self-government bodies | 11,030 | 15,374 | (4,344) | (28.3)% |

| Income on investment financial assets classified as: | 45,447 | 58,541 | (13,094) | (22.4)% |

| Available for sale | 25,361 | 37,891 | (12,530) | (33.1)% |

| Held to maturity | 20,086 | 20,650 | (564) | (2.7)% |

| Income on financial assets held for trading | 301 | 149 | 152 | 102.0 % |

| Interest expense | (148,128) | (179,593) | 31,465 | (17.5)% |

| Expense due to liabilities to other banks | (419) | (450) | 31 | (6.9)% |

| Expense due to liabilities to customers, including: | (121,894) | (156,552) | 34,658 | (22.1)% |

| Current accounts | (31,603) | (43,503) | 11,900 | (27.4)% |

| Term deposits | (90,291) | (113,049) | 22,758 | (20.,1)% |

| Individuals | (71,031) | (82,795) | 11,764 | (14.2)% |

| Institutional clients | (18,157) | (28,780) | 10,623 | (36.9)% |

| Self-government bodies | (1,103) | (1,474) | 371 | (25.2)% |

| Costs arising from issue of debt securities and subordinated loan | (23,199) | (21,312) | (1,887) | 8.9 % |

| Costs arising from sold securities (repo) | (2,616) | (1,279) | (1,337) | 104.5 % |

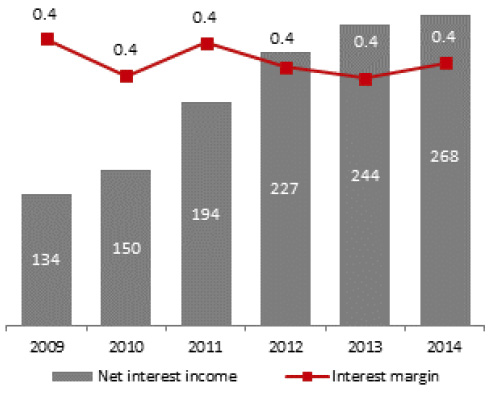

Apart from lower market interest rates, the net interest income of the Group in 2014 was determined by the following internal factors:

- Lower interest income. In 2013 it amounted to PLN 416.3 million and was by 1.7% lower than in the previous year. The decrease resulted mostly from reduced volume of institutional clients and selfgovernment institutions in the credit portfolio. As a result, interest income from this client group dropped by 9.7% and 28.3%, respectively, as did income on investment assets, which amounted to PLN 45.4 million and was by 22.4% lower than in the previous year. The key item in the interest income category, interest income from term loans granted to individuals amounted to PLN 390.0 million, i.e. grew by 5.0% at the end of 2014. The result was possible due to a significant increase in the lending to this customer group.

- Lower interest expense. In 2014 interest expense reached PLN 148.1 million and was by 17.5% lower than in 2013. The Group incurred much lower interest expense due to term deposits to all groups of clients, which resulted primarily from lower funds deposited on bank accounts. Interest expense on own treasury bonds grew, however (due to other bond issues in 2014), as well as on a subordinated loan and on securities sold under repo and sell-buy-back transactions.

Effective optimization of Group’s financing costs and changes in the structure of assets aimed at profitability improvement translated into an increase in the Group’s interest margin. In 2014 the Capital Group generated an interest margin of 3.8% versus 3.6% in the prior year.

Group's income (PLN MM)

Group's net interest income (PLN MM) interest margin (%)

Net fee and commission income

Net fee and commission income was the key element of non-interest income of the Group. It amounted to PLN 59.7 million and was by 43.3% higher than in the previous year.

Interest income and expense of the Bank Pocztowy S.A. Capital Group (PLN’000)

| 2014 | 2013 | Change 2014/2013 | ||

|---|---|---|---|---|

| PLN '000 | % | |||

| Fee and commission income | 102,304 | 73,006 | 29,298 | 40.1 % |

| Settlement and cash transactions | 42,783 | 36,742 | 6,041 | 16.4 % |

| Keeping bank accounts | 27,589 | 10,568 | 17,021 | 161.1 % |

| Payment and credit cards | 21,028 | 17,126 | 3,902 | 22.8 % |

| Sale of insurance products | 4,717 | 3,589 | 1,128 | 31.4 % |

| Originated loans and advances | 855 | 747 | 108 | 14.5 % |

| Other | 5,332 | 4,234 | 1,098 | 25.9 % |

| Fee and commission expense | (42,647) | (31,378) | (11,269) | 35.9 % |

| Keeping current accounts and term deposits | (18,108) | (14,788) | (3,320) | 22.5 % |

| Managing payment cards, ATM and POS cash withdrawals | (10,746) | (8,012) | (2,734) | 34.1 % |

| Cash management services for the Group | (8,513) | (5,901) | (2,612) | 44.3 % |

| Other services | (5,280) |

(2,677) |

(2,603) | 97.2 % |

Commission income amounted to PLN 102.3 million and was by 40.1% higher than in 2013. The Capital Group reported in particular an increase in:

- Income from bank account maintenance (by 161.1%). This was related to changes in the Fee and Commission Scheme introduced in the fourth quarter of 2013, involving introduction of charges from clients not using their current accounts and to the growing number of accounts held;

- Commissions on sales of insurance products (by 31.4%) including mainly insurance offered along with cash loans;

- Commissions on payment cards and credit cards (by 22.8%) mainly due to an increase in the number of transactions performed by clients and the number of cards issued;

- Income from settlement and cash transactions (by 16.4%) as a result of a growth in commissions on cash transactions, payments and withdrawals of cash by individuals.

In 2014 fee and commission expense increased as well, up to PLN 42.6 million, being 35.9% higher than in 2013. The Group saw an increase in the fee and commission expenses regarding:

- Maintaining of current accounts and term deposits by PLN 3.3. million, i.e. by 22.5%, mainly due to activation of payments from current accounts performed by postmen (commission costs paid by the Bank to Poczta Polska);

- Maintenance of cash cards by PLN 2.7 million, i.e. by 34.1% as a result of a growth in the number of transactions performed by clients and in the number of cards issued in relation to growing popularity of proximity card transactions and development of the acceptance network. Further, fees charged by VISA increased and the Bank incurred the costs of fees to MasterCard (related to the inclusion of their cards into Bank’s offer);

- Obsługi kasowej i rozlicCash and settlement services provided to the Group by PLN 2.6 million, i.e. by 44.3%, which was related to a change in settlements between Poczta Polska and the Bank with regard to Giro Premium, as a result of amendments to the agency agreement concluded with Poczta Polska.

Other income

In 2014 the gain/loss on financial instruments measured at fair value through profit or loss, gain/loss on foreign exchange transactions and gain/loss on other financial instruments amounted to PLN 4.5 million versus PLN 8.9 million reported in 2013. The category is discussed in detail in Section 5 dedicated to treasury operations.

In 2014 other operating income (other revenue/operating expenses) amounted to PLN 2.4 million and was by PLN 1.6 million, i.e. by 40.1%% lower than in the prior year. Other operating income amounted to PLN 8.7 million and was close to the previous year’s performance. Key items of other operating income included income from refund of costs of collection of receivables, court and bailiff enforcement (30.9% share) and other income (21.7% share). Other operating income included income from sales of balance sheet receivables, which amounted to PLN 1.9 million in 2014. During the year, they increased by PLN 1.2 million following the sales of Bank's receivables including the principal with the face value of PLN 13.6 million, interest and other expenses of PLN 8.1 million.

In 2014 other operating expense amounted to PLN 6.3 million and was PLN 1.6 million (35.0%) higher than in 2013. The increase resulted mostly from a growth in impairment losses on receivables (PLN 0.9 million) and costs of writing off receivables related to operating activities of the Bank (PLN 0.5 million).

General and administrative expenses

In 2014, the Group focused on further cost optimization. In 2014 operating expenses of the Group reached PLN 218.6 million compared to 212.7 million in 2013 (an increase by 2.8%).

Administrative expenses and amortization/depreciation of the Bank Pocztowy S.A. Capital Group (PLN ‘000)

| 2014 | Structure (2014) |

2013 | Structure (2013) |

Change 2014/2013 | ||

|---|---|---|---|---|---|---|

| PLN'000 | % | |||||

| Administrative expenses including amortization/depreciation | (218,622) | 100.0% | (212,738) | 100.0% | (5,884) | 2.8% |

| Employee benefits | (99,398) | 45.5% | (93,372) | 43.4% | (7,026) | 7.6% |

| Administrative costs | (98,420) | 45.0% | (98,427) | 46.3% | 7 | (0.0)% |

| Amortization/ depreciation | (20,804) | 9.5% | (21,939) | 10.3% | 1,135 | (5.2)% |

Employee benefits constituted the key cost item. In 2014 they stood at PLN 99.4 million and grew by 7.6% comparing to 2013. The increase in personnel costs in 2014 despite employment reduction resulted mostly from the fact that no bonus had been paid in 2013.

In 2014 the Group incurred non-personnel costs of PLN 98.4 million, i.e. the same as in previous year. The item included increased costs incurred for Banking Guarantee Fund, IT software service, IT services, advisory, audit and legal services. Expenses related to insurance, rent and lease (due to the change of the head office location in Warsaw) as well as promotion and advertisement costs were lower than in the prior year.

In 2014 the Group implemented measures aimed at tight cost control, which will allow permanent cost reduction in future, accompanied with improved efficiency of the Group and support for its further development. In the first half of 2014, the Group launched a cost and process optimizing project, whose implementation and outcome monitoring is planned for two years. Key initiatives include:

- Remodeling of the Bank’s organizational structure, change of its business model and determining FTE number of employees in each organizational unit in compliance with the new strategy assumptions (mainly reorganizing of the institutional service line);

- Optimizing of processes, procedures and internal Operating Rules;

- Optimizing of the scope of purchases and adjusting costs of support functions to sales objectives.

Net impairment losses

In 2014 the amount of PLN 61.0 million was recognized in the income statement due to impairment losses (vs. PLN 42.4 million in the comparable period).

Net impairment losses (PLN’000)

| 2014 | 2013 | Change 2014/2013 | ||

|---|---|---|---|---|

| PLN'000 | % | |||

| Loans and advances granted to clients, including: | (61,013) | (42,398) | (18,615) | 43.9 % |

| Individuals | (48,739) | (32,122) | (16,617) | 51.7 % |

| Overdraft facilities | (565) | (1,292) | 727 | (56.3)% |

| Consumer loans | (43,298) | (19,576) | (23,722) | 121.2 % |

| Real estate loans | (3,943) | (10,230) | 6,287 | (61.5)% |

| Credit card debt | (933) | (1,024) | 91 | (8.9)% |

| Institutional clients | (12,233) | (10,667) | (1,566) | 14.7 % |

| Self-government bodies | (41) | 391 | (432) | (110.5)% |

The increase in the impairment losses recognized in the income statement was related mostly to the change in the Bank’s strategy involving focus on the consumer finance segment with higher average risk costs.

The total growth in impairment losses includes:

- Growth in impairment losses on consumer loans (by PLN 23.7 million vs. the comparable period);

- Drop in impairment losses on real property consumer loans (by PLN 6.3 million vs. the comparable period);

- Growth in impairment losses on institutional loans (by PLN 1.6 million vs. the comparable period).

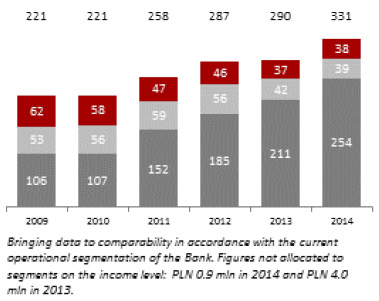

2. Business segment performance

Information regarding operating segments is reported on the same basis as is used internally in reports presented to the Management Board of the Bank for the purpose to allocate resources to segments and evaluate their performance. The segments are identified based on the method of carrying out activities and the type and scope of information used by management. This classification is consistent with the sales management and construction of the full offer for Bank’s clients.

The Bank’s operations have been divided into segments in accordance with products sold, services provided and types of clients, for management purposes. The following operating segments have been identified: consumer, institution, settlement and treasury.

Income per operating segment (PLN MM)

Bringing data to comparability in accordance with the current operational segmentation of the Bank.

Figures not allocated to segments on the income level: PLN 0.9 mln in 2014and PLN 4.0 mln in 2013.

Consumer segment

From management accounting perspective the consumer segment offers products targeted at individuals and microenterprises (individuals carrying out business activities). It is sold through traditional distribution channels in a countrywide network of branches and sales points (including the sales network of Poczta Polska and financial agents), Pocztowy24 Internet banking, PocztowySMS mobile banking and a Contact Center.

In 2014 the consumer segment generated a gross profit of PLN 30.1 million, which was by PLN 11.6 million, i.e. by 63.0% higher than in 2013.

Gross profit of the retail segment in 2014 (PLN MM)

Key gross profit growth drivers in the consumer segment:

- A considerable improvement in the net interest and commission income. Net interest income constituted the key source of segment income. It amounted to PLN 222.1 million and grew by PLN 17.0 million. A considerable improvement of the net interest income resulted from a dynamic growth of new lending to consumers. At the end of 2014 the credit portfolio for this segment amounted to PLN 4,454.7 million, i.e. grew by 7.0% during the year. The consumer segment generated a net fee and commission income of PLN 32.0 million, i.e. by PLN 25.7 million more than in the prior year. The increase was related to a growth in revenue from current account maintenance;

- Higher administrative expenses. In 2014 the consumer segment costs reached PLN 178.7 million, i.e. by PLN 14.0 million more than in 2013. The key driver of growth was higher back-office expense related to focusing on the retail segment arising from the Bank’s organizational structure being adjusted to the current strategy, as well as an increase in front-office expenses related to newly opened outlets;

struktury organizacyjnej Banku do obecnie obowiązującej strategii, a także wzrost kosztów front-office związany z nowo uruchamianymi placówkami Banku, - Higher net impairment losses. In 2014 they amounted to PLN 49.1 million comparing to PLN 32.5 million in 2013, due to focusing on sales of consumer loans charged with higher average risk costs.

Institutional segment

Institutional segment in management accounting includes operating profit/loss from services provided to business entities with legal personality, individuals and entities with no legal personality carrying out business activities under applicable regulations and central and local administration entities. The Bank’s offer for these clients includes credit and deposit products and settlement services with products aimed at improving cash management efficiency. Products are offered through the Bank’s own network, the network of Poczta Polska and financial agents.

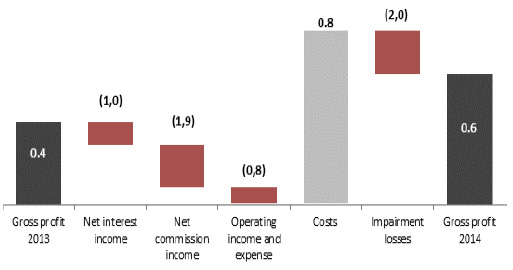

Gross profit of the institutional segment in 2014 (PLN MM)

In 2014 the institutional segment generated a gross profit of PLN 6.0 million versus PLN 3.8 million in 2013 (an increase of PLN 2.2 million).

The institutional segment profit was driven by the following items::

- A reduction in net interest income. It amounted to PLN 28.6 million, i.e. decreased by 3.5%, mainly due to a lower margin on deposit products, which amounted to 1.09% in December 2014, as compared to 1.32% in December 2013.

- A decrease in net commission income. The segment generated a net commission income of PLN 10.6 million, i.e. by 15.5% less than in the prior year. A decrease in net commission income was related also to reduction in the institutional segment. The most significant income drop occurred in commissions for opening and maintenance of bank accounts for self-government institutions and on overdraft limits for enterprises and cooperatives;

- Improved level of administrative expenses. They amounted to PLN 21.0 million, i.e. decreased by PLN 7.9 million, mainly due to the change resulting from the reduction in the institutional segment;

- An increase in net impairment losses, which amounted to PLN -11.9 million in 2014, as compared to -9,9 million in 2013.

Settlement and treasury segment

Settlement and treasury segment in management accounting includes:

- Gain/loss on operating activities covering settlement services. Key settlement services include: managing documents for payments to the Social Insurance Institution and Tax Offices, non-cash transfer of Social Insurance benefits to beneficiaries and cash payments in inter-bank settlements;

- Gain/loss on financial instruments measured at fair value through profit or loss, gain/loss on foreign exchange transactions and gain/loss on other financial instruments;

- Net interest income including sales and purchases of securities, depositing and borrowing funds on the interbank market. The segment repurchases client funds obtained by operating segments at a transfer rate and sells the funds to finance their credit operations.

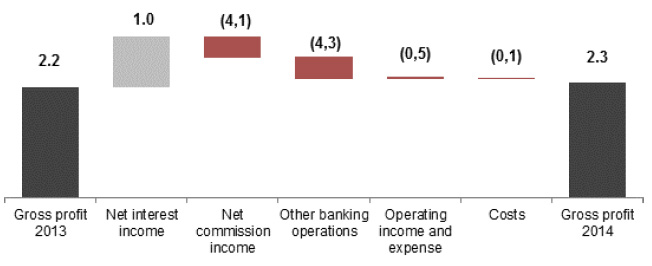

Gross profit of settlement and treasury segment in 2014 (PLN MM)

In 2014 the settlement and treasury segment generated a gross profit of PLN 22.7 million versus PLN 21.9 million in 2013 (an increase of PLN 3.4%).

The key gross profit drivers in the settlement and treasury segment in 2014:

- Increase in net interest income by PLN 9.8 million to PLN 18.1 million in 2014, mainly due to reduced transfer costs resulting from a drop in transfer prices;

- Decrease in the net commission income. It amounted to PLN 15.5 million and was by PLN 4.1 million (20.9%) lower than in the previous year. The drop resulted from a change in commissions per unit for ZUS III transfers and a reduced number of communications;

- Lower gain/loss on treasury operations comprising a gain/loss on other financial instruments, gain/loss on financial instruments measured at fair value through profit or loss and gain/loss on foreign exchange transactions. It amounted to PLN 4.5 million and vs. PLN 8,9 million in 2013;

- Administrative expenses remaining stable, on the previous year level. In 2014 the segment generated expenses of PLN 15.5 million.

3. Key effectiveness ratios

A growth in profit of the Bank Pocztowy Capital Group reported in 2014 resulted in ROE and ROA improvement. In 2014 return on equity stood at 10.5% and was by 0.9 p.p. higher than in the previous year.

A significant increase in the Group’s income along with slowing growth in expenses improved the Cost/Income relation. In 2014 the Cost/Income ratio amounted to 65.3%, i.e. was by 6.0 p.p. lower than in 2013.

At the end of 2014 the share of impaired loans (NPL) in the credit portfolio was 6.1% vs. 5.3% a year before. Significantly, the ratio was considerably better than that of the entire Polish banking sector (8.1%)1.

Key effectiveness ratios of the Bank Pocztowy S.A. Capital Group

| 31.12.2014 | 31.12.2013 | Change 2014/2013 |

|

|---|---|---|---|

| Net ROE (%) | 10.5 | 9.6 | 0.9 p.p |

| Net ROA (%) | 0.6 | 0.5 | 0.1 p.p |

| Costs including amortization / income (C/I) (%) | 65.3 | 71.3 | (6.0) p.p |

| Net interest margin (%) | 3.8 | 3.6 | 0.2 p.p |

| (CAR) (%) | 13.4 | 12.9 | 0.5 p.p |

| NPL – the share of impaired loans and advances in the credit portfolio (%) | 6.1 | 5.4 | 0.7 p.p |

Net ROE calculated as a net profit for a given year to average equity (calculated as the average of equity at the end of a given year and at the end of the previous year) taking into account the net profit for a given year.

Net ROA calculated as a net profit for a given year to average assets (calculated as the average of assets at the end of a given year and at the end of the previous year).

Costs including amortization and depreciation/Income (C/I) calculated as the general and administrative expenses including amortization and depreciation to total income (net interest income, net fee and commission income, gain/loss on financial instruments measured at fair value through profit or loss, gain/loss on foreign exchange transactions, gain/loss on other financial instruments, other operating revenue and expenses).

Net interest margin calculated a relation of net interest income for a given year to average assets (calculated as average daily balance of assets).

NPL (Non Preforming Loans) calculated as a relation of impaired loans to the gross loans and advances to clients.

4. Changes in the statement of financial position in 2014 – key items

As at 31 December 2014 the balance sheet total of the Group amounted to PLN 7,719.0 million and was by PLN 336.3 million, i.e. by 4.6% higher than at the end of 2013.

Key balance sheet items of the Bank Pocztowy S.A. Capital Group (PLN ‘000)

| 31.12.2014 | Share (31.12.2014) |

31.12.2013 | Share (31.12.2013) |

Change 2014/2013 | ||

|---|---|---|---|---|---|---|

| PLN'000 | % | |||||

| Cash in hand and deposits with the Central Bank | 757,643 | 9.8% | 327,242 | 4.4% | 430,401 | 131.5 % |

| Receivables from other banks | 158,269 | 2.1% | 36,329 | 0.5% | 121,940 | 335.7% |

| Loans and advances granted to clients | 5,151,777 | 66.7% | 5,055,712 | 68.5% | 96,065 | 1.9% |

| Investments in financial assets | 1,519,266 | 19.7% | 1,842,036 | 25.0% | (322,770) | (17.5)% |

| Net non-current assets | 80,322 | 1.0% | 74,881 | 1.0% | 5,441 | 7.3% |

| Other assets | 51,750 | 0.7% | 46,545 | 0.7% | 5,205 | 11.2% |

| Other assets | 7,719,027 | 100.0% | 7,382,745 | 100.0% | 336,282 | 4.6% |

| Liabilities to the Central Bank | 11 | 0.0% | 11 | 0.0% | - | - |

| Liabilities to other banks | 4,020 | 0.1% | 41,762 | 0.6% | (37,742) | (90.4)% |

| Liabilities arising from sold securities (repo) | 177,701 | 2.3% | 49,610 | 0.7% | 128,091 | 258.2% |

| Liabilities to clients | 6,492,023 | 84.1% | 6,230,578 | 84.4% | 261,445 | 4.2% |

| Liabilities arising from issue of debt securities | 358,256 | 4.6% | 431,597 | 5.8% | (73,341) | (17,.0)% |

| Subordinated liabilities | 142,090 | 1.8% | 142,027 | 1.9% | 63 | 0.0% |

| Other liabilities | 105,294 | 1.4% | 95,395 | 1.3% | 9,899 | 10.4% |

| Total liabilities | 7,279,395 | 94.3% | 6,990,980 | 94.7% | 288,415 | 4.1% |

| Total equity | 439,632 | 5.7% | 391,765 | 5.3% | 47,867 | 12.2% |

| Total liabilities and equity | 7,719,027 | 100.0% | 7,382,745 | 100.0% | 336,282 | 4.6% |

Other assets include: financial assets held for trading, current income tax receivables, net deferred income tax assets, other assets.

Other liabilities include: financial liabilities held for trading, provisions, current income tax liabilities, other liabilities.

Assets

Net amount of loans and advances originated to clients constituted the key asset of the Group. At the end of 2014 they amounted to PLN 5,151.8 million and grew by PLN 96.1 million during the year. The item accounted for 66.7% of the total assets of the Group (versus 68.5% a year before). The value of cash in hand and at bank (National Bank of Poland) increased. In December 2014 it amounted to PLN 757.6 million and increased by 430.4 million comparing to the end of 2013. Consequently, its share in assets increased from 4.4% at the end of 2013 to 9.8% in December 2014.

Investment assets decreased compared to the previous year and amounted to PLN 1,519.3 million, i.e. PLN 322.8 million less than in December 2013.

Consequently, their share in assets decreased from 25.0% at the end of 2013 to 19.7% in December 2014.

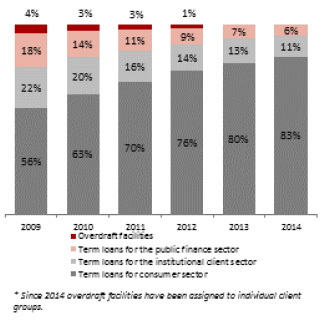

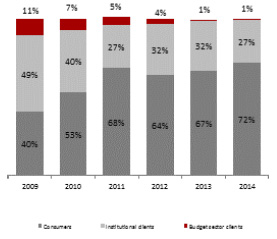

Structure of credit receivables from Group's clients (%)

* Since 2014 overdraft facilities have been assigned to individual client groups.

Equity and liabilities

The following changes occurred in the structure of Group’s equity and liabilities in 2014:

- The amount of liabilities towards customers increased. At the end of 2014 they amounted to PLN 6,492.0 million, i.e. grew by PLN 261.4 million during the year. They accounted for 84.1% of the balance sheet total versus 84.4% in December 2013;

- The value of liabilities arising from securities sold under sell-and-buy-back arrangements increased. In December 2014 they amounted to PLN 177.7 million vs. PLN 49.6 million a year before;

- The value of liabilities due to issue of debt securities decreased to reach PLN 358.3 million in December 2014, i.e. by PLN 73.3 million less than a year before. They accounted for 4.6% of the equity and liabilities of the Group versus 5.8% in December 2013;

- Equity amounted to PLN 439.6 million and accounted for 5.7% of total equity and liabilities compared to PLN 391.8 million in December 2013 with 5.3% in total equity and liabilities (an increase in net financial profit/loss for the current year contributed to the performance).

Structure of liabilities to Group's clients (%)

Index:

1 Source: NBP, Section: Banking sector financial data, file Receivables

Annual Report 2014 - Bank Pocztowy

Corporate Governance

- Corporate governance: principles and scope of application

- Control system in the process of preparing financial statements

- Entity authorized to audit financial statements

- Shareholding structure and share capital

- Key information regarding Poczta Polska S.A.

- Cooperation with Poczta Polska S.A.

- Investor relations

- By-laws amending principles

- Activities of the corporate bodies of the Bank