Treasury operations

financial assets

Treasury operations of Bank Pocztowy focus on:

- Managing interest rate risk and current liquidity risk under the Banking Book, as well as currency risk, transactions and customer service under the Trading Book;

- Managing long-term liquidity risk and debt securities issuing policy.

1. Banking Book

In 2014 the Bank concluded mainly sale and purchase transactions in securities, sell-buy- back and buy-sell-back transactions and deposited or borrowed funds in the interbank market as a part of managing short- and long-term liquidity and interest rate risk. Moreover, it entered into derivative transactions such as FRA, IRS or OIS to hedge against interest rate risk.

At the end of 2014 the total investment financial assets of the Bank reached PLN 1,519.3 million, i.e. by PLN 322.8 million (17.5%) less than at the end of 2013, mainly as a result of a decrease in the balance of debt instruments issued by the National Bank of Poland by PLN 359.9 million, to PLN 479.9 million in the Bank’s portfolio. Despite the drop, their share remained high and amounted to 31.6% of total investment financial assets of the Bank. Government bonds accounted for 66.2% of the Bank’s financial assets and constituted their key element. In December 2014 the face value of Government Bonds was PLN 1,005.4 million and was by PLN 47.9 million (i.e. by 5.0%) higher than at the end of 2013.

Investments in finacial assets (PLN'000)

| 31.12.2014 | 31.12.2013 | Change 2014/2013 | ||

|---|---|---|---|---|

| PLN'000 | % | |||

| Investment financial assets | 1,519,266 | 1,842,036 | (322,770) | (17.5)% |

| available for sale, including: | 1,100,547 | 1,455,018 | (354,471) | (24.4)% |

| State Treasury Bonds | 611,726 | 585,445 | 26,281 | 4.5% |

| Bonds and deposit certificates of banks | 8,866 | 29,740 | (20,874) | (70.2)% |

| Stock | 8 | 8 | - | - |

| Debt instruments issued by the National Bank of Poland | 479,947 | 839,825 | (359,878) | (42.9)% |

| held to maturity, including: | 418,719 | 387,018 | 31,701 | 8.2% |

| State Treasury Bonds | 393,688 | 372,080 | 21,608 | 5.8% |

| Bonds and deposit certificates of banks | 25,031 | 14,938 | 10,093 | 67.6% |

Investment financial assets available for sale with the total nominal value of PLN 1,100.5 million constituted 72.4% of the debt instrument portfolio and the remaining 27.6% were bonds held to maturity with the total face value of PLN 418.7 million.

In its securities portfolio the Bank also holds debt securities issued by other banks, classified to receivables from other banks. In 2014 the value of these securities reached PLN 158.3 million, i.e. by PLN 121.9 million more than in December 2013.

In 2014 interest income on investment financial assets and receivables from other banks amounted to PLN 54.8 million and was by 19.7% lower than in 2013. The decrease resulted from a drop in the balance of investment assets and a reduction in the market interest rates.

A the end of December 2014 the gain/loss on financial instruments measured through profit or loss and gain/loss on foreign exchange transactions amounted to PLN 1.2 million versus PLN 1.7 million reported in 2013, mainly as a result of a drop in the gain/loss on foreign exchange transactions by clients by PLN 0.9 million.

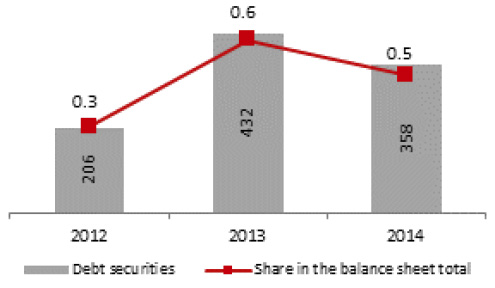

Debt securities (PLN MM)

Share in the balance sheet total (%)

In 2014 gain/loss on other financial instruments amounted to PLN 1.8 million, as compared to PLN 6.0 million in 2013. The performance deterioration resulted from material unpredictable fluctuations in the market environment and significant changes in the structure of securities portfolio aimed at maintaining of the interest rate risk exposure within the accepted limits.

Since 2012 the Bank has consistently built the portfolio of long-term equity and liabilities through issues of own debt securities. At the end of December 2014 they amounted to PLN 358.3 million and had a 4.6% interest in the balance sheet total.

2. Trading Book

In 2014 the gain/loss on financial instruments held for trading and gain/loss on foreign exchange transactions amounted to PLN 1.5 million versus PLN 1.2 million reported in 2013. The Bank generated a higher gain on trade transactions, debt instruments mainly. In 2014, on the currency market, the Bank generated the total gain on own and client transactions under individually negotiated currency transactions of PLN 0.7 million versus PLN 1.8 million in 2013.

At the end of 2014, the Bank concluded transactions denominated in 10 foreign currencies, i.e. the euro, American dollar, fund sterling, Swiss franc, Japanese yen, Canadian dollar, Czech koruna, Swedish krone, Danish krone and Norwegian krone.

The Bank also traded in interest rate financial instruments, mainly in treasury debt securities.

In 2014 the Bank’s trade transactions in the currency and interest rate market (trading in treasury bonds) remained insignificant.

Annual Report 2014 - Bank Pocztowy

Corporate Governance

- Corporate governance: principles and scope of application

- Control system in the process of preparing financial statements

- Entity authorized to audit financial statements

- Shareholding structure and share capital

- Key information regarding Poczta Polska S.A.

- Cooperation with Poczta Polska S.A.

- Investor relations

- By-laws amending principles

- Activities of the corporate bodies of the Bank