Activities in the consumer market

retail banking

1. Consumers1

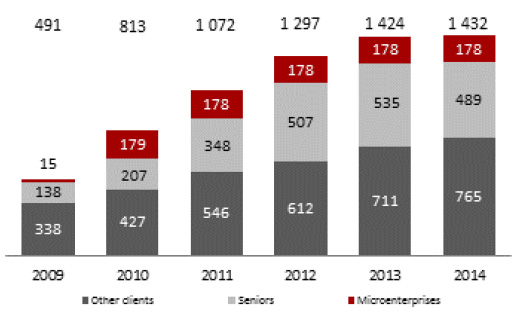

At the end of 2014, services offered by Bank Pocztowy were used by 1,432.3 thousand consumers, i.e. 8.2 thousand more than a year before. A small growth in their number has resulted from the introduction of an account maintenance fee for inactive holders of current accounts, which made them leave the Bank. Over 34% of consumers are elderly people.

In 2014 Bank Pocztowy S.A. acquired over 218.7 thousand new consumers. A group of these individuals was acquired under a wider project of Poczta Polska, Bank Pocztowy and Zakład Ubezpieczeń Społecznych (Social Insurance Institution) encouraging elderly people to accept payments of social security benefits to a bank account.

According to estimates, at the end of September 2014, Bank Pocztowy, with the share of 4.4%2, was seventh best on the market in terms of the number of consumers.

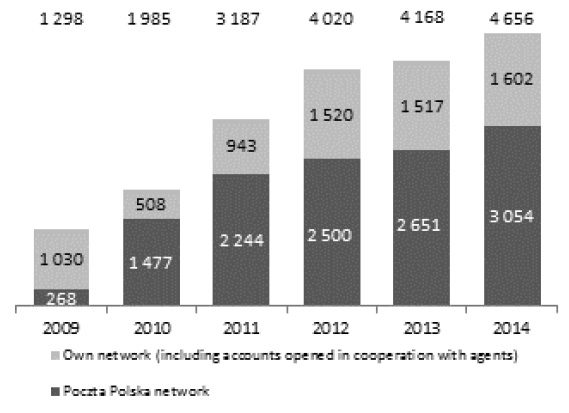

Number of retail clients ('000)

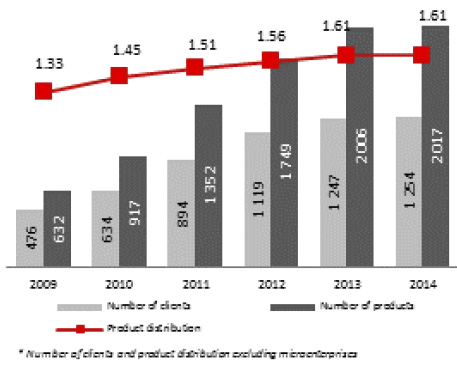

Number of consumers ('000) and product distribution*

The largest group of consumers (1,167 thousand) were current account holders.

2. Development of the product offer for consumers

Bank Pocztowy S.A. prepared a simple and comprehensible offer for consumers including a wide range of credit and deposit products. The Bank also offers insurance and investment products through its distribution channels. The offer covers the following product groups:

- current accounts (Pocztowe Konto Darmowe and Pocztowe Konto Nestor);

- saving accounts (Nowe Konto Oszczędnościowe, Pocztowe Konto Oszczędnościowe);

- term deposits;

- consumer credit (including cash loans for staff of Reduced Credit Risk Employers3, cash loans for elderly people and cash loans for other consumers, including revolving overdrafts);

- mortgage loans (including housing loans, mortgage loans and debt consolidation loans);

- insurance and investment products.

A current account is the key product used for acquiring consumers and the focal point in customer relationships. In order to win new clients, since September 2014, the Bank has introduced a new product, Konto ZawszeDarmowe, with free-of-charge maintenance guaranteed for an unlimited period of time. Konto ZawszeDarmowe has enjoyed significant popularity among clients: in the period from 15 September to 31 December 2014, the Bank opened 72,000 of such accounts.

A current account is the key product used for acquiring consumers and the focal point in customer relationships. In order to win new clients, since September 2014, the Bank has introduced a new product, Konto ZawszeDarmowe, with free-of-charge maintenance guaranteed for an unlimited period of time. Konto ZawszeDarmowe has enjoyed significant popularity among clients: in the period from 15 September to 31 December 2014, the Bank opened 72,000 of such accounts.

At the same time, Pocztowe Konto Standard was withdrawn from the Bank's offer, but the account for pensioners called Pocztowe Konto Nestor has been offered on a continuous basis.

Further, the Bank offers two types of current accounts for microenterprises: Pocztowe Konto Firmowe and Firmowe Konto Oszczędnościowe.

In 2014, the Bank presented the following deposit offer:

- Different interest on Coraz Więcej term deposits opened with and without current accounts, with higher interest on deposits accompanied with an account;

- Promotional interest on newly obtained funds for Pocztowe Konto Oszczędnościowe;

- Product offer extended by Rynek + (18 M and 30m) with interest depending on market rates (WIBID 3M) increased by client’s margin.

In order to use the synergy potential of the Poczta Polska Capital Group entities, the Bank has offered current account holders programs providing benefits from active use of products and services offered by these entities:

In order to use the synergy potential of the Poczta Polska Capital Group entities, the Bank has offered current account holders programs providing benefits from active use of products and services offered by these entities:

- Pakiet Pocztowy (Postal Package) program under which clients are refunded 10% of costs incurred for selected postal services offered by Poczta Polska (mainly packages and letters);

- Pocztowy Program Ubezpieczeniowy (Postal Insurance Program) under which clients are refunded 10% of the insurance premium amount paid from their current accounts held with Bank Pocztowy in relation to insurance policies concluded with Pocztowe Towarzystwo Ubezpieczeń Wzajemnych and co-insured by Sopockie Towarzystwo Ubezpieczeń Ergo Hestia S.A.;

- Pay by link Envelo program for remote clients, under which they are refunded 10% of costs incurred to buy Envelo products through pay by link functionality from their accounts held with Bank Pocztowy.

Further, the Bank implemented a new edition of Aktywny Nestor program promoting active use of debit cards by elderly people. Aktywny Nestor offers refund up to 5% of expenses incurred in pharmacies. The program is dedicated for holders of Pocztowe Konto Nestor.

Responding to clients’ needs, the Bank has extended its lending offer with:

- PIT-based cash loans addressed to clients with employment contracts as an income source. The offer involved temporary acceptance of PIT issued by an employer as a document confirming the amount of generated income.

- An attractive loan consolidation offer aimed at winning clients indebted with other banks. Additionally, in order to improve the processing of consolidation loans, the Bank has revised and simplified its documentation requirements introducing an option to use a consolidation statement instead of the previously required agreements and repayment schedules regarding the consolidated loans.

With regard to microenterprises, the Bank has implemented a new process of selling lending products offered both through Poczta Polska and its own network. Further, Bank Pocztowy has implemented a loan and deposit offer addressed to e-commerce segment clients along with a dedicated sales scenario.

It offers its clients with bancassurance products in cooperation with insurance companies, to include: Pocztowe Towarzystwo Ubezpieczeń Wzajemnych, Aviva Towarzystwo Ubezpieczeń na Życie S.A., Grupa Ergo Hestia, Towarzystwo Ubezpieczeń Europa S.A. and Amplico Life S.A.

Changes in the insurance offer involved:

- Introducing a personal assistance program in the form of Bezpieczny na Bank package ensuring protection of electronic money, personal documents and mobile communication tools should they be lost, stolen or used by unauthorized individuals;

- Modification of the accidental insurance product involving an increase in the sum insured for each risk type and a growth in the base amount.

- Offering legal insurance products in the insurance outlet (the Bank’s website enabling the Bank’s clients to compare products and make a purchase).

- Extending the life insurance offer with Wsparcie dla Bliskich, offered to clients aged up to 85 with a different sum insured and premium amount.

- Introducing life insurance for mortgaged loan holders.

- Extending the offer with a package property insurance product protecting against a variety of risks depending on the selected option: option I is dedicated to elderly people who have retired, while option II is dedicated to people who are still working.

The Bank has continued works to introduce the following products to the bancassurance offer: insurance package to the Standard and Nestor current accounts and assistance services.

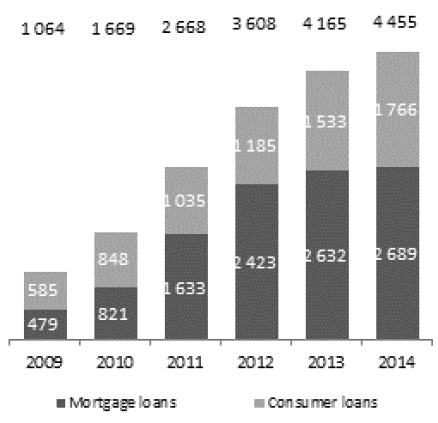

3. Credit operations

At the end of 2014 gross credit receivables of Bank Pocztowy from consumers totaled PLN 4,454.7 million versus PLN 4,165.2 million in December 2013 (a 7.0% increase). The Bank’s share in credit receivables from consumers of the banking sector amounted to 0.9%4.

Gross loans of Bank Pocztowy S.A. - retail segment (PLN'000)

| 31.12.2014 | Structure (31.12.2014) |

31.12.2013 | Structure (31.12.2013) |

Change 2014/2013 | ||

|---|---|---|---|---|---|---|

| PLN'000 | % | |||||

| Gross loans, including: | 4,454,674 | 100.0% | 4,165,192 | 100.0% | 289,482 | 7.0 % |

| Mortgage loans | 2,689,295 | 60.4% | 2,632,211 | 63.2% | 57,083 | 2.2 % |

| Consumer loans | 1,765,379 | 39.6% | 1,532,981 | 36.8% | 232,398 | 15.2 % |

Source: management information of the Bank. The data present the principal amount only. Default interest, due and undue interest, commissions, other prepaid expenses and revenue, other restricted revenue and interest and other receivables were not included.

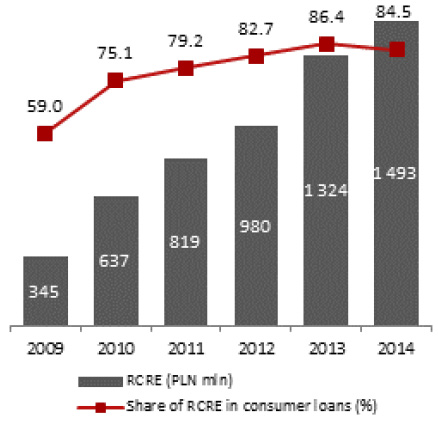

In 2014 the Bank dynamically acquired new consumer loans. At the end of December 2014 receivables due to such products reached PLN 1,765.4 million, i.e. by 15.2% more than a year before. In 2013 the Bank sold consumer loans with the value of PLN 869.0 million. In the consumer loan portfolio the Bank focuses on low-risk facilities for Reduced Credit Risk Employers (RCRE), which constituted 84.5% of the entire portfolio in December 2014.

Gross value of retail loans (PLN MM)

Value of loans to Reduced Credit Risk Employers

Mortgage loans remain a large portion of the portfolio. As at 31 December 2014, the Bank’s receivables due to mortgage loans reached PLN 2,689.3 million and were by 2.2% higher than in December 2013.

In 2014 the Bank, offering local currency loans only, extended PLN 204.6 million of mortgage loans, i.e. by 37.1% less than in 2013, when the sales reached PLN 325.4 million. The decrease resulted from the strategy followed. Due to limited capital, the Bank focuses on the sale of products with the highest profitability considering their effect on the capital, which implies promoting the sale of cash loans and stable sales of mortgage loans.

Spółka Dystrybucyjna is at present the only distribution channel for mortgage loans. The key distribution channels are own sales network and the offices of Poczta Polska.

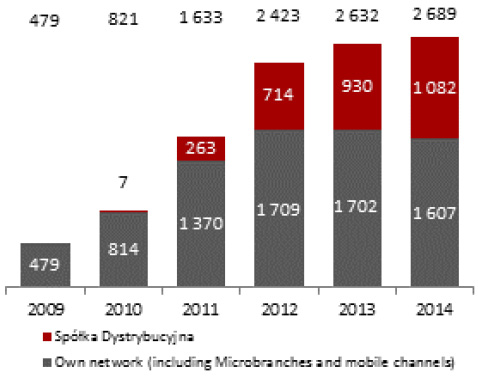

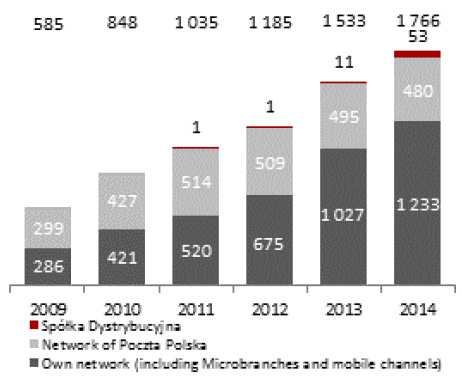

Value of mortgage loans per sales channel (PLN MM)

Value of consumer loans per sales channel (PLN MM)

4. Deposits

In 2014 the Bank adjusted the speed of developing its deposit base to credit needs, including optimization of the funding costs. In December 2014 consumers deposited in the Bank the total of PLN 4,656.2 million versus PLN 4,168.2 million at the end of December 2013 (a 11.7% growth). Consequently, the Bank's share in consumer's

deposits market reached 0.8%5.

Deposits of Bank Pocztowy S.A. - retail segment (PLN'000)

| 31.12.2014 | Structure (31.12.2014) |

31.12.2013 | Structure (31.12.2013) |

Change 2014/2013 | ||

|---|---|---|---|---|---|---|

| PLN'000 | % | |||||

| Client deposits including: | 4,656,169 | 100.0% | 4,168,158 | 100.0% | 488,011 | 11.7 % |

| Current accounts | 1,036,810 | 22.3% | 802,423 | 19.2% | 234,388 | 29.2% |

| Saving accounts | 1,332,618 | 28.6% | 1,494,557 | 35.9% | (161,939) | (10.8)% |

| Term deposits | 2,286,741 | 49.1% | 1,871,178 | 44.9% | 415,564 | 22.2 % |

Source: management information of the Bank. The data include only the principal balance, without accrued interest.

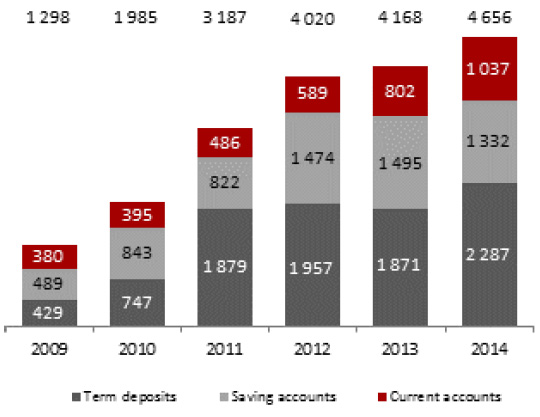

In 2014, the Bank focused on enhancing of a stable deposit base. At the end of December, term deposits of consumers reached PLN 2,286.7 million and were PLN 415.6 million higher than in December 2013.

Thanks to an offer including attractive products, in December 2014 the Bank collected PLN 628.6 million in the form of long-term deposits compared to PLN 616.0 million in December 2013.

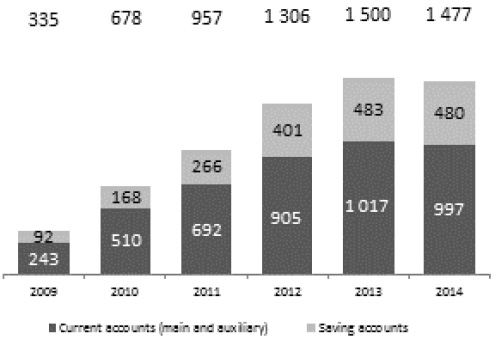

In 2014, the balance of cash on consumer current accounts increased as well, to reach PLN 1,036.8 million at the end of December 2014 (29.2% more than in December 2013). At the end of December 2014 Bank Pocztowy managed 997.4 thousand current accounts of consumers and microenterprises.

Number of current and saving accounts ('000)

Deposits of retail clients (PLN MM)

Deposits of retail clients by sales channel (PLN MM)

Following a decrease in interest rates, clients were less interested in saving accounts, whose interest dropped from 2.2% at the end of 2013 to 1.7% in December 2014. Funds collected on saving accounts at the end of December 2014 amounted to PLN 1,332.6 million and were PLN 161.9 million lower than at the end of 2013.

In December 2014, 65.6% of funds deposited with Bank Pocztowy came from consumers and were collected through Poczta Polska network, exceeding the closing balance of 2013 by 2.0 p.p.

5. Investment products

Aiming at extension of offer for consumers, in 2014 the Bank focused on investment product strategy. In March 2014 the Bank decided to get involved in sales of investment fund participation units. As a result of a procedure performed, the Bank selected Ipopema Towarzystwo Funduszy Inwestycyjnych as its strategic partner to supply the Bank and Poczta Polska network with an investment fund offer and then to build white label funds under the Bank’s brand.

At the same time, the Bank developed its selling and processing competencies regarding sales of structured products (Światowi Giganci structure) and unit-linked insurance (Złote Jutro) preparing the sales network and clients for the next step in development of its investment product offer to include commencing sales of investment fund participation units early in 2015.

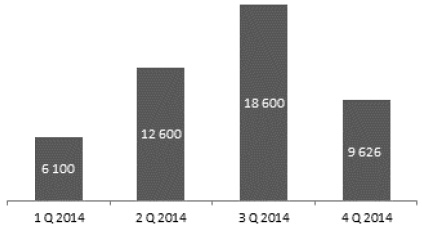

Sales of structured deposits - Światowi Giganci

gross premium amount (PLN'000)

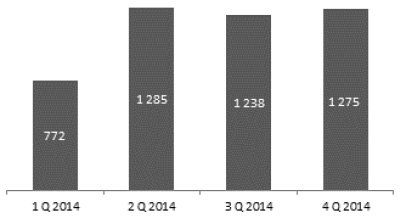

Sales of investment program - Złote Jutro

gross premium amount (PLN'000)

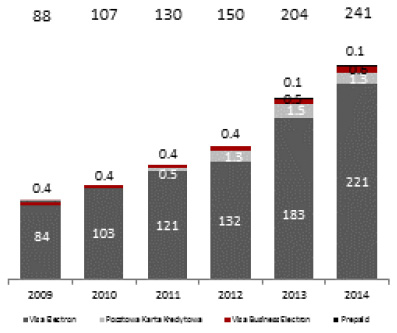

6. Bank cards

Bank Pocztowy offers the following types of bank cards to consumers:

- Visa Electron debit cards issued to personal accounts and saving accounts,

- Postal Visa Credit Cards,

- MasterCard debit and credit cards (introduced in December 2014);

- Zasilacz pre-paid cards.

Number of cash cards for retail clients ('000)

Major changes in the payment card offer of the Bank:

- Debit cards. In 2014 the Bank continued with the key components of the offer, i.e. eliminating the fee for the card upon conclusion of card transaction for PLN 200 for Nestor account and PLN 300 for ZawszeDarmowe and Standard accounts. As a result, in 2014 the value of non-cash debit card transactions concluded by the Bank’s clients doubled. Also, the value of cash transactions on debit cards grew nearly twice. The number of actively used debit cards also increased by 44,000 year to year. Aiming at further increase in the use of cards, the Bank introduced an option to buy a monthly prescription allowing charge-free cash payment from all ATMs around the world. MasterCard debit cards introduced in December 2014 allow clients concluding transactions through Internet and on the phone.

- Postal Credit Cards. In September 2014 the Bank introduced two new credit card images dedicated to all new clients: a white card and a black card.

By the end of December 2014 Bank Pocztowy S.A. issued 241.2 thousand payment cards for consumers (i.e. by 18.3% more than at the end of 2013), including 221.2 thousand debit cards (i.e. by 21% more than a year before) and 12.7 thousand credit cards.

Index:

1 In 2014 the microenterprise segment was moved from institutional banking to retail banking. At present, retail banking has included consumers and microenterprises. All financial data for previous years have been brought to comparability in accordance with the current segmentation.

2 Source: PRNews.pl Number of clients in banks, Q3 2014, 9 December 2014.

3 Reduced Credit Risk Employers include: the Police, city authorities, fire stations, public healthcare units, companies listed at the WSE and companies from the Poczta Polska Capital Group.

4 Source: WEBIS data for Bank Pocztowy, data of the National Bank of Poland for Monetary receivables and liabilities of financial institutions, December 2014 for the banking sector.

5 Source: WEBIS data for Bank Pocztowy, data of the National Bank of Poland for Monetary receivables and liabilities of financial institutions, December 2014 for the banking sector.

Annual Report 2014 - Bank Pocztowy

Corporate Governance

- Corporate governance: principles and scope of application

- Control system in the process of preparing financial statements

- Entity authorized to audit financial statements

- Shareholding structure and share capital

- Key information regarding Poczta Polska S.A.

- Cooperation with Poczta Polska S.A.

- Investor relations

- By-laws amending principles

- Activities of the corporate bodies of the Bank