Human resources management

Pocztowy's employees

1. Headcount and employment structure

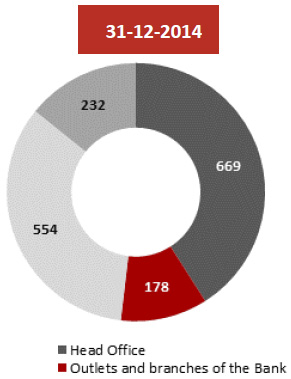

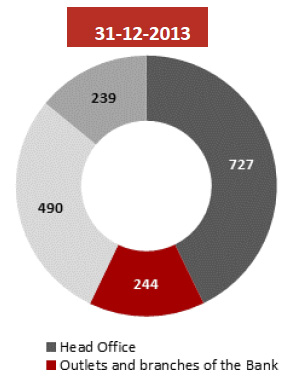

As at 31 December 2014, the Group had 1,633 FTEs vs. 1,700 FTEs at the end of 2013 (a decrease by 67 FTEs).

As at 31 December 2014, the Bank had 1,401 FTEs vs. 1,561 FTEs at the end of 2013 (a decrease by 60 FTEs). The headcount reduction resulted mostly from the optimization processes implemented in the Head Office of the Bank, aimed at adjusting the employment and organizational structure of the Bank to the current strategy.

Headcount in Bank’s subsidiaries was 232 FTEs including 10 FTEs in Spółka Dystrybucyjna and 22 FTEs in Centrum Operacyjne. During the year, the employment was reduced by 7 FTEs.

At the end of 2014, the Bank employed 1,417 people:

- Most of the employees (1,011) were female;

- The average age of an employee was 36;

- The average length of service with the Bank was four years;

- All employees were university or college graduates: 67% held university diplomas including 8% that completed post-graduate studies

2. Training and development

Training and development policy in 2014 reflected the business strategy adopted by Bank Pocztowy and included requirements of supervisory institutions. Training and development focused on extending and developing managerial competencies, key business development skills and specialist competencies supporting business efficiency improvement.

In 2014 the Bank commenced a series of efficiency improving measures:

- Building new corporate culture: workshops and consultations aimed at modification of the Bank Pocztowy Group’s corporate culture. In 2014, two workshops were carried out for the Management Board and one for high level managerial staff (37 participants). The meetings were supported by an external training and consulting company.

- Employee Survey: progressing preparation for the first employee involvement survey in Bank Pocztowy and Centrum Operacyjne was a response to the new business strategy adopted by the Group. The survey was held from 12 to 23 January 2015. Its purpose was to develop organization by providing work conditions that support employee involvement. A research and consulting firm cooperated on preparation and carrying out of the survey.

Development programs and training for managerial staff:

- Development program for key managerial staff, dedicated to the professional team of key managers built in 2012 with the purpose to improve the strategic competency level. Development initiatives carried out in 2014 included workshops aimed at preparing of business strategy for 2014-2017. The program gave its participants opportunities to develop top level competencies. The program included 35 high level managers.

- ”EkstraKLASA Menedżerów” comprehensive development program for managerial staff in the Bank’s sales network. Its key purpose is to improve business efficiency of participants through:

– Standardization of managerial competencies in the retail network;

– Identification of individual leadership styles and methods to improve personal efficiency;

– Providing practical tools and solutions to allow effective leading of teams and people in continuous change environment.

The program was commenced in 2013 with an in-depth diagnosis of training needs. In 2014 four modules consisting of two-day training each were performed to improve key managerial skills. The program includes evaluation to be carried out in 2015 with regard to competencies and business indicators. It covers approx. 60 managers. - “Mentoring and Succession in Bank Pocztowy” development program for successors, replacements and key individuals (mentors) in the Head Office (continuation). The project purpose was to ensure replacement of most crucial employees with unique competencies and gradual preparation of their successors to take over key positions. Further, the program provided tools to enhance managerial competencies through managerial mentoring, during which key talents appointed their successors or replacements and acted as their mentors, sharing professional knowledge, experience and good practices, as well as providing expert mentoring, whereby directors appoint key talents mentors in order for them to share their knowledge with employees designated as their trainees. The mentoring process has a cyclical, annual nature. In 2014 it was continued by 115 individuals. Human Resources Management Department prepared three soft skills training modules for the group: “How to be an efficient team member”, “How to teach efficiency and self-management in a team”, and “Assertive communication”. The training included the total of 105 participants.

- Managerial workshops dedicated to the entire managerial staff of Bank Pocztowy, carried out in June 2014. Their purpose was to present the new business strategy and work together on its efficient implementation. They gathered approx. 140 participants.

- “Cascading objectives in the MbO system” workshop dedicated to all managers in Bank Pocztowy working based on the MbO (Management by Objectives) system. The purpose was to support managers in defining goals and tasks providing an efficient response to initiatives included in the new business strategy and its key implementation factors developed in the course of managerial workshops. The workshop was delivered by employees of HR Management Department in Bank Pocztowy in July 2014. It included approx. 70 trainees.

- Labor law workshop carried out in 2014 under the training and development policy, mainly for retail sales network managers. The purpose of the training was to improve knowledge regarding practical application of labor law, also with regard to the personnel policy adopted by Bank Pocztowy. It included approx. 60 managers. The workshop was delivered by a labor law expert of HR Management Department in Bank Pocztowy.

Additionally, under the managerial competencies improvement projects, training was continued with regard to employee evaluation based on CREDO1 value code for all new managers in Bank Pocztowy and to efficient recruitment, dedicated mainly to retail sales network managers.

Training improving business efficiency:

- Inception training dedicated to 494 new hires, including the Bank’s product offer, IT systems and professional sales techniques on the basic and advanced level.

- Additional training regarding new products offered by the Bank and authorizing to perform specific banking transactions.

- Business workshops: ”Gala Filmowa Banku Pocztowego”. These are annual meetings of retail banking employees. In 2014, they were participated also by representatives of institutional banking, treasury and business support. Their purpose was to enhance business cooperation and present key business initiatives for 2015. Their participants could demonstrate their skills, among others creativity, teamwork and courage in taking new art challenges. During the event, business performance in 2014 was summarized.

- Individual training extending the professional knowledge regarding Treasury and enhancing analytical skills.

- A group training program dedicated to employees of pre-collection, call center and risk management units. The purpose of the group training was to enhance the skills of pre-collection client service. In 2014, six training sessions were delivered for approx. 100 participants.

Training improving IT efficiency:

- Individual and group training supporting IT security skills, which gathered approx. 30 participants.

- Project management training dedicated mostly to IT, business and business support employees, which included three groups of trainees in 2014, in total approx. 51 participants.

- Training enhancing the understanding of Recommendation D and supporting IT team efficiency, performed for all IT Function staff and their key clients, i.e. business representatives. It gathered approx. 95 participants.

Training improving finance efficiency

- Training enhancing specialist skills regarding MS Excel and VBA;

- Training extending knowledge of IAS;

- Training extending knowledge of tax related issues.

Other training initiatives:

- Individual development: employees who won the highest scores during CREDO-based individual performance assessment have been included in the training and development program. They were awarded with packages of individual development measures. Additionally, individual support in the form of training, conferences, seminars and post-graduate studies included new retail banking trend, marketing, risk, internal audit, HR Management Department, foreign languages and good practices in implementation of external regulations.

- Individual coaching: the purpose of the project was to enhance individual professional development of participants of “Mentoring and Succession" program. The project was performed in Q2 2014 and included 65 participants, each of which could take four sessions.

- E-learning courses for 3,229 people (employees of Bank Pocztowy) including security, banking secret, AML, personal data protection, ethics, quality standards, MiFID, CRM, audit and internal control, as well as Bank’s product offer. The year 2014 was the first to include Poczta Polska employees in e-learning sessions (they were attended by 6,003 employees of Poczta Polska).

- Obligatory training imposed by the law, e.g. by Labor Law, Banking Law, OHS, personal data protection.

- Training for the Poczta Polska Capital Group: in 2014, in cooperation with Poczta Polska's internal trainers, product and sales training was carried out for Poczta Polska employees. In 2014, 221 Poczta Polska employees were trained on Front-End pilot implementation in Poczta Polska.

- “Witamy w Pocztowym” training program dedicated to new hires, introducing the mission, vision, processes and principles adopted by the Bank. The training includes also introduction to IT systems and practical information useful in the first weeks of working at the Bank.

In 2014, Centrum Operacyjne employees participated in a number of training sessions and seminars, the most important of which were:

- Akademia Strategicznego Przywództwa (Strategic Leadership Academy);

- Polskie Forum Outsourcingu (Polish Outsourcing Forum);

- Time management;

- Internal Audit Methodology and Internal Control;

- Discipline and cooperation in employee teams;

- Back Office Operations Forum;

- CSR including assistance to kids from children's homes and foundations.

Since November 2014, a project co-funded by County Labor Office (National Training Fund) was commenced for employees aged 45+, aimed at improvement of their productivity and efficiency and including banking, IT and process knowledge.

3. Incentive system

In order to ensure smooth achievement of business objectives and improve organizational potential to achieve them in future, in 2014 the Bank used the Management by Objectives system introduced in 2011. Along with cascading and participational determining of objectives, it has been used to determine individual objectives of the managerial staff. Additionally, focusing on key objectives allows mobilization and preparing the Bank for achieving of stretch goals (including finance) in rapidly changing business environment. Implementing of MbO assumptions contributes also to improving of productivity and competencies of employees, providing incentives and involvement in the performance of tasks aimed at strategic objectives.

Objectives for 2014 were determined based on:

- Bank Strategy 2014-2017;

- Initiatives of Bank’s business lines developed during managerial workshops;

- Pending business initiatives.

The objective defining process was participated by managers and appointed employees of the Bank, except of the sales network included in a commission-based remuneration system. Individual goals were determined during workshops delivered by HR Management Department and Managing Directors.

The process of determining and cascading objectives followed the existing MbO methodology. According to this methodology, the objectives had to bring actual valuable change to the organization and to be measurable with business, quality and executive ratios with clearly defined algorithmic accountability.

This year, during MbO process, special focus was placed on aligning the planned objectives with the expected Bank’s performance. The adopted assumptions were reflected in Individual Objective Lists.

The business aspect was stressed also for other initiatives expressed in the form of objectives, and reflected in business ratios determining the legitimacy of each objective from the economic viewpoint.

Due to material changes in macroeconomic environment and rapid changes in the organization, a review of objectives was held in November 2014 in order to verify the contracted objectives and motivate employees to improve productivity during the last weeks of the year. The review took the form of individual consultations carried out by HR Management Department with Managing Directors.

As a result, determined objectives were as much as possible focused on improved work efficiency and Bank’s performance with special attention to changes in the macroeconomic environment and the current standing of the Bank.

“Principles of granting bonuses to field employees and selected members of managerial staff in Sales Network Management Department, Business and Sales Development Function in Bank Pocztowy S.A.” were introduced in 2012 to better motivate sales network employees.

In 2014, under the continuous incentive program for sales network employees, consistently encouraged to improve sales performance, the commission system was modified month to month to trigger sales in specific product groups. Each product included in the sales plan of the network employees has been assigned specific weight. Depending on the performance vs. plan, individual product weights are translated into the monthly commission amount.

In July 2014, a professional development path dedicated to the sales network employees was introduced. It allows continuous professional development beginning from Junior Advisor/ Account Manager all the way through Advisor/ Account Manager and Senior Advisor/ Account Manager. Employees can be promoted every six months if specific criteria are met. Additionally, in each stage of the development path, they can improve their sales and product related qualifications through dedicated training.

4. Management remuneration policy

In 2014 Bank Pocztowy maintained the previous management remuneration policy based on the existing internal regulations, i.e. “Principles of Remunerating Employees of Bank Pocztowy S.A." and for the variable portion of compensation, "Principles of Granting Bonuses to Management of Bank Pocztowy S.A." according to MbO methodology and CREDO evaluation system.

Adjusting its policy to the requirements of PFSA Resolution no. 258/2011, the Bank applies the principles of determining variable compensation components of individuals holding managerial positions in the Bank (the Policy).

The basis to grant an individual a variable compensation, including the deferred portion of such compensation, and to determine the total amount of the variable compensation applicable to qualifying individuals includes:

- Assessing an individual's performance vs. individual goals planned for the year subject to evaluation;

- Financial performance of the Bank for the last financial year;

- Performance of the cost budget;

- Financial profit/sales plan performance.

Determination of the variable compensation portion includes also a non-financial criterion, i.e. assessment of compliance of attitudes and behavior of an employee with the CREDO value system adopted by the Bank. The performance assessment underlying the entitlement to the variable compensation covers three years, to include the Bank’s business cycle and risk related to its business operations.

In 2013 the Policy of granting and deferring the variable compensation for 2012 for management staff was introduced in 2013. According to the Policy, the variable compensation is deferred and at least 50% of its amount is paid in phantom stock entitling to cash receipt. 40% of the variable pay (annual bonus) was deferred. In 2014, upon a decision of the Supervisory Board, the first portion of the deferred variable compensation was paid out.

5. Additional benefit packages

For years, Bank Pocztowy has provided its employees with a large package of additional benefits, to include:

- Comprehensive health care: a broad range of private health care services for all employees with an option to extend it to their family members on preferential terms;

- Sports and entertainment: employees can use a program supplied by Benefit Systems Sp. z o.o. MultiSport cards allow access to sports facilities around the country. Further, each employee can buy additional cards for children and a partner on preferential terms, under an agreement concluded between the Bank and Benefit Systems Sp. z o.o.;

- MultiBenefit rebate program performed in cooperation with Benefit Systems Sp. z o.o.: Employees may do shopping with a preferential rebate and use different forms of entertainment, such as movies, theater and weekend outings, booking through an Internet platform;

- Employee Pension Plan (EPP) significantly contributing to safe financial future of employees due to the growing need to accumulate capital for future pension benefits.

5. IT in HR processes

In 2014 the work under the project “IT tool supporting HR management processes" was continued. The tool, known in the Bank as KARO HR, is to sort out and simplify staff and training management processes and streamline personnel evaluation and goal settlement with MbO. Further, a recruitment automation module has been implemented.

Easier access and data flow among employees, managers and HR Management Department with regard to personnel data management allowed replacing paper versions of certain documents (e.g. annual leave application, personnel evaluation forms or training applications) with computer files. In 2014, KARO HR was extended with new functionalities. A module allowing employees access to their payroll data was implemented, and the pay slip was replaced with a computer file (which allows an employee downloading the file on the day following the payment date). Also, the 360 Assessment process has been given an electronic form2.

Index:

1 CREDO value code includes the value system of Bank Pocztowy as determined in its strategy, indicating desirable attitudes and behavior presented by employees in process of achieving professional objectives that allow the expected performance level.

2 360o assessment: a multi-dimensional evaluation allowing comparison of employee’s self-assessment with those made by colleagues (supervisors and subordinates).

Annual Report 2014 - Bank Pocztowy

Corporate Governance

- Corporate governance: principles and scope of application

- Control system in the process of preparing financial statements

- Entity authorized to audit financial statements

- Shareholding structure and share capital

- Key information regarding Poczta Polska S.A.

- Cooperation with Poczta Polska S.A.

- Investor relations

- By-laws amending principles

- Activities of the corporate bodies of the Bank