Significant events in the Capital Group in 2014

clients of Bank

Pocztowy

1. Growing client base

At the end of 2014 Bank Pocztowy had the total of 1,447.7 thousand clients, including:

- 1,254.4 thousand of individuals vs. 1,246.5 thousand at the end of 2013;1 254,4 tys. klientów indywidualnych wobec 1 246,5 tys. na koniec 2013 roku,

- 177.9 thousand microenterprises, which is comparable to the prior year;177,9 tys. mikroprzedsiębiorstw - liczba klientów porównywalna do roku poprzedniego,

- 15.4 thousand other institutional clients (small and medium enterprises, public sector entities, public benefit institutions). The number of the Bank’s clients in the segment slightly decreased.

Following the Bank’s actions aimed at stimulating customers to use banking services, such as an introduction of fees for clients who do not use their accounts, an insignificant number or current account holders who did not use their accounts left the Bank. The continuing growth in the number of clients accompanied with closures of inactive accounts has confirmed the efficiency of the Bank’s policy regarding its product offer. The policy is based on offering simple, user-friendly products and avoiding complicated procedures and incomprehensible communication.

2. Record net profit in Group’s history

In 2014 the Bank Pocztowy Capital Group generated a net profit of PLN 43.6 million, i.e. 21.1% higher than the profit generated in 2013. The significant profit growth resulted from a very good performance of the parent entity. In 2014, net profit of Bank Pocztowy reached PLN 48.6 million and was the highest in 25 years of its business operation.

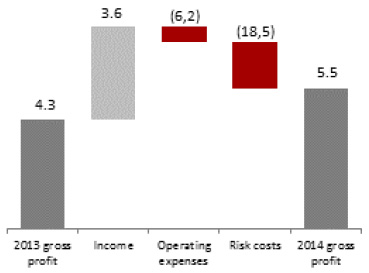

Key factors determining the financial profit or loss of the Group in 2014:

- Rapid income growth (to include revenue and expenses related to other operations). They reached PLN 334.8 million and increased by 12.2% year to year. In the environment with record low interest rates, net interest income increased by 10.0% thanks to a significant growth in new loans extended to consumers. As a result of amending the “Fee and Commission Scheme” in September 2013, introducing fees for current accounts for inactive clients, the profit on feesand commissions reached PLN 59.7 million, being 43.3% higher than in the prior year.

- Maintaining the cost discipline accompanying further growth of the sales network. In 2014 operating expenses reached PLN 218.6 million and were 2.8% higher than in 2013.

- An increase in impairment loss from PLN 42.2 million in 2013 to PLN 61.0 million (by 43.9%) resulting from recognizing impairment losses on loan receivables. The losses were recognized mostly for consumer loans with relatively high risk cost. Focusing sales on the consumer loan market has resulted from

assumptions adopted in the new strategy of the Bank.

Group's gross profit in 2014 (PLN MM)

As a result of an income growth and cost discipline the cost/income ratio improved and amounted to 65.3% in 2014, i.e. was by 6.0 p.p. lower than in 2013.

In 2014 ROE at year-end was 10.5% and was 0.9 p.p. higher than in the prior year. Net ROA in 2014 reached 0.6% vs. 0.5% in the prior year.

The good financial performance allowed the Group’s improving its capital adequacy ratio. As at 31 December 2014 the solvency ratio amounted to 13.4% compared to 12.9% in December 2013. Tier 1 capital ratio of the Group was also good and amounted to 10.1% at the end of 2014. Capital adequacy ratios remained high and exceeded the minimum level recommended by the supervising authority.

Financial performance of the Bank Pocztowy S.A. Capital Group

| 2014 | 2013 | Change 2014/2013 |

|

|---|---|---|---|

| Operating income1 (PLN'000) | 334,780 | 298,396 | 12.2 % |

| Operating expenses (PLN'000) | (218,622) | (212,738) | 2.8 % |

| Profit/loss before risk costs (PLN’000) | (216,608) | (210,725) | 2.8 % |

| Net impairment losses (PLN’000) | (61,013) | (42,398) | 43.9 % |

| Gross profit (PLN ‘000) | 55,145 | 43,260 | 27.5 % |

| Net ROA (%) | 0.6 | 0.5 | 0.1 p.p. |

| Net ROE (%) | 10.5 | 9.6 | 0.9 p.p. |

| Cost/Income ratio (%) | 65.3 | 71.3 | (6.0) p.p. |

| CAR (%) | 13.4 | 12.9 | 0.5 p.p. |

| Tier 1 (%) | 10.1 | 9.7 | 0.4 p.p. |

1 Income including profit on other operating activities.

3. Increase in loans granted to individuals

At the end of December 2013 the total gross loans and advances to customers granted by the Bank Pocztowy Group amounted to PLN 5,325.7 million and increased by PLN 145.2 million (2.8%). The Group had a 0.5%1 share in credit receivables from the banking sector clients.

Loans and advances granted to clients of the Bank Pocztowy S.A. Capital Group (PLN’000)

| 31.12.2014 | Structure (31.12.2014) |

31.12.2013 | Structure (31.12.2013) |

Change 2014/2013 | ||

|---|---|---|---|---|---|---|

| in PLN’000 | % | |||||

| Loans and advances granted to customers (gross) | 5,325,685 | 100.0% | 5,180,504 | 100.0% | 145,181 | 2.8 % |

| Individuals | 4,423,563 | 83.1% | 4,143,207 | 80.0% | 280,356 | 6.8 % |

| Institutional clients | 598,760 | 11.2% | 680,683 | 13.1% | (81,923) | (12.0)% |

| Self-government bodies | 303,362 | 5.7% | 356,614 | 6.9% | (53,252) | (14.9)% |

| Impairment losses on receivables | 173,908 | - | 124,792 | - | 49,116 | 39.4 % |

| Net loans and advances | 5,151,777 | - | 5,055,712 | - | 96,065 | 1.9 % |

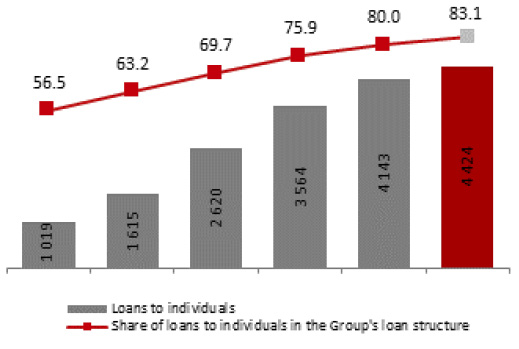

In 2014 the Group took steps to optimize its balance sheet structure and increase the share of highly profitable assets. At the end of December 2014 receivables arising from loans and advances granted to individuals amounted to PLN 4,423.6 million and grew by 280.4 million (i.e. by 6.8%) versus the end of 2013. The growth resulted from a growth in the number of new consumer loans, which amounted to PLN 1,925.8 million and grew by 11.8% in 2014.

Following the loan policy adopted, the change in the Group’s credit exposure structure followed the changes observed in recent years. First of all, the share of loans and advanced to consumers, i.e. of the largest group in the structure, increased. At the end of 2014 such exposures accounted for 83.1%, i.e. were by 3.1 p.p. higher than the previous year.

Loans granted to individuals (PLN MM)

Share in the Group's loan structure (%)

Loans granted to individuals (PLN MM) Share in the Group's loan structure (%)

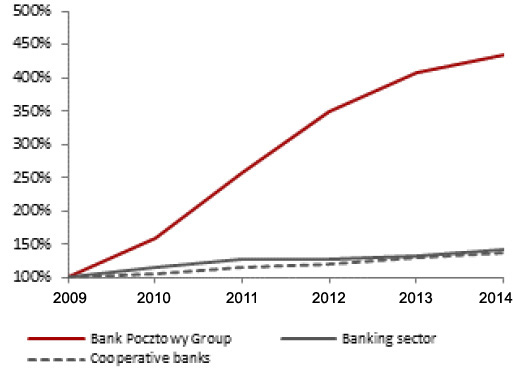

Growth in loans granted to individuals

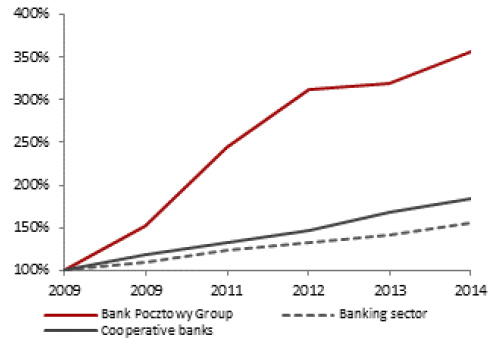

(2009=100)

Growth in loans granted to individuals (2009=100)

The growth in loans and advances to consumers in the years 2009-2014 was much higher than in the entire banking sector and in the group of cooperative banks. The average annual growth rate of the discussed loans in the analyzed period amounted to 34.1% vs. 7.22% growth in the banking sector and 6.73% growth in the group of cooperative banks.

4. Increase in consumer deposits

At the end of December 2014 liabilities of the Bank Pocztowy Capital Group to clients totaled PLN 6,492.0 million versus PLN 6,230.6 million at the end of 2013 (a 4.2% increase). The Group had a 0.7%4 share in credit liabilities to the clients.

Liabilities to clients of the Bank Pocztowy S.A. Capital Group (PLN ‘000)

| 31.12.2014 | Structure (31.12.2014) |

31.12.2013 | Structure (31.12.2013) |

Change 2014/2013 | ||

|---|---|---|---|---|---|---|

| in PLN'000 | % | |||||

| Liabilities to clients | 6,492,023 | 28.4% | 6,230,578 | 33.3% | 261,445 | 4.2 % |

| Consumers | 4,650,326 | 71.6% | 4,157,171 | 66.7% | 493,155 | 11.9 % |

| Institutional clients | 1,783,872 | 27.5% | 1,974,662 | 31.7% | (190,790) | (9.7)% |

| Government agencies and self-government bodies | 57,825 | 0.9% | 98,745 | 1.6% | (40,920) | (41.4)% |

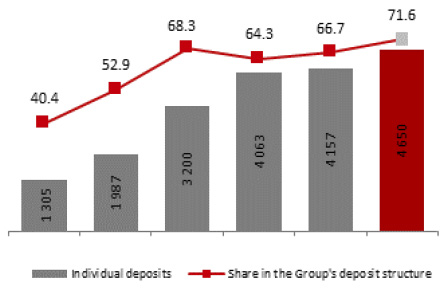

In 2014 deposits of consumers grew in the Group up to PLN 4,650.3 million versus PLN 4,157.2 million at the end of 2013 (a 11.9% growth).

Deposits of consumers (PLN MM)

Share on the Group's deposit structure (%)

Growth in liabilities to consumers (2009=100)

The average annual growth in consumer deposits compared to those obtained by the Bank Pocztowy Group in the years 2009-2014 amounted to 28.9%. The average annual growth in liabilities to consumers in the entire banking sector in the same period was 9.45% and 13.16% in the group of cooperative banks.

In the recent years, stable deposits of consumers accounted for two thirds of the total value of deposits.

5. Bank Pocztowy Development Strategy 2014-2017

|

1.5 MM current accounts

2017

|

60% C/I

2017

|

15% consolidated net

ROE 2017

|

On 9 June 2014, the Supervisory Board of the Bank approved the “Strategy of Bank Pocztowy S.A. for 2014-2017” which adjusted the direction and pace of Bank’s development to current conditions, allowing its further rapid growth and consistent profitability improvement. According to this strategy, the Bank has focused its operations on development of retail banking, i.e. acquisition of consumers and microenterprises. The strategic governing objective is to be the banking leader on the regional level, a multi-channel bank that educates its clients not only about finance, but also about the use of remote banking.

The Bank’s mission includes simple and accessible banking. The Bank shall continue:

- Providing comprehensible financial services and products adjusted to clients’ needs, friendly environment, clear procedures and understandable communications;

- Offering financial services at affordable prices in the largest access network, through Poczta Polska outlets, Bank’s outlets and remote channels.

The Bank’s vision includes three key areas:

- Being the retail banking leader on the regional level. The Bank is the leading supplier of services in Polish regions, providing full access to financial services countrywide, regardless of the size of human settlements.

- Being a multi-channel bank educating its clients about finance and the use of remote banking. The Bank offers its clients support in all finance-related issues in a manner adequate to their needs and knowledge. It teaches them benefits resulting from Internet and phone contacts with banks.

- Being a competency center of the Poczta Polska Capital Group with regard to banking services and bancassurance. With substantial banking experience, the Bank can efficiently win clients and its offer has been appreciated by opinion-makers.

According to the new strategy, key strategic objectives for 2014-2017 include:

| KEY FINANCIAL OBJECIVES 2017 |

Increase efficiency | 15% ROE |

|---|---|---|

| Improve productivity | 60% C/I | |

| BUSINESS OBJECTIVES 2017 | Increase the number of accounts | 1.5 MM current accounts |

| Bank Pocztowy to become a leader on the domestic regional level | ||

These strategic objectives are to be achieved among others through:

- Developing remote access channels (a new www platform, mobile banking, Contact Center as the key channel allowing clients reaching the Bank);

- Changing the Bank’s visual identity and brand repositioning;

- Further development of IT: implementing and developing tools that support sales and client service in Poczta Polska;

- Completing the extension of Microbranches;

- Gradual improvement of sales and client service processes.

Further, the Bank shall extend its offer with investment products adjusted to the needs of its key client segments.

Strategic partnership with Poczta Polska shall remain crucial for its strategy, as cooperation between the Bank and Poczta Polska is its key pillar. The Bank shall continue offering its comprehensive services to the Poczta Polska Capital Group. At the same time, the Bank wants to be the competency center and supplier of financial services including banking services, bancassurance and investment products in the Poczta Polska Capital Group. Projects involving development and improved efficiency of IT tools supporting sales in Poczta Polska outlets will be continued.

In order to improve its competitive position, the Bank is going to focus on further growth of e-distribution and e-service channels and IT in the nearest three years. The purpose is to make most clients use remote communication channels within the strategic horizon. Therefore, financial education of clients, now including also benefits of remote banking, has remained a crucial element of the Bank's mission.

Along with the adoption of the new strategy, the Bank has decided to renew its visual identity and adopt the logotype consistent with that of Poczta Polska. The key purpose of the change was to develop an image that would be consistent with Poczta Polska and stress the orientation on shared goals and development within the Poczta Polska Capital Group. Key assumptions regarding the image change were implemented in 2014.

The strategy assumes maintaining safe levels of capital ratios. In the years 2014-1017, accumulation of generated net profit in order to maintain CAR above 12% and Tier 1 above 9% will be the key source of capital enhancement. The Bank still aims at increasing its share capitals in the form of capital injection, but this depends on favorable market standing and a positive decision of its shareholders.

Following a decision to focus its operations on retail banking, the structure of loans in the balance sheet shall change. The share of consumer loans and loans to microenterprises will grow. The Bank is going to enhance its lending campaign with appropriate risk management. The assumed share of loans with recognized impairment losses in the credit portfolio (NPL) shall not exceed 11%.

Employees, their involvement, attitudes, behavior and knowledge-sharing motivation are of key importance in successful implementation of the strategy. In 2014 Bank Pocztowy commenced a series of Strategic Tour meetings, during which Management Board members and key managers discussed strategy-related issues. The meetings were held in all regions of Bank’s operation: Gdynia, Wrocław, Chorzów, Poznań, Bydgoszcz, Olsztyn and Warsaw. Employees of Poczta Polska participated in these meetings.

6. Bond issue

In order to diversify funds for financing new lending, in 2014 Bank Pocztowy issued short-term and long-term treasury bonds:

- Issue of short-term bonds, based on a resolution of the Extraordinary Shareholders Meeting of 26 April 2013 on the issue of short-term, ordinary non-interest bearing bonds. Under the Program the Bank will issue bearer shares with the face value of PLN 300 million with the maturity date from 14 days to 1 year. The issues will not be traded in the over-the-counter Catalyst market of Warsaw Stock Exchange. In 2014, Bank Pocztowy organized 4 issues of short-term bonds:

- on 2 June 2014 the Bank issued D4 series bonds with the face value of PLN 50 million. The issue covered 500 bonds with the face value of PLN 100,000 each. The issue price was PLN 98,353.00. Bond redemption at face value was carried out on 2 December 2014,2 czerwca 2014 roku Bank wyemitował obligacje serii D4 o wartości nominalnej 50 mln zł. Emisja obejmowała 500 sztuk obligacji o wartości nominalnej 100 000 zł każda. Cena emisyjna obligacji wynosiła 98 353,00 zł. Wykup tych obligacji po ich cenie nominalnej nastąpił 2 grudnia 2014 roku,

- on 2 June 2014 the Bank issued D5 series bonds with the face value of PLN 10 million. The series comprised 100 bonds with the face value of PLN 100,000 with the issue price of PLN 98,353.00 each. The Bank redeemed the bonds at face value on 2 January 2014,

- on 26 June 2014 the Bank issued D6 series bonds with the face value of PLN 30 million. The series comprised 300 bonds with the face value of PLN 100,000 with the issue price of PLN 98,888.60 each. Bond redemption at face value was carried out on 31 October 2014,

- on 1 July 2014 the Bank issued D7 series bonds with the face value of PLN 30 million. The series comprised 300 bonds with the face value of PLN 100,000 with the issue price of PLN 98,146.10 each. Bond redemption at face value was carried out on 2 October 2014.

- Issue of ordinary B3 series bonds. On 19 August 2014 the Bank issued 4,000 ordinary bearer bonds with the face value of PLN 10,000 each. They are fixed interest bonds determined as 4%. Bond redemption date was set at 20 August 2018. The issue has not been traded in the over-the-counter Catalyst market maintained by Warsaw Stock Exchange.

- Issue of ordinary B4 series bonds. On 17 December 2014 the Bank issued 17,000 ordinary bearer bonds with the face value of PLN 10,000 each. They are floating interest bonds determined as WIBOR6M+margin of 145 b.p., equal to 3.50% in the first interest period. Bond redemption date was set at 17 December 2018. It is the Bank’s intention to trade its B4 series bonds on the Over-The-Counter market of the Warsaw Stock Exchange (Catalyst).

At the end of December 2014 the total amount of bonds issued by the Bank was PLN 455,190 thousand, including PLN 245,190 thousand of bonds quoted on the Catalyst market of Warsaw Stock Exchange.

Bank Pocztowy S.A. provided detailed information on the issue of bonds in its current reports, which are available at the website of the Catalyst market and the Bank.

7. Awards and distinctions

The year 2014 brought a number of awards and distinctions to the Bank, granted in many categories in industrial rankings and countrywide contests, in appreciation of its product offer, management and communication with stakeholders. Individual awards were also won by the Bank’s managers and experts.

Bank Pocztowy was ranked third in a satisfaction survey for Internet users in January 2014. This means one position up compared to the prior year and proves appreciation of service quality and the growing role of Bank Pocztowy on the Polish banking market. The ranking included over 180,000 comments of Internauts, grouped in categories (positive, adverse and neutral) as well as assigned overtones. 92% of all comments about Bank Pocztowy were either positive or neutral. The ranking showed that Internet users particularly appreciated the Bank's credit offer.

Pocztowe Konto Firmowe (PKF) was ranked second in the expert ranking by money.pl. The ranking analyzed 87 corporate accounts offered by Polish banks. This was the third distinction won by PKF. The ranking evaluated 31 parameters of the offer, including price, availability and quality of services offered by the bank.

Consumer and corporate accounts maintained by Bank Pocztowy were considered the best for the selected client groups in rankings prepared among others by bankier.pl portal four times in 2014.

The cash lending offer was also recognized. It won in three listings prepared by bankier.pl. The Bank was in the top four in terms of the best consolidation loan in the rankings prepared by Gazeta Prawna.

Pocztowe Konto Standard won a high position in the ranking prepared by Bankier.pl portal. Its authors compared 51 accounts offered by 27 banks operating on the Polish market. Four types of clients were assumed: Internet client, multi-channel client, traditionalist and VIP. Pocztowe Konto Standard was considered the best offer for traditionalists. It was also one of the best accounts for active (multi-channel) clients and was ranked second best.

The Bank was also recognized for the level of its market communications the second consecutive year. It was ranked first in the prestigious The Best Annual Report contest 2013 organized by Instytut Rachunkowości i Podatków in the category "Banks and Financial Institutions" and recognized for the best Management Board’s report on the activities for the same period. Thus, the fact that Bank Pocztowy, as an issuer of bonds quoted with Catalyst market of Warsaw Stock Exchange, cares for top quality market communication, among others adopting reporting standards close to those applied by banks quoted with WSE, was recognized.

Bank’s managers won individual awards, to include Tomasz Bogus, Chairman of the Management Board, who was granted Crystal Dragon of Success as one of the best managers on the market, in the first edition of the contest. Its winners were selected by a jury composed of representatives of public administration, business and media.

Monika Kurtek, Bank’s Chief Economist, was recognized the second consecutive year. In 2014 she won a ranking by Puls Biznesu regarding projected foreign exchange rates. The ranking was based on projections made by analysts in the period of latest 12 months.

Index:

1 Source: PFSA, Monthly data for the banking sector, December 2014.

2 Source: PFSA, Monthly data for the banking sector, December 2014.

3 Source: PFSA, Monthly data for the banking sector, December 2014.

4 Source: PFSA, Monthly data for the banking sector, December 2014.

5 Source: PFSA, Monthly data for the banking sector, December 2014.

6 Source: PFSA, Monthly data for the banking sector, December 2014.

Annual Report 2014 - Bank Pocztowy

Corporate Governance

- Corporate governance: principles and scope of application

- Control system in the process of preparing financial statements

- Entity authorized to audit financial statements

- Shareholding structure and share capital

- Key information regarding Poczta Polska S.A.

- Cooperation with Poczta Polska S.A.

- Investor relations

- By-laws amending principles

- Activities of the corporate bodies of the Bank