Capital adequacy

The Group’s capital adequacy is managed on the Bank level. It is aimed to ensure that the Bank's equity level is not lower than the one required by internal and external regulations. The regulations link the required capital level with the scale of operations and risks assumed by the Bank.

Considering the above, the Bank regularly:

- identifies risks material for its business,

- manages key risks,

- determines internal capital to be maintained should the risk materialize,

- calculates and reports capital adequacy measures,

- allocates internal capital to business areas;

- performs stress tests;

- compares its capital needs with the level of equity held;

- ntegrates the capital adequacy assessment with development of the Bank’s Strategy, financial and sales plans.

In 2015 the solvency ratio, Tier 1 and internal solvency ratio of the Bank were above the required regulatory minimum. In order to ensure high standards of capital management, compliant with best banking practices, once a year the Bank reviews the applicable policies and procedures.

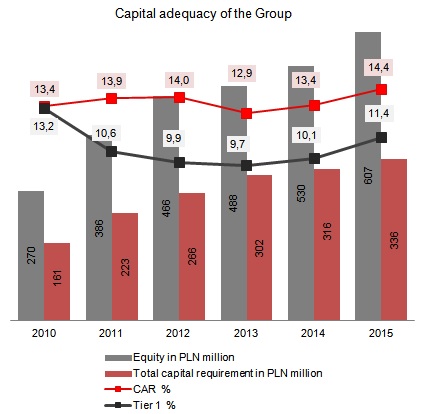

Capital adequancy of the Group

Equity

For the purpose of equity calculation, the Bank applies methods arising from Regulation of the European Parliament and of the Council (EU) no. 575/2013 of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending the Regulation (EU) no. 648/2012 (CRR). The Group’s equity consists of Tier 1 (CET1) and Tier 2 capital.

In 2015, Tier 1 funds in the Bank included:

- equity instruments meeting the conditions specified in CRR,

- agio related to the instruments referred to above,

- retained earnings, to include current period gains or annual profit before a formal decision confirming the final financial performance for a given year following an approval of a competent body,

- accumulated other comprehensive income,

- reserve capital,

- general risk reserve,

- unrealized gains and losses measured at fair value (in amounts including transition regulations referred to in Articles 467 and 468 of the CRR),

- ther Tier 1 items as determined in CRR

and reduced by:

- carrying amount of intangible assets;

- loss on measurement of debt instruments classified as available for sale.

In October 2015 the Bank issued ordinary registered C1 series shares with the total par value of PLN 12,842,480.00 and the issue value of PLN 60,000,066.56. The capital increase was recorded in the National Court Register on 20 November 2015. Subsequently, on 15 December 2015 the Bank obtained a consent of the Polish Financial Supervision Authority to classify the equity instruments in question to Tier 1 capital (file No. DBK/DBK2/7105/26/7/2015/AN).

In 2015, Tier 2 funds in the Bank included cash obtained from a subordinate loan received in 2014 from Poczta Polska S.A. and two issues of subordinate bonds (carried out in 2011 and 2012, respectively).

Capital requirements (Pillar 1)

For the purpose of total capital requirement calculation, the Bank applies methods arising from CRR, in particular:

- the standard method of calculating the capital requirement due to credit risk,

- a simplified collateral recognition method where the counterparty’s risk weight is replaced with the collateral (its issuer’s) risk weight,

- the standard method of calculating the capital requirement due to operational risk,

- the standard method for the risk of credit valuation adjustment,

- the standard method of calculating the capital requirement due to currency risk,

- the maturity method of calculating the capital requirement due to general interest rate risk,

- the standard method of calculating the capital requirement due to special debt instrument price risk,

- the method of calculating the capital requirement due to large exposures.

Since the trading scale was immaterial, the capital requirement regarding market risks for the Bank was PLN 0.00. This means that in the analyzed period the Bank’s capital requirement was limited to credit risk, operational risk, currency risk and risk of credit valuation adjustment. As at 31 December 2015 the adjustment amounted to PLN 51.0 thousand.

In 2015 the supervisory solvency ratio of the Group was above the required regulatory minimum.

Internal capital (Pillar 2)

When identifying key risks that occur in the Bank’s operations, having included the scale and complexity of a given operation, additional risks are considered which, according to the management, are not fully covered by Pillar 1 risks. The identification is to optimally adjust the structure of internal capital to the actual capital needs that reflect the true risk exposure level.

For the additional risk purpose, the internal capital is calculated based on internal methods accepted by the Management Board, which include the scale and specifics of the Bank’s operations in a given risk context.

Additionally, when determining the internal capital, the Bank applies a conservative approach with regard to risk diversification among each risk type.

Please note that due to the specifics of liquidity risk and in light of market standards and practices, the Bank does not determine an additional internal capital for this risk type. For this reason, special focus is placed on the process evaluation and management.

In 2015 the internal solvency ratio of the Group was above the required regulatory minimum.

Disclosures (Pillar 3)

Pursuant to the CRR and to the General Principles of Disclosing Information on Capital Adequacy in Bank Pocztowy S.A. accepted by the Supervisory Board of the Bank, in 2015 the Bank published information on its capital adequacy in a separate document.

The following tables present detailed calculation of base figures regarding regulatory capital and the solvency ratio as at 31 December 2015 and 31 December 2014.

| Equity (PLN’000) | |||

|---|---|---|---|

| 31.12.2015 | 31.12.2014 | ||

| I. Tier 1 capital | 480 417 | 399 481 | |

| Equity instruments paid for | 110 133 | 94 378 | |

| Adjustments related to instruments in Tier 1 capital in the transition period | 0 | 2 330 | |

| Agio | 55 691 | 8 600 | |

| Retained earnings, including: | 25 086 | 38 179 | |

| - profit | 25 086 | 38 179 | |

| - loss | 0 | 0 | |

| Accumulated other comprehensive income | 11 908 | 3 571 | |

| Adjustments related to unrealized gains/losses on instruments in Tier 1 capital* | (8 146) | (5 532) | |

| Reserve capital | 225 577 | 183 019 | |

| Funds for general banking risk | 114 345 | 108 345 | |

| Other intangible assets | (53 362) | (32 307) | |

| Additional value adjustments arising from prudent measurement requirements | (815) | (1 102) | |

| Tier 2 capital | 126 138 | 130 872 | |

| Equity instruments and subordinated loans classified as Tier 2 capital | 93 000 | 93 000 | |

| Adjustments related to instruments in Tier 2 capital in the transition period | 33 138 | 37 872 | |

| Equity | 606 555 | 530 353 | |

* The adjustment regards elimination of a portion of the positive valuation due to unrealized gains in the transition period.

| Capital requirements (PLN ‘000) | ||

|---|---|---|

| 31.12.2015 | 31.12.2014 | |

| Capital requirements for credit, counterparty credit, dilution and settlement risk, including for exposures | 293 365 | 278 431 |

| with 0% risk weight | 0 | 0 |

| with 4%** risk weight | 9 | 0 |

| with 20% risk weight | 4 128 | 4 955 |

| with 35% risk weight | 43 364 | 43 135 |

| with 50% risk weight | 2 535 | 1 154 |

| with 75% risk weight | 176 316 | 162 333 |

| with 100% risk weight | 57 038 | 59 528 |

| with 150% risk weight | 5 454 | 2 491 |

| with 250% risk weight | 4 521 | 4 835 |

| other risk weights | 0 | 0 |

| Capital requirement for operational risk | 41 270 | 37 495 |

| Currency risk capital requirement | 1 201 | 0 |

| Capital requirement for credit valuation adjustment (CVA) | 51 | 39 |

| Total capital requirement | 335 886 | 315 965 |

| Solvency ratio | 14,4% | 13,4% |

| Tier 1 | 11,4% | 10,1% |

** rounded up risk weight for exposures due to payments to central counterparty fund in case of default

** rounded up risk weight for exposures due to payments to central counterparty fund in case of default

In 2015 the Bank’s activities ensured the maintaining of capital ratios on a save level, above the regulatory minimum.

The Bank informs to have been granted no financial support from public funds in 2015 under the Accounting Act of 29 September 1994 and in particular under the Act on granting the support for financial institutions by the State Treasury of 12 February 2009 (Journal of Laws of 2014 item 158).