Development strategy

Development Strategy 2015-2018 and progress status

Due to considerable changes in the macroeconomic environment effecting the entire banking sector (including record low interest rates), changes in the banking sector (lessening possibility to develop in the existing small universal bank model) and the new strategy of Poczta Polska, which assumes growing importance of bank and insurance services in the strategy of the Poczta Polska Capital Group, the Bank decided to update the growth vision of Bank Pocztowy for the period until 2018. The updated version of the Development Strategy of Bank Pocztowy S.A. for the years 2015-2018 was adopted by the Supervisory Board on 16 April 2015.

In accordance with the strategy adopted, the key objective of Bank Pocztowy is to become a top consumer bank for regional Poland.

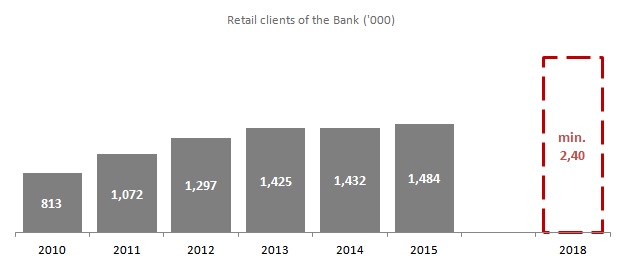

million retail clients

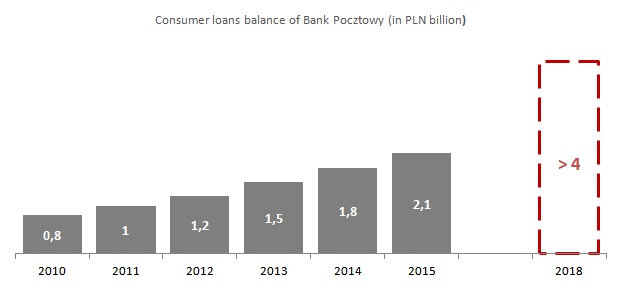

consumer loan balance (in PLN billion)

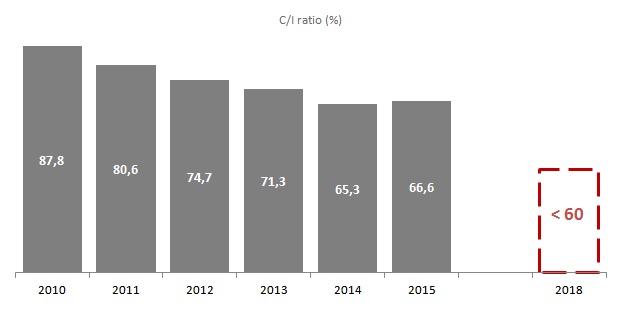

C/l ratio

At the same time, it was assumed that Bank Pocztowy’s competitive advantages will be built around:

- a network of offices which enable the widest access to financial products and services in Poland,

- a simple offer (one current account, three types of deposits: mini, midi and maxi and a simple cash loan), which satisfy basic financial needs of the Bank’s clients,

- advantageous and competitive prices of products (accounts, deposits, cash loans offered to the existing clients of the Bank) supported by operational models with competitive cost,

- advanced integration with Poczta Polska, which consists in using the potential of clients and Poczta Polska distribution networks and developing the product offer in cooperation with other entities from the Poczta Polska Capital Group,

- simple and inexpensive sales and customer service processes, based on Frond-End type solutions opened in a web bowser implemented in Poczta Polska outlets,

- simple marketing communication in sales points and outlets, based on advertising materials available in Poczta Polska outlets,

- corporate culture focused on performance of ambitious objectives in a manner specified in the corporate competency model, which defines attitudes and behaviors expected of the Bank’s management and staff.

The revised development vision of the Bank assumes transition from the universal bank model towards the bank focused on consumer services and a very simple offer, which can provide its clients with well-priced services and foster integration with Poczta Polska in the form of joint product initiatives and a sales network.

Which is Bank Pocztowy?

- The simplest – The bank is specialized in the simplest products

- Cheap – The bank is quaranting reasonable price for broad range of Customers

- Integrated with Poczta Polska – The bank is offering modern financial services based on integration in the Poczta Polska Group.

Key strategic goals to be achieved by the end of 2018:

- Client base of PLN 2.4 million individuals

On 31 December 2015 the Bank provided services to 1.48 million consumers, i.e. the number of retail consumers grew by 3.6% as compared to December 2014. The key growth driver was the implementation of KontoZawszeDarmowe account. The number of current accounts increased by 88 thousand and in December 2015 the number of current accounts maintained by the Bank reached 909 thousand.

In the years 2010-2015 the client base increased from PLN 0.81 million to PLN 1.48 million, i.e. by over 180%. The Bank intends to maintain a high growth rate of client acquisition and to acquire an additional million of new clients by the end of 2018. The Bank intends to maintain a high share in acquiring new clients, in particular in regional Poland.

- Exceeding the balance of PLN 4 billion in consumer loans

As at 31 December 2015 receivables due to consumer loans exceeded PLN 2 billion. In 2015 the Bank sold consumer loans with the value of PLN 1 058.3 million, i.e. by 26.7% higher than in 2014. At the end of 2015 the balance of consumer loans reached PLN 2.1 billion, i.e. by 19.9% more than at the end of 2014.

By the end of 2018 the Bank intends to double the consumer loan portfolio (to exceed PLN 4 billion), thanks to cross selling credit products to the existing client base. To this aim, the Bank intends to benefit from its strong presence in towns and significant demand for consumer loans in regional Poland. According to the data of BIK, i.e. the provider of credit information on borrowers, 47% of consumer loans (by volume) in Poland is granted in towns with up to 25 thousand inhabitants (43% by value ), and 71% (by volume) in towns and cities with up to 100 thousand inhabitants (67% by value).

- Credit portfolio diversification

The Bank intends to diversify the credit portfolio by way of returning to active sale of mortgage loans, which will allow for acquiring clients willing to buy a high number of products and increasing the sale of loans to selected parts of the institutional segment (mainly the housing sector).At the same time, the Bank intends to intensify sales to the SMEs, including settlement segment clients, who are provided with international and domestic cash transfer services by the Bank.

- Reducing the total cost/income ratio to less than 60%

In 2015 the Bank carried out a number of activities aimed at increasing the Group’s efficiency, mainly process streamlining and cost optimization initiatives.

Still the profit for 2015 was considerably affected by significant costs of unplanned one-off events such as: payment to the Bank Guarantee Fund related to the bankruptcy of SK Bank of PLN 11.9 million or the costs of creating the Borrowers Support Fund (ca. PLN 3.6 million). As a result of these events, in 2015 the consolidated Cost/Income ratio amounted to 66.6%, i.e. was by 1.3.p.p. higher than in 2014. The Bank’s objective is to improve the operational efficiency and to reduce the Cost/Income ratio to the level below 60% by the end of 2018.

New business model as the key element of the strategy adopted

Four key elements of the business model adopted by Bank Pocztowy:

|

Mass acquisition |

Improved cross-sell |

|

The Bank offers simple and cheap products, such as one account for consumers, one for microenterprises, a simple credit, deposit and investment offer supported with loyalty schemes. |

The Bank focuses on efficient management of the client life cycle, including cross-sell of cash loans. |

|

Efficient operating model |

Full integration with the Poczta Polska Capital Group |

|

Simple cheap and automated processes in the Bank Group |

Efficiently used potential of the Poczta Polska’s distribution network and development of a modern product offer in cooperation with other companies from the Poczta Polska Capital Group |

Determination to achieve strategic objectives supported by special strategic initiatives.

Following the revised strategy the Bank developed its CODE of thinking and behaving. The CODE is based on the following paradigms:

- Simple – simple banking, keep it simple,

- CAN DO approach – look for solutions and act,

- Cheap – focus on profits of your clients and the Bank like on our own money.

In accordance with the mission and CODE in 2015 the Bank completed a number of initiatives in four key areas:

- PRODUCTS

- Simple offer (e.g. one current account, three deposit options),

- Liquidating low-margin products,

- Implementation of Pocztowy SFIO,

- Implementation of Pożyczka na Poczcie.

- PROCESSES:

- New cash loan approval process,

- Optimized approval process for Account opened within 15 minutes,

- Implementation of Process Management and Process Ownership Principles.

- EMPLOYEES:

- Implementation of the profile and culture of desired attitudes (CAN DO),

- MBO process and CODE-based goal setting,

- CODE-based annual performance progress review and 360° evaluation process.

- PROCEDURES AND STRUCTURE:

- Review of the organizational structure and regulations,

- Review and consolidation of internal regulations,

- New legislative principles.

Development directions for 2016

Key activities carried out in 2016 which should contribute to performance of key strategic objectives include:

- continued dynamic sales of consumer loans,

- digital bank launch in 2016 (EnveloBank project). The initiative is aimed at encouraging young people to use services of Bank Pocztowy. Project details have been presented item 11.3 hereof,

- changes in the offer, such as adding services fit for sale in Poczta Polska offices or investment funds of Bank Pocztowy as white label products,

- works on the implementation of the Customer Relationship Management system, which allows for increasing sales margin,

- further development of Front End, an IT solution, which standardizes the sales scope and method and bank product support in Poczta Polska outlets,

- development of traditional sales outlets and their rebranding, Further development of microbranches is planned with accompanying steps aimed at increasing margin generated in microbranches.

Key business objectives for 2016:

- Increase in the balance of consumer loans by over 20%,

- Increase in sales of current accounts by over 20%,

- A twofold increase of the balance of net current assets in the funds,

- Maintaining the existing performance in the institutional segment.

Moreover, the Bank still aims at increasing its share capitals in the form of capital injection, but this depends on favorable market standing and a positive decision of its shareholders.

The Bank’s ability to achieve the objectives determined for 2016 shall depend mostly on external conditions, in particular the economic growth seen in Poland. Bank tax imposed as of 1 February 2016 may also deteriorate the Bank' profit. A liability resulting from this tax, estimated based on the value of the Bank Pocztowy’s assets as at 31 December 2015 will amount to ca. PLN 6 million.

New digital brand – EnveloBank

One of the strategic projects for 2016 is the launch of EnveloBank - a new digital brand of Bank Pocztowy responding to the needs of mobile clients.

The traditional banking model based on distribution in bank offices supported by digital channels

offers a limited growth potential only. Although still quite high, the group of unbanked Poles has been shrinking steadily. The share of middle-aged and elderly people in the group of unbanked Poles have been decreasing, while the group of young people who do not use Bank services has been growing. Based on the analysis of the needs of young people, changes in the market and global trends related to the growing popularity of digital and internet technologies, the Bank decided to develop modern financial services under the EnveloBank brand, coherent with the marketing strategy of the Poczta Polska Capital Group.

EnveloBank will constitute a digital solution aligned with the increasing trend to provide services to clients in many channels ("omnichannel business model”). Such approach will enable man

aging individual elements of a given process in many channels – depending on client needs and preferences. EnveloBank will constitute the ecosystem, offering clients not only bank services but also additional services provided in cooperation with partners, in particular with the key strategic partner – Poczta Polska. Along with the omnichannel business model, additional services offered in the bank system constitute the key pillars of EnveloBank, which focuses on customer experience of modern mobile and digital clients. The bank will offer an additional benefit, i.e. a loyalty program, where clients using digital services of Poczta Polska would be reimbursed the costs of courier services.

EnveloBank will ensure organized daily payments, it will pro-actively communicate with the client and take care of his liabilities, operating like an intelligent application rather than a simple website. The key enhancement for clients will be the invoice module integrated with the calendar. It will enable registering invoices in the manner the client finds most comfortable (automatic registration of invoices sent by issuers, invoices sent by e-mail, making a scan of the invoice, scanning the code) and the calendar functionality will be responsible for remembering about payment deadlines. Apart from the cooperation within the Poczta Polska Capital Group, the Bank will look for synergies with firms offering digital products and services, such as mobile payments. The central focus of EnveloBank is on client needs, where financial services are only the method to fulfill them. Other attractive services for clients will be offered in the course of the bank’s development.

EnveloBank has been the largest project carried out by the Bank in terms of its elements and resources involved.It requires developing an IT solution, its integration with the Bank's applications, development and implementation of mobile and digital banking designed with RWD, preparing the product and service offer for clients, optimization of all front-office and back-office processes and market launch of a new brand.