Significant events in the Capital Group in 2015

clients of Bank

Pocztowy

Capital injection to the Bank

In 2015 Bank Pocztowy prepared the Bank’s shares to be traded on the regulated market of the Warsaw Stock Exchange. The Bank’s debut at the WSE was planned for Q4,2015. However, due to a disadvantageous market situation and bank share quotations which were lower than expected, the Bank delayed the stock exchange debut. Therefore, on 23 September 2015 the Bank’s shareholders, i.e. Poczta Polska and PKO Bank Polski decided to inject capital of PLN 60 million to the Bank by way of a private placement, which will secure the Bank's growth in 2016 if the Polish Financial Supervision Authority maintains the same capital requirements in the coming quarters.

The General Shareholders’ Meeting adopted a resolution to increase the share capital of the Bank by way of:

- the issue of new C1 series ordinary registered shares in the form of a private placement with subscription rights entirely excluded for the existing shareholders; the change in the Bank’s charter following the capital increase; dematerialization of C1 series shares; and a request for admitting these shares to trading on the regulated market,

- the issue of new D series ordinary bearer shares in the form of a public offering with subscription rights entirely excluded for the existing shareholders; the change in the Bank’s charter following the capital increase; dematerialization of D series shares and rights to D series shares; and a request for admitting these shares and rights to trading on the regulated market.

The existing shareholders took up new shares in the form of the capital increase and maintained the existing share: 75% of the share capital less 10 shares for Poczta Polska and 25% of the share capital plus 10 shares for PKO BP.

The unanimous decision of the shareholders with respect to the capital injection to the Bank enables the Bank's ongoing growth, in particular increasing new lending at the same time meeting the increased capital requirements applicable to the Bank since 1 January 2016. In compliance with the guidelines of the Polish Financial Supervision Authority (No. DRB/0735/2/1/2015) since 1 January 2016 the Bank has been obliged to maintain capital adequacy taking into consideration capital buffers at the level of at least:

- CAR – 13.25% (versus 12% before 31 December 2015),

- Tier 1 – 10.25% (as compared to 9% before 31 December 2015).

Thanks to the capital injection of PLN 60 million, the capital adequacy ratios remained high and exceeded the minimum level recommended by the supervising authority. As at 31 December 2015, CAR amounted to 14.4% and Tier 1 to - 11.4%.

Significantly, the Bank intends to continue its preparations to the capital increase in the form of the IPO to follow the dynamic growth strategy for the period until 2018.

Growing client base

At the end of 2015 Bank Pocztowy had the total of 1,499.4 thousand clients, including:

- 1,305.7 thousand of individuals vs. 1,254.4 thousand at the end of 2014;

- 178.4 thousand microenterprises versus 177.9 thousand at the end of 2014,

- 15.2 thousand other institutional clients (small and medium enterprises, public sector entities, public benefit institutions). The number of the Bank’s clients in the segment slightly decreased.

In 2015, the Bank’s client portfolio grew by 3.6%. Following the Bank’s actions aimed at stimulating clients who do not actively use accounts, an insignificant number of dormant account holders left the Bank. The continuing growth in the number of clients accompanied with closures of inactive accounts has confirmed the efficiency of the Bank’s policy regarding its product offer. The policy is based on offering simple, user-friendly products and avoiding complicated procedures and incomprehensible communication.

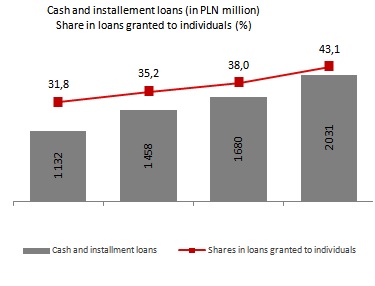

Dynamic growth of cash loans and installment loans

In 2015 the Group took steps to optimize its balance sheet structure and increase the share of highly profitable assets. At the end of December 2015 the total cash loans and installment loans amounted to PLN 2 031.3 million, having increased by PLN 351.3 million, i.e. by 20.9% versus December 2014.

Following the loan policy adopted, the change in the Group’s credit exposure structure followed the changes observed in recent years. Since 2012, the share of consumer loans, i.e. of the largest group in the structure, has increased. At the end of 2015 such exposures accounted for 43.1%, i.e. were by 5.1 p.p. higher than the previous year.

| Loans and advances granted to customers of the Bank Pocztowy S.A. Capital Group (in PLN ‘000) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 31.12.2015 | Structure (31.12.2015) | 31.12.2014 | Structure (31.12.2014) |

|

|||||||

| Gross loans and advances granted to customers (gross) | 5 542 489 | 100,0% | 5 325 685 | 100,0% | 216 804 | 4,1 % | |||||

| individuals, including: | 4 711 355 | 85,0% | 4 423 563 | 83,1% | 287 792 | 6,5 % | |||||

| cash loans and instalment loans | 2 031 277 | 36,6% | 1 680 009 | 31,5% | 351 268 | 20,9 % | |||||

| mortgages | 228 598 | 4,1% | 245 792 | 4,6% | (17 194) | (7,0)% | |||||

| real estate loans | 2 402 034 | 43,3% | 2 444 023 | 45,9% | (41 989) | (1,7)% | |||||

| overdraft facilities | 32 478 | 0,6% | 35 836 | 0,7% | (3 358) | (9,4)% | |||||

| credit card debt | 16 968 | 0,3% | 17 903 | 0,3% | (935) | (5,2)% | |||||

| institutional customers | 578 292 | 10,4% | 598 760 | 11,2% | (20 468) | (3,4)% | |||||

| local authorities | 252 842 | 4,6% | 303 362 | 5,7% | (50 520) | (16,7)% | |||||

| Impairment losses on receivables | 229 607 | - | 173 908 | - | 55 699 | 32,0 % | |||||

| Net loans and advances | 5 312 882 | - | 5 151 777 | - | 161 105 | 3,1 % | |||||

Cash and installement loans (in PLN milion) Share in loans granted to individuals

Net ROE in excess of the market average

In 2015 the Group operated in sustained low interest rate environment, as in March 2015 the Monetary Policy Council decreased interest rates by 50 b.p. to record low levels, at the same time announcing the end of the monetary policy easing cycle. At the same time, certain adverse one-off events occurred in the banking sector (SK Bank, Office for Competition and Consumer Protection and Borrowers’ Support Fund) and both factors decreased banks’ performance.

In 2015 the Capital Group generated the second-highest net profit since the registration. It reached PLN 33.9 million and was by 22.2%, i.e. by 9.7% lower than the record high net profit reported in 2014. At the same time, the total impact of one-off events remaining out of the Group’s control which accumulated in Q4,2015 (an additional payment to the Band Guarantee Fund related to the bankruptcy of SK Bank, a payment to the Office for Competition and Consumer Protection under a court's decision dated 6 October 2015, a provision for payment to the Borrowers’ Support Fund) and amounted to PLN 18.5 million, which translated into a decrease in the net profit of PLN 14.6 million.

Net profit of the Group in 2015 (in PLN million)

Apart from one-off events, which considerably increased the expenses, the financial profit of the Group in 2015 was affected by the following factors:

- Income deterioration (to include revenue and expenses related to other operations). The income amounted to PLN 326.1 million, i.e. by 2.6% less YoY. In the record low interest rate environment net interest income decreased by 3.7%. Net fee and commission income decreased by 6.4% to PLN 55.8 million. The drop resulted from:

- market interest rate decreases – average WIBOR 3M decreased by 0.8 p.p, (from 2.5% to 1.7%) in 2015, hence the interest margin of the Group dropped by 0.2 p.p. (from 3.8% in 2014 to 3.6% in 2015),

- reduced interchange rates since 1 July 2014 to 0.5% at maximum and since 1 February 2015 to 0.2% for debit cards and 0.3% for credit cards and other payment cards,

- a tendency to limit the bancassurance product range and investment and insurance offer related to the implementation of the Recommendation U issued by the Polish Financial Supervision Authority and lower demand among clients,

- launch of the new Bank offer in Q4,2014 – ZawszeDarmowe account with no monthly fee for account maintenance, which translated into higher acquisition of new clients in 2015 and limited revenue due to account maintenance.

- Maintaining the cost discipline despite one-off events discussed above. In 2015 operating expenses reached PLN 217.0 million and were 0.7% lower than in 2014.

- The increase in the loss on impairment allowances from PLN 61.0 million in 2014 to PLN 66.1 million in 2015 (an increase of 8.4%). The losses were recognized mostly for consumer loans with relatively higher cost of risk.

In 2015 the cost/income ratio amounted to 66.6%.

Despite disadvantageous environment the Group generated higher net ROE than the entire banking sector. In 2015 net ROE of the Group amounted to 6.9% and was by 0.1 p.p. higher than the market average.

In 2015 the net ROA of the Group reached 0.5% vs. 0.6% in the prior year.

As at 31 December 2015 the solvency ratio amounted to 14.4% compared to 13.4% in December 2014. The ratio increased after the injection of PLN 60 million made by the existing shareholders. Tier 1 capital ratio of the Bank also exceeded regulatory requirements and amounted to 11.4% at the end of 2015. Capital adequacy ratios remained high and exceeded the minimum level recommended by the supervising authority.

| Financial performance of the Bank Pocztowy S.A. Capital Group | |||

|---|---|---|---|

| 2015 | 2014 | Change 2015/2014 | |

| Operating income1 (PLN’000) | 326 054 | 334 780 | (2,6)% |

| Operating expenses (PLN ‘000) | (217 030) | (218 622) | (0,7)% |

| Profit before cost of risk2 (PLN’000) | 109 024 | 116 158 | (6,1)% |

| Net impairment losses (PLN’000) | (66 145) | (61 013) | 8,4 % |

| Gross profit (PLN ‘000) | 42 879 | 55 145 | (22,2)% |

| Net profit (PLN ‘000) | 33 931 | 43 639 | (22,2)% |

| Net ROA (%) | 0,5 | 0,6 | (0,1) p.p. |

| Net ROE (%) | 6,9 | 10,5 | (3,6) p.p. |

| Cost/Income ratio (%) | 66,6 | 65,3 | 1,3 p.p. |

| CAR (%) | 14,4 | 13,4 | 1,0 p.p. |

| Tier 1 (%) | 11,4 | 10,1 | 1,3 p.p. |

1 Total income including profit on other operating activities

2 Cost of risk within the meaning of the result to the write-downs for impairment

Development Strategy 2015-2018

In April 2015 the Supervisory Board of the Bank approved “Development Strategy of Bank Pocztowy S.A. for 2015-2018", which assumes that the Bank will become a top consumer bank for regional Poland.

Key strategic objectives of the Bank for the period until 2018 include:

- increasing the number of consumers in the portfolio to 2.4 million,

- exceeding the balance of PLN 4 billion in consumer loans,

- credit portfolio diversification

- reducing the total cost/income ratio to less than 60%.

The bank intends to achieve all these strategic objectives by way of acquiring new clients (in particular clients of Poczta Polska), further expansion of the Bank’s distribution network, using the Poczta Polska distribution network more efficiently, increasing profitability of the existing clients based on cross-sell (cash loans in particular), increasing operational process efficiency, maintaining low-cost and efficient marketing activities and developing the corporate culture of the Bank.

Details of the strategy have been discussed in item 11.1 of the Report.

Bond issue

In order to diversify funds for financing new loans, in 2015 Bank Pocztowy issued short-term and long-term treasury bonds.

- Short-term bonds issue.

- On 29 June 2015 the Bank issued D8 series bonds with the total nominal value of PLN 30 million. The issue covered 300 bonds with the nominal value of PLN 100,000 each. The issue price was PLN 99,205.50. Bond redemption at nominal value was carried out on 2 November 2015.

- Long-term bonds issue.

- On 22 December 2015 the Bank issued B5 series bonds with the nominal value of PLN 145 million. The issue covered 14,500 bonds with the nominal value of PLN 10,000 each. The issue price was PLN 100. They are floating interest bonds determined as WIBOR6M + 1.80 p.p. Bond redemption at face value was will be carried out on 22 December 2019. It is the Bank’s intention to trade its B5 series bonds on the Over-The-Counter market of the Warsaw Stock Exchange (Catalyst).

The Bank provided detailed information on the issue of bonds in its current reports, which are available at the website of the Catalyst market and the Bank.

Awards and distinctions

The year 2015 brought a number of awards and distinctions to the Bank, granted in many categories in industrial rankings and countrywide contests in appreciation of its product offer, management and communication with stakeholders.

In April 2015, the Bank was awarded a prestigious title of the Best Small and Medium Bank in 2014. The jury appreciated dynamic growth of the Bank in the recent years. The Bank was awarded for “Dynamic growth generated in the recent years and bold market trend setting, such as the introduction of Pocztowe Konto ZawszeDarmowe – the first account with the unconditional lifetime guarantee of no maintenance fees”. The Bank win in the category of banks with the equity up to PLN 3 billion. In the recent years the Bank received a number of awards granted by Banking Leaders experts. In 2013 the Bank received awards in the Best Bank and Best Medium and Small Bank categories.

The cash loan of Bank Pocztowy received the "Wprost Portfolio" award in 2015. The Bank’s product won in the “loan for the client” category. “Wprost Porfolio” winners were selected in a two-stage survey which focused on: brand recognition, offer adjustment to market needs, offer transparency for the client, fees and commissions, customer service, loyalty policy, client loyalty and confidence. In the first stage a consumer survey was carried out in cooperation with the psychology and sociology departments. Later, the institutions surveyed completed a product questionnaire. The survey results were discussed by the jury, which declared the winners.

The Bank's cash loan offer was selected one of the top three most attractive market offers in the August rating prepared by TotalMoney.pl.

The cash loan offer for “internal clients” came fourth in the September ranking of TotalMonay, which is a good position.

Pocztowe Konto Firmowe (PKF) is regularly granted market awards. In the July ranking published by bankier.pl Pocztowe Konto Firmowe (Company Postal Bank Account) got two second places in the corporate bank account ranking for start-ups and medium-sized enterprises. The assessment criteria included costs of account maintenance and additional services.

Comparing with other accounts offered on the market, the Bank Pocztowy’s account stands out as that offering:

- the widest company account service network in Poland including offices of the Bank and Poczta Polska,

- account opening, maintenance and basis corporate services offered free of charge.

In the October Forbes ranking analyzing the offer of 12 banks, Pocztowe Konto Firmowe received four out of five stars.

Once again Pocztowe Konto Firmowe was ranked the third top account for SMEs. The authors of the ranking published by the Dziennik Gazeta Prawna daily particularly appreciated the possibility to open and keep an account with the Bank, to make transfers (including to the Social Insurance Institution and the Tax Office), to pay out cash from all ATMs worldwide free of charge. The ranking, which distinguished the account of Bank Pocztowy analyzed offers of 12 banks.

ZawszeDarmowe account got the "Dark Horse" title in the ranking of personal accounts prepared by the Banking-Magazine web service. The portal analyzed personal accounts offered by top Polish banks. The objective of the analysis was to select a current account, which offers the most additional benefits and profits to clients at the same time keeping its costs low. The “Dark Horse” title distinguished the account as the offer perfectly tailored to the needs of a specific client group.

The Gazeta Prawna daily published the results of the third edition of the survey analyzing remote communication with top Polish banks. The Bank was ranked eighth

The survey was composed of three key parts covering various forms of the client’s communication with the bank:

- helpline,

- online communication (e-mail, contact form and chat),

- finding contact details (homepage, contact tab).

This good position in the ranking was achieved with the effort of the Contact Centre Department and the Bank, who were focused on one objective only: improving the quality of client’s communication with Bank Pocztowy.

The key changes include:

- improved quality of helpline communication,

- shorter IVR message transmission,

- shorter call waiting time,

- improved quality of telephone conversations,

- changes in e-mail forms,

- changes in contact forms available on the website,

- website changes to highlight contact forms available in Bank Pocztowy.

For yet another year the consolidated annual report of Bank Pocztowy was awarded in The Best Annual Report contest organized by the Institute for Accounting and  Taxes and the Warsaw Stock Exchange for the tenth time. The consolidated annual report of Bank Pocztowy for 2014 was ranked second in the Banks and Financial Institutions category. Moreover, the Bank was awarded for the best application of the IFRS/IAS in the financial statements. Thus, the fact that Bank Pocztowy, as an issuer of bonds quoted with Catalyst market of the Warsaw Stock Exchange, cares for top quality market communication, among others adopting reporting standards close to those applied by banks quoted with WSE, was recognized. In the previous rounds of The Best Annual Report competition, the annual report of Bank Pocztowy was ranked the first in the Banks and Financial Institutions category and the Bank was distinguished for the best Management Report on the activities of the Bank (in 2013 and in 2012), and for the best application of the IFRS/IAS in the financial statements (in 2011).

Taxes and the Warsaw Stock Exchange for the tenth time. The consolidated annual report of Bank Pocztowy for 2014 was ranked second in the Banks and Financial Institutions category. Moreover, the Bank was awarded for the best application of the IFRS/IAS in the financial statements. Thus, the fact that Bank Pocztowy, as an issuer of bonds quoted with Catalyst market of the Warsaw Stock Exchange, cares for top quality market communication, among others adopting reporting standards close to those applied by banks quoted with WSE, was recognized. In the previous rounds of The Best Annual Report competition, the annual report of Bank Pocztowy was ranked the first in the Banks and Financial Institutions category and the Bank was distinguished for the best Management Report on the activities of the Bank (in 2013 and in 2012), and for the best application of the IFRS/IAS in the financial statements (in 2011).

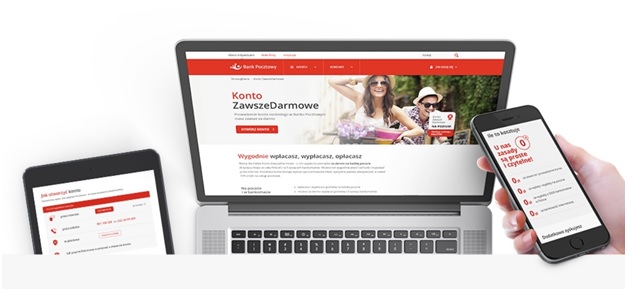

New website

In September 2015 the Bank launched an upgraded version of its website. The only thing that remained unchanged is the address: http://www.pocztowy.pl. The Bank has introduced new facilities for users, which are visible at first glance. The Bank’s website www.pocztowy.pl has been prepared in accordance with the current market standards, it is modern, simple and user-friendly. Thanks to the Responsive Web Design technology, the new website can be accessed from any type of device: smartphone, tablet, laptop and desk top. It has also been adjusted to the needs of users with visual disability. The new website uses a number of interesting solutions compliant with the latest market standards and it is easy to navigate. Bank Pocztowy’s products are divided into three categories: daily banking, loans, savings and investments. The website has a search function (which enables easy data search based on a word or phrase), table of contents (moving when scrolled and highlighting accessed section), bank office and ATM search (which allows for determining client location and the route to the selected office).

Key advantages of the new website:

- content adjustment to the client segment,

- simple presentation of the Bank’s offer,

- efficient content search,

- clear layout,

- simple navigation,

- modern search engine to find branches and offices, ATMs and cash deposit machines.

In September 2015 the Bank prepared the new version of the Sales Website, presenting products and sales information for the distribution network staff of the Bank and Poczta Polska. Thanks to user remarks and suggestions, a new simple clear and modern website has been developed. The website offers:

- clear layout,

- easy data search and active phrase search,

- logical structure of publications and advertising materials,

- new artwork.

In early October 2015 the Bank launched an upgraded version of the Management Information Website to centralize report management and provide management and operational information to the Bank’s staff. Apart from the attractive artwork, the new website enables an easy search for reports, intuitive navigation, clear layout for various browsers and screens and an efficient report search.

Bank Pocztowy in cooperation with Poczta Polska launched a website dedicated to the stock exchange and basic investing skills. The www.gieldowy.pocztowy.pl website has been created to explain the stock exchange to beginners. The web service presents information useful for all newcomers to the stock market, such as general information about the stock exchange, its history, the listing process, stock exchange indexes and other interesting facts, such as famous investment quotes.