Treasury operations

financial assets

Treasury operations of Bank Pocztowy focus on:

- interest rate risk and liquidity risk (for the banking book),

- currency risk, own trading risk, treasury risk (for the trading book).

Banking Book

In 2015 the Bank concluded mainly sale and purchase transactions in debt securities, sell-buy-back and buy-sell-back transactions and deposited or borrowed funds in the interbank market as a part of managing short-term liquidity and interest rate risk. Moreover, it entered into derivative transactions such as FRA, IRS or OIS to hedge against interest rate risk. In line with its long-term liquidity management strategy the Bank issued treasury debt securities.

| Investments in financial assets (in PLN ‘000) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| 31.12.2015 | 31.12.2014 |

|

|||||||

| Investments in financial assets | 1 248 037 | 1 519 266 | (271 229) | (17,9)% | |||||

| available for sale, including: | 803 347 | 1 100 547 | (297 200) | (27,0)% | |||||

| Treasury bonds | 779 609 | 611 726 | 167 883 | 27,4 % | |||||

| Bank bonds and certificates of deposit | 8 924 | 8 866 | 58 | 0,7 % | |||||

| Shares | 14 814 | 8 | 14 806 | 185 075,0 % | |||||

| Debt instruments issued by the National Bank of Poland | - | 479 947 | (479 947) | (100,0)% | |||||

| held to maturity, including: | 444 690 | 418 719 | 25 971 | 6,2 % | |||||

| Treasury bonds | 394 645 | 393 688 | 957 | 0,2 % | |||||

| Bank bonds and certificates of deposit | 50 045 | 25 031 | 25 014 | 99,9 % | |||||

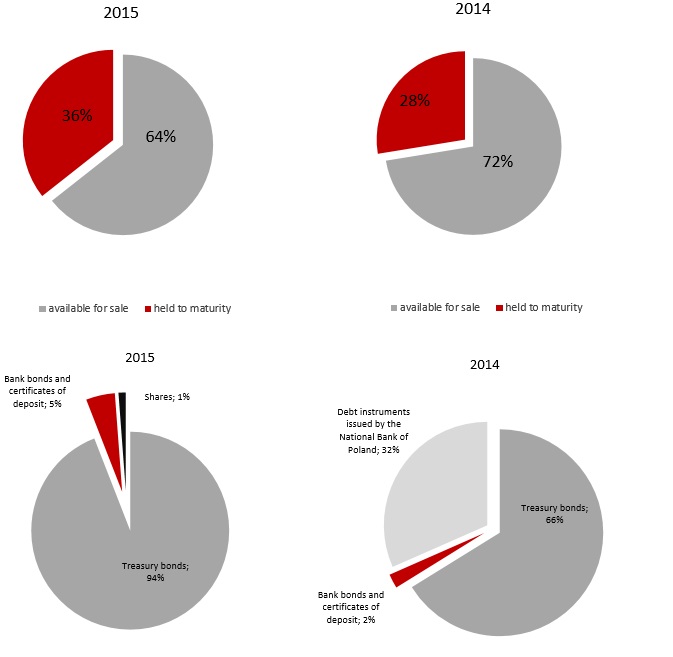

At the end of 2015 the total investments in financial assets of the Bank reached PLN 1 248.0 million, i.e. by PLN 271.2 million (17.9%) less than at the end of 2014, which resulted from lower investments of the Bank in short-term money bills issued by the National Bank of Poland. Government bonds accounted for 94.1% of the Bank’s investments in financial assets (as compared to 66.2% in December 2014) and constituted their key element. In December 2015 the face value of Government Bonds was PLN 1,174.3 million and was by PLN 168.8 million (i.e. by 16.8%) higher than at the end of 2014.

In 2015 the shares item included the fair value of shares in Visa Europe Limited (”Visa Europe”). In December 2015 Visa Europe informed the Bank that the projected settlement amount for the acquisition of Visa Europe by Visa Inc. allocated to the Bank will reach EUR 3,511 thousand, including EUR 2,614 thousand of cash and EUR 897 thousand of preference shares convertible to shares in Visa Inc. The amounts in question may be adjusted by transaction costs and other adjustments resulting from possible appeals filed by members of Visa Europe, which regard adjustments of amounts awarded to members due to transaction settlement. Moreover, deferred earn-out payments to Visa Europe members after 16 quarters of the transaction close have been accounted for in the deal. Earn-out is awarded to members meeting qualification criteria for payments in cash and shares who will not have discontinued their membership in Visa for 4 years of the transaction date. As at 31 December 2015 the deferred earn-out amount allocated to the Bank was not determined.

Based on the information the Bank remeasured shares in Visa Europe to their fair value, with the fair value assumed in the projected amount of cash allocated to the Bank as a result of the transaction settlement and the projected value of shares awarded including a 6% discount, i.e. EUR 3,457 thousand (i.e. PLN 14,733 thousand).

Fair value measurement of shares was recognized in revaluation reserve. As the deferred earn-out allocated to the Bank was not determined at the end of the reporting period, the Bank did not account for this amount in the measurement of shares in Visa Europe.

Securities by type

Investments in financial assets available for sale with the total nominal value of PLN 803.3 million constituted 64.4% of the debt securities portfolio and the remaining 35.6% were bonds held to maturity with the total face value of PLN 444.7 million.

In its securities portfolio the Bank also holds debt securities issued by other banks, classified to receivables and loans. In 2015 the value of these securities reached PLN 45.3 million, i.e. PLN 112.9 million less than in December 2014.

In 2015 interest income on investments in financial assets and non-treasury bonds amounted to PLN 40.1 million and was by 26.9% lower than in 2014. The decrease resulted from reduced market interest rates and a lower balance of debt securities.

At the end of December 2015 the gain on financial instruments measured at fair value through profit or loss and the gain on foreign exchange transactions amounted to PLN 1.2 million, i.e. reaching the level reported in 2014, where the gain on foreign exchange transactions was by PLN 0.6 million higher than in 2014 and equaled PLN 1.4 million. The change resulted from the increased business operations in the consumer segment.

In 2015 the gain on other financial instruments amounted to PLN 11.7 million, as compared to PLN 1.8 million in 2014. The increase resulted from higher income from sale of debt securities.

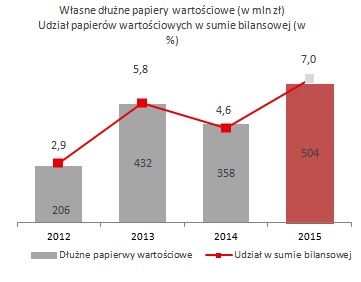

Since 2012 the Bank has consistently built the portfolio of long-term equity and liabilities through issues of own debt securities. At the end of December 2015 they amounted to PLN 503.5 million and had a 7.0% share in the balance sheet total.

Treasury debt securities (in PLN million)

Share of securities in the balance sheet total (%)

Trading Book

In 2015, the Bank concluded commercial transactions denominated in 10 foreign currencies, i.e. the euro, American dollar, fund sterling, Swiss franc, Japanese yen, Canadian dollar, Czech koruna, Swedish krone, Danish krone and Norwegian krone.

The Bank also traded in interest rate financial instruments, mainly in treasury debt securities.

In 2015 the gain on financial instruments held for trading and gain on foreign exchange transactions amounted to PLN 0.6 million versus PLN 1.5 million reported in 2014. The Bank generated a lower gain on trade transactions, debt instruments mainly. In 2015, on the currency market, the Bank generated the total gain on own and client transactions under individually negotiated currency transactions of PLN 1.0 million versus PLN 0.7 million in 2014.

In 2015 the Bank’s commercial transactions were insignificant.