Management’s discussion and analysis

In 2015 the Group generated a gross profit of PLN 42.9 million.

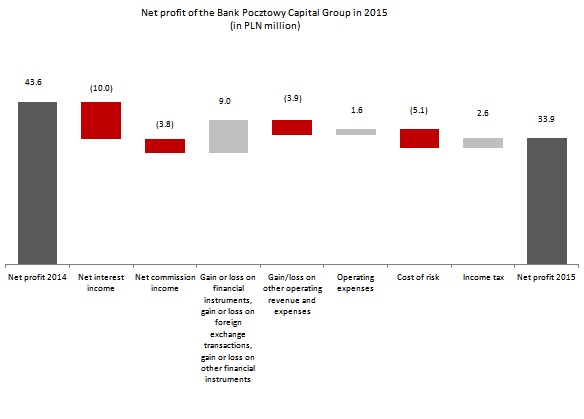

The net profit reached PLN 33.9 million and was 22.2% lower than in the prior year, when it hit the record level in the Group’s history.

The key income statement items:

Net profit of the Bank pocztowy Capital Group in 2015 (in PLN million)

The financial performance of the Group in 2015 was affected by one-off events which occurred mainly in Q4,2015:

- additional payment of PLN 11.9 million to the Bank Guarantee Fund related to the bankruptcy of SK Bank used for payment of guaranteed funds to depositors of SK Bank under the Resolution No. 87/DGD/2015 of the Management Board of the Bank Guarantee Fund,

- PLN 2.9 million paid to the Office for Competition and Consumer Protection under the court’s decision dated 6 October 2015,

- costs of provision of PLN 3.6 million for a contribution to the Borrowers’ Support Fund established under the Act of 9 October 2015. The Fund’s objective is to provide financial support to borrowers who have found themselves in a difficult financial situation due to external factors and who have to repay a housing loan, which constitutes a significant burden for their household budgets.

Moreover, apart from one-off events, which considerably increased the expenses, the financial profit of the Group in 2015 was affected by the following factors:

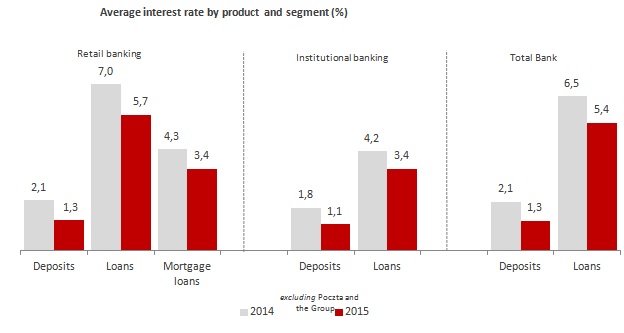

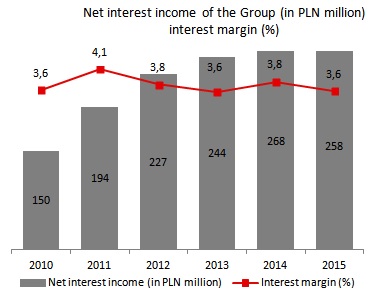

- Net interest income was by PLN 10 million (3.7%) lower than in 2014 and amounted to PLN 258.2 million. The performance deterioration resulted from the disadvantageous business environment and low interest rates, as in March 2015 the Monetary Policy Council decreased interest rates by 50 b.p. to record low levels, at the same time announcing the end of the monetary policy easing cycle. In 2015 average WIBOR 3M decreased by 0.8 p.p, (from 2.5% to 1.7%), hence the interest margin of the Group dropped by 0.2 p.p. (from 3.8% in 2014 to 3.6% in 2015).

- A decrease in the net fee and commission income by PLN 3.8 million. The Group generated PLN 55,8 million of net fee and commission income, i.e. 6.4% less than in the prior year, mainly due to the following changes in the market environment and in the Bank's offer in 2015:

- statutory reduction of interchange rates from 1 July 2014 to 0.5% at maximum and from 1 February 2015 to 0.2% for debit cards and 0.3% for credit cards and other payment cards,

- a tendency to limit the product range in the area of bancassurance, investment and insurance offer related to the implementation of the Recommendation U issued by the Polish Financial Supervision Authority and lower demand among clients,

- launch of the new Bank offer of current accounts – ZawszeDarmowe account with no monthly fee for account maintenance, which translated into higher acquisition of new clients in 2015 and limited revenue due to account maintenance.

- Higher gain on transactions in securities available for sale, gain on foreign exchange transactions and gain on financial instruments. The Bank generated the total income from such transactions of PLN 13.5 million, i.e. by PLN 9.0 million more than in 2014. The increase resulted from higher income from sale of debt securities.

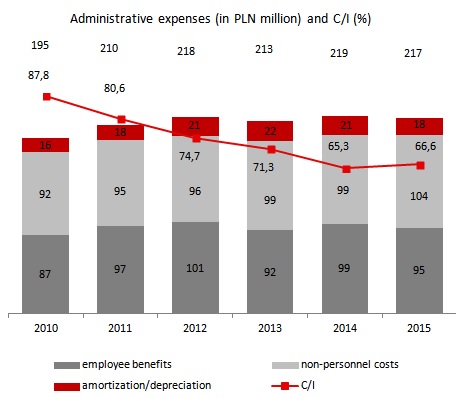

- Maintaining a cost discipline, which translated into lower administrative expense despite additional one-off events mentioned above. In 2015 administrative costs amounted to PLN 217.0 million and were by PLN 1.6 million (0.7%) lower than in 2014.

- A gain on other revenue and operating expenses lower by PLN 3.9 million mainly due to additional payments to the Office for Competition and Consumer Protection.

- Higher impairment losses on assets. In 2015 the cost of risk reached PLN 66.1 million and grew by 8.4% comparing to 2014. The increase resulted from change in the exposure structure and a dynamic growth in consumer loans with relatively higher cost of risk.

| Key items the income statement of the Bank Pocztowy S.A. Capital Group (in PLN’000) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| 31.12.2015 | 31.12.2014 |

|

|||||||

| Operating income | 327 528 | 332 340 | (4 812) | (1,4)% | |||||

| Net interest income | 258 175 | 268 150 | (9 975) | (3,7)% | |||||

| Net fee and commission income | 55 837 | 59 657 | (3 820) | (6,4)% | |||||

| Gain or loss on financial instruments measured at fair value through profit or loss and gain or loss on foreign exchange transactions | 1 789 | 2 763 | (974) | (100,0)% | |||||

| Gain or loss on other financial instruments | 11 727 | 1 770 | 9 957 | 562,5 % | |||||

| Gain/loss on other operating revenue and expenses | (1 474) | 2 440 | (3 914) | x | |||||

| General and administrative expenses | (217 030) | (218 622) | 1 592 | (0,7)% | |||||

| Net impairment losses | (66 145) | (61 013) | (5 132) | 8,4 % | |||||

| Operating profit/loss | 42 879 | 55 145 | (12 266) | (22,2)% | |||||

| Net financial profit/loss for the current period | 42 879 | 55 145 | (12 266) | (22,2)% | |||||

| Income tax | (8 948) | (11 506) | 2 558 | (22,2)% | |||||

| Net financial profit/loss for the current period | 33 931 | 43 639 | (9 708) | (22,2)% | |||||

Net interest income

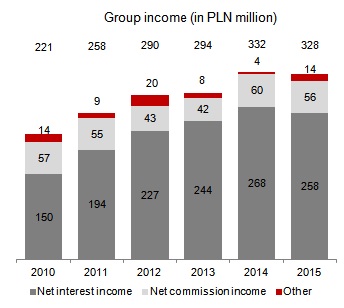

In 2015, like in the previous year, the net interest income constituted the key source of income for the Group. It amounted to PLN 258.2 million and was by PLN 10.0 million, i.e. by 3.7% lower YoY.

The deterioration of the net interest income of the Group in 2015 occurred in the following circumstances:

- Lower interest income. It amounted to PLN 355.2 million and was by 14.7% lower than in the previous year. The deterioration resulted mainly from the decrease in interest income from term loans granted to individuals of PLN 31.8 million, i.e. 10.3% despite higher credit balances in this area, which resulted from a decrease in average interest on consumer loans. At the end of 2015 the yield on consumer loans amounted to 8.9% and was by 2.5 p.p. lower than in 2014. To a large extent, it resulted from a reduction in Lombard rates by 0.5 p.p., which constitute the basis for calculating interest caps under the Act on supervision over the financial market. Moreover, interest income on term loans granted to institutional clients and local government bodies decreased by: 22.6% and 34.8% respectively, which resulted from lower credit exposures granted to this portfolio as well as adverse effects of lower interest rates. Income on investment financial assets decreased as well and amounted to PLN 35.1 million, i.e. was by 22.8% lower than in the previous year.

- Lower interest expense. In 2015 interest expense amounted to PLN 97.1 million and was by 34.5% lower than in 2014. The Group incurred much lower interest expense due to term deposits of all groups of clients, which resulted from:

- deposit pricing policy aimed at limiting the cost of financing and mitigating the negative impact of lower yield on assets.

- lower balance of cash at bank.

| Interest income and interest expense of the Bank Pocztowy S.A. Capital Group (PLN’000) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 31.12.2015 | 31.12.2014 |

|

||||||||

| Interest income | 355 240 | 416 278 | (61 038) | (14,7)% | ||||||

| Income on receivables from banks | 4 914 | 9 064 | (4 150) | (45,8)% | ||||||

| Income on loans and advances to clients, including: | 315 165 | 361 466 | (46 301) | (12,8)% | ||||||

| Overdraft facilities | 4 209 | 7 125 | (2 916) | (40,9)% | ||||||

| Credit facilities and term loans | 310 956 | 354 341 | (43 385) | (12,2)% | ||||||

| individuals | 277 228 | 309 011 | (31 783) | (10,3)% | ||||||

| institutional clients | 26 540 | 34 300 | (7 760) | (22,6)% | ||||||

| local authorities | 7 188 | 11 030 | (3 842) | (34,8)% | ||||||

| Income on investments in financial assets classified as | 35 089 | 45 447 | (10 358) | (22,8)% | ||||||

| available for sale | 18 729 | 25 361 | (6 632) | (26,2)% | ||||||

| held to maturity | 16 360 | 20 086 | (3 726) | (18,6)% | ||||||

| Income on financial assets held for trading | 72 | 301 | (229) | (76,1)% | ||||||

| Interest expense | (97 065) | (148 128) | 51 063 | (34,5)% | ||||||

| Expense due to liabilities to other banks | (1 125) | (419) | (706) | 168,5 % | ||||||

| Expense due to liabilities to customers, including: | (73 287) | (121 894) | 48 607 | (39,9)% | ||||||

| Current accounts | (16 975) | (31 603) | 14 628 | (46,3)% | ||||||

| Term deposits | (56 312) | (90 291) | 33 979 | (37,6)% | ||||||

| individuals | (46 370) | (71 031) | 24 661 | (34,7)% | ||||||

| institutional clients | (9 489) | (18 157) | 8 668 | (47,7)% | ||||||

| local authorities | (453) | (1 103) | 650 | (58,9)% | ||||||

| Expense due to issue of liquidity and subordinated bonds, and subordinated debt | (20 384) | (23 199) | 2 815 | (12,1)% | ||||||

| Costs arising from sell-buy-back securities | (2 141) | (2 616) | 475 | (18,2)% | ||||||

| Expense due to hedging instruments | (128) | - | (128) | - |

||||||

Lower net interest income of the Group translated into a decrease in the interest margin. In 2015 the Group reported an interest margin of 3.6% versus 3.8% in the preceding year, still the decrease in the interest margin by 0.2 p.p. was accompanied by lower average market rate WIBOR 3M by 0.8 p.p. (from 2.5% to 1.7%).

Group income (in PLN million)

Net interest income of the Group (in PLN million) interest margin (%)

Net fee and commission income

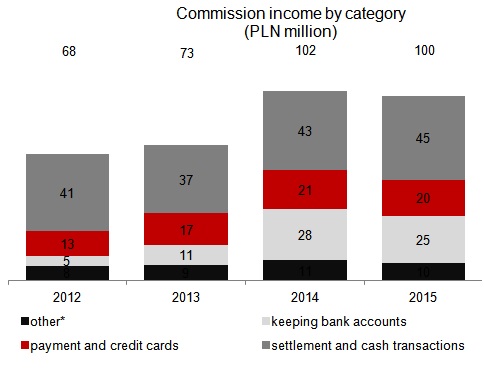

Net fee and commission income was the key element of non-interest income of the Group. It amounted to PLN 55.8 million and was by 6.4% lower than in the previous year.

| Fee and commission income and expense of the Bank Pocztowy S.A. Capital Group (PLN’000) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2015 | 2014 |

|

|||||||

| Fee and commission income | 99 710 | 102 304 | (2 594) | (2,5)% | |||||

| settlement and cash transactions | 45 401 | 42 783 | 2 618 | 6,1 % | |||||

| keeping bank accounts | 25 221 | 27 589 | (2 368) | (8,6)% | |||||

| payment and credit cards | 19 520 | 21 028 | (1 508) | (7,2)% | |||||

| sale of insurance products | 3 412 | 4 717 | (1 305) | (27,7)% | |||||

| originated loans and advances | 1 097 | 1 243 | (146) | (11,7)% | |||||

| other | 5 059 | 4 944 | 115 | 2,3 % | |||||

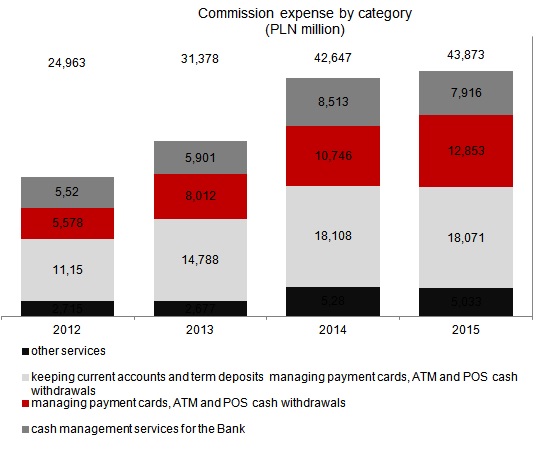

| Fee and commission expense | (43 873) | (42 647) | (1 226) | 2,9 % | |||||

| keeping current accounts and term deposits | (18 071) | (18 108) | 37 | (0,2)% | |||||

| managing payment cards, ATM and POS cash withdrawals | (12 853) | (10 746) | (2 107) | 19,6 % | |||||

| cash management services for the Group | (7 916) | (8 513) | 597 | (7,0)% | |||||

| other services | (5 033) | (5 280) | 247 | (4,7)% | |||||

Commission income amounted to PLN 99.7 million and was by 2.5% lower than in 2014. The Capital Group reported in particular an decrease in:

- Commission on sale of bancassurance products (by 27.7%). It was related to limiting the product range in the area of bancassurance and investment and insurance offer related to the implementation of the Recommendation U issued by the Polish Financial Supervision Authority and lower demand among clients.

- Income from bank account maintenance (by 8.6%). This decrease resulted from the launch of the new Bank offer of current accounts – ZawszeDarmowe account with no monthly fee for account maintenance.

- Commissions on payment cards and credit cards (by 7.2%) mainly due to a decrease in interchange rates on non-cash transactions. Interchange rates were decreased twice. On 1 July 2014 they were decreased to 0.5% (down from 1.2%) and since January 2015 they have stood at 0.2% for debit cards and 0.3% for credit cards.

At the same time, the Group increased the commission income due to settlement and cash operations by 6.1%. In 2015 it amounted to PLN 45.4 million, as compared to 42.8 million a year before. The key reasons were higher commission income from cash transfers made by consumers, from cash operations and higher commission income from an increased number of standard payments to the account.

Commission income by category (PLN million)

Commission expense by category (PLN million)

*Other commission income included: income from sale of insurance products, originated loans and other income. In the years 2010-2011 the financial statements did not account for bancassurance adjustments. The Bank decided to not disclose these items for data comparability reasons.

In 2015 the fee and commission expense increased as well up to PLN 43.9 million, being 2.9% higher than in 2014. The Group reported higher fee and commission expenses related to payment cards and cash withdrawals from ATMs and POS by PLN 2.1 million, i.e. by 19.6% as a result of a growth in the number of transactions performed by clients and in the number of cards issued in relation to growing popularity of proximity card transactions and development of the acceptance network. Further, fees charged by VISA increased and the Bank incurred the costs of fees to MasterCard (related to the inclusion of their cards into Bank’s offer);

Other income

In 2015 the gain on financial instruments measured at fair value through profit or loss, gain on foreign exchange transactions and gain on other financial instruments amounted to PLN 13.5 million versus PLN 4.5 million reported in 2014. The category is discussed in detail in Section 5 dedicated to treasury operations.

In 2015 other operating income (other revenue/operating expenses) amounted to (PLN - 1.5 million) as compared to PLN 2.4 million at the end of 2014. Other operating revenue amounted to PLN 5.7 million and was by PLN 3.0 million lower than in 2014, mainly due to lower revenue from sales of on-balance sheet receivables.

In 2015 other operating expense amounted to PLN 7.2 million and was PLN 0.9 million (14.0%) higher than in 2014. The items which grew most (by PLN 1.9 million) was the costs of damages and fines which were related to the fine imposed after the validation of the decision of the President of the Office for Competition and Consumer Protection No. DAR 15/2006 on fining banks for joint determination of the “interchange” rate. The fine imposed on the Bank amounted to PLN 2,895 thousand. The Bank maintained a related provision of PLN 1 million. The remaining portion not provisioned for (PLN 1.9 million) was recognized in other operating expenses.

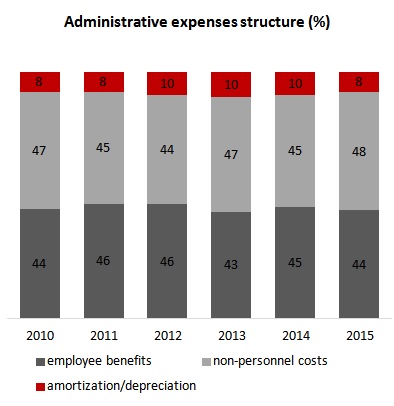

General and administrative expenses

In 2015, the Group followed the cost optimization strategy. In 2015 operating expenses of the Group reached PLN 217.0 million and remained at the level comparable to that of 2014.

| Administrative expenses and amortization/depreciation of the Bank Pocztowy S.A. Capital Group (PLN ‘000) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2015 | Structure (2015) | 2014 | Structure (2014) |

|

|||||||

| Administrative expenses including amortization/depreciation | (217 030) | 100,0% | (218 622) | 100,0% | 1 592 | (0,7)% | |||||

| Employee benefits | (95 276) | 43,9% | (99 398) | 45,5% | 4 122 | (4,1)% | |||||

| Non-personnel costs | (103 576) | 47,7% | (98 420) | 45,0% | (5 156) | 5,2 % | |||||

| Amortization/ Depreciation | (18 178) | 8,4% | (20 804) | 9,5% | 2 626 | (12,6)% | |||||

The key element of operating expense of the Group were non-personnel costs. In 2015 they amounted to PLN 103.6 million, having grown by 5.2% comparing to 2014. The item included the following increased costs:

- Other non-personnel costs, which grew by PLN 16.2 million to PLN 24.3 million in 2015, as a consequence of an increase in payments to the Bank Guarantee Fund, which resulted from:

- changes in basic rates applicable in 2015. The following payment rates to the Bank Guarantee Fund applied in 2015.

- Mandatory annual fee for 2015 calculated as 0.189% of the total of capital requirements pertaining to each risk type and to the exceeding of limits and other standards determined in the Banking Law multiplied by 12.5. The rate applied in 2014 was 0.1%.

Consequently, the costs grew by PLN 3.7 million. - Prudential fee for 2015 calculated as 0.05% of the total of capital requirements pertaining to each risk type and to the exceeding of limits and other standards determined in the Banking Law multiplied by 12.5. The rate applied in 2014 was 0.037%.

Consequently, the costs grew by PLN 0.6 million.

- Mandatory annual fee for 2015 calculated as 0.189% of the total of capital requirements pertaining to each risk type and to the exceeding of limits and other standards determined in the Banking Law multiplied by 12.5. The rate applied in 2014 was 0.1%.

- changes in basic rates applicable in 2015. The following payment rates to the Bank Guarantee Fund applied in 2015.

- an additional payment of PLN 11.9 million to the Bank Guarantee Fund used for payment of guaranteed funds to depositors of Spółdzielczy Bank Rzemiosła i Rolnictwa in Wołomin under the Resolution No. 87/DGD/2015 of the Management Board of the Bank Guarantee Fund,

- a provision for the costs of premiums to the Borrowers’ Support Fund for obligors in a difficult financial situation of PLN 3.6 million.

Administrative expenses structure (%)

Administrative expenses (in PLN million) and C/l (%)

In 2015 employee benefits amounted to PLN 95.3 million and dropped by 4.1% comparing to 2014. The decrease in costs resulted from personnel costs optimization related to the reorganization in the Bank’s head office. The changes included in particular headcount reduction in the institutional segment due to the strategic decision to focus business activities on the consumer segment and to reverse provisions for annual bonuses of PLN 3.7 million.

In 2015 the Group followed its strategy aimed at tight cost control, which will allow for permanent cost reduction in future, accompanied with improved efficiency of the Group and support for its further development. In the first half of 2014, the Group launched a cost and process optimizing project, whose implementation and outcome monitoring has been planned for two years. Key initiatives included:

- remodeling of the Bank’s organizational structure, change of its business model and determining FTE number of employees in each organizational unit in compliance with the new strategy assumptions (mainly reorganizing of the institutional service line),

- optimizing of processes, procedures and internal regulations,

- optimizing of the scope of purchases and adjusting costs of support functions to sales objectives.

Net impairment losses

In 2015 the amount of PLN 66.1 million was recognized in the income statement due to impairment losses (vs. PLN 61.0 million in the comparable period).

| Net impairment losses (PLN’000) | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2015 | 2014 |

|

|||||||

| Loans and advances granted to customers, including | (66 145) | (61 013) | (5 132) | 8,4 % | |||||

| individuals | (59 544) | (48 739) | (10 805) | 22,2 % | |||||

| overdraft facilities | (742) | (565) | (177) | 31,3 % | |||||

| cash loans and instalment loans | (53 725) | (41 943) | (11 782) | 28,1 % | |||||

| mortgage loans | (2 915) | (1 355) | (1 560) | 115,1 % | |||||

| real estate loans | (1 903) | (3 943) | 2 040 | (51,7)% | |||||

| credit card debt | (259) | (933) | 674 | (72,2)% | |||||

| institutional customers | (6 649) | (12 233) | 5 584 | (45,6)% | |||||

| local authorities | 48 | (41) | 89 | (217,1)% | |||||

The increase in the impairment losses recognized in the income statement was mostly related to:

- loans for individuals, where the impairment loss recognized was higher by PL 10.8 million, which results from the increased focus of the Group on cash and installment loans which are characterized by higher cost of risk,

- loans for institutional clients, where the impairment loss recognized in the income statement was by PLN 5.6 million lower, because no significant events of default were reported in the segment.

Business segment performance

The Bank’s operations have been divided into segments in accordance with products sold, services provided and types of clients, for management purposes. The following operating segments have been identified: consumer, institution, settlement and treasury.

Detailed principles of separating revenue, expenses, assets and liabilities in each segment are described in internal regulations of the Bank. The Bank settles inter-segment transactions applying internal transfer rates determined based on market data. Most operations are carried out in the Polish market – the client base is composed mainly of local individuals and corporations. The Bank’s activities are not exposed to the risk of fluctuations resulting from seasonality of operations.

The Bank’s Management Board assesses segment financial performance based on the following figures:

- operating profit after any impairment losses including other operating revenue and expenses,

- general and administrative expenses,

- C/I (cost/income).

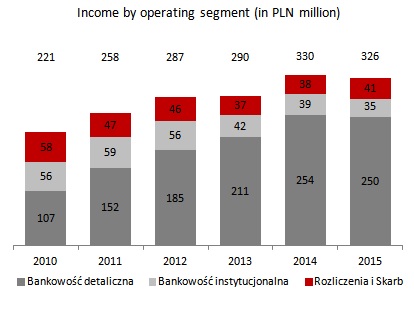

Income by operating segment (in PLN million)

Changes in operational segment reporting

In 2015 the Bank introduced changes in operational segment reporting. The changes resulted from a revised allocation key applied to the general and administrative expenses based on an internal capital assigned to individual segments. In addition, the net interest income in the settlement and treasury segment has been divided into external clients and other segments. The data for 2014 have been appropriately restated in the financial statements to ensure comparability.

The Group has separated assets and liabilities related to the settlement and treasury segment from the data related to assets, equity and liabilities as at 31 December 2015. The data as at 31 December 2014 have been appropriately restated to ensure comparability.

As the Management Board of the Bank analyses the aggregate net interest income, no interest income or interest expense has been separated in financial performance of individual segments

Consumer segment

From management accounting perspective the consumer segment offers products targeted at individuals and microenterprises (including sole proprietorships). The offer consists of saving and settlement accounts (current accounts), savings accounts, term deposits, consumer loans (including cash loans and overdrafts), mortgage loans (including housing loans and mortgages), debit and credit cards, insurance products and investment funds. It is sold through traditional distribution channels in a countrywide network of branches and offices (including the sales network of Poczta Polska and financial agents), Pocztowy24 Internet banking, PocztowySMS mobile banking and a Contact Center.

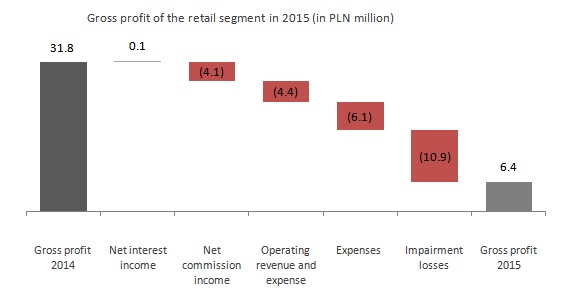

In 2015 the consumer segment generated a gross profit of PLN 6.4 million, which was by PLN 25.4 million lower than that generated in 2014.

Key gross profit growth drivers in the consumer segment:

- maintaining the net interest income at the level reported in the previous year thanks to balancing the decrease in interest income with the appropriate reduction of costs related to deposits. Net interest income constituted the key source of segment income. It has grown by PLN 71.0 thousand and amounted to PLN 222.2 million,

- a decrease in the net commission income. In 2015 the consumer segment generated a net fee and commission income of PLN 28.0 million, i.e. by PLN 4.1 million less than in the prior year. The decrease resulted from lower income due to current account maintenance (following the launch of the ZawszeDarmowe account with no monthly fee for account maintenance) lower income and higher costs related to bank cards,

- lower gain on other operating revenue and expenses. The decrease resulted from recognizing the fine imposed by the Office for Competition and Consumer Protection for the joint determination of the interchange rate by banks (court decision on the Decision of the Office for Competition and Consumer Protection of 2006) in the operating expenses,

- higher administrative expenses. In 2015 the consumer segment costs reached PLN 178.1 million, i.e. by PLN 6.1 million more than in 2014. The key reason for growth was allocating additional non-personnel expenses to the consumer segment (the cost of payments made to the Borrowers Support Fund supporting borrowers in a difficult financial situation and a portion of the premium paid to the Bank Guarantee Fund following the bankruptcy of SK Bank),

- higher net impairment losses. In 2015 they amounted to PLN 65.1 million comparing to PLN 54.2 million in 2014, due to focusing on sales of consumer loans charged with higher average cost of risk.

Gross profit of the retail segment in 2015 (in PLN million)

Institutional segment

For management accounting purposes institutional segment includes operating profit/loss from services provided to business entities with legal personality, individuals and entities with no legal personality carrying out business activities under applicable regulations and central and local administration entities.

Products offered in the institutional segment include: credit products (working capital loans including revolving loans, overdrafts, investment loans, loans with thermal improvement and refurbishment premium, mortgage loans and bank guarantees), deposits (current accounts, standards and individually negotiated deposits, savings accounts) and settlement services with reasonably priced cash management offer. Services such as accepting in-branch deposits and secure deposits for institutional clients and giro transfers (cash payments to beneficiaries, i.e. third parties who are not Bank clients) are offered through the Bank's own network and the distribution network of Poczta Polska S.A., while bank products such as credit facilities are sold through the Bank's network and financial agents.

The Bank offers the following types of treasury products: purchase and sale of debt securities (treasury and non-treasury securities, certificates of deposit) and forward contracts within the treasury limit.

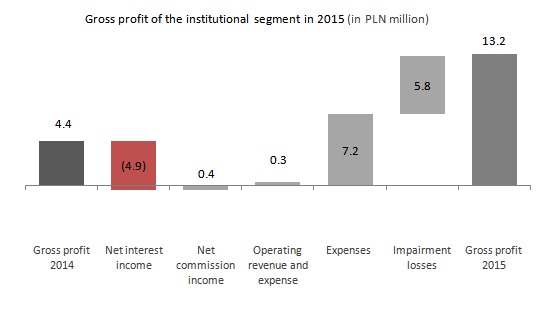

In 2015 the institutional segment generated a gross profit of PLN 13.2 million versus PLN 4.4 million in 2014 (an increase of PLN 8.8 million).

The institutional segment profit was driven by the following items:

- a reduction in net interest income. It amounted to PLN 23.8 million, i.e. decreased by 17.0%. The decrease resulted from limiting the lending and deposit activities, in accordance with the strategy adopted,

- flat net fee and commission income. The segment generated a net commission income of PLN 11.2 million, i.e. by 0.4 more (i.e. by 3.3%) than in the prior year. The highest commission income was generated on secure deposits and in-branch deposits.

- improved level of administrative expenses. They amounted to PLN 20. 8 million, i.e. decreased by PLN 7.2 million, mainly due to the change resulting from the reduction in the institutional segment;

- improved net impairment losses. In 2015 the net impairment losses amounted to (PLN – 1.0 million), versus (PLN – 6.8 million) in 2014, which resulted from limited lending in the institutional segment

Gross profit of the institutional segment in 2015 (in PLN million)

Settlement and treasury segment

For management accounting purposes, the settlement and treasury segment recognizes the profit or loss from settlement services and treasury activities.

The Bank offers the customers of Poczta Polska S.A. comprehensive settlement services such as cash payments, because cash payments received in the offices of Poczta Polska S.A. have been included in interbank settlements. The services include mainly: managing cash payments made in other banks and handling payments made to the Social Insurance Institution and Tax Offices.

Operations of the treasury function include treasury transactions, financial markets, and management of liquidity, interest rate and currency risks. The department concludes transactions in the interbank market (e.g. deposits), buys and sells securities (Treasury bonds, debt instruments issued by the National Bank of Poland, bank bonds) and enters into sell-buy-back and buy-sell-back transactions and derivative transactions such as FRA, IRS or swap. It repurchases client funds obtained by operating segments at a transfer rate and sells the funds to finance their credit operations.

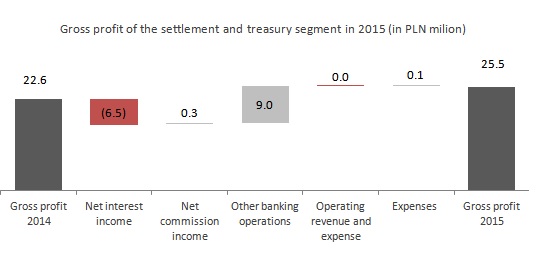

In 2015 the settlement and treasury segment generated a gross profit of PLN 25.5 million versus PLN 22.6 million in 2014 (an increase of PLN 12.9%).

The key gross profit drivers in the settlement and treasury segment in 2015:

- a decrease in net interest income by PLN 6.5 million to PLN 11.6 million in 2015. The key reason was a decrease in the profitability of treasury assets from 3.2% in 2014 to 2.4% in 2015, which followed the market rates reduction,

- flat net fee and commission income. In 2015 the net fee and commission income amounted to PLN 15.5 million and was by PLN 0.3 million (i.e. by 2.1%) higher than in the prior year,

- higher gain on other banking operations comprising a gain on other financial instruments, gain on financial instruments measured at fair value through profit or loss and gain on foreign exchange transactions. It amounted to PLN 13.5 million and vs. PLN 4.5 million in 2014 due to higher income from sale of debt securities,

- administrative expenses remaining stable, on the previous year level. In 2015 the segment reported expenses of PLN 15.1 million.

Gross profit of the settlement and treasury segment in 2015 (in PLN million)

Unallocated items

Deterioration of the net profit of the Group in 2015 and the increase in equity following the capital injection to Bank Pocztowy resulted in a lower net ROE. In 2015 the return on equity stood at 6.9% and was by 3.6 p.p. lower than in the previous year.

| Key performance ratios of the Bank Pocztowy S.A. Capital Group | |||||

|---|---|---|---|---|---|

| 31.12.2015 | 31.12.2014 | Change 2015/2014 | |||

| Net ROE (%) | 6,9 | 10,5 | (3,6) p.p. | ||

| Net ROA (%) | 0,5 | 0,6 | (0,1) p.p. | ||

| Costs including amortization / income (C/I) (%) | 66,6 | 65,3 | 1,3 p.p. | ||

| Net interest margin (%) | 3,6 | 3,8 | (0,2) p.p. | ||

| CAR (%) | 14,4 | 13,4 | 1,0 p.p. | ||

| NPL – the share of impaired loans and advances in the credit portfolio (%) | 7,0 | 6,1 | 0,9 p.p. | ||

Net ROE calculated as a net profit for a given year to average equity (calculated as the average of equity at the end of a given year and at the end of the previous year) taking into account the net profit or loss for a given year.

Net ROA calculated as a net profit for a given year to average assets (calculated as the average of assets at the end of a given year and at the end of the previous year).

Costs including amortization and depreciation/Income (C/I) calculated as the general and administrative expenses including amortization and depreciation to total income (net interest income, net fee and commission income, gain/loss on financial instruments measured at fair value through profit or loss, gain/loss on foreign exchange transactions, gain/loss on other financial instruments, other operating revenue and expenses).

Net interest margin calculated a relation of net interest income for a given year to average assets (calculated as average daily balance of assets).

NPL (Non Preforming Loans) calculated as a relation of impaired loans to the gross loans and advances to clients.

A significant increase in the Group’s income (by 1.4%) which was lower than the reduction of operating expenses (by 0.7%) translated into the deterioration of the Cost/Income ratio. In 2015 the Cost/Income ratio amounted to 66.6%, i.e. was by 1.3 p.p. higher than in 2014. At the end of 2015 the share of impaired loans (NPL) in the credit portfolio was 7.0% vs. 6.1% a year before. The key reason for the higher NPL was the dynamic growth in consumer loans for individuals which bear higher risk. Significantly, the ratio was considerably better than that of the entire Polish banking sector (7.4%)[1].

[1] Source: National Bank of Poland, financial data for the banking sector; file – Receivables, data for December 2015.

Changes in the statement of financial position in 2015 – key items

As at 31 December 2015 the balance sheet total of the Group amounted to PLN 7 213.0 million. The decrease in the balance sheet total resulted mainly from the decrease in transfer funds of Poczta Polska, which amounted to PLN 193.6 million at the end of December 2015, i.e. were by PLN 452.1 million lower than at the end of December 2014. If transfer funds were not accounted for in the balance sheet total, its amount would have to remain at the level similar to that of 31 December 2014.

| Key balance sheet items of the Bank Pocztowy S.A. Capital Group (PLN ‘000) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 31.12.2015 | Share (31.12.2015) | 31.12.2014 | Share (31.12.2014) |

|

|||||||

| Cash in hand and deposits with the Central Bank | 426 875 | 5,9% | 757 643 | 9,8% | (330 768) | (43,7)% | |||||

| Receivables from other banks | 45 346 | 0,6% | 158 269 | 2,1% | (112 923) | (71,3)% | |||||

| Receivables from securities purchased under reverse repo and buy-sell-back agreements | 19 794 | 0,3% | 0 | 0,0% | 19 794 | - | |||||

| Loans and advances granted to clients | 5 312 882 | 73,7% | 5 151 777 | 66,7% | 161 105 | 3,1 % | |||||

| Investments in financial assets | 1 248 037 | 17,3% | 1 519 266 | 19,7% | (271 229) | (17,9)% | |||||

| Investments in subsidiaries | 0 | 0,0% | 0 | 0,0% | - | - | |||||

| Net non-current assets | 100 137 | 1,4% | 80 322 | 1,0% | 19 815 | 24,7 % | |||||

| Other assets | 59 959 | 0,8% | 51 750 | 0,8% | 8 209 | 15,9 % | |||||

| Total assets | 7 213 030 | 100,0% | 7 719 027 | 100,0% | (505 997) | (6,6)% | |||||

| Liabilities to the Central Bank | 10 | 0,0% | 11 | 0,0% | (1) | (9,1)% | |||||

| Liabilities to other banks | 34 440 | 0,5% | 4 020 | 0,1% | 30 420 | 756,7% | |||||

| Liabilities from securities sold under repo and sell-buy-back agreements | 154 017 | 2,1% | 177 701 | 2,3% | (23 684) | (13,3)% | |||||

| Liabilities to clients | 5 742 377 | 79,6% | 6 492 023 | 84,1% | (749 646) | (11,5)% | |||||

| Liabilities arising from issue of debt securities | 503 500 | 7,0% | 358 256 | 4,6% | 145 244 | 40,5 % | |||||

| Subordinated liabilities | 141 887 | 2,0% | 142 090 | 1,8% | (203) | (0,1)% | |||||

| Other liabilities | 94 314 | 1,3% | 105 294 | 1,4% | (10 980) | (10,4)% | |||||

| Total liabilities | 6 670 545 | 92,5% | 7 279 395 | 94,3% | (608 850) | (8,4)% | |||||

| Total equity | 542 485 | 7,5% | 439 632 | 5,7% | 102 853 | 23,4 % | |||||

| Total liabilities and equity | 7 213 030 | 100,0% | 7 719 027 | 100,0% | (505 997) | (6,6)% | |||||

Other assets include: Financial assets held for trading, hedging financial instruments, net deferred income tax assets, other assets.

Other liabilities include: financial liabilities held for trading, provisions, current income tax liabilities, other liabilities.

Assets

In 2015 the key changes in the Group’s asset structure resulted from:

- Increased value of the key item in the Group’s assets, i.e. net loans and advances granted to clients. At the end of 2015 they amounted to PLN 5 312.9 million and grew by PLN 161.1 million during the year. The item accounted for 73.7% of the total assets of the Group (versus 66.7% a year before).

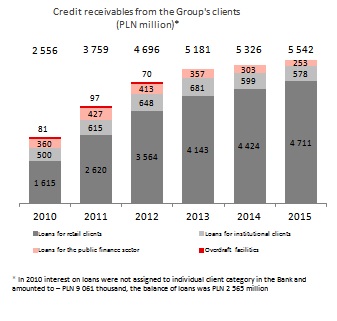

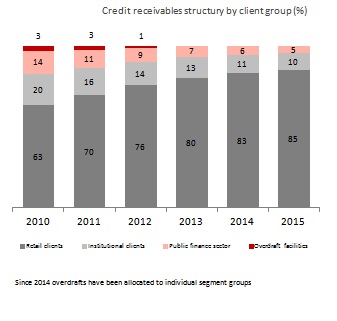

Credit receivables from the Group's clients (PLN million)*

Credit receivables structury by client group (%)

- The decrease in the value of cash in hand and at bank (National Bank of Poland). In December 2015 it amounted to PLN 426.9 million and decreased by 330.8 million comparing to the end of 2014. Consequently, its share in assets increased from 9.8% at the end of 2014 to 5.9% in December 2015.

- The decrease in investments in financial assets comparing to the previous year. They amounted to PLN 1 248.0 million, i.e. PLN 271.2 million less than in December 2014. Consequently, their share in assets decreased from 19.6% at the end of 2014 to 17.3% in December 2015.

Equity and liabilities

The following changes occurred in the structure of Group’s equity and liabilities in 2015:

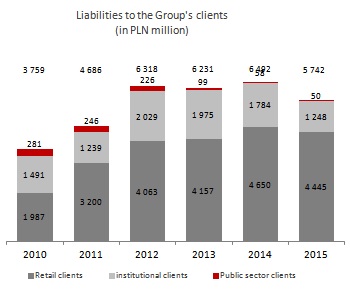

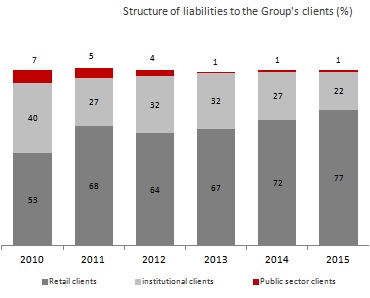

- The liabilities to clients decreased. At the end of 2015 they amounted to PLN 5,742.4 million, i.e. dropped by PLN 749.6 million during the year. They accounted for 79.6% of the balance sheet total versus 84.1% in December 2014.

Liabilities to the Group's clients (in PLN million)

Structure of liabilities to the Group's cielnts (%)

- The value of liabilities due to issue of debt securities increased. In December 2015 they amounted to PLN 503.5 million having increased by PLN 145.2 million since December 2014.

- Equity amounted to PLN 542.5 million, which accounted for 7.5% of the total equity and liabilities, as compared to PLN 439.6 million and 5.7%, respectively, at the end of December 2014. The equity increased due to the capital injection of PLN 60 million to the Bank made by the existing shareholders and the allocation of the prior year profit.