Situation in the banking sector

Deposits of households and enterprises

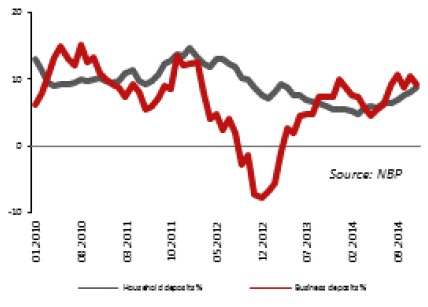

At the end of 2015 the total deposits in the banking system amounted to PLN 996 billion, i.e. by 8.9% more than at the end of 2014. Deposits of households stood at PLN 646.0 billion. In 2015 the growth rate of deposits of households gradually increased and in December reached 9.2% year-on-year (versus 8.8% in December 2014). The deposit growth being higher than in the prior year resulted mostly from an improvement on the labor market, while the interest rate reduction introduced by National Bank of Poland in March adversely affected the attractiveness of investments in the banking sector. Another deposit driver was deflation reported during the entire year. In December 2015, deposits of enterprises amounted to PLN 249.4 billion, i.e. increased by 10.4% during the year vs. a 9.4% increase in December 2014. A higher growth rate of corporate deposits resulted from improved financial condition of businesses. Historic low costs of credit encouraged enterprises to take out loans for financing growth and investment.

Dynamics of deposits (year to year)

Loans and advances to households and enterprises

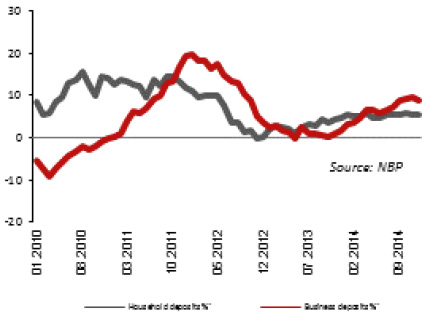

In December 2015, loan receivables in the banking sector totaled PLN 1 076.4 billion, being 7.0% higher than in December 2014. In 2015 loans and advanced to households went up by 6.6% up to PLN 632.6 billion. Housing loans in the local currency grew from PLN 190.4 billion in December 2014 to PLN 212 billion at the end of 2015 (by 11.3%). Record low interest rates and an improvement on the labor market positively affected the scale of the new lending campaign. In the second half of 2015, apartments bought on the secondary market were included into the Flat for the Young program, which considerably increased credit appetite of consumers. On the other hand, the down payment was increased from 5% to 10% on 1 January 2015 in accordance with the Recommendation S issued in 2014, which adversely affected the appetite for debt. In December 2015 the portfolio value of foreign currency loans increased to PLN 166.2 billion, i.e. by PLN 3.1 billion since the end of 2014. The increase in the portfolio value resulted in particular from weakening PLN versus CHF and other currencies. More restrictive provisions of the Recommendation S have made taking out foreign currency loans very difficult. Receivables of the banking sector due to consumer loans from individuals increased. In December 2015 they totaled PLN 126.4 billion (versus PLN 118.4 billion in December 2014). The consumer loan volume increase resulted from a reduction in interest rates and more lenient loan terms offered by banks, among others in relation to the observed labor market improvement. In December 2015 the value of loans granted to enterprises was PLN 326.0 billion versus PLN 300.9 billion in December 2014 (8.3% growth). More new loans in the corporate sector resulted from increased investments made by businesses. Moreover, corporations were encouraged to apply for loans due to attractive interest rates offered after the reduction introduced in March by the Monetary Policy Council and the Council's announcement that the rates would not be reduced any further in the following months.

Growth in loans (year to year)

Interest rate on deposits and loans

In March 2015 the Monetary Policy Council cut interest rates and announced to have closed the cycle of easing the monetary policy. The reference rate was reduced to the lowest level in history (i.e. down to 1.50%), while the Lombard rate went down to 2.50%, which materially affected the interest rates on loans and deposits. According to the data of the National Bank of Poland, in December 2015 the average interest rate on new deposits of households in PLN amounted to 1.8% versus 2.3% in December 2014. Average interest on new deposits of enterprises was equal to 1.5% as compared to 1.9% in the previous year. Average interest on new loans granted to households in the Polish zloty in 2015 stood at 6.2%, having dropped by 1.2 p.p. versus the end of 2014. As for loans for households, in December 2015 the interest on housing loans amounted to 4.4% (versus 4.7% at the end of 2014), and interest on consumer loans reached 8.0% (versus 9.5% at the end of 2014). In the business sector, the interest on new loans in the local currency amounted to 3.6% in December 2015, having increased by 0.1 p.p. as compared to December 2014. The interest rate reduction made by the National Bank of Poland in March 2015 did not result in a further decrease in interest on loans in this segment.

Financial performance of the banking sector

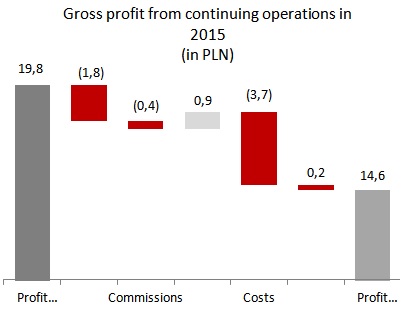

- A decrease in the operating profit (by PLN 1.7 billion, i.e. by 3.0% in 2015), mainly due to the decrease in the net interest income (by PLN 1.8 billion, i.e. by 4.8%). The latter resulted mainly from interest rate reduction introduced by the National Bank of Poland in October 2014 and in March 2015, which translated into lower interest rates on loans and deposits. Another factor, which adversely affected the operating profit was the deterioration of the net fee and commission income (by PLN 0.4 billion, i.e. by 3.3% in the analyzed period), which resulted mainly from lower revenue due to payment cards related to the reduction of the interchange rate (from 0.5% applicable to both type of cards to 0.2% for debit cards and 0.3% for credit cards).

- The increase in operating expense with amortization and depreciation in December 2015 (by PLN 3.7 billion, i.e. by 12.0% comparing to December 2014), which resulted from a higher annual fee and prudential fee to the Bank Guarantee Fund (an increase from 0.1% and 0.037% to 0.189% and 0.05%, respectively, comparing to the end of 2014) and an additional payment to the Bank Guarantee Funds of PLN 2 billion resulting from the need to pay out guaranteed deposits after the Polish Financial Supervision Authority had filed a bankruptcy petition for Spółdzielczy Bank Rzemiosła i Rolnictwa in Wołomin on 23 November 2015. Payments to the Borrowers Support Fund established under the Act on supporting borrowers in a difficult financial situation who have been granted a mortgage loan constituted an additional expense for the banking sector (PLN 600 million) in 2015.

- An increase in the negative balance of allowances and provisions by PLN 219.9 million in 2015. This adverse trend should be associated with the increase in the CHF-PLN rate, which increased the costs of loan repayment for households which were granted such loans in the past. Factors which positively affected the balance of impairment losses and provision were: stable economic growth and low interest rates which drove stabilization or improvement of the financial situation of a number of borrowers and the sale of credit receivables to debt collection agencies by selected banks.

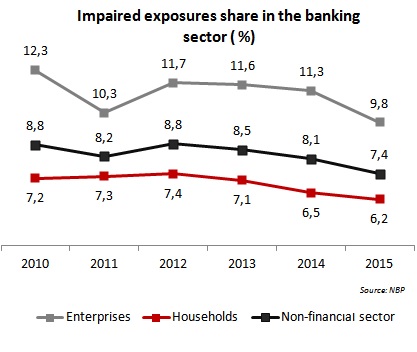

The share of impaired receivables in the total receivables from the non-financial sector dropped from 8.1% in December 2014 to a record low level of 7.4% in December 2015[1]. The year 2015 also saw an improvement in the quality of credit exposures of banks to enterprises and households and certain banks sold their credit exposures to external companies.

Banks retained a large portion of profits generated in 2014 and refrained from or suspended dividend payment, hence the capital base strengthened (the increase in equity from PLN 136.8 billion at the end of 2014 to PLN 149.2 billion at the end of September 2015) and the total capital ratio increased from 14.7% in December 2014 to 15.6% in September 2015. In September 2015 CET 1 capital ratio amounted to 14.3% (13.5% at the end of 2014).

Banks continued with measures aimed at efficiency improvement through optimization of headcount and sales networks. As a result, a headcount drop in the banking sector was observed in 2015 (by 1.7 thousand people at the end of December 2015) and a reduction in the sales network (by 566 outlets at the end of December 2015).

Gross profit from continuing operations in 2015 (in PLN)

Impaired exposures share in the banking sector (%)